During a few months each year, the accounting world kicks into a collective frenzy. Firms are inundated with requests, the work piles up and deadlines loom large. In the industry, this period is known as busy season — and, as the name suggests, things can get pretty manic.

Busy season can be a challenging time. The increased volume traditionally means that accountants have to work longer days and even weekends, which can leave even the most seasoned professionals feeling jaded. But it doesn’t have to be that way.

In this article, we’ll explain everything you need to know about accounting busy season: what it entails, when it occurs and — most importantly — how to survive it.

What is busy season?

Busy season is a period when accounting professionals handle a huge spike in volume due to various financial reporting requirements. It usually occurs during the lead-up to key financial deadlines, such as the tax-filing season or the year-end financial reporting period.

Busy season isn’t just a busy period — it’s a pivotal time for accountants across various specializations, including auditors, tax preparers and financial analysts. During this period, the importance of their role cannot be overstated. Here’s why:

Tax compliance

Tax preparers are swamped with individual and corporate tax returns during busy season. These returns must be meticulously prepared, reviewed and filed on time to ensure clients remain compliant with tax regulations.

Auditing

Auditors engage in rigorous examinations of financial statements to ensure they are free from errors. This process is vital for maintaining the integrity of financial reporting and fostering trust in the business world.

Year-end reporting

Many businesses follow a fiscal year-end that aligns with the calendar year, making the end of the year a critical period for finalizing financial statements. This information is critical for decision-making, attracting investors and complying with legal obligations.

While busy season occurs across the accounting profession, it is particularly noticeable in certain industries and sectors such as:

- Public accounting firms

- Corporate accounting departments

- Financial services

- Government and nonprofit organizations

When does busy season start and end

Busy season is a rather broad term that encompasses different timeframes associated with different accounting processes. We’ll explore these different timeframes in detail below.

1.Tax season

Tax season is perhaps the most widely recognized busy season for accountants.

While it can vary from country to country, tax season traditionally kicks off in the United States in January and culminates on April 15, which is the IRS’s deadline for filing individual tax returns. If the deadline falls on the weekend or a legal holiday, it’s delayed until the next business day.

During this window, individuals and businesses must file their annual tax returns. The rush to meet this deadline results in a surge of work for tax preparers, who must collect financial data, calculate tax liabilities and submit returns accurately and promptly.

2. Audit season

Audit season varies depending on the type of audit — e.g. internal or external — and the organization’s fiscal year. That said, it often coincides with the tax busy season, with preparations beginning in the new year and continuing throughout the first quarter.

Because auditing involves detailed examination of financial statements and records, starting early in the year gives auditors time to review the previous year’s financial performance and provide accurate assessments.

3. Year-end reporting season

In the United States, the fiscal year can vary from company to company, but many choose to align their fiscal year with the calendar year.

Once a publicly traded company’s fiscal year ends, they typically have between 60 and 90 days, depending on the size of the company’s public float, to file their annual earnings reports with the Securities and Exchange Commission (SEC).

Private companies such as LLPs, sole proprietorships and partnerships aren’t required to disclose their financial statements, but they will likely still have internal reporting requirements once their fiscal year ends.

4. Industries and specializations

Busy seasons can also vary within specific industries and specializations. For example, in the retail sector, the holiday season triggers a surge in financial activity, resulting in a spike in accounting work.

Similarly, industries with specific regulatory requirements, such as healthcare or real estate, may have unique busy season timelines.

Tips to help accountants during busy season

Busy season is known for being a challenging and intense period. But with the right strategies and tools, it’s possible to not only survive but also thrive during those hectic few months.

Here are some valuable tips to help you along the way:

1. Prioritize tasks effectively

With so many tasks to juggle, you need to know what needs doing first. If you’re part of a team, you also need visibility into who’s doing what and when.

There are tons of tools out there that can help you prioritize, assign and track tasks. You can use dedicated task management tools like Asana or Trello. Alternatively, you can go for a practice management platform that includes task management capabilities.

