This month, we’ve introduced more improvements to help you power through the upcoming tax season with more productivity and efficiency.

Our new Calendar enables you to see due dates of tasks and jobs at a glance: you can plan out your time and manage the workload to keep your team focused and on track. The Calendar is customizable – both employees and managers can utilize it.

We’ve added line items to invoices to make them more transparent for clients. You can now include discounts, mark individual line items as taxable (versus the whole invoice being taxable or not), and quickly add one-off services.

We’ve also upgraded the ‘done uploading’ functionality to include a clear button in the client portal. This feature is optional – but when enabled, your clients will have a clear ‘Done Uploading’ button in their portal.

Finally, we’ve published our freeze release policy which has been in place since Jan 2022. In short, we do not push new code to production ahead of major US tax deadlines (Marc 15, Apr 15, Jun 15, Sep 15, Oct 15). After the October deadline, releases will start again and you can expect exciting new features such as recurring invoices, firm Insights, Proposals, a new version of the Windows desktop app and other updates. See you on the other side!

Let’s see what we’ve rolled out this month in detail.

📅 New: Calendar

Calendar view added for Jobs, Tasks

With the new Calendar, you can view jobs and tasks in a more convenient format and visualize your workload more effectively.

- Fewer clicks to update details and statuses — edit task and job details in the sidebar

- Split by day, week and month — reduce the number of overdue tasks and your team’s workload

- Filter by assignee, account, priority, status, start and due date

Check our blog about how to customize the calendar as an employee or team manager>>

Sneak peek: The next step is to show not just active Jobs/tasks, but also future Jobs which will be created via the recurring Jobs functionality. We recognize that calendars are planning tools and seeing future Jobs is critical – we’re working on this and will be adding it.

Future improvements will also include integrations with your personal Calendar.

💰 Billing & Invoicing

Invoice upgrades: client-facing itemized list of products and services

By itemizing invoices, your team can better communicate the specific services your team is delivering and at which rate; your clients can see exactly where the total amount comes from. Although this feature has existed for a while, user testing and feedback has shown that it was incomplete and did not meet the needs of tax & accounting firms – both from a functionality and from a UX perspective.

With this update, we are introducing ‘line items’ — the new way to provide transparency to your clients and streamline the invoice creation process. By utilizing line items, you can:

- Create ad-hoc services quickly and easily

- Add ad-hoc services to the list of your firm’s services

- Update existing services

- Add discounts

- Mark individual line items taxable or not. Previously, the entire invoice was taxable (or not)

More about the invoice upgrades>>

Sneak peek: Recurring invoices are coming very soon! Stay tuned!

