To thrive in today’s ultra-competitive world of accounting, firms must be highly efficient and streamlined. That means embracing technology that allows them to do more with less — like process automation.

Process automation means that many of the repetitive tasks associated with accounting happen automatically. As a result, accountants are liberated from mundane, low-value work, allowing them to spend more time bringing real value to their clients.

In this article, we’ll dive deep into accounting process automation, covering:

- The benefits it can bring

- Key processes that can be automated

- How to successfully automate your accounting processes

- Examples of process automation in action

- Risks and challenges to be aware of

Understanding accounting processes

Before we explore how automation can transform your accounting processes, it’s important to understand what those processes are, and the challenges that accountants traditionally face with them.

Let’s look at some key examples.

1. Accounts payable

Accounts payable involves managing the money your business owes to its suppliers and creditors. This process includes invoice processing, payment authorization and ensuring timely payments.

2. Accounts receivable

Accounts receivable focuses on managing the money owed to your business by its customers. This process includes invoicing, tracking payments and pursuing outstanding receivables, all of which are critical for maintaining healthy cash flow.

Take a deeper dive into accounts receivable and download our free AR template>3. Financial reporting

Financial reporting involves preparing and presenting financial statements to internal and external stakeholders. It provides insights into your company’s financial performance, enabling informed decision-making.

4. General ledger

The general ledger is the core of your company’s financial records. It aggregates all financial transactions, categorizes them into accounts and provides a comprehensive overview of your company’s financial position.

5. Budgeting and forecasting

This process involves creating budgets, forecasts and financial plans to guide your company’s financial decisions and broader strategy. This process relies upon accurate and timely financial data, as well as effective models to interpret that data.

6. Processing tax returns

Come busy season, accounting firms are inundated with tax return requests. Handling this spike in volume is a huge challenge for accountants, who have to gather key tax documents and keep clients in the loop throughout the process.

Explore how to create a tax return letter for your clients >7. Practice management

In addition to the nitty-gritty of accounting, there are also a range of processes that accountants must handle relating to the day-to-day running of their firm. These include:

- Onboarding new clients

- Communicating with clients

- Managing projects and tasks

- Sending out proposals, engagement letters and invoices

The processes we’ve listed here are all crucial to the success of your accounting firm or business, but without the right technology, there are all sorts of challenges that can hold you back from delivering high-quality, accurate work at scale. Let’s look at some examples:

- Human error associated with manual processes

- Manual processes can be very resource-intensive, making it difficult to scale your business

- Lack of real-time data and insights

- Compliance and reporting complexity

The rise of automation in accounting

To appreciate what a game-changer accounting automation is, it’s important to first understand how technology has shaped the accounting landscape up until this point.

In this section, we’ll explore the historical context, looking at the driving forces behind the adoption of accounting process automation.

1. Pre-technology

Once upon a time, accountants did everything manually. There were no calculators, no personal computers and certainly no accounting software. Since those early days, technological advancements have transformed the way accountants work.

2. The spreadsheet era

The introduction of Microsoft Excel in the 1980s revolutionized financial data management, allowing for more efficient data entry and basic calculations. The accountant still had to manually input all data themselves, however.

3. Dedicated accounting software

The late 20th century saw the emergence of dedicated accounting software such as QuickBooks and Peachtree (now Sage 50). These systems automated certain tasks but often required manual data entry. They also lacked the integration capabilities we see today.

4. Cloud-based solutions

With the advent of cloud technology in the 21st century, accounting software transitioned to the cloud, offering real-time collaboration, data accessibility and simplified updates. Integration capabilities also improved, allowing different platforms to share data seamlessly.

5. Accounting process automation

Today, we stand at the beginning of a new technological revolution: process automation. In essence, this ensures that humans no longer need to worry about all those repetitive, low-value tasks that are traditionally a barrier to productivity.

Because accounting is full of these tasks, the potential impact of automation on accounting is huge. Tasks like client communications, account reconciliations, document sending and invoicing can all be automated, leaving accountants to focus on more high-value work.

The adoption of accounting automation isn’t just a trend — it’s a fundamental shift in the industry. What was once a futuristic idea is now a present reality, as these statistics show:

- Nearly half (43%) of accounting firms are already using software with automation capabilities

- Finance is enjoying a greater ROI from automation than any other department in 30% of organizations

- Only a small minority of accounting professionals (6%) believe that automation isn’t useful to their practice

Benefits of accounting automation

In this section, we’ll look at some of the key advantages that accounting automation can bring to your practice.