2. Leverage workflow automation tools

Whether it’s emailing new clients or sending out invoices, accounting involves a lot of repetitive tasks. Thanks to automation tools, you no longer have to waste your time performing these tasks manually.

Workflow automation is a fast-growing market, and in the accounting world, there are plenty of options to choose from. Tools like QuickBooks and Xero allow you to automate the actual accounting process, covering routine data entry and reconciliation tasks.

Then there are practice management platforms like TaxDome that automate the processes involved in delivering accounting services and managing your firm, including:

- Client communications

- Task management

- Generating and sending engagement letters, questionnaires and invoices

- Account access

- Document management

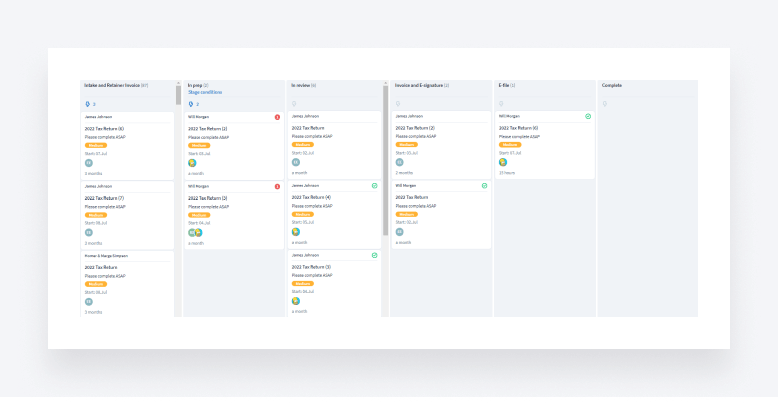

Let’s look at an example of how automation can help you streamline the tax return process.

- First, new clients are automatically sent a “welcome” email. Returning clients receive a “welcome back” email

- A tax organizer is then automatically sent to all clients to gather relevant information and documents for the tax return

- Once the organizer is completed, the accountant reviews the documents and processes the return

- An invoice is automatically sent out to the client

- Once the invoice is paid, the completed tax return is automatically sent to the client

As you can see, this automates almost all of the repetitive tasks associated with the tax return process. You still have to complete the actual tax return yourself, but everything else — all communications, document sending, and payments — happens automatically, without you lifting a finger.

This is what the process looks like in TaxDome. You can see the stages of the process and where each client is in that pipeline.

Automating your tax return process not only allows you to take on more clients during busy season, but it also enables you to keep your clients in the loop with automated messages every step of the way.

In addition to tax returns, you can set up automated workflows for client onboarding, payroll processing, bookkeeping or any other accounting process. TaxDome has a library of ready-made templates that you can use and customize, so there’s no need to set everything up from scratch.

3. Be realistic about how much work you can take on

If you’re a freelance accountant or a firm owner, it can be tempting to say yes to anyone and everyone who needs your services. During the rest of the year, you’re out there searching for new clients, and all of a sudden you are inundated with requests.

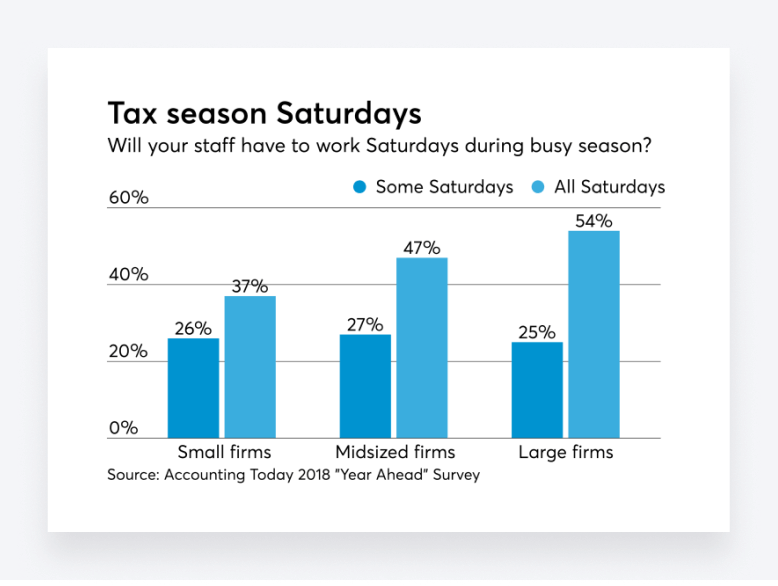

Taking on a ton of new clients might feel good at the time, but remember, there are only so many hours in the day to serve them all. No wonder so many accountants end up working weekends during busy season — as you can see from the chart below.

