Growing your own business as a tax preparer or a bookkeeper is tough. You wear a lot of hats: you’re a CEO, marketer, client assistant, office manager, so oftentimes the actual deliverables (tax preparation or clean books) barely squeeze into this workload.

But some lucky fellows manage to successfully scale their business without working 24/7. We’ve met one of these lucky few to find out how a sole practitioner can do more without being overloaded.

Meet Dane Janas, an Enrolled Agent and the founder of Boundless Tax firm. Dane founded Boundless Tax firm in 2017 and during 2020 he has converted to being a 100% virtual firm. He has automated many manual processes, increased client adoption, and is now looking to add new hires as his client base is actively growing.

Your website should create a seamless experience for your clients

We couldn’t help but notice how awesome Boundless Tax’s website looks. We asked Dane how and where he created it:

“The template was from WordPress, so I had to design everything myself. But if I used TaxDome when I started this company, I would probably have been the first to use a website builder instead of going out on my own.”

Through his website, Dane provides a seamless experience to his clients. The sign up page leads to a form that gives him basic info about new clients and services they need. His signup link also triggers an automated process that makes Dane’s workflow so effective, but we’ll cover this further on.

Your firm is not 100% virtual without a proper client portal

We often hear that tax professionals can’t have their clients use client portals, and that’s the main obstacle to going virtual. We wondered how Dane managed that.

“Before I started this business, I had a mix of clients in-person and remote. I had a previous portal that allowed me to do that 50% — but the other 50% was a mish-mash of other software.

I wanted a seamless process: You go on my website, sign up & get forwarded into a portal. All of this happens automatically. That would not have been possible without TaxDome. I would never have been able to take them onto a portal and communicate with me online so efficiently.”

Here are the top three things that helped Boundless Tax with portal adoption from their clients:

- Secure messaging. Instant communication with clients is essential, and their previous portal did not have this ability.

- Having everything in one place. Getting clients to use a portal is hard. But to have half send you documents in email, others via dropbox and other tools — using many solutions to fill in the gaps was hard. TaxDome’s all-in-one approach allows Boundless Tax to keep all important business functions in one place.

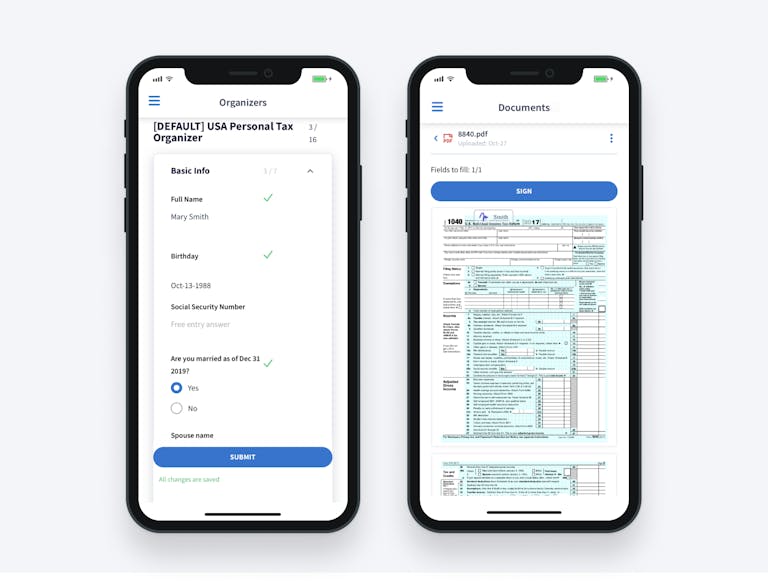

- Mobile App. Dane’s clients love the mobile portal as it’s easy to use. They never log into TaxDome on the computer — they do everything on mobile.

Work on autopilot

Boundless Tax used to have Taxaroo as a portal. That solved some of their needs – organizers, clients could sign up & pay – but it was buggy and critical pieces were missing. Dane had to email clients for information – which is not secure.

