Learn how TaxDome has allowed a financial services firm with 650 clients to improve their processes and to stay organized despite COVID-19.

Welcome to #TestimonialThursday! This week’s interview is with Rafael Ferrer from F&S Projects, a Florida-based firm that provides the integral services for entrepreneurs, particularly in the strategy, tax & accounting, and administration areas.

Why did you choose TaxDome?

I chose TaxDome because it was the best software firm we came across at the IRS Tax Forum in Orlando.

Their product checked all the boxes we were looking for in a practice management solution.

I was looking for something that would allow us to communicate with my team of tax preparers and had all the information in one place—emails, documents, everything—so that we wouldn’t lose track of anything. We also wanted something friendly enough for our clients to be comfortable using but, at the same time, could adjust to our needs.

Another big driver was the extensive audit trails, which would enable us to say the client gave us such information on such a date so that there could be zero denial or need to go through our inbox to find that information.

TaxDome was exactly what we were looking for.

We also tried to develop software in-house, and it was too complicated and expensive.

Other services are limited. QuickBooks is good, but it just does payments. There are other systems to gather documents, but they aren’t flexible and are separate systems. TaxDome allows us, among many other things, to do workflow, email, communicate with the client, all in one place, which is not common. I go to three forums and trade shows throughout the year, IRS Forum, NACVA, and Scaling New Heights, looking for software, but I could not find a software with the capabilities that TaxDome has. There is not much disruption in the tax and accounting industry (the average age at some of these events is 65 plus), so it is great to see that someone is bringing this industry to the 21st century.

Also, I love that nobody knows that TaxDome is behind F&S; we are fully custom-branded.

If a client calls me on a weekend, I can access their information from anywhere. That makes it easy. — Rafael Ferrer on using TaxDome.

Which features do you find most useful?

Document storage and email sync. Being able to see all the emails among the team is key. I use the messages a lot, and I can set up automatic reminders so that I never have to track clients. When you have 650 of them, it gets very convoluted to chase clients one at a time. Mrs. Martha would do this all day long. Now, she’s in charge of corporate services. By reducing administrative tasks, TaxDome freed her up so she can focus on higher-value matters.

Our team is not the most computer savvy, but we’re finding it very easy and helpful to use TaxDome. Mr. Juan, used to work for the IRS. He’s been doing this since the days of filing with pen and paper—since before software even existed. That he can use TaxDome without any issues speaks volumes to how easy it is.

TaxDome is not the same as checking your email; it makes us officially organized. Everything is centralized. There are audit trails and digital time stamps.

If a client calls me on a weekend, I can access their information from anywhere. That makes it easy.

I want to use the locking-to-bill feature; this will be interesting for us. And we look forward to reducing additional administrative overhead by billing inside TaxDome.

Office administration and workflow aside, we plan to send all our marketing emails through TaxDome. We sent our last update through TaxDome using the bulk-email feature, and we got even more responses than we usually get with Constant Contact. So we will keep shooting these emails—with important information, such as the stimulus payment information, warnings about scams, etc.—through the bulk-email feature.

What’s been the feedback from your clients?

My clients love it. They cover a wide range of demographics: I have farmers who still use old landline phones, and they love it; I have millennials, who of course love it.

Here’s our process:

- We tell them to download the mobile app.

- We show them how to activate their account with a video we send them.

- They take pictures of the documents,then upload that information.

- Once we prepare the return, we send them a limited number of pages to show them the return and to avoid the confusion that they can print it and send the return with the approval feature.

- If they approve it, we issue them an invoice and send it to them (not through TaxDome at the moment). Once they have paid, we post the return with the signature feature enabled.

- This is crucial right now, especially with Covid-19!

- Then we e-file the return

A lot of them are using TaxDome on their phones, too. It’s great.

Had you used other practice-management systems in the past?