If you take on too much work, it could easily backfire. For example, you might:

- Find yourself overworked, stressed and burnt out

- Fail to meet deadlines — and disappoint clients as a result

- Complete the work but to a poor standard

None of these outcomes are good for your business or wellbeing. So instead of saying yes to everyone, we recommend being pragmatic about how much work you can take on. As a general rule of thumb, it’s best to underpromise and overdeliver rather than the other way around.

4. Dip into the freelance market for temporary support

Alternatively, you can turn to the freelance accounting market to bolster your ranks during busy season. This will allow you to temporarily scale up your accounting capacity without having to commit to long-term hiring decisions.

Check out platforms like Upwork, Fiverr and Freelancer to access a global talent pool of freelance accountants and tax professionals.

5. Collaborate, communicate and delegate

To come through busy season unscathed, you and your colleagues will need to work as a team. That means fostering a collaborative environment where open communication is prioritized. Let’s look at some practical ways you can do this:

- Delegate tasks appropriately to leverage the strengths of team members

- Use a task-management tool that lets everyone see who’s working on what

- Use an instant-messaging platform like Slack to help your team communicate effectively

6. Stay informed about tax law changes

As if busy season wasn’t tricky enough, the underlying laws and regulations you must adhere to often change from year to year. To ensure that you are always on the right side of regulations, you’ll need to stay up to date with the latest changes.

Here are some great places to stay informed:

- IRS Newswire: subscribe to get tax law news right from the source

- AICPA CPA Insider: a weekly news bulletin from the American Institute of Professional Accountants

- Accounting Today: subscribe for the latest tax news, insights and tools

- Deloitte Tax Alerts: subscribe to get tax alerts straight to your inbox

- EY Tax Alerts: choose which tax topics you want to hear about and how often

- KPMG TaxNewsFlash: get tax reports and updates in the US

- PWC Insights: a daily summary of all tax, finance and regulatory news

7. Experiment with time management techniques

For most people, the default approach to handling a high volume of work is to plough through long hours with few breaks. But this strategy can be counterproductive. Most people simply can’t focus for hours on end, especially when numbers and screens are involved. This can lead to mistakes and burnout.

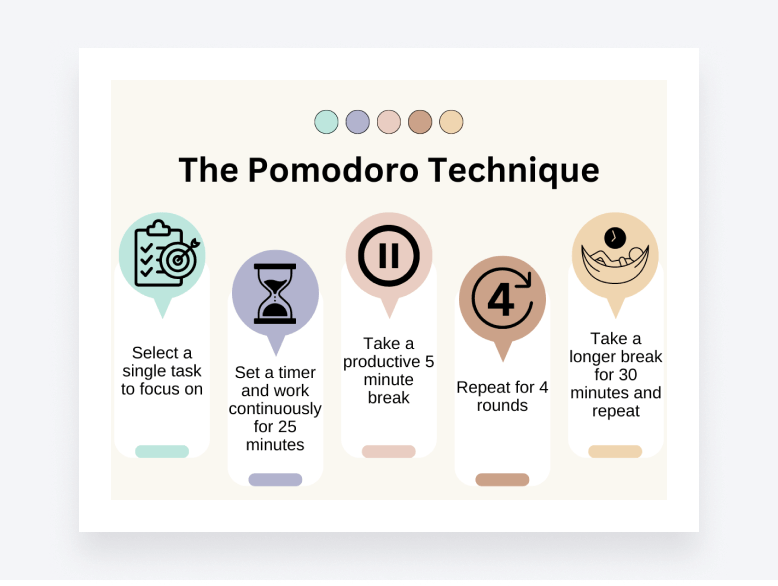

Instead of marathon work sessions, you could experiment with alternative time management strategies. The Pomodoro Technique is one such example. It involves focusing on a single task for 25 minutes, then taking a five-minute break to regain focus. You repeat this cycle four times before taking a longer break.