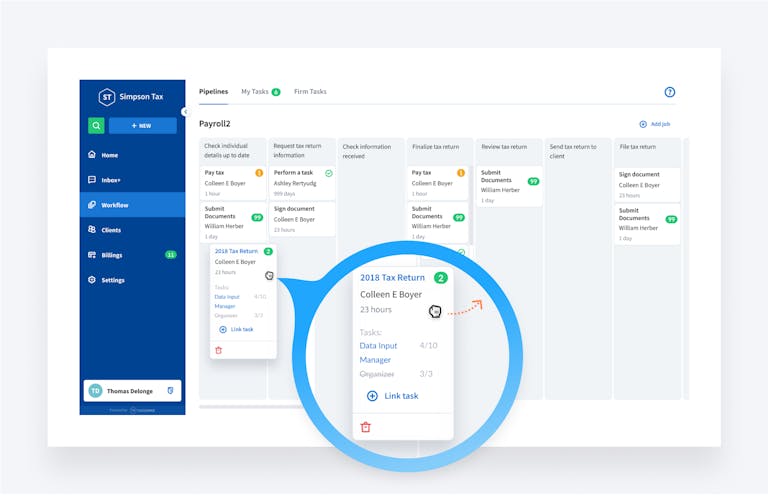

Utilizing TaxDome, manual processes have been eliminated and Boundless Tax is able to provide their clients an easy-to-use, secure method of communication. We asked Dane to describe his typical busy workday:

“I’ll describe a typical day Inside of tax season. I log on to TaxDome. I peruse the Inbox+ to see emails + messages. Then, I go into workflow to see where my engagements are at that point. It really depends on the day. Some days I do a lot of prep, other days I help my admin send out a load of returns for e-signatures. For however many hours of the day I am doing Payroll, Bookkeeping, or Taxes — I have TaxDome open. It’s something I’m truly using all day long.”

Dane’s admin finds it awesome to use.

“My admin finds it AWESOME to use. Prior systems were cumbersome. Getting the finished returns inside TaxDome with the windows app & virtual drive is super easy. Setting up e-signatures — all of that stuff is very simple & easy to use.”

Dane is very cognizant that the quicker he can respond to queries and get prospects into his pipeline, the higher his conversion rate will be.

“The quicker they get the information to us, the quicker we can get the process going & the return done. When clients contact us – they are ready then and there and it’s important for us to convert them.”

Dane is very excited to make use of the auto-route feature, which will allow his team to streamline their prospect and new client workflow even further.

Growing your practice

This coming tax season, Boundless Tax is planning on adding 50-75 more clients. This number doesn’t seem scary to Dane:

“With more automation I have with TaxDome, I can spend more time with clients even as my business keeps growing. I recently started doing video reviews [of their tax returns] with clients. They really appreciate it and helped me separate myself from the competition.”

Dane is considering hiring additional staff to assist with the tax return preparation — the only step that occurs outside of TaxDome.

“All of the ‘admin’ and ‘heavy-lifting’ work inside of TaxDome will be automated.”

Making the switch

Switching to new software is always hard and takes time. Obviously, Dane was hesitant as well.

“There were other solutions that I looked into. But from day 1 TaxDome has solved basically everything that I was looking for and I didn’t find that anywhere else.”

Dane realised he didn’t need to pay for dozens tools. As a solo practitioner, he couldn’t use a portal that is $5k per year, and TaxDome offered everything needed to run his practice and at a reasonable price:

“I don’t want to use Docusign & pay for Docusign when TaxDome already solves that for me with e-signatures. TaxDome has workflows, Inbox+, e-signatures, and more all wrapped into one. I wouldn’t pay for something that has just one of those things.”

It took him a couple of weeks to be completely set and done: “I did the onboardings but I also like to figure it out myself. I genuinely enjoyed them and discovered new functionality. I wasn’t afraid to reach out for help. At most I have a response within a couple of hours unless I am burning the midnight oil. No software I have used has given me this sort of responsiveness.”

You too can adopt the Boundless Tax experience to grow your practice and streamline your workflow. Want to know how to automate your practice?

Thank you! The eBook has been sent to your email. Enjoy your copy.

There was an error processing your request. please try again later

Looking to boost your firm's profitability and efficiency?

Download our eBook to get the answers