Meet Michelle Cook, one of the partners at Carter Cook CPAs that helps small local businesses run more efficiently and maximize profit.

Michelle came from a public accounting background and now is looking to build a firm where clients feel they are taken care of. She is also focused on work-life balance and ensuring that her employees do not burn out.

“I started my own business because I felt the accounting industry has a lot of potential to offer. If a firm is well run and managed, we can provide superior service to our clients and take care of the employees at the same time. So I’m crafting a firm where our employees don’t work overtime during tax season, which is unheard of in the industry. It would be impossible without TaxDome”.

Organizing firm structure

Michelle is passionate about building a new age accounting firm, so we decide to dive deeper into the structure of it.

“One of the problems I found being an employee within a public accounting firm was that I had 10 different bosses on different projects. Now I’m trying to get rid of that by creating so-called ‘pods’.

Each pod works as a team on the same clients. We have monthly packages for taxes, sales tax returns, bookkeeping, and quarterly calls with clients. A pod will consist of bookkeepers, a CPA, a manager, and a virtual assistant to cover all the services. Now we’re building our first pod and getting all of our systems in place. TaxDome and the pipelines we set up have been a big piece of it.”

At the time of publication, Carter Cook CPAs has 6 employees and is looking to grow, building additional pods based off of the aforementioned structure.

Watch Michelle Cook explain how pods will work:

Improving team performance

Setting up a new firm means building processes from scratch. Michelle thinks back to the time when they were getting started.

“We didn’t have any system in place. We were using Google Drive for document sharing, organizers, and task tracking. It was really confusing to figure out where we were on projects. Then, I got to the point where I was about to build a team. I knew I could handle everything on my own, but as soon as you bring in other people, lack of organization doesn’t fly. I needed a system where my team would know where each project was at.”

Michelle confesses that she spent a lot of time researching various software solutions. Most options were not all-in-one, like TaxDome. Carter Cook CPAs wound up choosing between TaxDome and Canopy, but chose TaxDome because of the transparent pricing structure.

All-in-one was a must have for Carter Cook CPAs. Michelle knows firsthand that context switching is one of the worst things for being productive. With TaxDome, her team has a centralized system for projects, clients, and documents that helps them track everything more efficiently.

Top 5 TaxDome tools to increase team efficiency, according to Carter Cook CPAs:

- Email Sync: shared inbox to email clients & keep the team apprised of all communication.

- CRM: ability to track client interactions, notes, and personal information.

- Conditional organizers: efficient and professional-looking method to obtain information from clients. Follow-up questions appear based on client answers (are you married, did you sell property, etc).

- Mobile scanner: many clients don’t have physical scanners, so they can easily scan documents in the Android or iOS mobile apps

- Project management boards: keeping track of everything without losing context is key to a team’s efficiency.

Watch Michelle Cook talk about how TaxDome helps increase their team’s efficiency:

Building a better customer experience

Carter Cook CPAs works remotely with clients all over the U.S.. Michelle’s partner has a much older client base, so clients drive to the office to hand him their papers. Michelle herself follows a different approach:

“I have millennial clients, everyone is pretty into technology. I’ve had fantastic feedback on the mobile app. I love that I can send organizers through the portal. I record a Loom video that explains how to use organizers. With video instructions, clients are able to fill it out whenever it’s convenient for them. If they want to do it at 10pm, that’s fine! It frees up my schedule to be able to focus on things other than paper pushing.”

Watch Michelle Cook talk about her client’s experience:

Carter Cook CPAs are focused on communicating and building trust with their clients — small businesses.

“When I have sales calls with clients, 90% of the time the reason why they’re switching accountants is because they can’t get a hold of their accountant and they can’t get answers. So we want to proactively use TaxDome to be able to keep people happy and informed.”

Carter Cook CPAs have a whole process for that in TaxDome:

- Discovery call, where clients fill out a questionnaire.

- Admin creates an account in TaxDome.

- Clients securely upload information.

- Phone call with client to determine client needs.

- Contract sent & signed.

- Welcome email with instructions sent.

- Tags applied.

- ACH direct deposit set up.

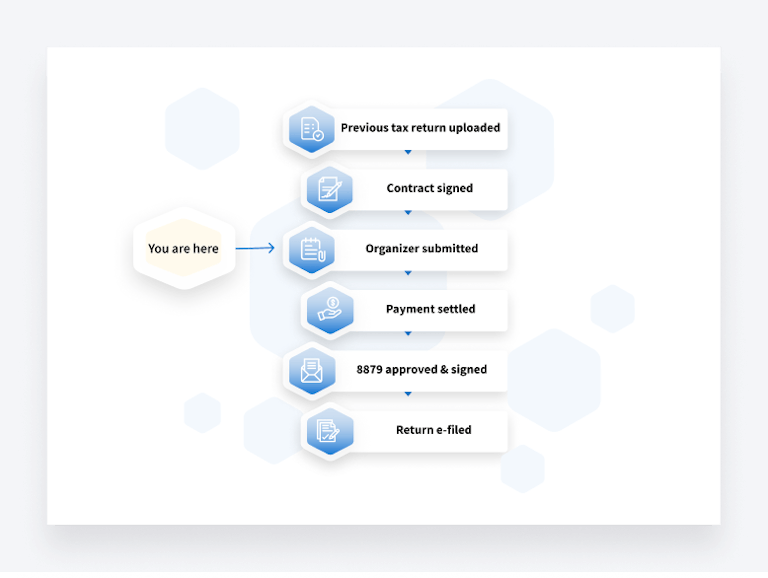

Carter Cook CPAs plan to improve their communication even more by adding visual descriptions of where their clients are in the process to automatic emails. We recreated how these descriptions might look like:

Read on how Joseph & Hetrick, LLC grow their client base with a top-notch client experience.

Having these touch points with clients takes no additional time from Carter Cook CPAs, but creates deeper relationships with them, like Michelle was dreaming about.

Thank you! The eBook has been sent to your email. Enjoy your copy.

There was an error processing your request. Please try again later.

What makes the best accounting firms thrive while others struggle to keep up? We analyzed our top 20 TaxDome firms, representing over $100M in combined revenue, to uncover the strategies driving their success.