Meet Brittany Pullin, manager and sales tax associate at Tax Man To You, LLC. The firm focuses on e-commerce sellers and sales taxes. Having experienced strong growth for the last 3 years, Tax Man To You were looking to build predictable processes and centralize client management.

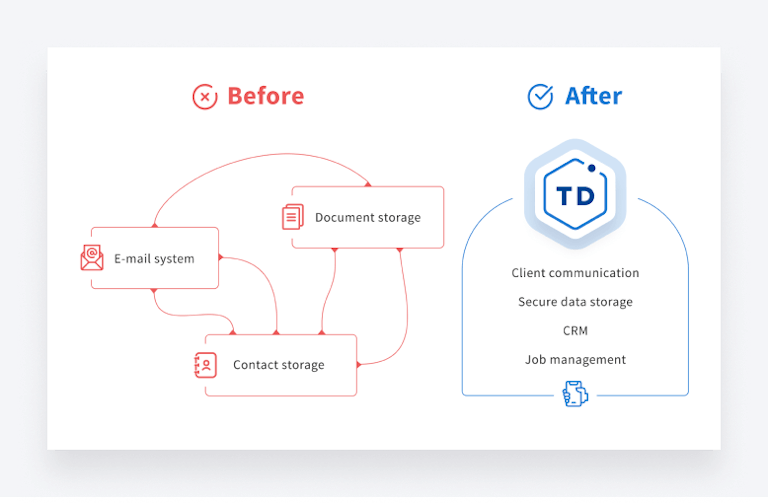

“We were trying to move from a process of file storage and client management into a true CRM. We had tried a couple of different management systems before we stumbled on TaxDome. And TaxDome seemed to be exactly what we were looking for and a lot more.”

TaxDome enabled Tax Man To You to get rid of a standalone email system, replace insecure document storage with secure unlimited document storage and to fully centralize client data.

Building team management processes

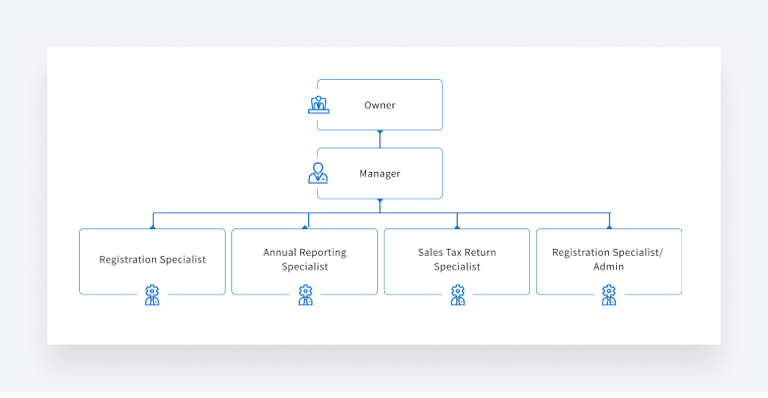

By the time Brittany joined the team in 2018, the firm had one full-time employee and about 80 clients. Since then they have scaled the business 2x, bringing on new staff and clients.

Watch Brittany Pullin discuss the growth of the team:

At the time of publication, Tax Man To You had 6 employees, over a hundred business clients and actively growing their client base.

We asked Brittany what helped the firm to better organize their processes:

“With TaxDome we’ve been able to gather client management and job management in one place: communicate with clients, store data, create organizers to obtain data from clients, assign tasks to our team. It’s been a game changer.”

Having TaxDome workflows at hand allows Brittany to know who’s working on a particular client and to segment their clients accordingly. For example, to quickly find which team member is working with clients from California and to allocate work to other team members. As a manager, she is always in the know of task responsibility, timelines, deadlines and can plan workload accordingly.

“TaxDome helps us to see what our processes look like, how much workload there is and whether or not we’re in a position to bring on new clients, or if we need to slow down onboarding.”

Watch Brittany Pullin sharing her way of managing the team with TaxDome:

Read how Carter Cook CPAs organizes their team to provide better services.

Growing a niche business

Tax Man To You works in a niche market serving e-commerce sellers who sell on Amazon, their own website or have a brick and mortar point of sale. Their services include nexus surveys (whether the products that sellers are selling are taxable in each state where they may have a tax obligation for sales tax), reverse audits and sales tax registrations.

“Most regular accountants and bookkeepers don’t learn sales tax. It’s not a topic that’s covered in depth. A regular CPA or bookkeeper is regulated in the state where they practice, so they’re not required to know the laws and sales tax, or otherwise of other states, other than the state where they are practicing. As soon as e-commerce businesses begin to operate in multiple states, that’s where we step in.”

Watch Brittany Pullin explaining the benefits of working in a niche market like Sales Tax:

Implementing new software into every firm process

There is a misconception that TaxDome is built solely for tax practices. TaxDome is flexible and works for accounting and financial firms of all sorts (sales tax, financial planning, bookkeeping, payroll, part time CFO, and more). Firms are able to tailor TaxDome tools to the specific needs of their firm.

The key to implementing the new software has been to anoint a ‘Champion’ to lead the team. Laura has taken charge to implement the new software in the firm; learning new features, creating pipelines specific to their unique processes, creating and testing automations to ensure that they function exactly how they want them to. Thanks to Laura, the firm processes have become more streamlined.

3 steps to move to a new system

- Import clients and documents

- Learning the new processes

- Re-learning how to do the new processes from the old processes

The TaxDome team is always available to help you get started, including free 1:1 training sessions. Here is our brief on your first week with TaxDome.

Top TaxDome features to streamline sales taxes processes

- Organizers to obtain data from clients easily. These are secure and encrypted forms that clients can get online and fill out and upload sensitive data into them.

- Pipelines to see exactly who is working on each Job, the status of it and ensure nothing slips through the cracks.

- Automations to reduce admin work and send messages, emails and timely reminders.

- Unlimited document storage to store and share sensitive data and processes to retrieve any information that the firm needs from clients.

- Unlimited support with free screen-sharing training sessions where onboarding specialists help you build up processes depending on your needs.

- Dedicated client help area with handy videos to share with clients.

Watch Brittany Pullin sharing their clients’ feedback on using a new client portal:

At the time of publication, Tax Man To You is looking to integrate their billing process into TaxDome and automate admin work wherever possible which will allow them to bring on more clients with the same amount of resources.

Thank you! The eBook has been sent to your email. Enjoy your copy.

There was an error processing your request. Please try again later.

Download our eBook to get the answers