Sydney H. Highley CPA have been in business for 30 years: they have a large accounting and bookkeeping practice. Sydney H. Highley, the founder of Sydney H. Highley CPA, told us how they adopted TaxDome two weeks before the start of tax season 2021, and how it helped them to complete the most returns in their practice.

‘‘It’s impressive how your software is so user-friendly for me to be able to automate all my processes and actually launch this thing in the second week of January. I was telling my staff that one of the best things we’ve done in our business is to get you guys on board.”

Watch Sydney talk about how TaxDome became a game-changer for their practice:

Challenge

Every tax season they prepare over 800 returns. They had been looking for a tool to inform clients about the status of their return and make the process less time-consuming for the team. Additionally, their invoicing and billing process lacked structure and offered limited payment options.

Things got more complicated when the season started and their main admin took another job; finding and training a new employee needed time. Losing an experienced team member during this busy time could have resulted in slowing down operations and the loss of client trust.

The key problem was a lack of organized and centralized workflow, which meant that most of their time and effort was spent on manual, repetitive operations (emailing clients, manually reconciling invoices, etc), leaving less time for revenue-generating work.

Solution

Their main goal was to find a way of preparing over 800 returns while maintaining the quality of services in spite of limited staff resources. Here is how implementing TaxDome into the core of their practice helped Sydney H. Highley CPA streamline key business processes and maintain the reputation of their firm.

‘’People would email us or call us, ‘Hey, I am just checking on my return, can you let us know what the status is?’ We tried to stay ahead of the waves. TaxDome helped us with automatic emails with my videos: ‘Your taxes have been prepared but they are now in review. Stay tuned.’ It’s probably the best software I’ve ever used in my entire career.’’

1. They automated client communications by sending out automated emails with explanatory videos to keep clients in the loop, and adding a personal touch without expending extra time and effort.

2. Integrating TaxDome with CPACharge, Stripe and QuickBooks Online allowed them to not only accept credit cards and ACH payments but also have all accounting data automatically synced to QuickBooks, thus increasing their account receivables.

Watch Sydney talk about the TaxDome tools that allowed them to reduce friction and stress during last tax season:

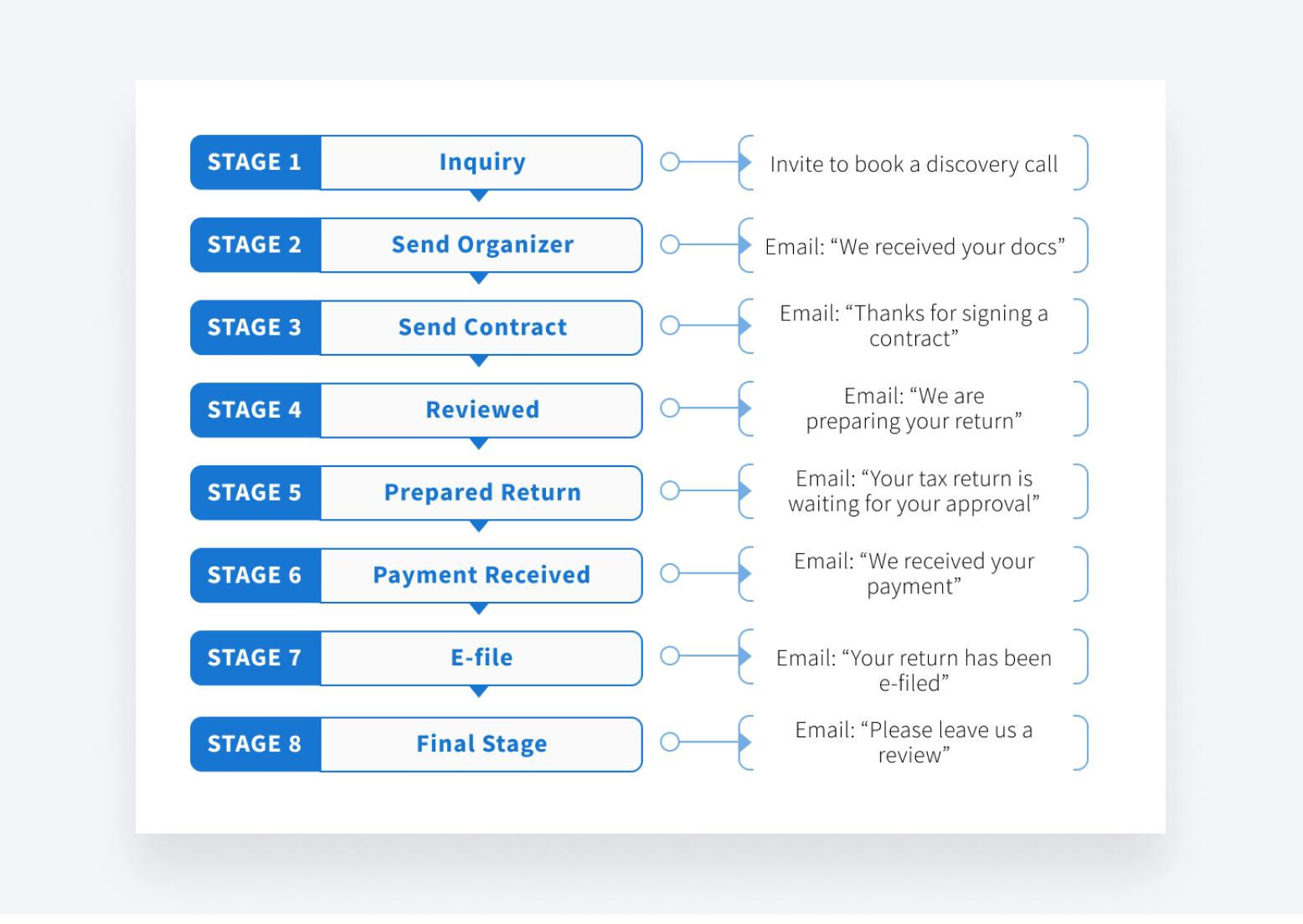

3. They used the Pipeline feature to automate every step of the tax return process and keep track of every assignment by due date, assignee, status, etc.

‘‘We take advantage of the pipelines. That is how we manage the status of all our jobs. I put on each of the jobs who’s assigned to the job, who is the lead person, the stage where the returns are in. You can move the statuses; you can change the settings. It’s a better way of managing the team.’’

Check out how Brittany Pullin of Tax Man to You scales sales tax processes with TaxDome automations.

Results

As stormy as tax season 2021 was for Sydney H. Highley CPA, they got through it, and the tools they used to deliver greater benefits meant they were more than ready for 2022’s upcoming season. By utilizing TaxDome, they:

- Enhanced client experience and saved the masses of time they once spent on manually sending emails and follow-up calls by automating client communications.

- Integrated with the key payment providers and built a stronger invoicing process without needing manual reconciliation.

- Stayed informed about every project’s activity at any given moment – without switching between multiple apps and tabs – by setting up their tax prep workflow with TaxDome.

- Maintained a high level of service and client loyalty.

- Reduced the number of subscriptions they had before switching to the all-in-one TaxDome approach.

Join our daily demo to see how to automate your practice with TaxDome

Join Live demoSydney told us that he’s now become a TaxDome power user and advocate. Although he is a DIY type and appreciates TaxDome’s intuitive user interface, our Customer Support Team is always there and of great help when he needs them. At the time of publication, they are setting up the bookkeeping workflow within TaxDome and getting ready for the upcoming tax season.

Thank you! The eBook has been sent to your email. Enjoy your copy.

There was an error processing your request. Please try again later.

Looking to boost your firm's profitability and efficiency?

Download our eBook to get the answers