Key takeaways:

- Despite advances in technology, email remains a popular communication channel for accountants and their clients.

- Email can pose challenges from a productivity perspective, however. If email inboxes are isolated from other technologies and team members, important information can be difficult to access.

- By using practice management software with email integration, you can centralize client communication alongside your document, task, team, and workflow management.

- Not all email integrations are the same. Some offer basic functionality while others enable seamless task management and team collaboration.

- TaxDome stands out from the crowd as the only platform that offers advanced email integration alongside a complete set of practice management features, clear and transparent pricing, and industry-leading support.

Email is a relative dinosaur in the world of digital communication. Yet despite the widespread adoption of new technology, email is still the go-to communication channel for most people and businesses. In 2023, a staggering 347 billion emails were sent each day. This amount is predicted to increase to over 400 billion per day by 2027.

One thing is clear: email isn’t going anywhere. With this in mind, accounting practices must find more effective ways to integrate email into their daily workflows.

Thankfully, there is a simple solution for accounting firms: practice management software with email integration. In this article, we’ll explore five of the best options on the market. We’ll look at their pros and cons, pricing, and key features — so you can find the best platform for your accounting practice.

Why email integration is crucial for accounting firms

In recent years, instant messaging apps such as WhatsApp and Telegram have changed how we communicate, enabling a more conversational approach than legacy communication channels. Likewise, Slack and Microsoft Teams have done the same for professional teams.

Yet despite these technological shifts, email — a tool widely used for almost three decades — is still going strong. In a professional setting, over 62% of people still prefer to communicate by email. This is because email is:

- A universal tool that everyone knows and trusts

- Easy to use — you don’t need to be tech-savvy to communicate using email

- Perfect for formal, non-conversational communication — e.g. welcoming a new client to your firm

However, email communication poses potential challenges for accounting firms from a productivity perspective. Traditional email inboxes are siloed. If a client sends an email to one accountant’s inbox, his or her teammates cannot see it. This can hamper team collaboration and efficiency.

At the same time, email inboxes are isolated from the crucial systems accountants use to manage clients and work. This can lead to a disconnect between what’s being communicated via email and what’s recorded on another platform. What’s more, companies already use an average of 80 external apps. Jumping between multiple apps and your email inbox is an inefficient and messy way to work.

Thankfully, it doesn’t have to be this way. With practice management platforms that offer email integration, accountants can centralize their client communication alongside tasks, projects, and documents. Email can be woven into accounting workflows, rather than being separate to them. This can have numerous benefits, including:

Simplified client communication

With email integration, there’s no need to toggle between your email inbox and your practice management software. All client communication is stored on one centralized platform. This enables you to:

- Automate email communication

- Ensure seamless access to key information for your team

- Send bulk emails to multiple clients

- Use customizable email templates to speed up communication

Firms that use TaxDome can simplify client communication. Through a combination of email integration, templates, and automated reminders, Sovereign Solutions ApS was able to significantly reduce the amount of time it spent on email management.

Here’s what Christopher Dahl, the firm’s owner, had to say: “My favorite thing about TaxDome is that it integrates with, for example, Gmail, so you can automate your communication with customers.”

Read the full story of how Sovereign Solutions ApS streamlined client communication using TaxDome >Enhanced task and workflow management

Email integration makes it easier to manage client tasks. Instead of email and task management being separate processes, you can transform client communication into actionable tasks. For example, if a client emails you with new information, you can quickly create a corresponding task, set a deadline, and assign it to an accountant — all without jumping from one platform to another.

Client communication can also be built into accounting workflows and automated. For example, you can set a welcome email to be sent automatically when the client signs an engagement letter. This saves you time while ensuring that every client is kept in the loop at all times.

Smarter collaboration

Email integration consolidates client communication into one platform. But more than that, with shared inboxes, every email that comes into your firm is visible to all team members, depending on access rights. So no more siloed communications or isolated inboxes. No more inability to retrieve key information if a team member is off sick or on holiday.

This level of transparency makes collaboration simple. Accountants can see a client’s communication history alongside all other relevant account information, ensuring that everyone is on the same page.

What to look for in an accounting practice management platform

Accounting practice management software is a bit like a Swiss army knife. It combines multiple capabilities designed to streamline the way modern accounting firms are run — spanning team, client, project, workflow management, and more.

Using practice management software, accounting firms can consolidate their data, processes, and tools in one centralized platform. This ultimately saves them time and money while increasing efficiency. In this section, we’ll look at the key features of practice management software.

Workflow and task management

Practice management software helps accountants standardize and organize their accounting workflows and tasks. The most powerful platforms enable teams to automate entire workflows and create task dependencies. So when a certain action is completed, another action is triggered.

Team management

Practice management platforms enable smarter team management and collaboration, enabling you to assign tasks, set deadlines, and view progress towards completion. You also get a top-down view of your team’s jobs, enabling you to allocate work more efficiently. The best platforms offer firm-wide reporting, which can provide valuable insights into team performance and productivity.