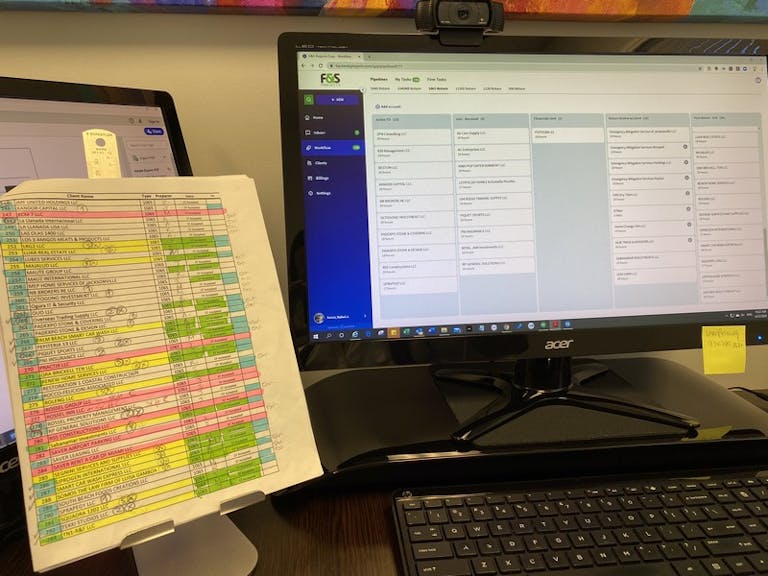

We use Drake Software to prepare tax returns. Every year before we go on vacation in November and December, I print out the complete list of all the returns we prepared that year. That list gets converted into an Excel spreadsheet. Then, at the beginning of the New Year, I print out physical lists for each preparer and Mrs. Martha. We go one by one over each client and color-code. If they have already made contact, we mark the client green. Other columns are for extensions, etc. By the end of the year, we have a page with lots of color codes, and we compare the old list with the new list. Very laborious! Now our list is becoming more and more digitized since we can manage everything in TaxDome.

There’s so much more functionality. We’re excited to adjust it even more to our situation.

For instance, one of the things we use frequently are the organizers. Organizers considerably reduce the time spent with each client. Now, everyone knows exactly what they need to send us. We can easily track what they submitted and what they didn’t; it’s so much faster than before.

We have different customized organizers for 1040, 1040NR, and another for businesses.

For the business organizer, I’m also able to add in a question about how the client wants to provide their information. I can indicate that the less organized way will cost more, so they know what to expect. If I have to spend more time on a file, I have to bill accordingly.

I don’t like being the person to both prepare the return and explain the fees. I would work for free, but that’s not realistic. This takes away the burden of that annoying conversation.

Before using the organizers, we had to do this with each client, one by one, on the phone. I would use that same IRS script.. We printed out hundreds of copies of it, and I feel bad for wasting all that paper, but we don’t need to anymore.

Are you using pipelines or any of the task-management tools? How have you set it up?

The tasks are very helpful. They allow us to avoid issues we used to commonly have. By utilizing checklists in the task templates, we’re able to reduce errors. We have tasks with checklists for individuals and for companies.

Address, Social Security number, bank account information: These sound silly, but the reason we add tasks to them is that we’ve made mistakes in the past. One client couldn’t get refunds because she closed her bank account and didn’t tell us. Now things can’t slip through the cracks. In the checklist, we have the most basic items: “If 8879 is signed,” “If direct deposit is complete,” etc. We can only close a file once everything has been checked off. We’ve made templates, and now all of that is done automatically.

Also, sending emails to each client used to take so much time: “Your return is filed” or “We are reviewing your information.” We can automate these emails with pipelines.

Has it been a big learning curve?

Moving to TaxDome forced us to review our processes; we identified so many areas as opportunities to improve.

At the beginning, it was a little hard, but we had time to learn and a chance to delve in. Once we did, it was easy—everything had a flow.This was the first time we didn’t create physical paper folders for each client. We would end up having 500 of them waiting for clients to come in. This year, for the first time, we didn’t do that. It was a little scary at first, but we wanted to force ourselves to embrace the new system. Now everything is in the same place. No more printing. Everything is electronic. We used to misplace documents; now nothing gets lost. And despite COVID-19 we are able to stay organized.

Any other feedback?

No, but the fact that I see announcements about new features every day in the community forum on Facebook is very reassuring. For me, it was hard putting all of our information on TaxDome—hard psychologically. If we dedicate our time and our clients’ time to something, we want to be certain it’s going to be a long-term marriage. Otherwise, it’s a bad experience. But we’ve had buy-in from our clients, and they see how comfortable it is.The product keeps improving, with new features coming in. Even the technical support team is great. I feel supported and that things are constantly going in the best direction.

The only reason we use Drake is because If I’m working on a return on a Saturday, someone will answer me. This is big—and TaxDome provides the same amazing support. I am very happy with the way that TaxDome is improving every day. It has by far exceeded our expectations.

We always consider making improvements to TaxDome and like to let you know about our updates and expected roll-out dates. Are there features that you feel are missing? Or features you wish we would add?

I would love to be able to lock a return to the client without locking it to the bill.

The fact that you’re already working on KBA is good, as well. I can’t wait for that to come: big game changer!

[KBA is already released!]

Do you know other people in the industry who use TaxDome?

We told some of our friends, but they’re slow movers. I know that after the season, they will want feedback, and I think they will be blown away by our experience.

Thank you! The eBook has been sent to your email. Enjoy your copy.

There was an error processing your request. please try again later

Looking to boost your firm's profitability and efficiency?

Download our eBook to get the answers