Key takeaways:

- An accounting problem is anything that gets in the way of efficient, accurate, or timely accounting work.

- If left unaddressed, accounting problems can hamper profitability, damage team morale, and result in poor client service.

- Examples of common accounting problems include inaccurate financial records and poor cash flow, expense, and payroll management.

- Accounting problems can also be operational in nature, such as poor team management, compliance issues, and sub-par client experiences.

- Most accounting problems can be overcome by adopting the right technology, updating processes, and educating employees on best practices.

Accountants are no strangers to challenges. From analyzing financial discrepancies to conducting rigorous audits, accounting is full of highly complex and potentially problematic tasks. When problems arise — and they often do — accountants must act fast and with confidence.

In this article, we’ll highlight some of the most common accounting problems you’ll encounter. We’ll also offer some practice strategies you can implement to overcome those challenges — or better still, avoid them altogether.

What is an accounting problem?

An accounting problem is any issue or challenge that disrupts or jeopardizes the work of an accountant, accounting team, or accounting business. Accounting problems can arise from all manner of sources — from poor communication to inefficient processes, outdated technology, or non-compliance with the latest regulations.

In short, anything that acts as an obstacle to accurate, timely, and efficient accounting work can be considered an accounting problem. If left unaddressed, accounting problems can have a detrimental impact on your business, leading to reputational damage, poor client experiences, and even legal issues.

Top 12 accounting problems and their solutions

Accounting problems are surprisingly widespread for an industry with a heavy focus on compliance. Each year, the US Securities and Exchange Commission (SEC) receives approximately 20,000 tips and complaints. More than 4,000 of these come through the SEC’s official Whistleblower Program. And these are just the accounting problems that get reported via official channels.

To help you understand the type of problems your firm may encounter — and how to overcome them — here’s a list of 12 common accounting problems.

1. Inaccurate financial records

Accuracy is everything in accounting. One seemingly small mistake can lead to inaccurate financial statements. In turn, this can lead to inaccurate reporting, resulting in poor decision-making — and potential regulatory issues.

The vast majority of accounting inaccuracies are a result of manual processes. No matter how experienced or skilled an accountant is, they are only human, and humans tend to make mistakes. A recent Gartner report found that a third of accountants make several mistakes each week, with almost 60% making several mistakes each month.

The solution

The same Gartner report found that the answer to human error is the adoption of modern accounting technology. Companies that have high rates of tech adoption see a 75% reduction in financial errors.

While accounting software has been around for decades, the last few years have seen accounting automation become a standard feature in most platforms. By automating repetitive tasks such as data entry, account reconciliation, and reporting, firms can all but eliminate the risk of human error. At the same time, they can increase efficiency and save time.

2. Cash flow management issues

As famous entrepreneur Richard Branson once said, “Never take your eyes off the cash flow because it’s the lifeblood of your business”. Cash flow problems often arise when accounting teams struggle to manage the money coming into and out of a business. Poor cash flow management can hold a business back, leading to:

- Poor vendor relationships due to late payments

- Time wasted chasing clients for money

- An inability to plan for the future or grow the business

The solution

Many cash flow problems are caused by poor financial planning. Understanding what cash flow will look like six months or a year from now is extremely difficult, and inaccurate assumptions can lead to liquidity problems further down the line. This is where predictive analytics can help.

Predictive analytics uses advanced machine learning algorithms to analyze historical data. It then makes accurate projections and predicts future trends, enabling you to understand what future cash flow will look like with a high degree of confidence.

Another major contributor to poor cash flow is late payment of client invoices. Almost three-quarters of businesses are affected by this, with 10% of businesses spending up to 10 hours each week chasing late payments. You can mitigate this issue by automating payment collection.