Time and billing

Most practice management platforms help you streamline the process of getting paid, with automated invoicing and payment collection. Some platforms stand out from the crowd with built-in proposals and engagement letters. These enable you to engage potential clients and formalize working relationships in one place.

Document management

By replacing the need for standalone document management tools, practice management software enables smoother document workflows without compromising on security. While most platforms offer basic document management capabilities, look for those that offer:

- Unlimited document storage

- Legally compliant e-signatures

- Built-in PDF editors

Client management

Practice management software offers a host of tools designed to improve client management and enhance the client experience. Internally, the best platforms come with customer relationship management (CRM) capabilities that enable you to track and manage all client data and interactions in one place.

On the client side, look for platforms that offer client portals and client mobile apps. These enable your clients to manage all touchpoints with your firm in a secure, easy-to-use environment. Customizable forms and questionnaires are another key feature to look for if you want to automate the process of gathering client documents and data.

Email integration

In addition to the above, email integration is a crucial piece of the practice management puzzle. By centralizing your client emails alongside your other core tools, you can break down information silos, improve transparency, and supercharge team collaboration.

Top 5 accounting practice management software with email integration

The accounting practice management software sector is growing all the time. To help you choose the right platform for your business, we’ve narrowed down the field to the following five options, all of which come with email integration:

1. TaxDome

TaxDome is an award-winning practice management platform used by accounting, bookkeeping, and tax firms of all sizes. With its extensive feature set and commitment to innovation, TaxDome has positioned itself as a market leader in the practice management space.

