No matter the size, an accounting firm’s success hinges on its organizational structure. It serves as the foundation that fosters growth, effective communication, and exceptional client service delivery. In this guide, we’ll explore tailored structures for small, medium, and large accounting firms and offer tips on how to maximize efficiency while building them.

The significance of structure within an organization

An accounting firm’s organizational structure is more than just a hierarchical chart. It’s a strategic framework that aligns roles, responsibilities, and workflows to achieve optimal performance and scalability. Its main functions are:

- To coordinate a diverse range of services, from tax preparation and financial reporting to auditing and consulting

- To guarantee seamless communication among teams by clearly defining roles and duties

- To prevent chaos, overlapping tasks, communication breakdowns, and inefficient resource allocation

Furthermore, an organizational structure is critical to promoting business growth and expansion. As your firm scales, a well-defined structure minimizes vulnerability to personnel changes and enables seamless integration of new talent to adapt to changing market demands.

Let’s delve into the intricacies of organizational structures to ensure you build the best framework for your company’s unique needs.

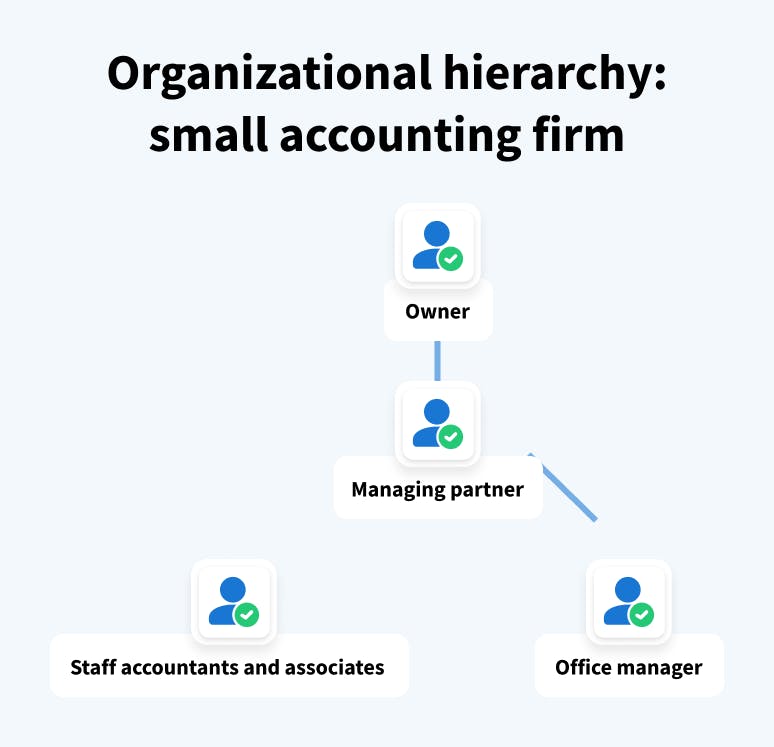

Organizational structure for small accounting firms

A small accounting firm typically has between 2 and 9 team members, and their organizational structure doesn’t need to be overly complicated. Take a look at the chart illustrating the optimal framework:

1. Owner

- Oversees the overall operations and strategic direction of the firm

- Leads client acquisition and business development activities and manages key client relationships

- Makes high-level financial and operational decisions

2. Managing partner

- Oversees the day-to-day operations of the firm

- Handles financial management, budgeting, and administrative decisions

- Ensures compliance with accounting policies, tax laws, and regulations

- Supervises and reviews the work of staff accountants and associates

- Provides guidance, training, and mentorship to junior staff members

- May also manage some key client relationships

3. Staff accountants and associates

- Perform day-to-day accounting tasks such as bookkeeping, payroll, tax preparation, and financial reporting

- Conduct research and analysis as needed

4. Office manager

- Handles administrative tasks such as scheduling appointments, managing files, and maintaining office supplies

- Assists with client communication and correspondence

- Handles billing, invoicing, and accounts receivable and payable tasks

- May also assist with human resources and general office management tasks

This structure strikes a balance between clearly defined responsibilities and opportunities for career advancement within the firm. By nurturing a collaborative environment and providing growth opportunities, small accounting firms can cultivate a talented and dedicated team, laying the groundwork for long-term success.