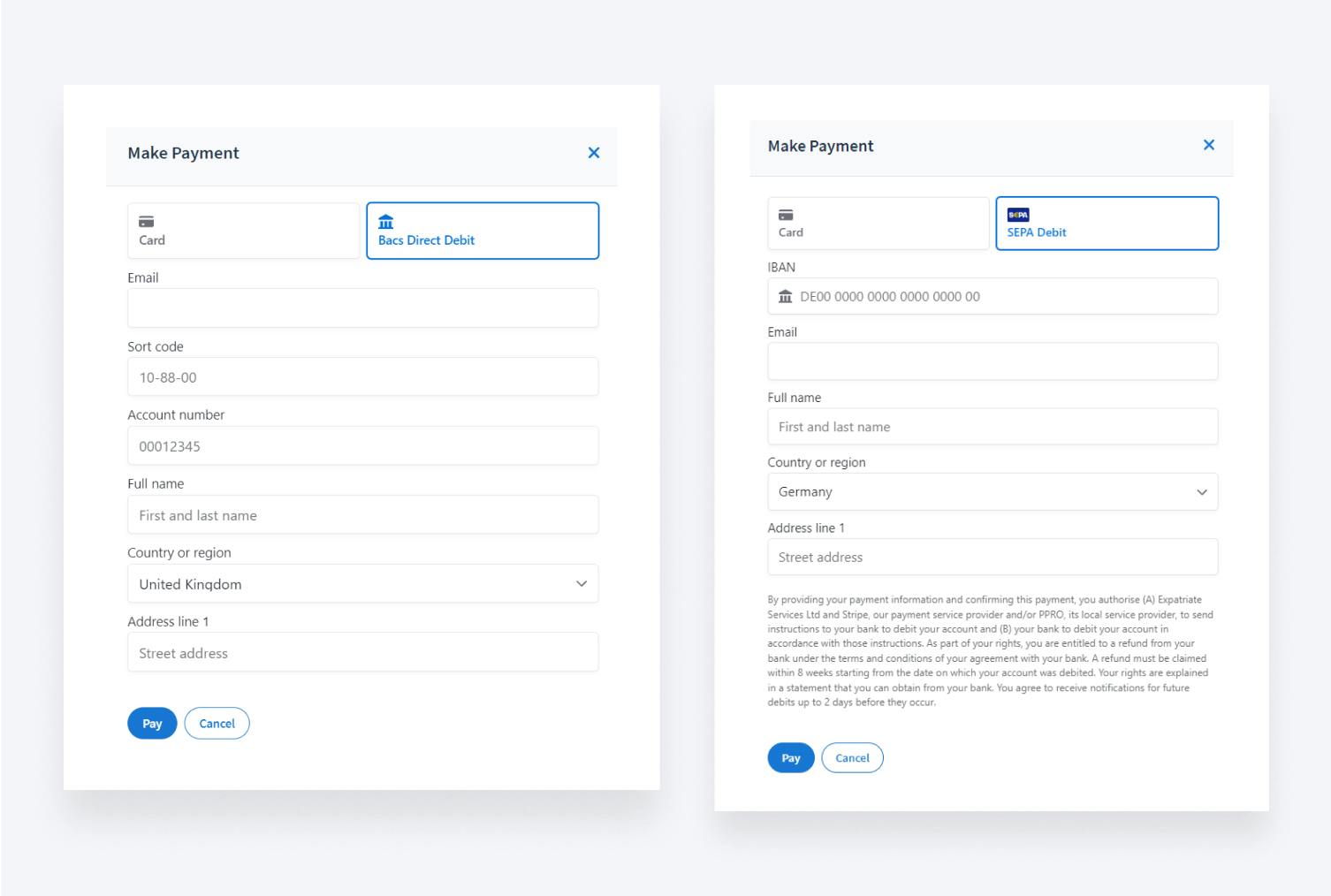

BACS and SEPA payment methods available for UK & EU

Similar to ACH in the US, firms can now accept BACS and SEPA payments in the UK and EU. Unlike credit cards which are paid to processors as % of transaction (generally around 3%) – BACS and SEPA payments are direct bank to bank payments. SEPA transactions are as little as €0.35 per successful bank account charge. Of course, bank to bank payments, like ACH in the US, have longer clearing times than credit cards.