Email integration

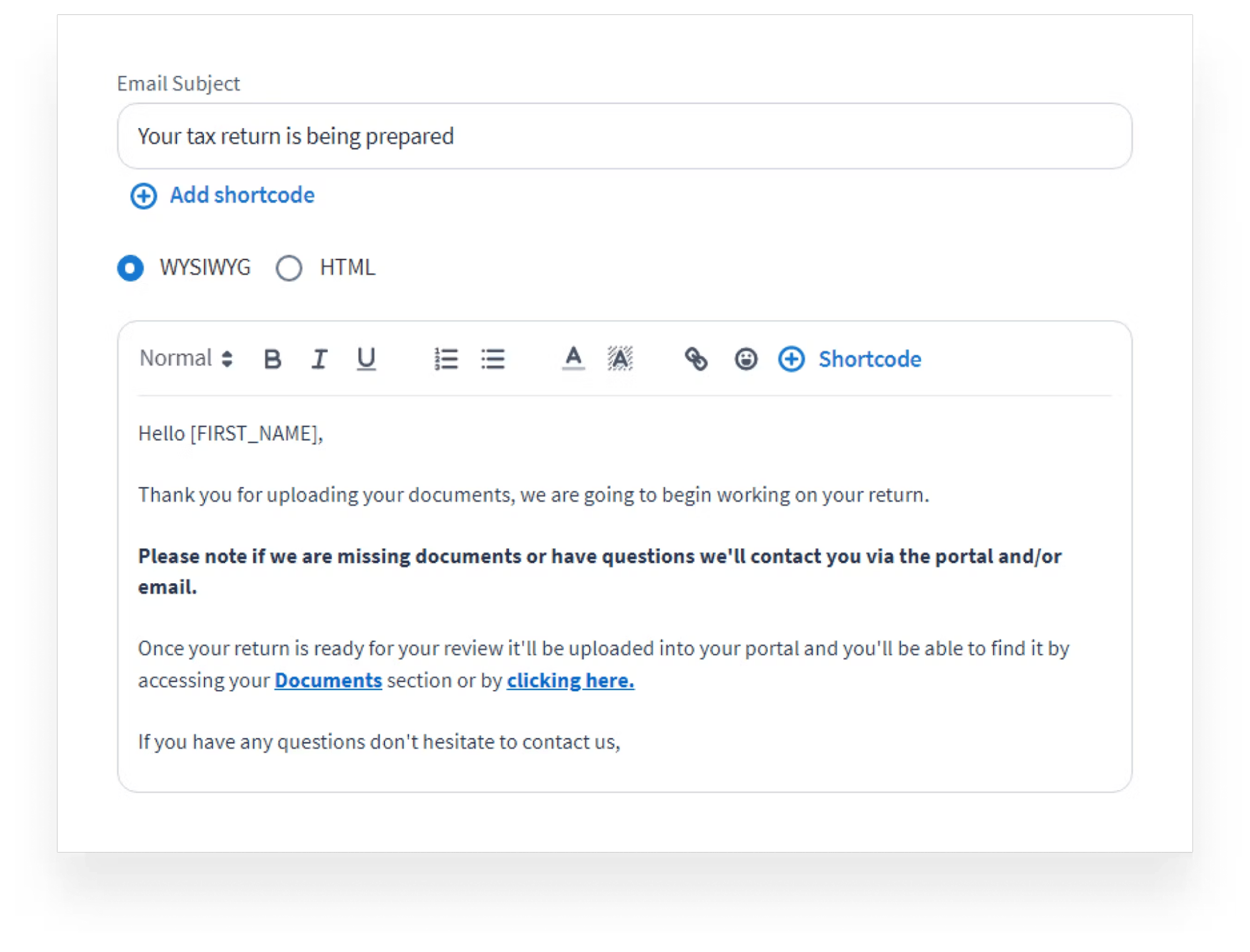

TaxDome offers secure email integration for all of its customers. You can sync Gmail, Outlook, Office 365, and any other email provider in just a few clicks. Once set up, TaxDome’s email integration transforms the way you communicate with clients, enabling your team to:

- Work collaboratively and transparently via a shared email inbox

- Build email communication into automated workflows

- Send bulk emails using templates — and personalize them using shortcodes

- Save attachments directly to the client’s profile

- Store and view all client correspondence via TaxDome’s CRM

Key features

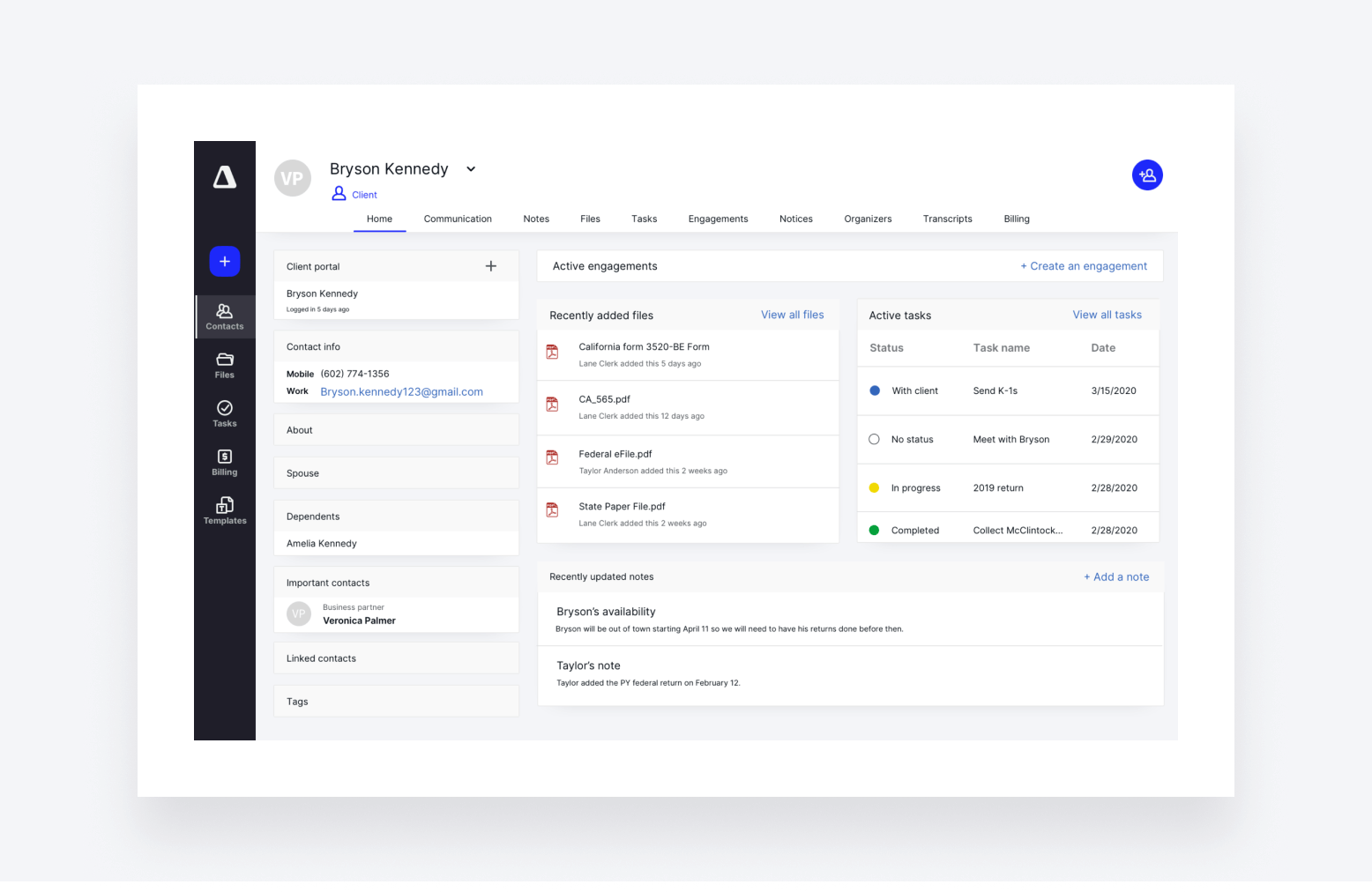

In addition to email integration, TaxDome offers everything you would expect from a complete practice management platform. It also comes with some advanced features that are missing on competitor platforms. Here are some of its key features:

- Advanced workflow automation. Use customizable templates to create automated pipelines for client onboarding, tax preparation, monthly bookkeeping, or any other process. Automate everything from client communication to task management, document sharing, invoicing, and more.