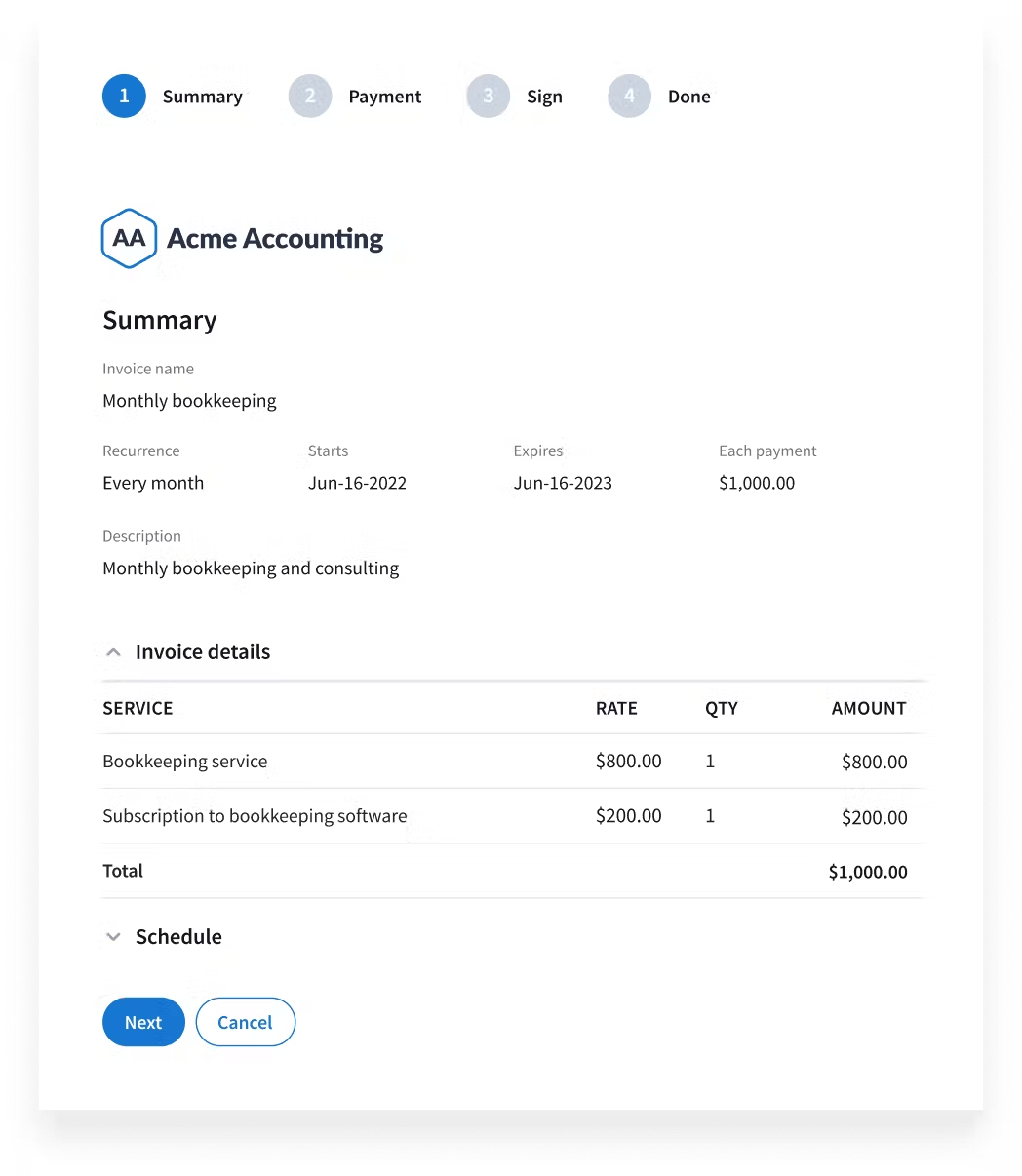

With TaxDome’s Proposals and Engagement Letters feature, you can capture payment details, set up recurring payments, and collect deposits when establishing new client relationships. TaxDome also enables you to lock invoices to documents, meaning clients can only access completed work once they’ve paid for your services. This helps reduce accounts receivable and improve cash flow.

TaxDome’s recurring invoices and payments automate the process of getting paid, ensuring better cash flow for your business.

Get paid on time, every time with TaxDome. Automate your client payments and drive consistent revenue without lifting a finger.

Request demo3. Non-compliance with tax regulations

Tax regulations are constantly evolving. Failure to keep up with the latest changes, or misinterpreting them altogether, can lead to legal issues. This, in turn, can result in hefty fines and reputational damage that’s hard to recover from.

The solution

Staying current with the latest tax regulations is an ongoing challenge. There’s no single solution, but rather a combination of strategies you can employ to reduce the risk of compliance issues. These include:

- Holding regular training sessions for your team to cover the latest regulatory changes

- Sign up for updates and news bulletins from tax authorities such as the IRS

- Use accounting software with regulatory compliance features built-in

4. Poor expense management

Poor expense management can damage your business in several ways. First, a loose expense policy can easily be abused, with employees claiming false expenses that drain your firm’s revenue. On the flip side, an overly complex process may put employees off claiming expenses, leading to low morale.

Then there are the issues that come with manually processing expenses. These include human error, inefficiencies, and time wasted on administrative tasks that don’t drive real value.

The solution

The first step is to create a clear expense policy that everyone understands. This will help avoid any misunderstandings or disputes later on. The right technology is also essential. Accounting software with robust expense management capabilities can help streamline and automate much of the process, including:

- Scanning receipts and capturing data

- Detecting duplicate expenses

- Ensuring compliance with internal policies

- Routing expense approvals to the right people

- Generating accurate expense reports

5. Poor team management

Effective team management is essential for any successful accounting firm. Often, however, firm owners and teams have poor visibility into who’s working on what. As a result, tasks get assigned to the wrong people, workloads become unbalanced, and deadlines are missed.