Read about BACS and SEPA payments>>

📚 Document Management

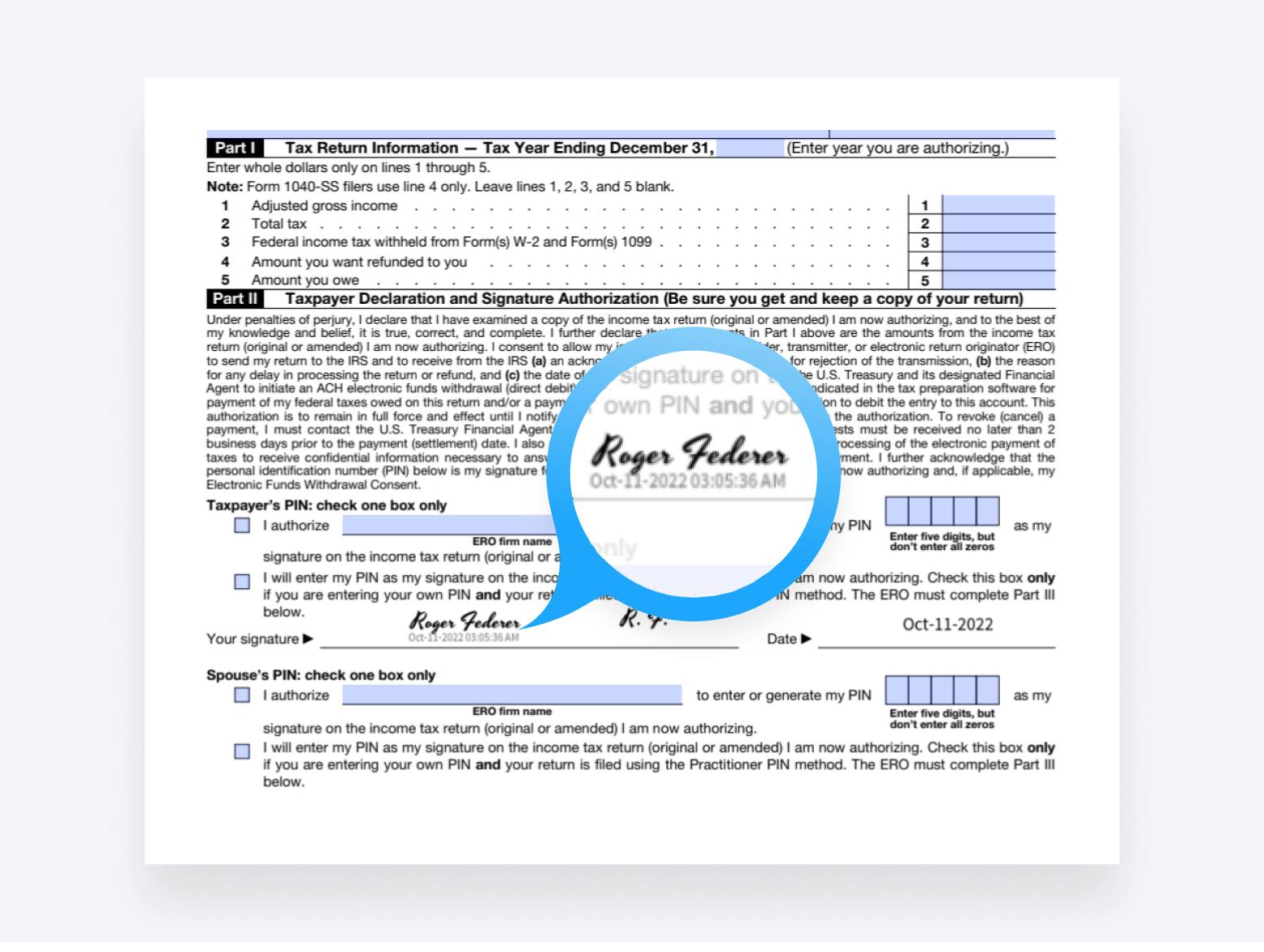

E-signature: timestamps in the signature placeholder and audit trail

Previously, you could see only the signature date in the signed document and audit trail. With this update, the signature placeholder and audit trail include timestamps.