- Accounting CRM. Manage all your client records, communications, documents, and more on one easy-to-use platform. Nurture client relationships with targeted communications and automated reminders.

- Secure client portal. Transform your client experience with a secure portal and top-rated client mobile app. Enable clients to communicate with accountants, pay bills, and scan, view, and e-sign documents — all on one secure and intuitive portal.

- Multichannel communication. In addition to synced email, TaxDome enables you to communicate with clients via secure chats and two-way SMS. Consolidate all of your client communications in one place for more efficient client management.

- Document management. TaxDome provides a secure environment for storing and managing documents, with unlimited file storage. You also get unlimited digital signatures, including KBA, AdES, and QES, as well as a built-in PDF editor.

- Customizable organizers. TaxDome automates the process of requesting and gathering client documents and information. You can create intuitive digital forms that clients actually want to fill in. All information can then be automatically added to your CRM.

- Proposals and Engagement Letters. Engage potential clients, promote your firm, set out your services and prices, formalize relationships, and secure payment — all as part of one seamless workflow.

- Team management. Assign tasks and set deadlines for your team while enjoying complete visibility into workloads. Create standard operating procedures (SPOs) to standardize work. Gain powerful insights into team performance with AI-powered reporting and analytics.

What kind of accounting firms use TaxDome?

TaxDome is used by more than 10,000 accounting, tax, and bookkeeping firms in 25+ countries worldwide. Due to its flexible nature and simple, transparent pricing, it’s popular with firms of all sizes — especially those that prioritize efficiency, transparency, and an exceptional client experience.

Pricing

TaxDome has designed three plans tailored to meet your specific needs and goals:

- TaxDome Solo: The all-in-one platform to run your entire firm with ease.

- TaxDome Pro: Empower your team and streamline operations with advanced tools for collaboration, visibility, and efficiency.

- TaxDome Business: Deliver premium client experiences and enhance internal efficiency with the most advanced tools in the market.

Current Pricing:

TaxDome Solo

- 3-year subscription: $700/year

- 2-year subscription: $750/year

- 1-year subscription: $800/year

TaxDome Pro

- 3-year subscription: $900/year

- 2-year subscription: $950/year

- 1-year subscription: $1,000/year

TaxDome Business

- 3-year subscription: $1,100/year

- 2-year subscription: $1,150/year

- 1-year subscription: $1,200/year

Free trial?

Yes, TaxDome offers a free 14-day trial to anyone who wants to take it for a spin.

User reviews and ratings

TaxDome scores an impressive average rating of 4.7 out of 5 on both G2 and Capterra, from a combined total of more than 3,500 reviews.

There are all sorts of reasons why users give positive reviews, but the most common factors include TaxDome’s ease of use and comprehensive feature set. The platform’s workflow automation is particularly popular, thanks to its ability to save firms time and increase scalability.

2. Karbon

Karbon is another popular practice management platform. It is well regarded for its broad capabilities that help accounting practices improve collaboration, communication, and client management.

