We rolled out some major updates: recurring invoices, a redesigned interface for messages (now called Chats) and a better overview of jobs done for a client. We’ve also tweaked document management, the client portal and the workflow section. Without further ado, let’s sink our teeth into what’s new.

Sneak peek:

In the near future you will be able to send and receive SMS messages in TaxDome, giving your firm another communication channel through which to collaborate with your clients. We are also working on a new native client mobile app, proposals (to convert prospects into clients with ease), and improved time tracking & billing within TaxDome.

Watch a video overview of the new features and improvements:

💰 Invoicing

Recurring Invoices: eliminate admin work and get paid automatically

Recurring invoices allow you to send invoices to clients on a regular predetermined basis (weekly, monthly, etc.) They are especially helpful if you continually provide repeat services. We recently hosted an in-depth webinar introducing this feature and gave examples on how you can incorporate it in your practice. You can access the webinar recording and Q&A transcript here>>

Below is a shorter video overview that goes over the feature and shows you both the firm and client experience:

Recurring invoices automate the billing process, so you only have to set up invoices once. If you switch on automatic payment authorization, your clients will only have to enter their card/bank account details once, too: the money will then automatically be withdrawn on an agreed-upon schedule.

Run through our checklist on setting up recurring invoices to get paid for your repeat services automatically and without delay.

Payment authorization is currently only available with Stripe as the default payment provider. You’ll still be able to create recurring invoices if you use CPA Charge — but your clients will need to enter their payment info every time as payment authorization will be disabled. You can have both Stripe and CPACharge enabled in your platform – you do not have to disconnect CPACharge to enable Stripe.

Find out more about using recurring invoices and how they benefit your business>>

