KBA is required for IRS Form 8879. Here, we analyzed eight providers and found out that you are probably paying three times more for KBA than you should. Keep reading to find out how you can save money on KBA.

What is KBA?

There are two levels of electronic-signature authentication.

The first is through the ESIGN Act. This act provides a general rule of validity for electronic records and signatures. Back in 2000, e-signatures were new, and firms got away with overcharging for the service because they could. In fact, it didn’t cost them a thing, much like it doesn’t cost Microsoft to add another pixel to your screensaver.

The second is specifically requested for Form 8879 and is called knowledge-based authentication (KBA). This actually costs money, because an outside credit agency must verify the identity of the individual signing by searching public records. If you’ve ever called a bank and been asked a multiple-choice question about a previous address of yours—(a) 123 Main St., (b) 456 Main St., (c) 555 Alpha St, or (d) None of the above—then you are familiar with the types of questions that are autogenerated by a credit agency.

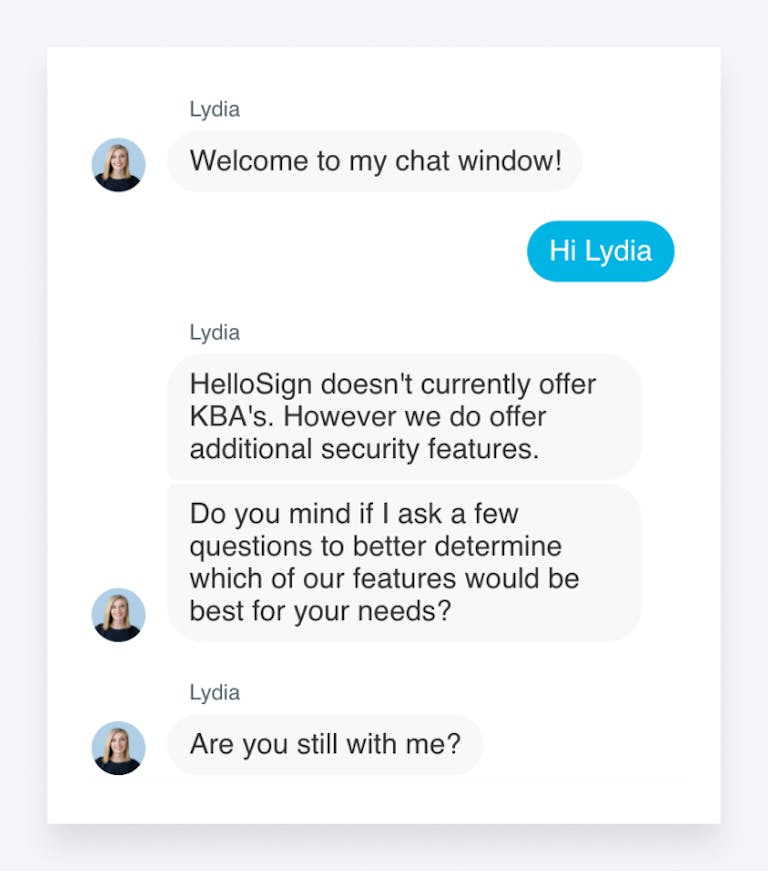

Most online e-signature platforms, like DocuSign or Adobe, will certainly have KBA (Hello Sign surprisingly does not). But they likely charge hefty fees for it—in addition to the expense of using their service.

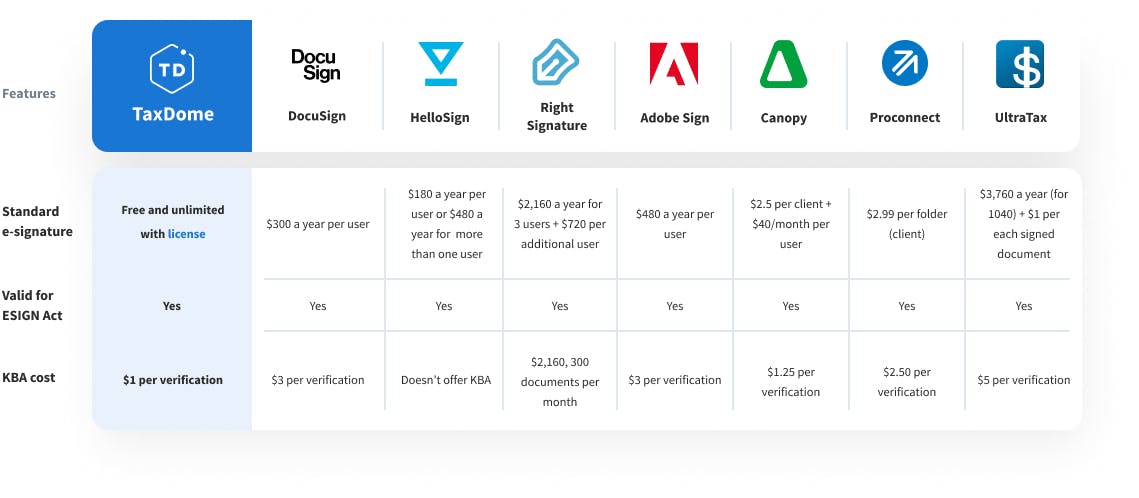

We decided to compare KBA pricing on some different e-signing platforms to find out how much each one will cost altogether.