Efficiency and time savings

Perhaps the most obvious benefit of automating repetitive tasks is that your accounting practice becomes more efficient and streamlined. With your accountants liberated from mundane work, there’s more time for serving clients and growing your business.

Cost savings

If automation can save you time, it can also save you money. Your staff are now more efficient, meaning it takes less work to serve your clients.

Increased accuracy

Automating data entry and calculations not only minimizes the risk of costly human error but also allows you to flag anomalies or discrepancies in real time. It also ensures that processes happen consistently at scale.

Real-time data insights

Automation ensures that decision-makers have access to real-time financial information, enabling them to make informed decisions promptly and conduct accurate analyses and forecasts.

Compliance and reporting

Automation also makes it easier to meet regulatory requirements and reporting standards. You can automate compliance checks in real time, reducing the risk of non-compliance and associated penalties. You can also automate the process of generating financial reports.

Scalability

Unlike human accountants, your automation tool can perform once-time-consuming tasks instantly. It can also perform the same task multiple times simultaneously. This means accountants can scale their operations significantly, allowing them to take on more clients without needing to hire new staff.

The client experience

A recent report found that 87% of accountants believe that clients now expect more flexibility and a better service without an increase in their rates. Automation allows accounting firms to deliver on this expectation, enabling them to improve service speeds, client communication and the overall client experience.