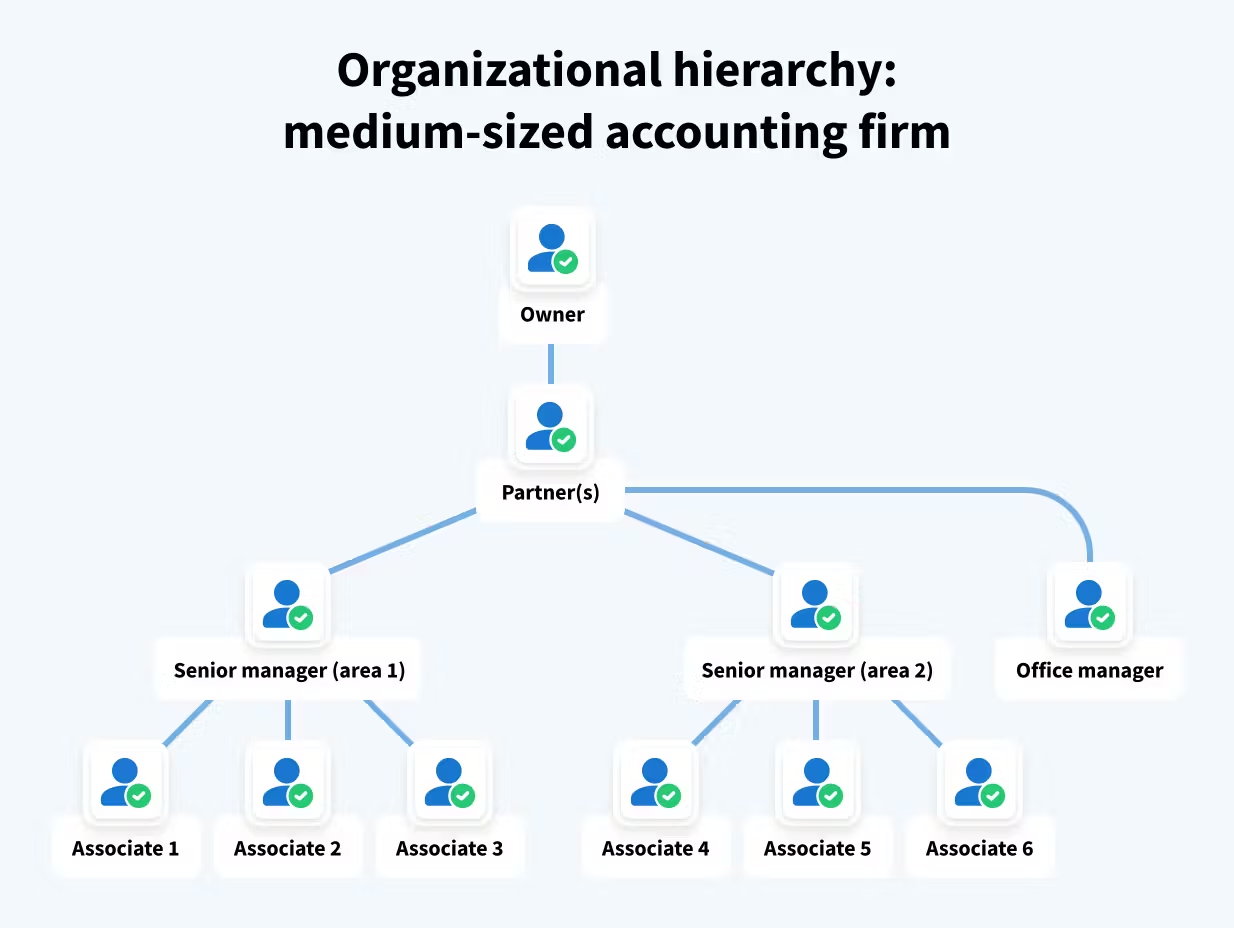

Organizational structure for medium-sized accounting firms

For medium-sized accounting firms with 10 to 30 team members, a more intricate organizational structure is required to maintain efficient operations and management:

1. Owner

- Sets the overall vision, mission, and strategic direction for the firm

- Makes high-level decisions regarding major investments, acquisitions, or expansions

- Oversees the firm’s financial performance and ensures profitability

- May be involved in key client relationships and business development efforts

2. Managing partners

- Implement the strategic direction set by the owner

- Ensure the firm’s success by overseeing its financial performance, cultivating client relations, and leading team management

- Make decisions on the direction and strategy of the business within the owner’s guidelines

3. Senior managers

- Supervise the work of their respective teams of associates

- Take charge of a specific area of the firm’s operations (e.g., taxation, auditing, advisory services, etc.)