Email integration

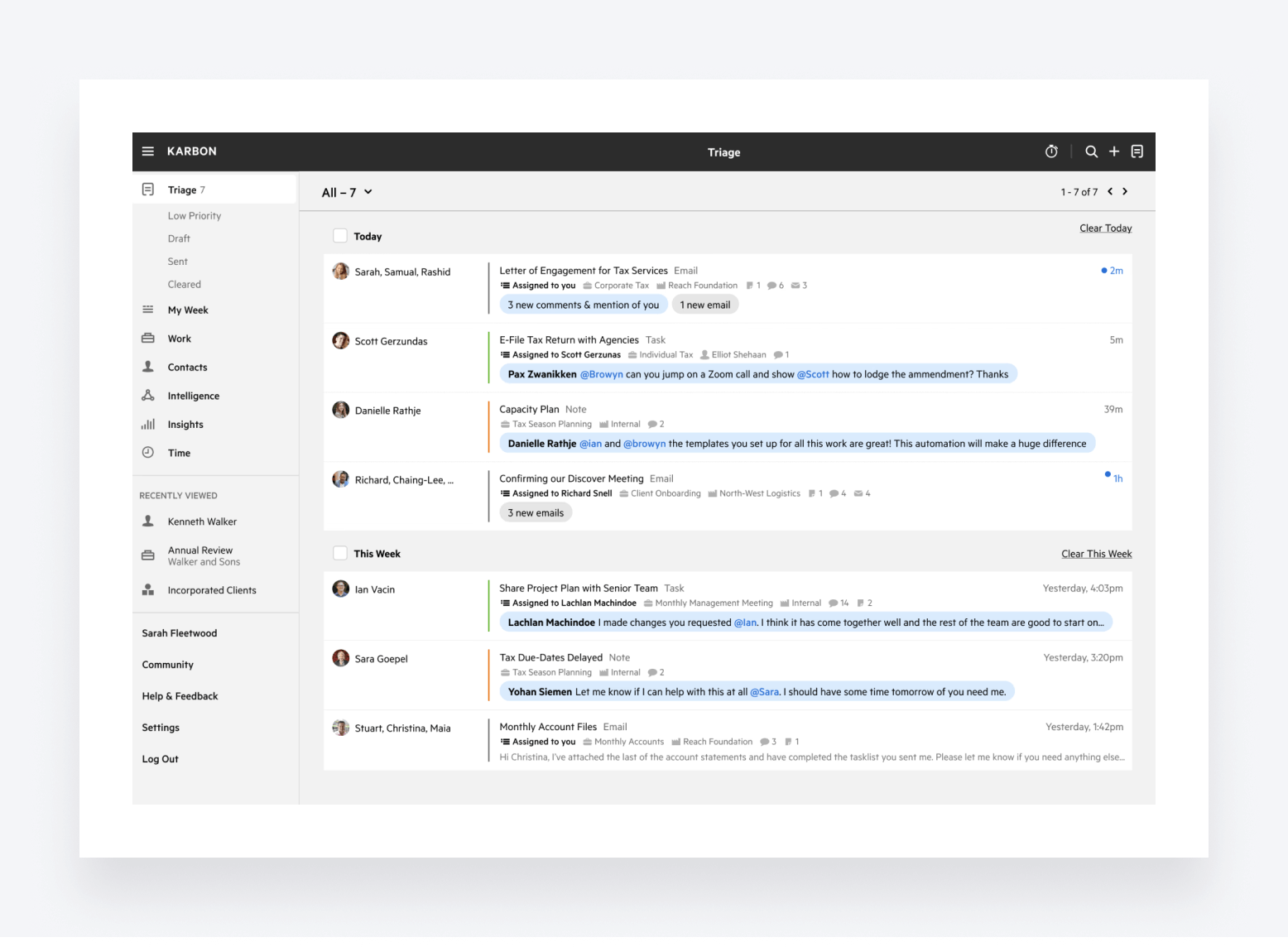

Karbon offers email sync for major email services such as Gmail, Microsoft Outlook, and Microsoft Exchange. Once connected, your team has access to all emails exchanged with clients via a shared inbox. Karbon’s email management features enable you to:

- Turn emails into tasks

- Assign emails to team members

- Tag colleagues and leave comments directly in emails

Key features

When it comes to capabilities, Karbon offers everything you’d expect from a modern practice management system — plus a few interesting extras.

You get a range of team collaboration tools, as well as workflow automation. You can also standardize workflows using a range of templates. There are also standard document management, project management, and time and billing features.

With Karbon AI, you get an AI assistant that drafts communications, summarizes emails, and sends smart suggestions. Karbon also offers decent firm analytics.

On the client side, Karbon offers a client portal — but it’s only available on desktop. Currently, there’s no client mobile app, which may put off firms looking to provide an outstanding client experience on all devices.

What kind of accounting firms use Karbon?

Karbon has pricing plans for all types of accounting firms, from small practices to enterprises. Due to its pricing structure, however, you have to upgrade to more expensive plans to unlock some key features, which might put off smaller firms that want a comprehensive system.

Pricing

Karbon has three pricing plans:

- Team at $59 per user per month when billed annually

- Business at $89 per user per month when billed annually

- Enterprise, which offers custom pricing plans available on request

Each plan has different feature sets — the more expensive the plan, the more features you get access to. Similarly, there are different usage limits on the Team and Business plan. This means you are restricted to a certain number of contacts, teams, templates, and more.

Support and training are also limited on cheaper plans. If you want hands-on guidance when importing data or setting up processes, you’ll have to pay expensive one-off costs.

Free trial?

Yes, Karbon offers a free trial, but it doesn’t say on the website how long the trial is for.

User reviews and ratings

Karbon has an average rating of 4.8 out of 5 from more than 600 reviews on G2. On Capterra, Karbon scores 4.7 out of 5 from just over 170 reviews. On G2, the most common reasons for a positive review are Karbon’s ease of use and task management capabilities.

On the flip side, the most common reason for a negative review is Karbon’s email functionality — something to consider when looking for a practice management platform with email integration. Specifically, users struggled to locate old emails and found issues with downloading documents directly from email.