The main point here is that taking regular breaks is beneficial for your productivity, as is breaking work into manageable chunks of time. This allows you to tackle accounting tasks with your full focus — and avoids the mental and physical fatigue that comes with long stints at the desk.

8. Prioritize your mental and physical wellbeing

The long hours and stress that come with busy season can take a toll on your mental and physical health. The screenshot below was taken from the r/Accounting subreddit and portrays just how brutal busy season can be:.

Ultimately, no job is worth sacrificing your wellbeing for, and everyone deserves to maintain an acceptable work-life balance. That can mean different things to different people, of course, so the key thing is to know yourself and your limits — and to not push yourself beyond those limits.

Here are some practical tips you can apply to help alleviate stress and maintain a healthy state of mind during busy season:

- Allocate time for relaxation, exercise and spending quality time with loved ones

- Practice stress management techniques like meditation, mindfulness or yoga

- Use mental health apps like Headspace to help you disconnect from work

- Set boundaries between your work life and personal life — and stick to them

On that last bullet point, it’s worth reading this message from a busy-season veteran on the same subreddit:

9. Continuous learning

The accounting profession is constantly evolving. Not only must you keep up with tax law changes, but you also need to understand the latest technological trends and how they are shaping the industry.

Continuous learning is the key to staying ahead of the accounting curve. If you’re a CPA, a minimum of 40 hours of continuous professional education (CPE) each year is essential to keep your license.

Here are some suggestions for continuous learning:

- Invest in your professional development by taking online courses or certifications

- Explore new accounting software and tools to enhance efficiency

- Join industry associations for networking and access to resources

10. Client communication

Clear communication with clients is always necessary, but it’s especially important during busy season. With tax deadlines looming, your clients want to know where you are at with their tax returns.

Keeping clients in the loop not only helps provide a better service but also heads off any potential questions they may have, which can be time-consuming to respond to.

Here are some tips for getting client communication right:

- Be upfront with clients about progress and potential delays

- Try to preempt what clients might need to know — and tell them before they ask

- Set clear expectations regarding response times and deliverables

- Develop templates for different types of communication (welcome emails, updates, etc.)

- Use a tool that automates client communication

11. Maintain a support system

Support is important during challenging times, especially if you are a junior accountant. Make sure you reach out to more experienced colleagues for advice and guidance during busy season. Here are some practical suggestions:

- Get a professional mentor who’s been there and done it

- Connect with peers to share insights and strategies

- If you’re a firm owner, check in with your staff regularly to see how you can support them

12. Review and reflect

It might feel like busy season will last forever, but things will eventually calm down. In addition to enjoying the relative peace, it’s important to review how it went and identify areas where you and your team can improve. Here are some questions you can ask to help with that process:

- What strategies worked well, and what didn’t?

- What were the major pain points and bottlenecks in our process, and how could we remove them?

- What role did technology play in simplifying our processes, and where could it be improved?

The key here is to approach next year’s busy season in a better position, allowing you to reduce stress and serve clients faster.

Conclusion

Busy season is traditionally a challenging time for accountants due to the sheer volume of work they have to deal with. But with the right strategies, mindset and technology, there’s no reason to dread it.

By embracing the tips we’ve outlined in this guide, you can provide your clients with the best possible service without sacrificing your mental and physical wellbeing. So when the next busy season rolls in, be prepared to ride the wave of work with confidence and competence.

Thank you! The eBook has been sent to your email. Enjoy your copy.

There was an error processing your request. Please try again later.

Looking to boost your firm's profitability and efficiency?

Download our eBook to get the answers