Everything is being moved to the cloud. Businesses are no exception, as more continue migrating their data from internal servers to software providers in the cloud. For those of you who haven’t yet made the switch, it may seem overwhelming. But sooner or later, you’ll have to make the move. Taking your tax business into the cloud could be one of the best business decisions you ever make.

The easier things are for your clients, the more likely they are to become repeat customers and loyal business advocates. This is a huge benefit you can expect to receive when switching to cloud software like TaxDome. You will also save big on your expenses, improve the overall efficiency of your organization, and increase your profits by moving to the cloud.

In today’s technology-dominated society, transferring your business to the cloud is something that will have to happen eventually. Let TaxDome help you step by step and take your tax business into the future.

Cloud vs. server technologies

Up until now, most businesses installed their software on internal servers, located in a closet, backroom, or sometimes even a larger dedicated space. Depending on the particular software agreement, a license is needed for either the server installation or each of its users. And the organization is responsible for managing the software, its security, and updates. All of this seemed very secure.

Well, not exact. Now that we have the cloud, we see the sticking points of the previous system more clearly.

With a SaaS (Software as a Service), you cut through the complications of doing it all yourself. Instead, you pay an outside company that already hosts the software you need and provides you a platform.

You use the software and store your data all via the Internet. And rather than fronting the cost of an entire software package and numerous licenses, SaaS works on a subscription basis. You pay as you go—and only for the access you need.

The growth of SaaS is undeniable, with the market expected to increase in excess of $160 billion before 2022.

To sum up, this is the benefits of cloud technology for your accounting business:

- Accessed by computer, smartphone, or tablet anywhere you have an Internet connection.

- No software to install or hardware to set up.

- Subscription-based.

- Encrypted cloud data.

- Cheap. You pay for what you need, and the costs of security, updates, and maintenance are included.

- Storage is virtually unlimited.

Starting your e-commerce business online is the norm today, but what about tax companies? TaxDome user Dane Janas told in an interview about his journey from a sole practitioner to a virtual firm owner. Read about his Boundless Tax Experience in our blog.

Main areas of your tax practice that can be updated with TaxDome

There is no better time than now to take your business forward. Let’s go through some of the TaxDome features, which can significantly simplify how you run your tax practice.