3. Canopy

Canopy is another big-hitter in the accounting practice management space. It helps streamline core workflows and processes for accounting firms — or as Canopy puts it, it “unclunks” your accounting firm.

Email integration

Canopy offers email integration with Gmail and Outlook. In addition to synced email inboxes directly in the portal, Canopy enables you to:

- Create tasks and client profiles directly from emails

- Save attached documents to a client’s record

- Color-code emails and organize them into folders

Key features

Canopy offers most of the regular features you’d expect from a practice management platform, such as document management, client engagement, and time and billing. In addition, there are standard workflow management and automation capabilities and a solid CRM.

They’ve also managed to pack in some advanced features, including a handy AI assistant that streamlines email writing and data analytics. Canopy also comes with firm-wide data analytics that provide insights into performance, profitability, and more. On the client side, there’s a client portal and mobile app.

What kind of accounting firms use Canopy?

Canopy tends to target mid-sized accounting firms. Due to its five-user minimum for pricing, smaller firms and solopreneurs will want to look elsewhere. At the same time, Canopy’s pricing might put off fast-growing firms who are concerned about increasing costs as they scale.

Pricing

Canopy’s pricing is particularly complex. It offers two plans: Standard and Pro. The latter unlocks more advanced features and costs more. On top of this, Canopy takes a modular approach to pricing. In other words, it breaks the software down into different parts. You can pick and choose which ones you want to pay for.

Every customer gets Canopy’s Client Engagement Platform as standard. They can then add Document Management, Workflow, and Time and Billing on top. Each of these additional modules is priced on a sliding scale — the more users you have, the more you pay.

But that’s not all. Canopy also offers additional features as add-ons. These include Tax Resolution, Transcripts & Notices, and Collection Cases. Each add-on has its own price.

The benefit of Canopy’s pricing is that you can build a custom solution to meet your needs. But in practice, understanding what you need and how much it will cost is complicated. If you want everything the software offers, the costs quickly spiral.

User reviews and ratings

Canopy has an average rating of 4.5 out of 5 on both G2 and Capterra, from a combined total of more than 600 reviews. It scores highly for ease of use and document management, but it falls down when it comes to value for money.