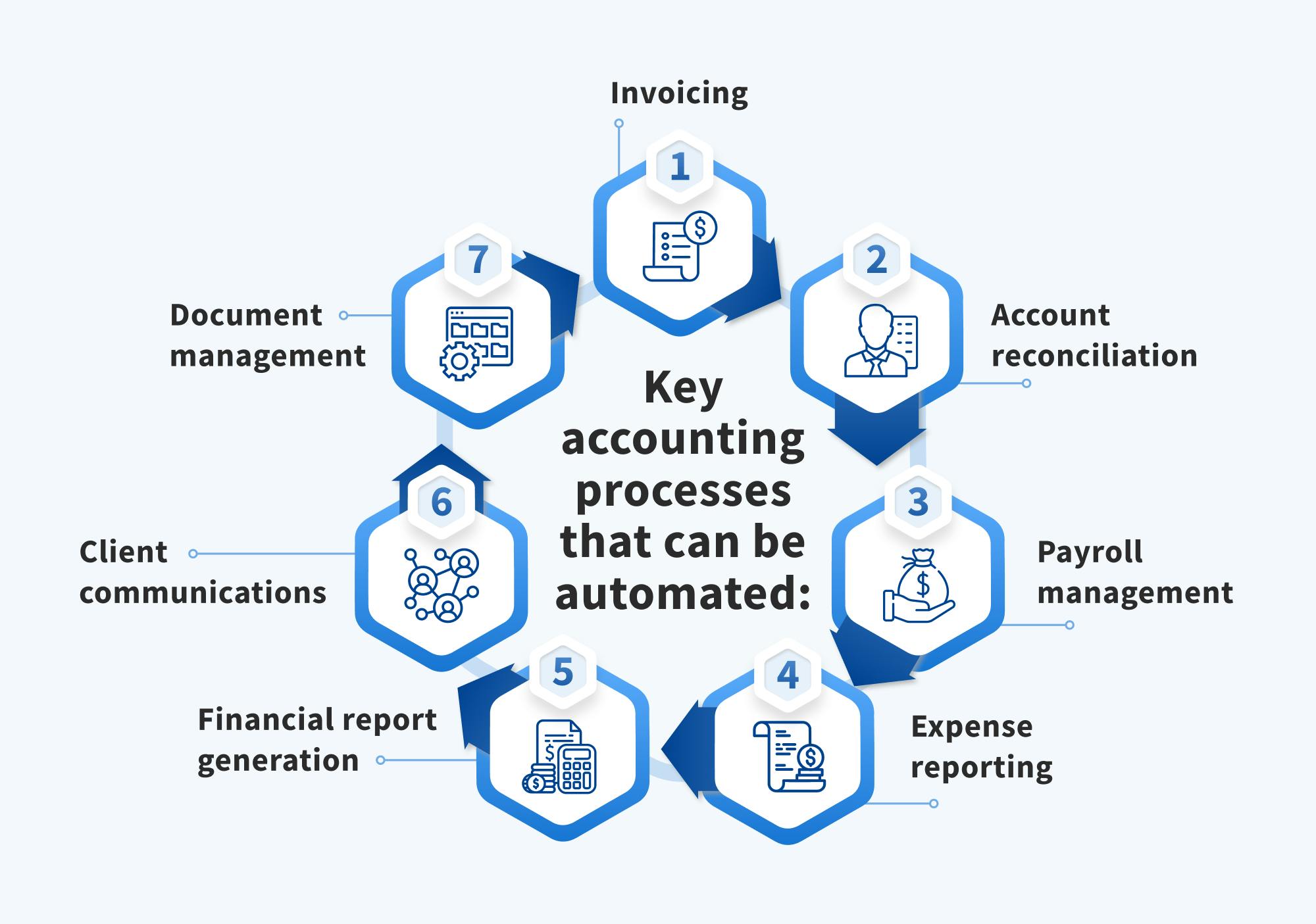

Key accounting processes that can be automated

We’ve talked about the benefits of automation in accounting. Now, let’s look at some real-life examples of processes that can be automated.

1. Invoicing

Accounting firms work with a lot of clients. That means there are a lot of invoices to generate and send each month. Doing this manually can be very time-consuming, but with the right tool, you can:

- Automatically generate and send invoices at predetermined dates or when certain actions are triggered

- Send automated reminders for outstanding invoices

- Trigger certain actions (like sending a completed tax return) when an invoice is paid

Not only does automating the invoice process save you time, but it also ensures that invoices are always sent at the right time, in the right format and with zero errors.

What tools can I use?

Popular accounting software like QuickBooks Online and Xero, as well as practice management software like TaxDome.

2. Account reconciliation

Reconciliation is critical for ensuring accuracy in financial records. Automation can improve this process by:

- Automatically comparing financial transactions with bank statements

- Identifying discrepancies and flagging potential errors

- Generating reconciliation reports with minimal human input

What tools can I use?

In addition to accounting software, there are niche tools for automating account reconciliation, such as BlackLine, ReconArt and Duco.

3. Payroll management

Payroll involves calculating and distributing employee salaries, deductions and taxes. Automation can simplify this process by:

- Automatically calculating payroll based on predefined rules

- Auto-generating pay stubs and tax forms

- Directly depositing salaries into employees’ bank accounts

What tools can I use?

Accounting software like QuickBooks Online, as well as HR and payroll software such as Deel, Gusto and Paychex.

4. Expense reporting

Manually tracking, verifying and reporting on expenses can be a time-consuming and complex task. Automation can enhance it by:

- Automatically capturing receipts and expense data

- Validating expenses against company policies

- Generating expense reports for approval and reimbursement

What tools can I use?

Tools for automating expense reporting include Expensify, Zoho Expense and SAP Concur.

5. Financial report generation

Preparing financial reports is another time-consuming task to perform manually. Given the complexities involved, the risk of inaccuracies or errors is also high. Automation can simplify it by:

- Pulling data from various accounting sources

- Generating standardized financial reports, such as balance sheets and income statements

- Customizing reports based on specific business needs

What tools can I use?

Most modern accounting software can automate the generation of financial reports. You can also use AI-based tools to help generate and format financial reports.

6. Client communications

On top of the processes already mentioned, accountants must ensure that they are delivering an outstanding client experience — and that means keeping their clients informed and updated at all stages.

Manually writing and sending countless messages can take up a lot of your time, but with the right automation tool, you can:

- Automatically generate and send welcome emails

- Send client messages when certain actions are triggered

- Send automatic reminders for outstanding invoices or tasks

What tools can I use?

Practice management platforms like TaxDome allow you to auto-send client emails and messages as part of a wider automated workflow.

You can also use marketing automation, email marketing and CRM platforms to automate client communications. Alternatively, you can use AI tools like ChatGPT to help draft client emails, messages and reusable templates.

7. Document management

Whether it’s onboarding new team members or processing individual tax returns, accounting typically involves gathering, storing and sending a lot of documents. Automating document management saves you countless hours of manual work.

Here are just some of the ways an automation tool can help:

- Auto-sending documents during client or employee onboarding

- Auto-sending forms to gather important documents

- Automatically applying folder templates to client accounts

- Automatically requesting e-signatures

What tools can I use?

Again, practice management systems like TaxDome allow you to automatically send documents, organizers or e-signature requests when certain actions are triggered. Dedicated document management systems like DocuWare and M-Files also have automation capabilities.

Alternatively, you could use an automation tool like Zapier or Make to connect your file storage service (Google Drive, OneDrive, iCloud, etc.) with other tools and create automated workflows that way.