As a reminder, your clients can now hand draw signatures, show them how>>

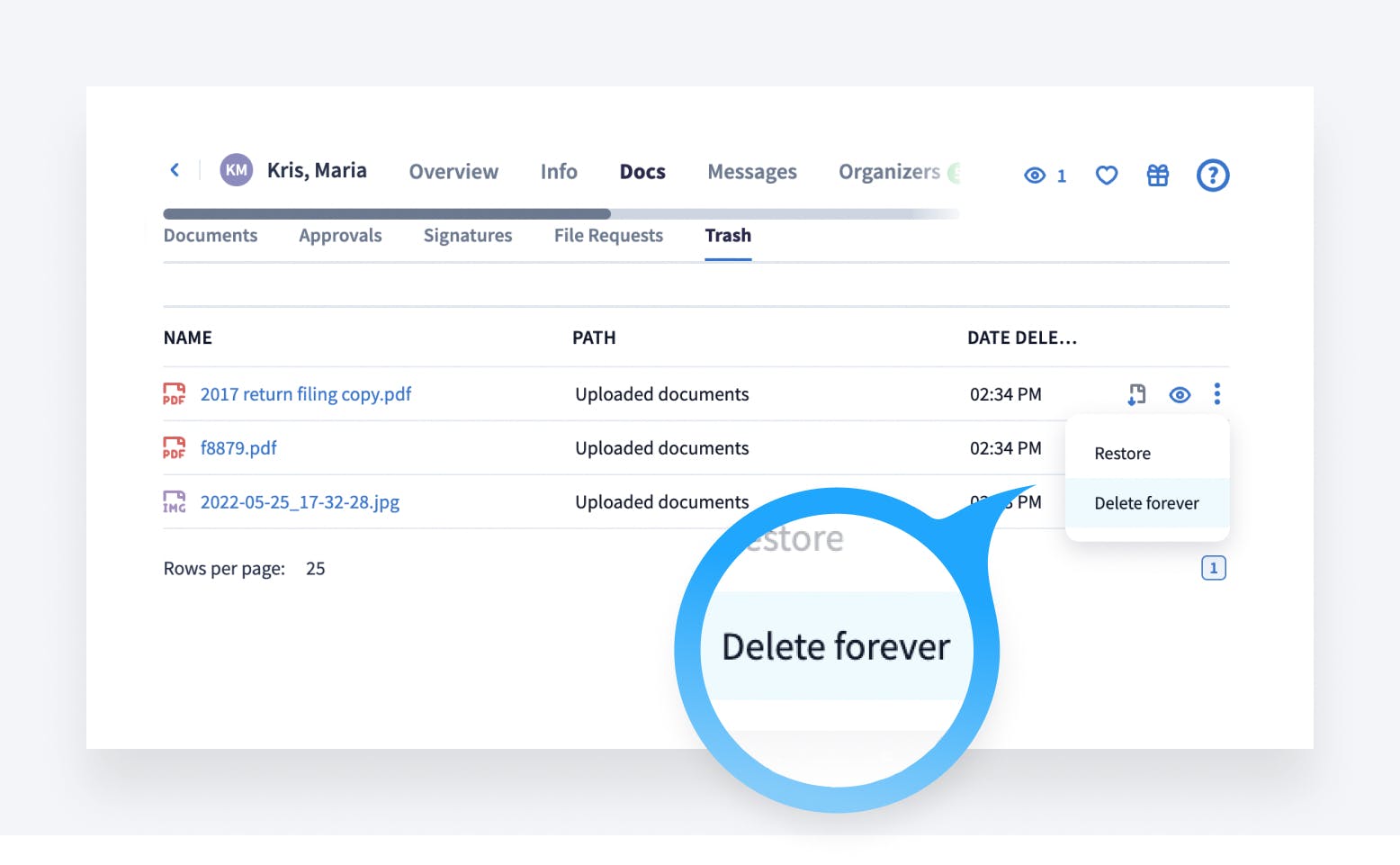

Permanently delete documents from trash

When documents are deleted, they are placed into ‘trash’ (just like the recycle bin in Windows or Trash in Mac). The documents remain for 120 days, during which they can be restored any time. After 120 days, they delete automatically. With this release, you can now permanently delete documents from trash immediately without having to wait 120 days.

As a reminder, documents deleted by firm members are never visible to clients.

More about deleting & restoring files in TaxDome>>

🏢 TaxDome Advisor Directory

Get leads & win new clients by getting listed

This directory is exclusive to TaxDome firms and at no additional cost.

Create a profile and obtain new leads to grow your business. The directory is integrated with Google to showcase your existing reviews and is focused on increasing your visibility and amplifying your brand. If you have not yet, please do so.

Read more about the Advisor Directory>>

🔥 Other

- UX/UI improvements: the actions for payment preview and to edit documents have been moved to the right sidebar menus. We continue to work to create a unified and predictable UI across all areas of TaxDome.

- Freeze release policy published: We do not make changes the last two weeks before major deadlines (Mar 15, April 15, June 15, Sep 15, Oct 15).

All of the above—plus 68 more tweaks and fixes! Join our Facebook Community to ask any questions, request features or just chat with your peers.

In case you missed it, here’s a summary of the major features we covered in our previous post.

Thank you! The eBook has been sent to your email. Enjoy your copy.

There was an error processing your request. Please try again later.

Looking to boost your firm's profitability and efficiency?

Download our eBook to get the answers