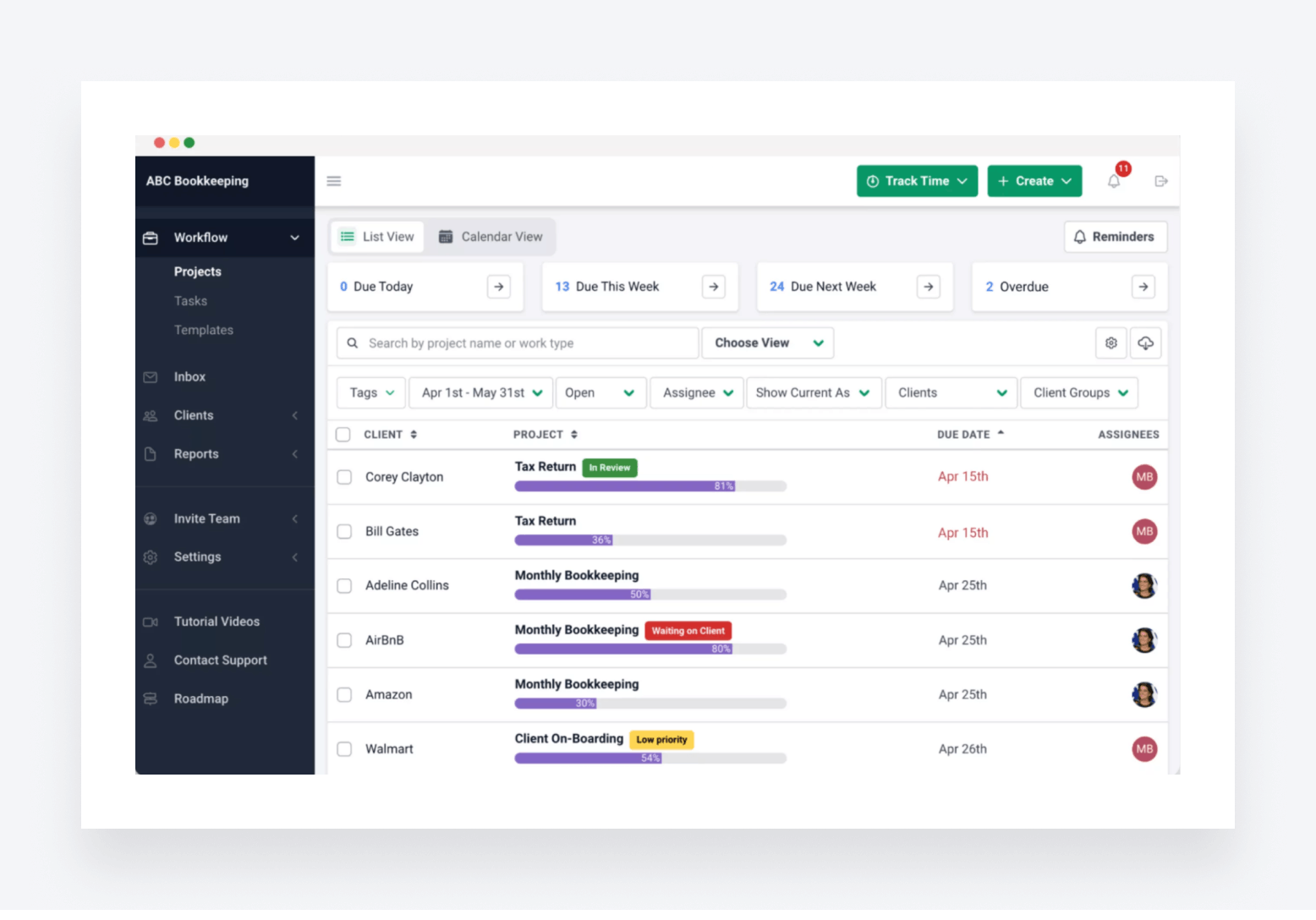

4. Financial Cents

Financial Cents is a simple practice management system used by more than 1,000 accounting, bookkeeping, and CPA firms. It’s aimed primarily at small and medium-sized businesses.

Email integration

Financial Cents offers email integration for Gmail and Outlook. If you use a different email provider, you’ll either need to swap to a new one or miss out. In addition to a shared email inbox for your entire firm, Financial Cents enables you to:

- Pin client emails to relevant work

- Turn emails into projects — and assign them to team members

Key features

In addition to email integration, Financial Cents comes with a basic accounting CRM for managing client records and communications. There are also workflow management tools that help accountants better manage and track work, as well as capacity management for understanding workloads.

Financial Cents offers basic task automation, including automated reminders. For advanced workflow automation, you’ll have to look elsewhere. There’s also a client portal, but there are no mobile apps for staff or clients.

What kind of accounting firms use Financial Cents?

Financial Cents is popular with solopreneurs and small accounting firms. It’s a relatively basic platform compared to some of the more comprehensive options on this list, so customers tend to be happy with a narrower set of features and capabilities.

Pricing

Financial Cents has three pricing plans:

- Solo at $9 per month — only for solopreneurs

- Team at $39 per user per month

- Scale at $59 per user per month

User reviews and ratings

Financial Cents has an average G2 rating of 4.8 out of 5, but this is from a small sample size of under 100 reviews. Over on Capterra, it scores the same — 4.8 out of 5 — this time from 140 reviews.

On Capterra, it ranks very highly for ease of use but lower for features. This reflects the fact Financial Cents is a relatively simple platform. What it does, it does very well. But its lack of mobile apps and customizable workflow automation is the price you pay.