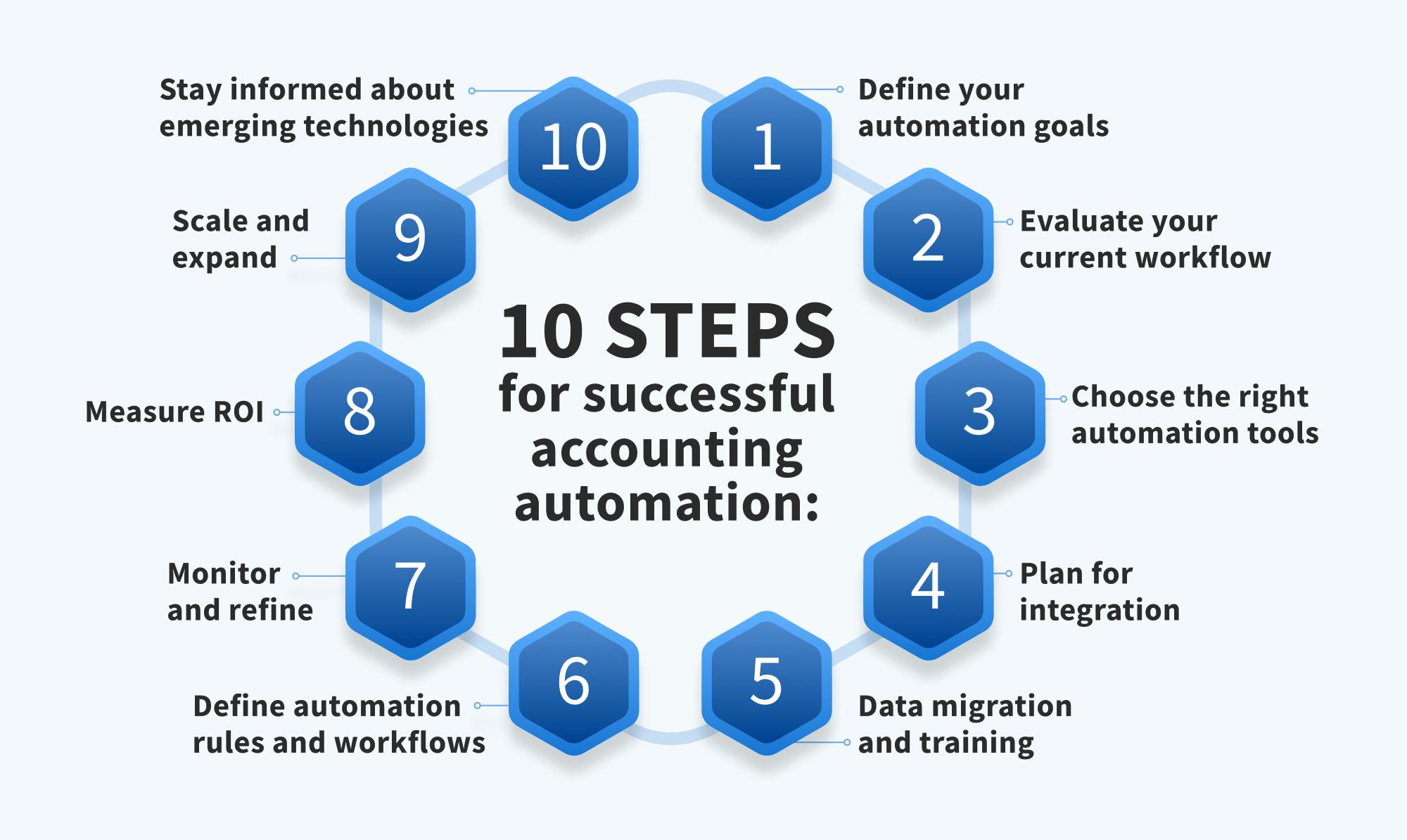

10 steps for successful accounting process automation

Automating your accounting processes can have a transformative effect on your firm, but it requires careful planning and execution. To help you on your automation journey, here are 10 steps you can follow.

Step 1: Define your automation goals

Before diving into automation, you need to clearly define your objectives. Take some time to determine which accounting processes you want to automate and what you aim to achieve.

Step 2: Evaluate your current workflow

Look closely at your existing accounting processes and identify any efficiency bottlenecks. You’ll need to consider the data flow, dependencies and pain points in your current workflows before you can automate them.