E-signature & KBA Pricing Approaches

When and how do you pay for KBA? Generally, e-signing platforms take two different approaches:

- Pay as you go: You pay only when you need KBA rather than a monthly fee.

- KBA pricing is included in a large fee, up to thousands of dollars (see our examples below).

Free KBA doesn’t exist. If you see such an appealing offer, more than likely the platform is making up for the cost somehow.

KBA Pricing Comparison

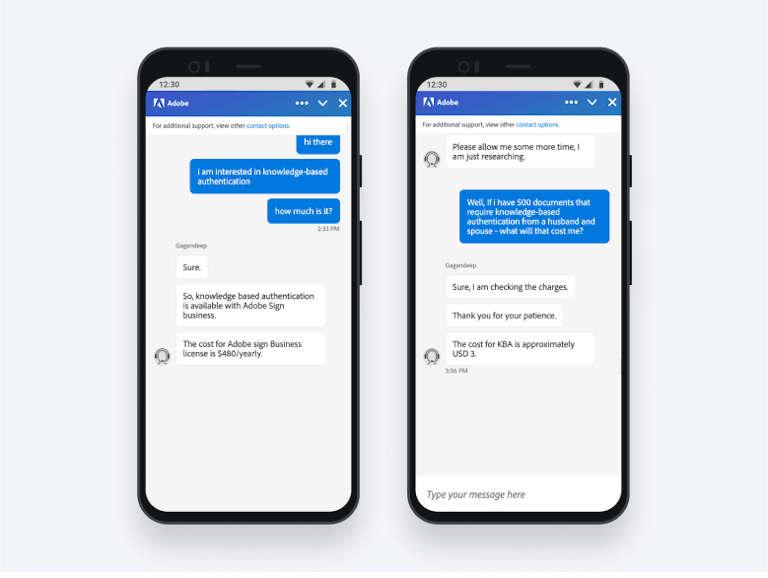

We chose five platforms that provide e-signature options and compared their pricing structures to TaxDome’s. Below is a summary of the vendors and some of the screenshots of our discussions with sales staff about costs (most do not share them publicly).

Only one platform, RightSignature, among five gave a clear idea of their pricing from the start: a minimum fee of $2,700 a year for up to three users and 300 documents per month—for signatures alone.

KBA Pricing Overview

This table shows the pricing structures for TaxDome, DocuSign, HelloSign, RightSignature, and Adobe.

TaxDome

E-signing on TaxDome is free without restriction. TaxDome offers UNLIMITED and free electronic signatures included in the subscription price. The cost for KBA is $1 per signature.

The difference between this service and the others listed? TaxDome’s business model isn’t built on generating revenue from e-signatures. E-signing is just one feature among many that work together to create an integrated platform, where tax and accounting professionals can handle all aspects of their practice both internally (workflow, project management, etc.) and externally (communication with clients, exchanging documents, invoicing, etc.).

DocuSign

DocuSign charges $300 per year for unlimited e-signatures. Plus, $3 per KBA.

We’ll use this model throughout to make our calculations: Say, you’re a sole practitioner with a 500-client practice, and each client—for simplicity’s sake—is married.

This will be your cost for e-signatures alone.

HelloSign

HelloSign offers three free e-signatures per month; otherwise, it’s $180 per user for unlimited e-signatures, with no option for KBA.

We’ll skip the calculation here. No sense figuring out expenses for electronic signatures that you can get for free elsewhere….

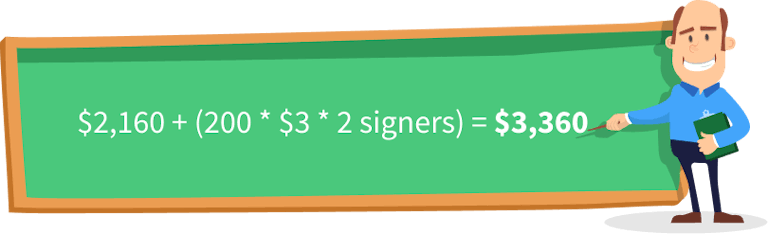

RightSignature

KBA costs are baked into the RightSignature subscription price, which includes 300 KBA requests. After going through three sales people, we still could not obtain a clear idea of the pricing once the 300-signature limit is exceeded.

The calculation using the model above includes 500 documents ($3 per signature after 300 are used):

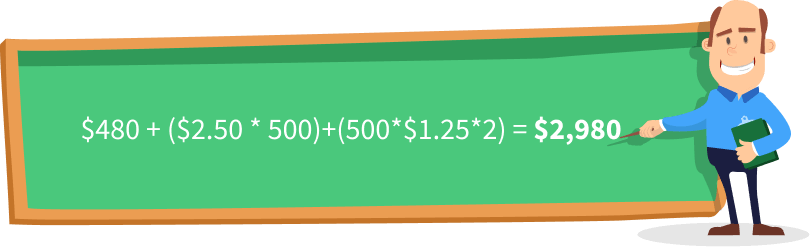

Adobe

This platform charges $480 a year per user for collecting signatures—and $3 for each KBA. No biggie, right?