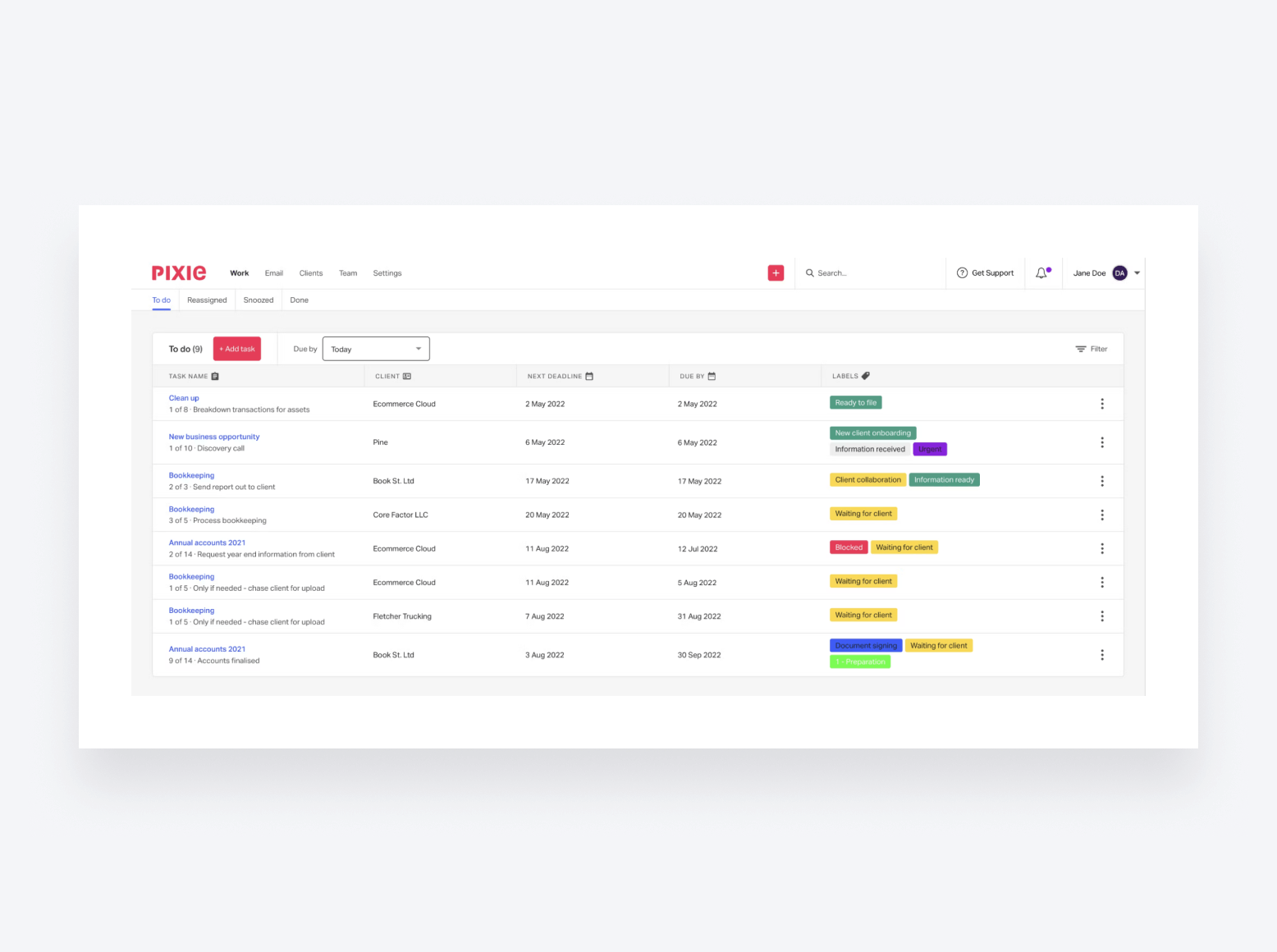

5. Pixie

Pixie is a relative newcomer to the practice management scene. In recent years, it’s gained traction with accounting and bookkeeping firms thanks to its interesting range of features and intuitive user interface.

Email integration

Pixie enables you to sync with your Gmail or Outlook email account. Once integrated, you can send and receive emails directly in Pixie. You can also:

- Automatically push client emails to the top of your inbox

- Turn emails into tasks with a single click

- Delegate emails to team members

- Send and request secure attachments

Key features

Pixie offers a CRM for managing client relationships and team management tools for staying on top of work and tasks. There’s also workflow automation, auto-reminders, and templates for speeding up internal processes.

On the client side, Pixie comes with a GDPR-compliant client portal. You can also create tasks and checklists for clients, and answer client questions via real-time chats. There are no mobile apps, however — neither for staff nor clients.

What kind of accounting firms use Pixie?

Pixie is a decent solution for small and medium-sized accounting and bookkeeping firms that want an intuitive and cost-effective practice management platform. Its per-client pricing structure doesn’t suit solopreneurs, however, who will end up paying over the odds.

Pricing

Pixie takes a different approach to pricing than the other platforms on this list. Instead of paying per user, you are charged based on the number of clients you have at the following rates:

- Fewer than 150 clients: $129 per month

- 251-500 clients: $199 per month

- 501-1000 clients: $329 per month

If you’re a firm with more than 1,000 clients, you’ll need to contact Pixie directly for a quote. There are no limits on the number of users for each pricing level.

User reviews and ratings

Pixie has an average rating of 4.8 out of 5 on both G2 and Capterra. It’s worth noting, however, that this is from a combined total of just under 50 reviews. These stats reflect the fact that Pixie is an interesting up-and-comer, but at the moment, it isn’t able to compete with the big players in the space in terms of adoption.

Pixie scores highly for ease of use and value for money. Users are also very complimentary about its customer support. The main downside, according to reviews, is the platform’s lack of advanced features.

The bottom line

In an increasingly tech-driven industry, software plays a central role in accounting firms’ success. With the right practice management platform, accounting firms can enhance their productivity, communication, and collaboration. Ultimately, this leads to happier clients and a more profitable business.

While accounting practice management software offers tons of powerful features, email integration is one of the most important. Despite new communication channels, email remains a popular tool for accountants and clients alike. By integrating email into practice management software, you can centralize your client communication alongside tasks, documents, workflows, and everything else.

All the software we listed in this article comes with email integration, but only TaxDome offers a complete feature set, clear and transparent pricing, and industry-leading support for every customer.

To see for yourself, request a demo.

Thank you! The eBook has been sent to your email. Enjoy your copy.

There was an error processing your request. Please try again later.

What makes the best accounting firms thrive while others struggle to keep up? We analyzed our top 20 TaxDome firms, representing over $100M in combined revenue, to uncover the strategies driving their success.