Step 3: Choose the right automation tools

There’s a growing number of automation tools on the market, so you’ll need to pick one that aligns with your needs, goals and budget. Consider factors like scalability, integration, user-friendliness and data security when making your choice. Always do your due diligence by checking out user reviews.

Step 4: Plan for integration

Your automation tools should work in harmony with your accounting software, CRM and other tools. Pick a tool that comes with ready-made integrations. Alternatively, choose a system that allows you to replace multiple tools with a single one.

Step 5: Data migration and training

You’ll need to migrate your data to the new automation system and provide training to your team. Familiarize your staff with the new processes, tools and workflows to maximize efficiency.

Step 6: Define automation rules and workflows

Set up automation rules that reflect your desired processes and goals. Define workflows for tasks such as invoice approval, reconciliation and report generation.

Better still, choose tools that come with ready-made workflow templates. TaxDome, for example, offers a library of pipelines, complete with automations, that you can select and customize as you wish. There are ready-made pipelines for client onboarding, individual tax returns, monthly bookkeeping — and many more.

Step 7: Monitor and refine

Once up and running, you’ll need to continuously monitor the performance of your automated workflows. Track key metrics like error rates, processing times and cost savings. Regularly review and refine your automation processes to optimize efficiency.

Step 8: Measure ROI

Evaluate the return on investment (ROI) of your automation efforts by comparing the costs saved and the improvements achieved. Use this data to refine your automation strategy further.

Step 9: Scale and expand

If you started by automating a couple of key tasks, now you can scale and expand your automation initiatives to encompass additional accounting processes. You could even integrate automation into other business departments, like marketing, customer support or HR.

Step 10: Stay informed about emerging technologies

Accounting is a fast-evolving industry, so you’ll need to keep an eye on emerging technologies and trends in accounting automation. Regularly assess your automation tools and processes to ensure they remain competitive and aligned with industry best practices.

Accounting process automation examples

To truly understand the transformative power of accounting process automation, let’s look at three real-world examples of firms that have harnessed this technology to their advantage.

1. How Polaris Tax & Accounting scaled its client base from 50 to 1,500 using TaxDome’s automated workflows

Polaris Tax & Accounting is a virtual accounting practice based in Florida. With the acquisition of a local brick-and-mortar business, the firm’s client base jumped from 50 to 1,500. To manage this huge spike in demand, the Polaris team needed its processes to be as scalable and efficient as possible. This is where TaxDome came in.

By switching to TaxDome, Polaris was able to automate key accounting processes from start to finish, including all client communication and document sending. Now, accounting jobs automatically move through different stages of a pipeline, triggering new automations each time key actions are completed.

Here’s what Polaris’s president and managing partner, Joseph Serrone, had to say:

When we add a client on a tax return, they automatically get a copy of the engagement letter to sign. Once they sign it, they move to the next stage, and they’re informed by email that we’re working on their return. Once that’s completed, they move on to the next stage, to let them know that the tax return has been reviewed.

Automating the firm’s workflows has enabled the Polaris team to work smarter, faster, and more efficiently than ever before, while simultaneously providing a superior client experience.

Read the full story here >2. How Acc Pro Group increased efficiency by eliminating manual processes

Acc Pro, a Singapore-based compliance and advisory firm, was experiencing all sorts of efficiency bottlenecks as a result of manual accounting processes.

When they ditched their legacy accounting system and switched to QuickBooks Online, they were able to eliminate many of the manual processes that had been holding them back, including bookkeeping and reporting. This allowed the firm and its clients to save countless hours while improving data accuracy.

3. How Firebolt streamlined their accounts payable using automation

Firebolt is a fast-growing cloud data warehouse, but it operates with a relatively small finance team of three, including just one internal accountant.

Using DOKKA, an AI-powered accounting and bookkeeping automation system, they were able to automate and streamline their invoicing and accounts payable process. This allowed them to rapidly scale their business while retaining a small team. They have just one person responsible for accounts payable, which would be impossible without automation.