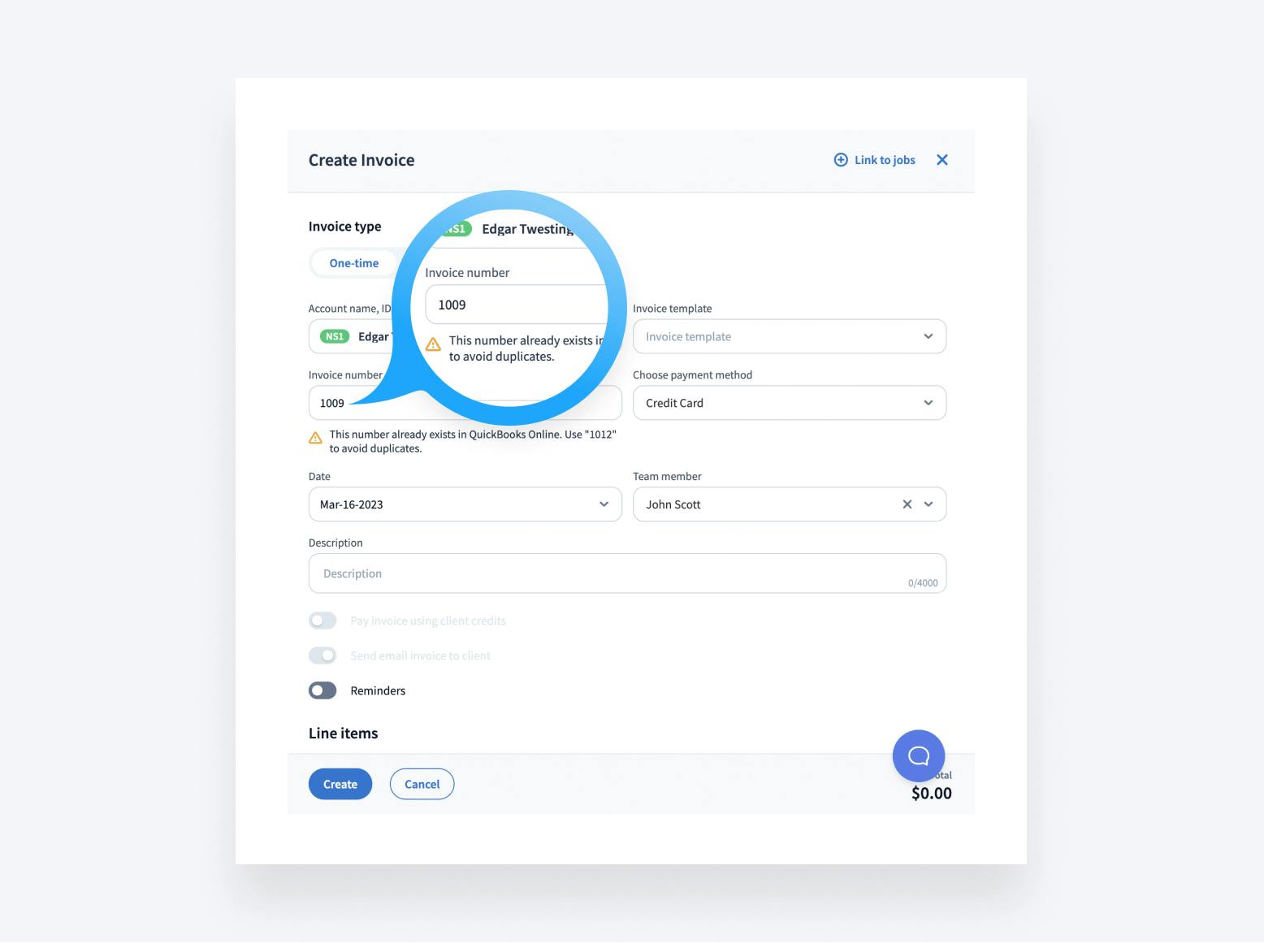

QBO integration update: fewer error messages and automatic matching of invoice numbers for those who use multiple invoicing systems

We’ve added automatic verification to prevent duplicate invoice numbers. Invoice numbers will now be automatically assigned based on the most recent invoices in QBO.

We’ll assign invoice numbers automatically when:

- The invoice number was left blank

- The invoice was created via an automation

- The invoice was generated automatically as part of a recurring invoice

- Invoices are created in bulk

️ If you manually enter an invoice number that’s already in use in QBO, we’ll notify you and suggest the next available number instead.

Additional QBO sync updates that will be coming soon:

- QuickBooks class and location tracking fields will be added to the invoice screen

- It will become possible to select a separate QuickBooks income account for each service

- We’ll add a status display so you can see which services are synced with QuickBooks

To learn more about the update, visit our Help section>>

Add custom fields to PDF invoices

You can now customize your invoices with custom fields. This allows you to include any information you want about the client in the invoice.

To add custom fields to invoices, navigate to the Firm Details subtab in Settings and toggle on the fields you want. The address, city, state and email fields are visible by default, but you can see other options by clicking Show more.

For more information on custom fields, check our Help article>>

Use shortcodes for invoices to save time and add a personal touch

Customize your invoices to add a personal touch using shortcodes. Shortcodes can be added to the invoice description and client messages, and can contain any account information, including custom fields.

Shortcodes save time for your team members, too. Shortcodes can be created for:

- One-time invoices

- Recurring invoices

- One-time invoice templates

- Bulk one-time invoices

To learn more about how shortcodes work, visit our Help portal>>

💬 Chats

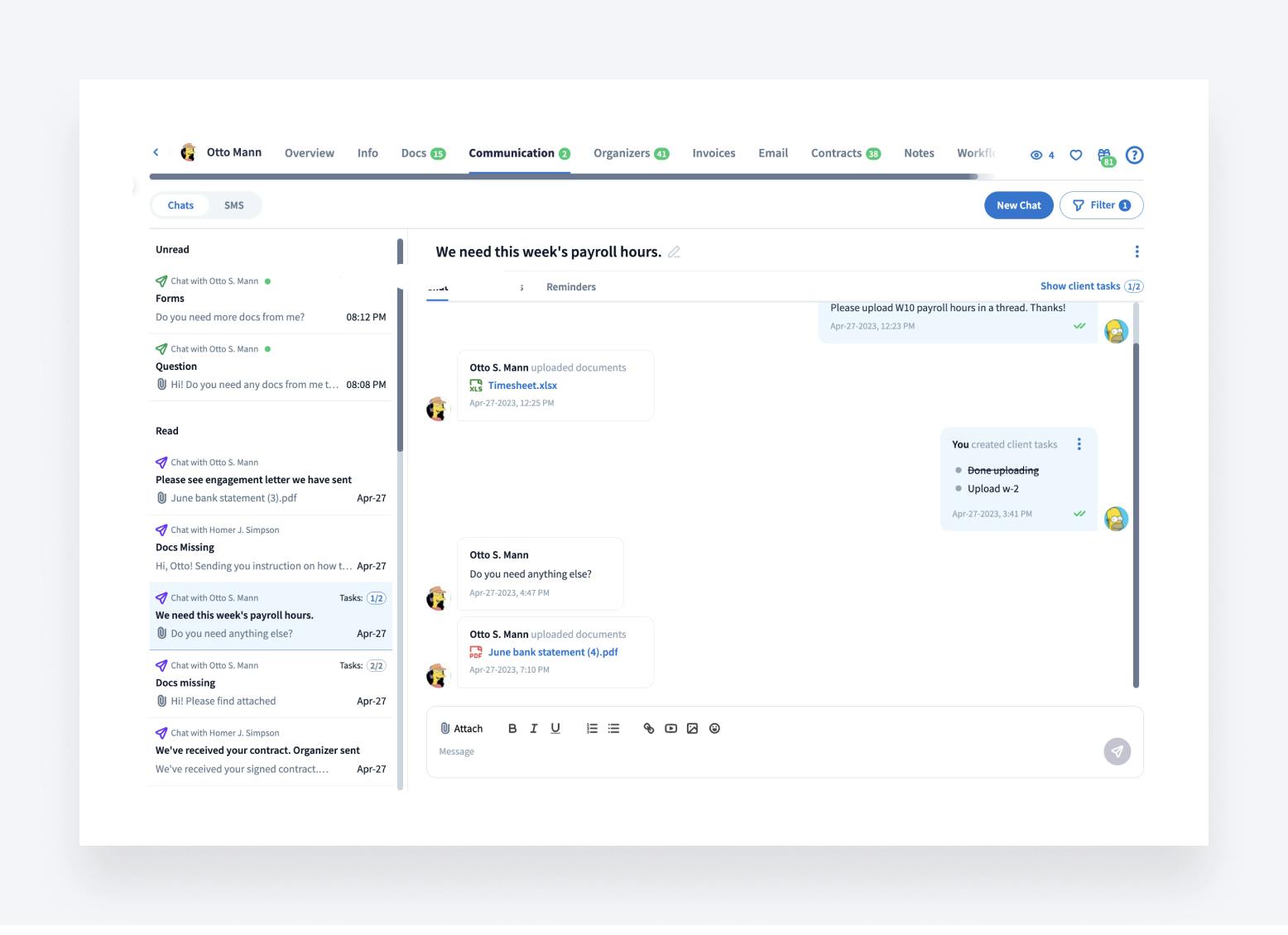

Redesigned chats: setting the stage for a unified communication feed

We have introduced several major enhancements to the interface and the functionality of our messaging system (now called Chats). We aim to achieve three goals with this update:

- Add new features

- Create a more user-friendly interface

- Set the stage for a unified communication feed

Here are some of the most important additions:

- Prominent task checklists (locked into place for clients)

- Sorting chats into “Read” and “Unread”

- Ability to preview content (such as documents, tasks, links and images)

- Ability to edit and delete sent messages

- Resending tasks to clients

- Hidden archived chats tab

You can find Chats inside the Communication tab. SMS integration is coming soon, too: you’ll be able to send and receive text messages to and from your clients within TaxDome.