Client List management

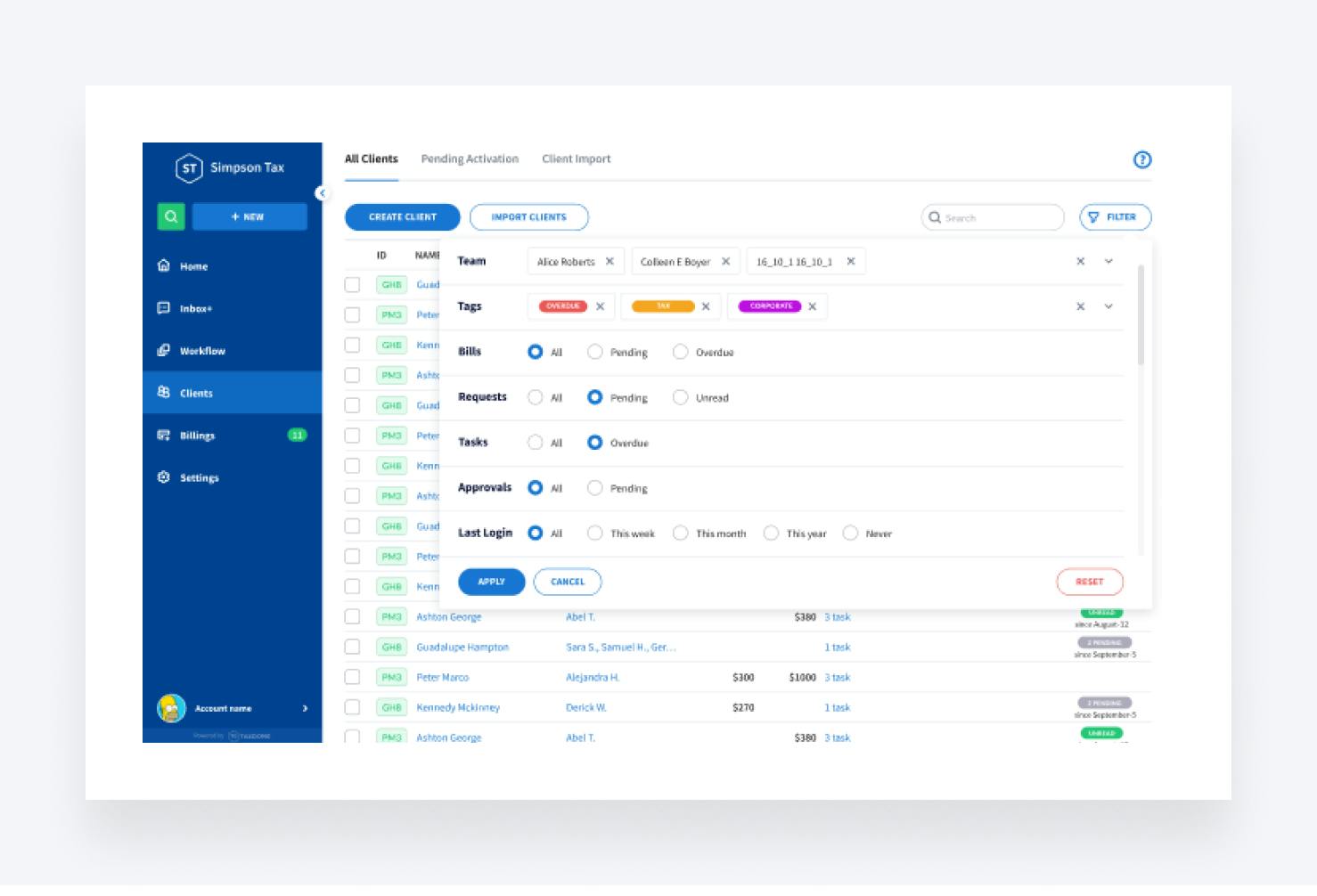

Gone are the days of using desktop Excel, paper documents, shared google docs, which are likely updated manually. Welcome to the cloud-based client list—all the important info at your fingertips, organized and filterable.

Not only can you tag your clients and find clients with actionable items (example: client responded to your open questions), but you can also perform actions such as bulk messaging with the click of a mouse, and all information is updated seamlessly. Additionally, customizable CRM allows you to create your own custom fields to ensure you have the data you need in one place.

Filter clients list, tag your clients, and simplify management with Customizable CRM.

Communication with clients

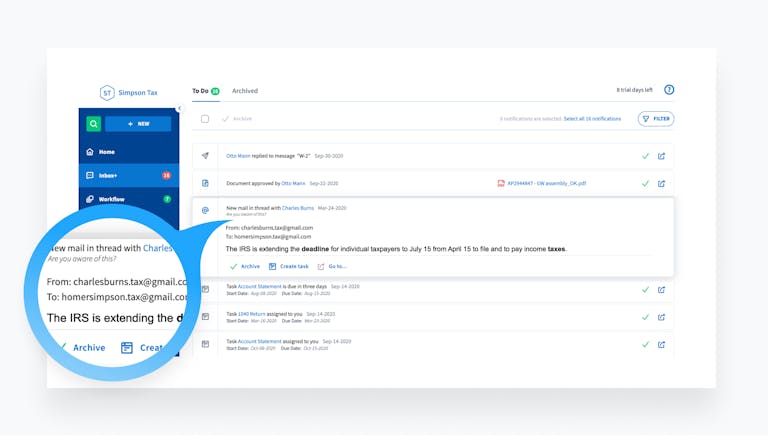

Communicating well with your clients is absolutely vital to the success of your tax business. Time is money, particularly when it comes to taxes. With TaxDome, we provide a means of communication that is modern and easy to use.