- Ensure timely completion of projects, meet budget goals, and take care of client needs within their area

- Work closely with partners on developing and implementing the firm’s strategy

4. Staff accountants and associates

- Carry out day-to-day tasks within their respective areas (taxation, auditing, advisory services, etc.)

- Prepare financial statements, tax returns, and other accounting-related projects

- Provide support to clients and assist Senior Managers with larger projects

5. Office manager

- Handles the administrative work of the firm

- Oversees office operations, manages staff, and ensures daily activities run smoothly

- May help manage the firm’s finances and ensure compliance with regulatory requirements

This organizational structure allows for sustainable growth as partners can focus on strategic decision-making, while senior managers oversee specialized areas and guide their teams.

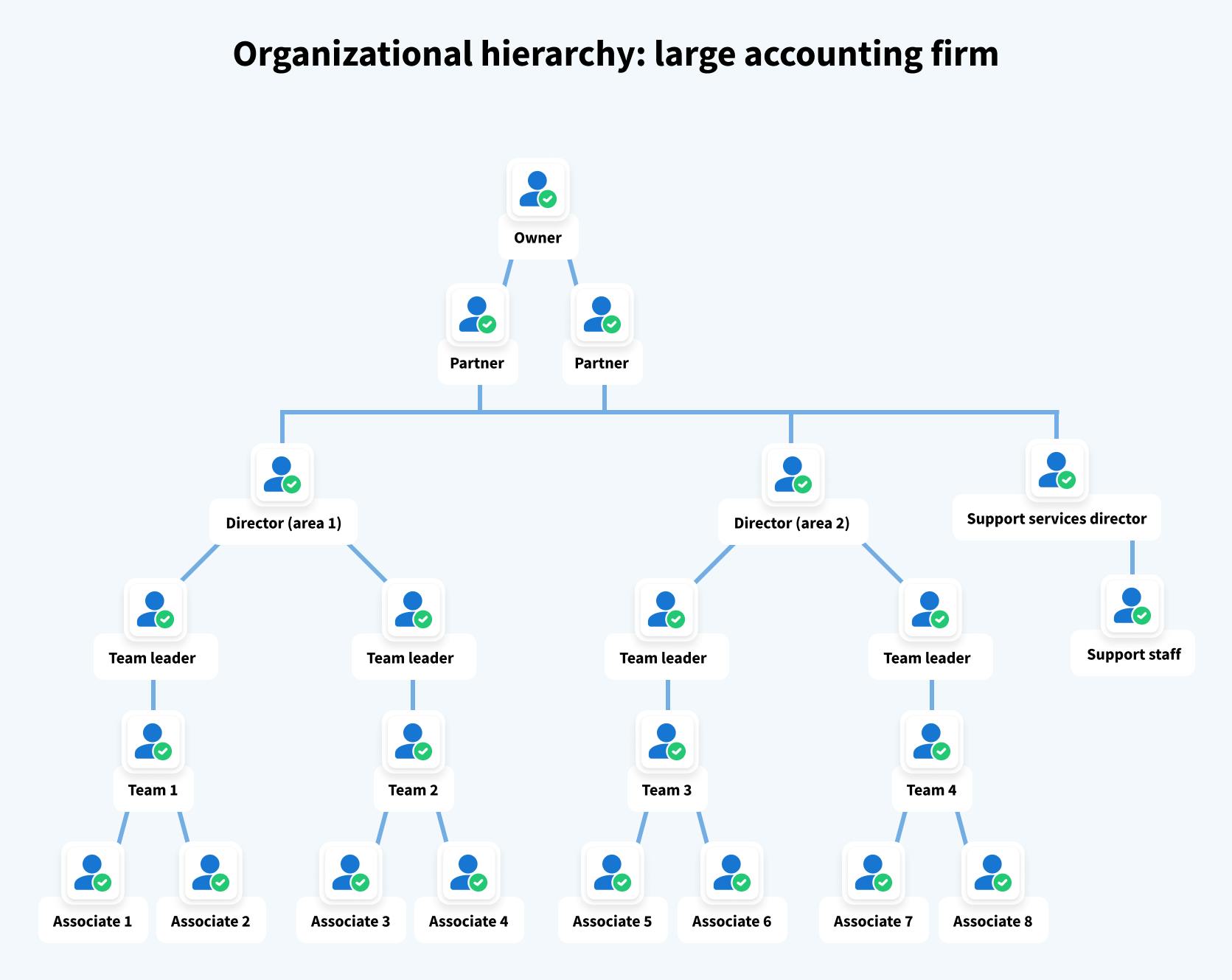

Organizational structure for large accounting firms

For large accounting firms with 30 or more team members, a well-structured organizational hierarchy is crucial to orchestrating success across multiple departments and specialized areas:

1. Owner

- Sets the overall vision, mission, and strategic direction for the firm

- Makes high-level decisions regarding major investments, acquisitions, or expansions

2. Partners

- Lead the day-to-day operations of their respective departments

- Implement the strategic direction set by the owner

- Promote the department’s success through oversight of its financial performance, nurturing client relations, and guiding team management initiatives

- Make decisions on the direction and strategy of the department within the owner’s guidelines

- Develop and maintain key client relationships within their respective areas

3. Directors

- Report to the partners and manage their respective departments

- Ensure timely completion of projects, meet budget goals, and take care of client needs within their department

- Maintain adherence to professional standards, regulations, and firm policies

- Develop and implement departmental strategies and initiatives

- Manage departmental budgets and resource allocation

4. Team leaders

- Supervise and guide the work of accountants in their respective teams

- Provide training, mentorship, and performance feedback to Accountants

- Ensure adherence to standards, regulations, and quality control measures

- Delegate tasks and monitor workloads within their teams

5. Staff accountants and associates

- Carry out day-to-day tasks within their respective departments

- Prepare financial statements, tax returns, audits, and other accounting-related projects

- Conduct research and analysis related to their tasks

- Provide support to clients and assist Team Leaders and Directors/Managers with larger projects

- Stay up-to-date with relevant laws, regulations, and industry developments

- Maintain accurate and detailed records of work performed

6. Support services director

- Manages the support services department, which includes administrative staff, IT support, human resources, and other support functions

- Ensures efficient and effective support operations for the firm

- Develops and implements policies and procedures for support services

- Manages the department’s budget and resource allocation

- Oversees staff training and development within the support services department

7. Support staff

- Handle administrative tasks, IT support, human resources, and other support functions for the firm

- Provide administrative assistance to various departments and teams

- Maintain office equipment, supplies, and inventory

- Assist with event planning, travel arrangements, and other logistical support

- Support the implementation of firm policies and procedures

This comprehensive structure enables large accounting firms to operate with precision and agility. Clear lines of authority and specialized roles allow for attracting and retaining top talent, ensuring a strong foundation for sustained growth in a competitive market.

Best practices for designing an organizational structure

We have compiled some essential tips to help a company build an effective structure:

1. Align with strategic goals

The organizational structure should align with the firm’s strategic goals, mission, and vision. It should facilitate the achievement of these objectives by promoting efficient workflows, collaboration, and decision-making processes.

2. Define clear roles and responsibilities

Clearly define the roles, responsibilities, and accountability of each position to ensure that tasks are properly assigned, authority is well-defined, and employees understand their scope of work and reporting lines.

3. Promote specialization

As the firm grows, consider introducing specialized roles or departments to facilitate expertise and efficient service delivery. This could include dedicated teams for tax, auditing, advisory services, or specific industry verticals.

4. Facilitate collaboration

Design the organizational structure to promote effective communication and collaboration among teams and departments. Establish clear reporting lines, regular meetings, and information-sharing mechanisms to ensure seamless coordination and information flow.

5. Embrace flexibility and adaptability

Recognize that organizational structures are not static; they should evolve as the firm grows and its needs change. Regularly review and adjust the structure to accommodate new services, market trends, or changes in the competitive landscape.