📚 Document management

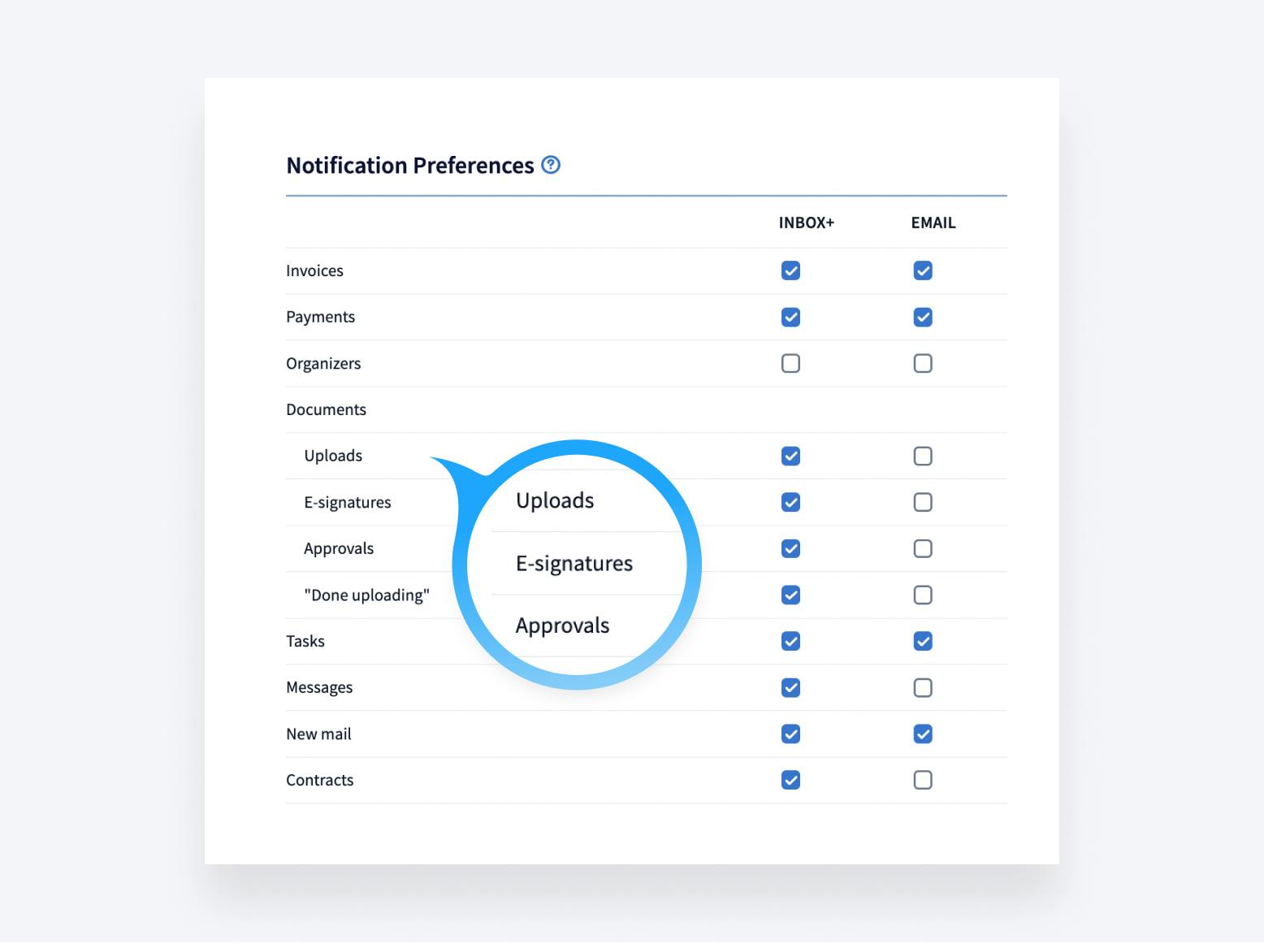

More customized notification preferences for documents: get only the notifications you care about

You can now decide which specific document notifications you want to receive. There are now separate notifications for when documents have been e-signed, uploaded and approved by your clients.

This way you can choose which events trigger a notification. You can also pick where notifications appear: in your Inbox+, email, or both.