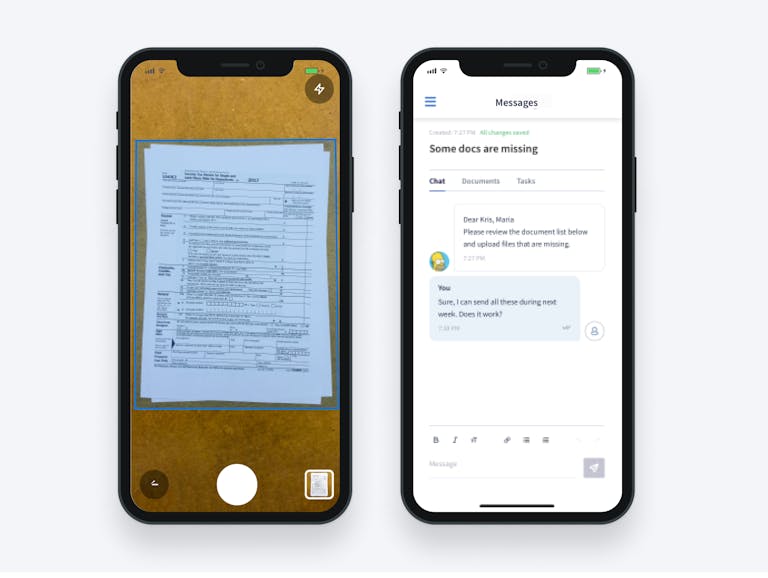

Tax businesses that move to the cloud can take advantage of an entirely new way of communication—a client portal where your clients can log in and scan documents on their phones, settle payments, and answer any questions you ask them.

Build-in mobile docs scanner allows transferring docs into TaxDome within seconds.

With a client portal, your client can check in on their case at any time and have access to their files and history of payments.

Streamline your practice with TaxDome:

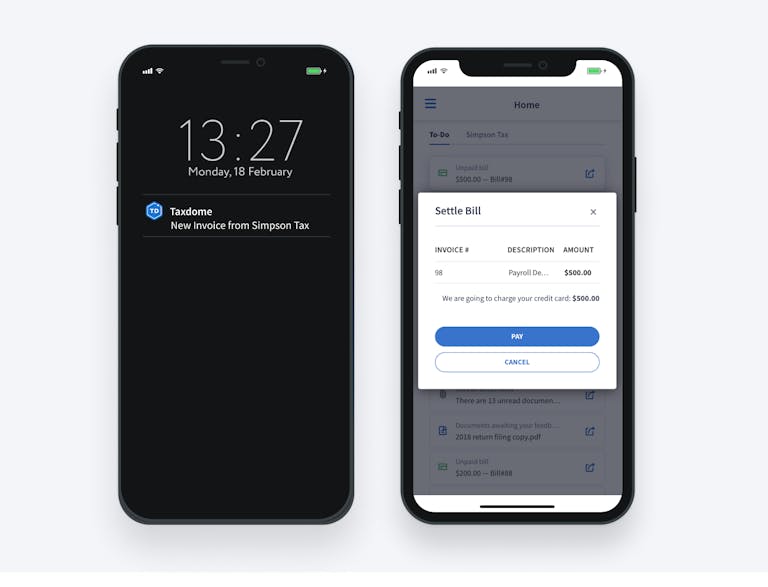

Join demoA client portal can offer your business increased cash flow and quicker payments from clients. Online payments are becoming standard for all business types. The easier you can make it for your clients to pay you, the less pending accounts receivable you will have. It’s also simple to send reminders and notifications to your clients when their payment is due.

Your clients will receive push notifications when their invoices are ready to be paid.

Client Data gathering and management

With TaxDome, it’s possible to gather and manage client data electronically all in one place. Your workflow is paperless now, so you can focus on your business more. If you have existing business systems containing client data, it’s easy to import your client list from the existing software directly into TaxDome.