But you’re a small business owner, and every expense counts:

Canopy

E-signatures are included in Document Management package that costs $40 per month (billed annually) which is $480 annually. However, Canopy is charging an additional $2.5 per client.

Getting back to our example, the calculation is:

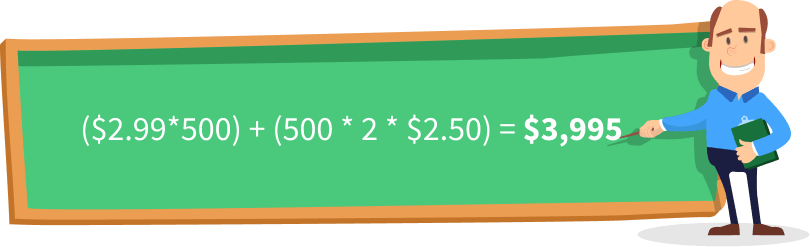

Proconnect

Proconnect sells e-signatures in packages depending on folders. One folder per client costs $2.99. You can opt for a 50 folder package, but for our example and 500 clients we’ll take $2.99 per folder/client. Simple calculations give us these results: $ 3 995—and this is for document management only!

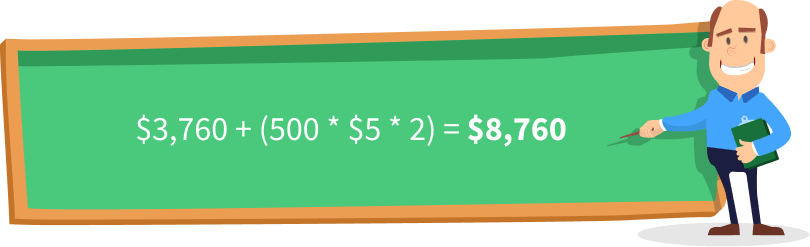

UltraTax

UltraTax provides plenty of packages, but the one for 1040s is the most expensive one: $3,760. E-signatures are included in all packages, but UltraTax will charge you an additional $1 for each document signed or $5 per document with KBA.

Calculating these gives us the following: $8 760— this is officially the most expensive provider in our research.

Secret method to save money on KBA

You can bundle all signature pages in one PDF file (you can merge them in TaxDome) so that each client verifies only one. This is legal and can save you a lot of money.

No KBA but step-by-step instructions on how to print and mail 🤦♂️

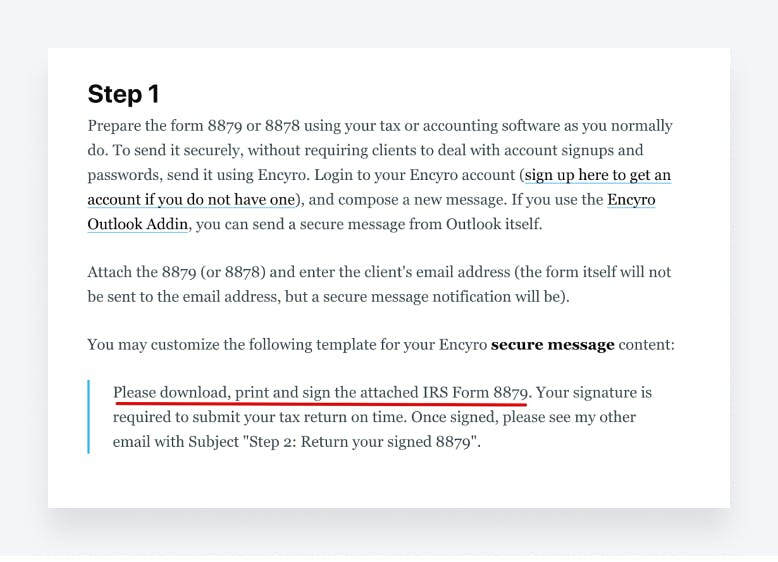

Some companies suggest using workarounds to avoid paying for KBA. A Google search turned up Encryo as such a platform (see screenshot below). They do not offer KBA, but they instead recommend emailing your client, asking them to physically print Form 8879, sign it, take a picture, then send it back to you. Print? Mail? Seriously?…

We know how hard it is to run your own business. That’s why we aim to remove barriers for firms and provide an all-inclusive integrated platform with easy and transparent pricing.TaxDome offers unlimited e-signatures, contacts, and document storage together with secure messaging, white-labeled client portal, and top-notch client service: everything you need to automate your accounting or bookkeeping practice.

Thank you! The eBook has been sent to your email. Enjoy your copy.

There was an error processing your request. Please try again later.

What makes the best accounting firms thrive while others struggle to keep up? We analyzed our top 20 TaxDome firms, representing over $100M in combined revenue, to uncover the strategies driving their success.