See our help article to learn how to set up your notification preferences

👨👩👧👧 Client portal

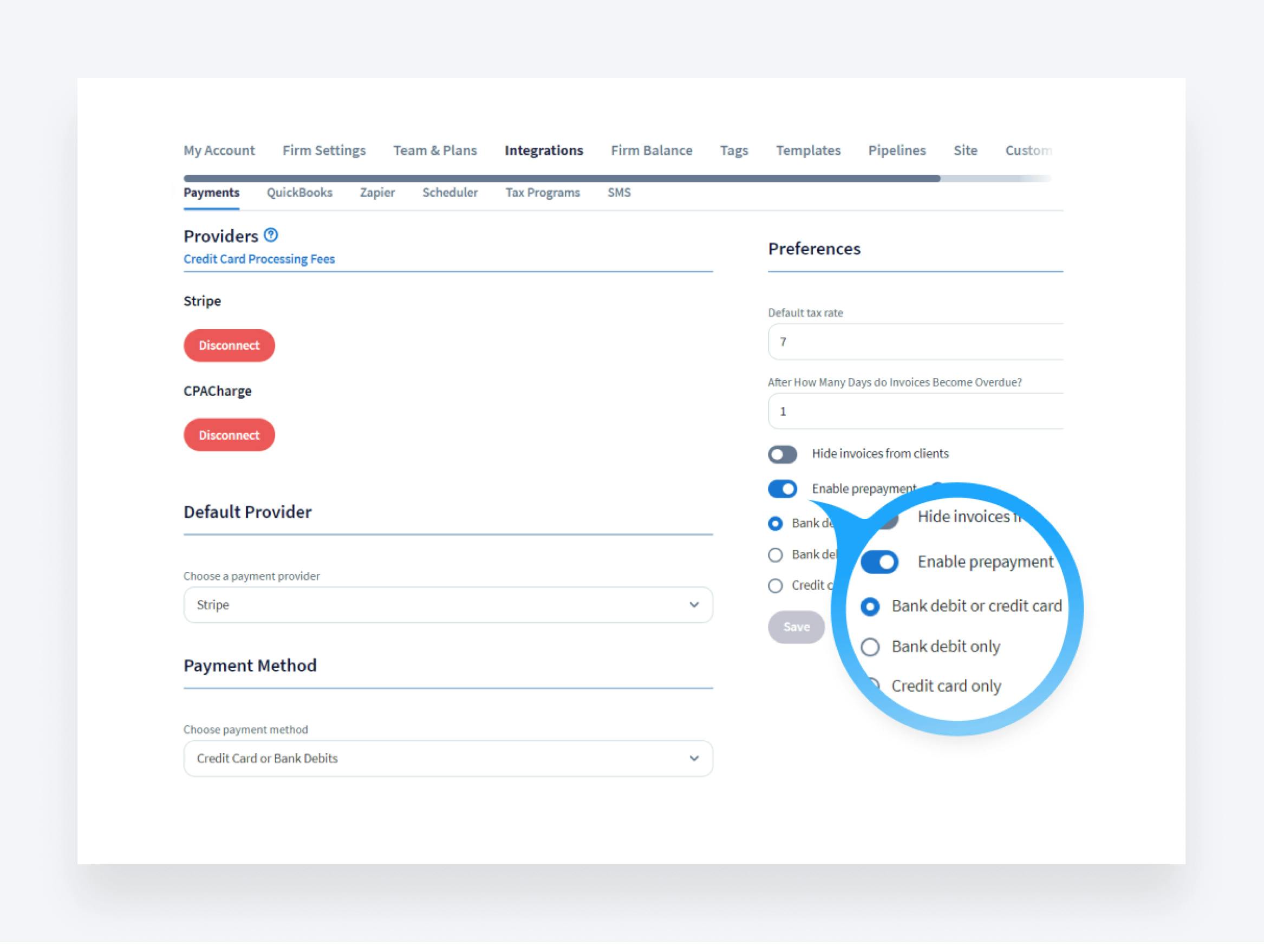

New setting controls for the prepayment option in client portal

By default, all firms have the ability to accept prepayments, but we have now added additional settings to help you customize it to your firm preference.

- You can choose to show the prepayment button or disable it from your portal

- Payment options added — if enabled, decide through which payment methods clients can make prepayments: bank debits, credit cards, or both.

In order to accept payments (and enable prepayments, too) – a payment provider (Stripe/CPA Charge) must be connected. Learn how to configure the prepayment option>>

🤖 Workflow

New access right: which team members can edit pipeline recurrence schedules

For each user, you can customize the access rights depending on their role. We have added a new access right specifically related to workflow – you can decide which of your team members can modify job recurrences. When switched off, firm members will still be able to view pipelines (if they are in the ‘Available to’ field of that pipeline) — but won’t have the option to modify the recurrence schedule.

Find out how to update workflow access rights for your teammates>>

Use recent jobs to quickly see the latest work the client has engaged you for

Context is king: knowing which tasks you’ve completed for a client in the past matters. That’s why we’ve added the Recent jobs section to account profiles. It shows the five last jobs you’ve worked on, with quick access to each.

Learn how to view recent jobs>>

You can now interlink jobs as well. For example, a personal tax return Form 1040 may not be able to be completed until Form 1065 Partnership return is completed. By linking the two jobs together, you can ensure the 1040 is not completed prematurely.

See how to link jobs to one another

📚 Help & Education

- Automate your payroll workflow in 70 minutes with TaxDome for Payroll

- We now have a separate tips & tricks section specifically for tax preparers full of advice on how to onboard new tax clients, collect documents, deal with extensions, and much more

🔥 Other

- Quick navigation to all linked accounts when viewing a contact has been restored

- You can now edit time entries that currently have “In Progress” status

- Have you joined our early access program? Early access members get to use and comment on our new features first. Read about it and join the program>>

All of the above — plus 63 more tweaks and fixes! Join our Facebook Community to ask questions, request features or chat with other TaxDome users.

In case you missed it, here’s a summary of the major features we covered in our previous post.

Thank you! The eBook has been sent to your email. Enjoy your copy.

There was an error processing your request. Please try again later.

Looking to boost your firm's profitability and efficiency?

Download our eBook to get the answers