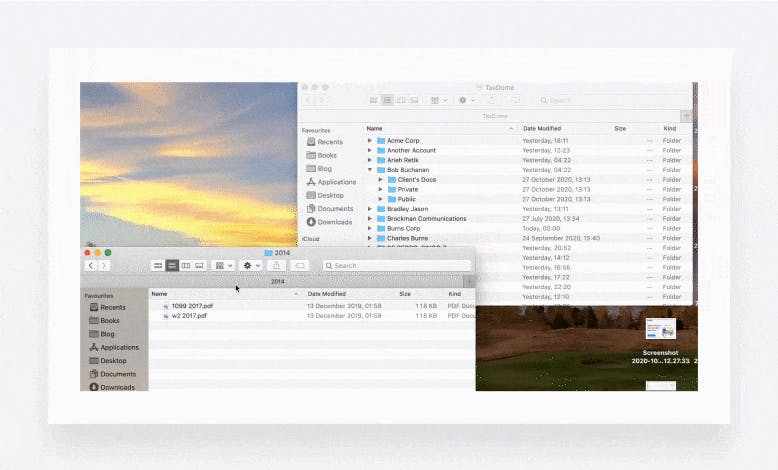

You can simply drag and drop files between your PC and TD

Going paperless with TaxDome provides you with the ability to store all your important documents and files electronically on the cloud. Not only will your entire business become more organized, but you will also be helping the environment by reducing your business carbon footprint. Here are a few ways that gathering and managing client data will improve by moving your business over to the cloud:

- Easy access to documents: You will no longer be spending time poring through your file cabinets to locate your client’s documents. The cloud updates in real-time, so you won’t have to deal with multiple versions of documents and the issues that come with versioning control.

- Saving your valuable time: Instead of faxing, organizing, and locating all the necessary documents to complete work for your clients, you will be spending your time on more productive tasks and increasing your billable hours without increasing your time in the office.

- Improved data security: Keeping your important business files confidential is key. By investing in services from a top cloud provider like TaxDome, you are investing in a completely secure network. If anything happens to your computer or physical files in your office, you can rest assured they will be safely backed up on the cloud.

Staff management

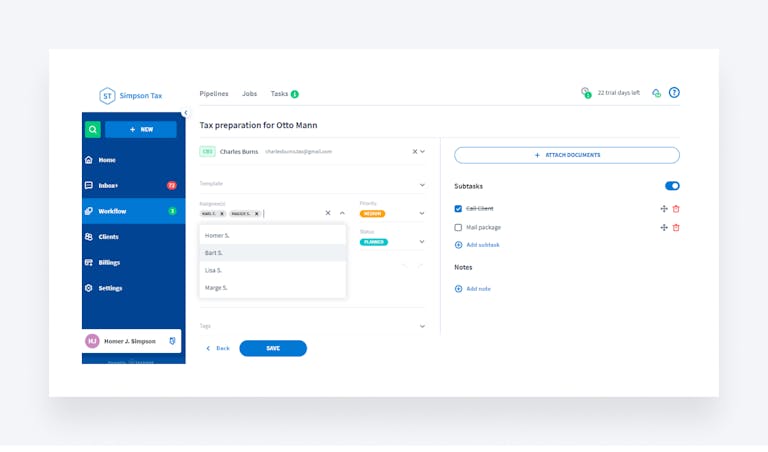

It’s easy to get overwhelmed at the sheer amount of information, especially during the busy tax season, which is why it is vital to surround yourself with a great team. With TaxDome, you can assign clients to specific team members, delegate tasks, and restrict usage rights to keep client information on a need-to-know basis.

Assign team member(s) to tasks and track progress.

You can also share and maintain internal source documents (proprietary spreadsheets, tax program source files). With our shared Inbox+, you can link your existing email accounts and have access to all the email interactions between your clients and staff. It’s your business, and with TaxDome, you retain the ability to scale while maintaining full proprietary control.

You can see all notifications as well as the client’s reply in one place.

Some companies already succeeded after implementing TaxDome into their usual workflow.

Brooklyn FI is a perfect example of how start-ups could grow their businesses using TaxDome software. Read about Brooklyn FI Experience in our blog.