6. Leverage technology

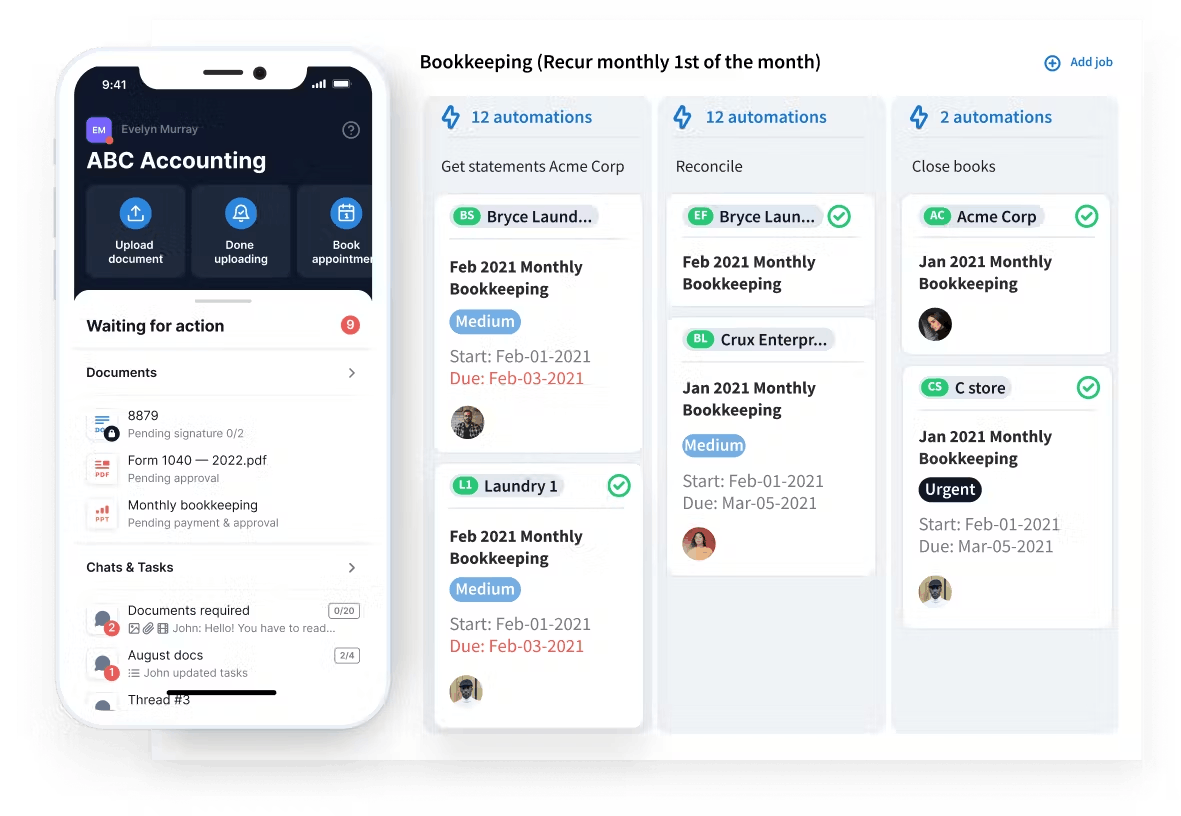

Implement robust practice management software to support and reinforce the effectiveness of your organizational structure. Utilize tools that enhance communication, collaboration, and coordination across different roles, teams, and departments within the defined structure.

One such solution is TaxDome, the operating system for practices of all sizes:

- Small firms: store all client data in a centralized hub, automate tasks, and streamline client interactions, maximizing efficiency for sole practitioners and small teams

- Medium-sized firms: build repeatable workflows across multiple service offerings and teams and deliver outstanding client experiences, increasing retention

- Large firms: gain visibility and control over all processes across multiple departments and specialized areas, and implement foolproof standard operating procedures (SOPs) while scaling

7. Foster career development

Design the organizational structure to provide clear career paths and opportunities for professional growth. Incorporate mentorship programs, training initiatives, and paths for advancement to attract and retain top talent.

8. Monitor and evaluate

Regularly monitor and evaluate the effectiveness of the organizational structure. Gather feedback from employees, analyze performance metrics, and make adjustments as needed to optimize efficiency and productivity.

Conclusion

An accounting firm’s organizational structure is the deciding factor in its success. This guide covered tailored structures for small, medium, and large companies, highlighting roles, responsibilities, and hierarchies that drive efficient operations. To evolve and thrive in a dynamic market, firms may need to thoughtfully design and consistently evaluate their organizational structures.

Moreover, implementing the practices described in the article allows accounting firms to unlock their full potential, deliver exceptional client experiences, and pave the way for sustainable growth and profitability.

Thank you! The eBook has been sent to your email. Enjoy your copy.

There was an error processing your request. Please try again later.

Looking to boost your firm's profitability and efficiency?

Download our eBook to get the answers