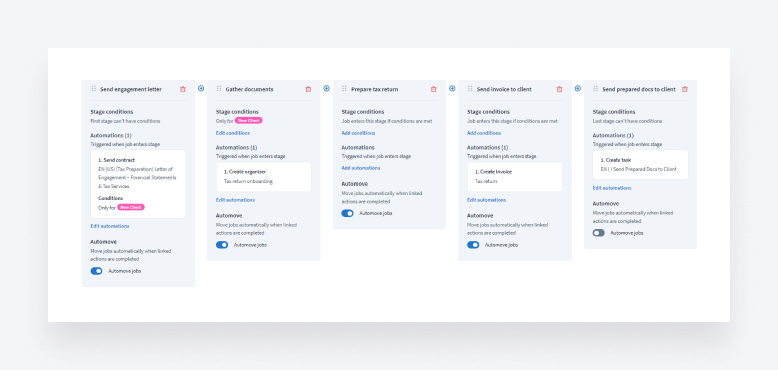

Enhancing efficiency with accounting workflow automation

We’ve already discussed how the accounting profession is packed with repetitive transactional tasks that are ripe for automation. But while automating individual tasks is powerful enough, accounting workflow automation is where things get really interesting.

Accounting workflows encompass a series of interconnected tasks and processes. With the right workflow management software, you can automate these broader processes almost entirely. Each task connects to the next in the workflow, so when one task is completed, the next one automatically triggers.

Let’s look at how this process might work for a specific accounting workflow: individual tax returns for new clients.

- A welcome email and engagement letter are automatically sent out to new clients

- Once the engagement letter is signed, a tax questionnaire is automatically sent out to gather key information and documents

- Once the tax questionnaire is completed, a task is automatically created for an accountant to review these documents and complete the tax return — the client receives an automated message updating them on what’s happening

- Once the tax return is completed, an invoice is automatically generated and sent out to the client

- Once the client pays the invoice, the completed tax return is automatically sent to them

Here’s what an automated workflow for individual tax returns might look like in TaxDome:

This is just one example of how an accounting workflow can be automated. There are many more candidates for automation too, including client onboarding, invoice processing and monthly bookkeeping.

The point here is that you aren’t just automating standalone tasks, you’re automating entire processes from start to finish. This can unlock huge value for your firm, allowing you to increase efficiency, save time, improve accuracy and provide a better client experience — all with minimal manual effort.

Make sure your firm implements automation successfully with our 7 key steps to automate accounting workflow.

The risks and challenges of accounting automation

We’ve discussed the benefits that accounting automation can bring to your firm, but it’s also important to understand the potential challenges that come with adopting this relatively new technology.

Let’s explore some of the key risks, as well as some strategies to ensure a smooth transition to automated accounting.

Data security

Risk: Automating accounting processes often involves handling sensitive financial data. If adequate security measures aren’t in place, this data could be vulnerable to breaches or unauthorized access.

What to do: Implement robust data security measures, including encryption, access controls and regular security audits. Train employees on data security best practices and ensure compliance with relevant regulations such as GDPR or HIPAA, depending on your industry.

Job displacement

Risk: Automation leads to increased efficiency, but the flip side is that it may reduce the need for certain manual roles. Workforce disruptions can lead to poor morale and uncertainty among your team.

What to do: Emphasize that automation aims to enhance, not replace, human roles. Invest in reskilling and upskilling your employees to help them transition to more strategic, high-value work, such as data analysis, strategy development and decision-making.

Integration challenges

Risk: Integrating automation tools with your existing accounting tech stack and processes can be complex, leading to incompatibility or data transfer issues.

What to do: Assess compatibility before selecting an automation tool. It also makes sense to work with IT experts to ensure seamless integration with your existing systems. Once you’ve picked a tool, conduct rigorous testing to identify and resolve integration issues before you implement it across your firm.

Technical failures

Risk: Automation tools are susceptible to technical glitches or system failures. These issues can disrupt operations and cause financial inaccuracies.

What to do: Develop a robust disaster recovery plan and backup systems. Monitor automation tools regularly for glitches and ensure that IT support is readily available to address technical issues promptly.

Lack of expertise and understanding

Risk: You might have the perfect automation tool, but if your staff don’t know how to use it, it will ultimately be ineffective.

What to do: Invest in training for employees who will be using the automation tool to ensure that they have the skills and confidence to work effectively with it. Explain the goals and benefits of automation to your team, and address any concerns they may have.

Conclusion

For accounting firms looking to stay competitive in today’s fast-changing business environment, process automation isn’t merely a convenience — it’s a strategic imperative.

Embracing automation allows you to unlock levels of efficiency and accuracy that were once impossible, saving you time and money. You can liberate your team from mundane administrative tasks, empowering them to focus on driving value and growing your business.

By following the advice, steps and best practices outlined in this guide, you’ll be well placed to embrace accounting process automation and all the benefits that come with it.

Thank you! The eBook has been sent to your email. Enjoy your copy.

There was an error processing your request. Please try again later.

Looking to boost your firm's profitability and efficiency?

Download our eBook to get the answers