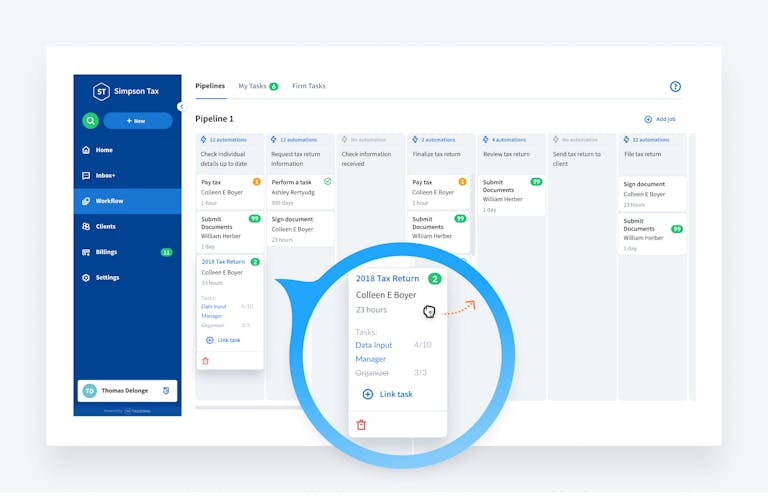

Workflow Management Automated

Administrative work is a necessary evil for all businesses, but it can certainly take productive time away from you if it is not managed correctly.

With TaxDome, you can easily simplify and automate all of your administrative tasks. Your tax practice will be running like a well-oiled machine. Workflow tools offer loads of benefits, but here are a few of the most important ones:

- Boosted client onboarding: TaxDome cares about saving your time, and, in this case, we have prepared a guide on how you can onboard new clients without even lifting a finger. You can find out the step-by-step instructions in our blog post: How to Automate Client Onboarding with TaxDome.

- Increased case transparency: TaxDome features a unique and easy to use dashboard that displays all the tasks currently in process for your practice. All of your team members set up in TaxDome will be able to see real-time changes to casework. You can even set up notifications for specific tasks to let your team members know that something requires their attention. Increased transparency in your cases means less time spent in team meetings updating everyone. It means your entire team is on the same page all the time. TaxDome provides you with peace of mind since you know that your team is fully informed on the tasks at hand.

Track progress of your jobs using pipelines.

- Delegate work with ease: Being the leader of your business comes with lots of responsibility. It’s unrealistic to expect to handle all the tasks required to run your business on your own. That means delegating work is a true necessity. Imagine having a one-stop-shop for all the tasks that you and your team need to be working on. TaxDome provides a workflow tool that allows you to delegate work with ease. The dashboard tool allows you to create unique tasks for individual team members, track staff progress, and communicate with your entire team. Instead of scheduling meetings to connect with your team to get the ball rolling, you can delegate their work and get them started with the simple click of your mouse.

- Superior task management: When the responsibilities start to pile up, it’s easy to get overwhelmed. As a tax professional, managing your time and prioritizing work is key to your overall success. A workflow tool allows you to identify priorities and timelines with ease. Sending and receiving files directly in the platform is a big plus as well. Instead of spending precious time trying to determine the order of which tasks and deadlines need to be accomplished, you can get started working right away with the help of TaxDome’s task management tools.

Payment system

It can be a constant struggle to take care of your accounts receivable. Of course, all we want is to increase cash flow and streamline the way we get paid.

However, you can dramatically improve the way that you get paid with TaxDome. The reason why this works great is that TaxDome offers a quick and easy way for clients to pay you directly by credit card, from the comfort of their home and even on their mobile device. Minimizing your accounts receivable isn’t the uphill battle that you might think because your clients can pay you directly through TaxDome with a simple click. That means no more manually emailing invoices or spending time reconciling all of your invoices.

TaxDome already supports Stripe and CPACharge as payment solutions and an integration with QBO. We’re also happy to announce that the ACH solution will be released soon.

- Streamlined client experience: These days, everyone expects to have the ability to pay for things online. If you aren’t offering your clients the opportunity to pay you digitally, you are putting your entire business at a disadvantage. TaxDome provides a streamlined client experience that makes paying for your services a truly simple process.

- More timely payments: Making things as easy as possible for your clients is a great way to ensure that you get paid on time. The last thing you want to do is chase down outstanding invoices for work that you previously completed. By switching to online billing and invoicing, you are increasing the chances of receiving more timely payments from your valued clients. Make things as easy as possible for your clients and reap the rewards with TaxDome.

Thank you! The eBook has been sent to your email. Enjoy your copy.

There was an error processing your request. please try again later

Looking to boost your firm's profitability and efficiency?

Download our eBook to get the answers