The solution

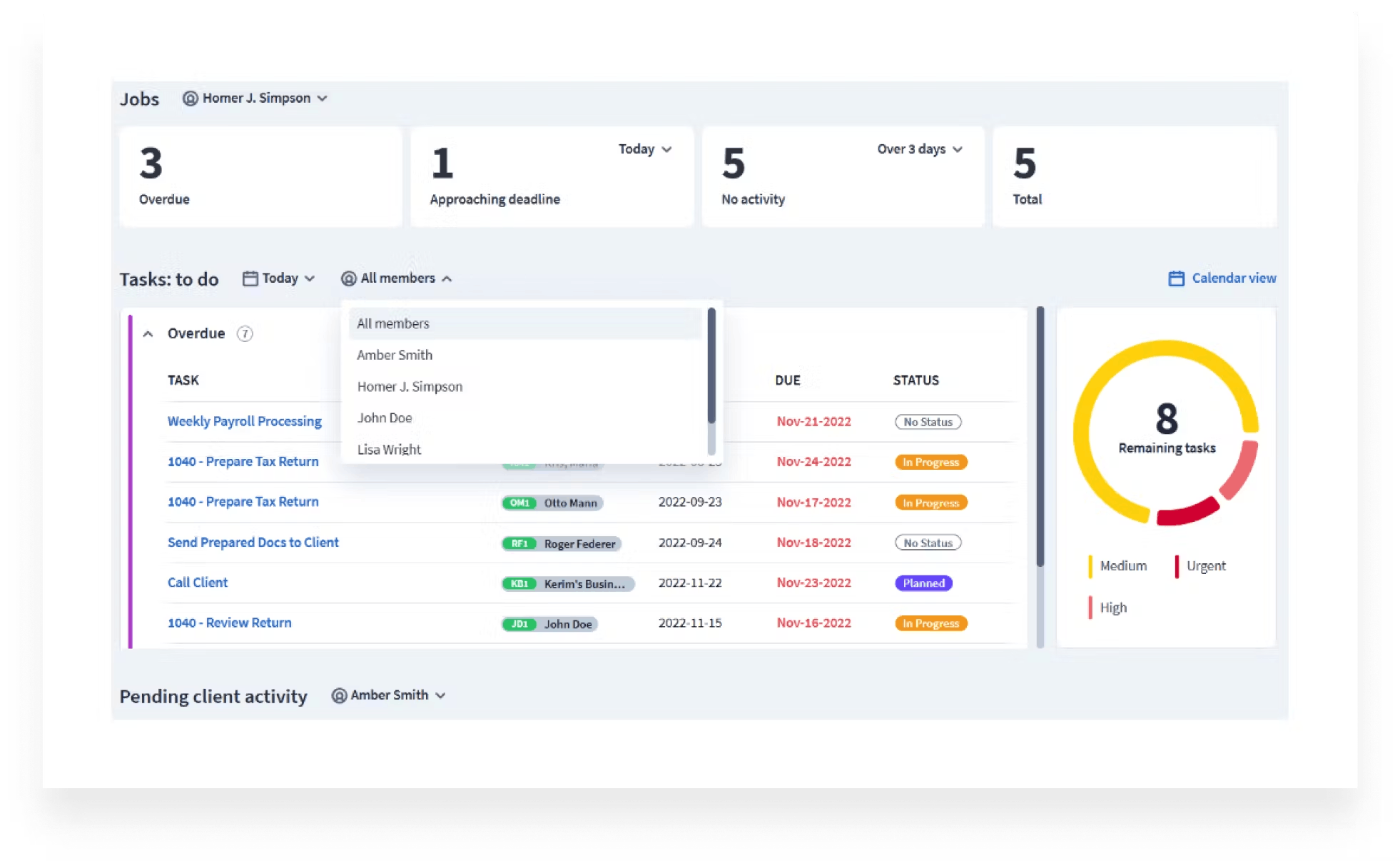

The issues associated with poor team management can only be solved through technology. While standalone task and project management tools can help, the best way forward is comprehensive practice management software. In addition to the tools you need to manage teams and tasks, you also get everything else you need to run a highly successful and efficient accounting firm.

TaxDome, for example, comes with powerful team management features, enabling you to:

- Gain a top-down view of tasks, deadlines, and workloads

- Automatically assign tasks when certain actions are triggered

- Supercharge team collaboration through chats, comments, and mentions

- Set and modify team access rights at a granular level

- Gain insights into team productivity and performance through powerful reporting

TaxDome’s team management dashboard provides a top-down view of work, progress, and deadlines.

6. Sub-par client experiences

Accounting is still a relatively traditional profession. Some accounting firms are slow to adapt to changing client expectations, which include:

- Slick digital experiences

- Personalized services and interactions

- The convenience of a mobile-first approach

Client experience is becoming a key differentiator when choosing an accounting firm, with clients preferring those that have embraced a digital-first approach. In other words, if your firm can’t meet these expectations, clients will find a competitor that can.

The solution

The only way to offer the kind of digital interactions your clients expect is through the right technology. When you choose accounting or practice management software, consider not only how it will improve your internal processes, but also how it will improve the client experience.

The best practice management software comes with client portals, for example. These are secure environments where clients can interact with accountants, upload and e-sign documents, complete tasks, and pay invoices. TaxDome’s client portal is available on desktop or our top-rated client mobile app, enabling clients to stay in the loop on any device.

TaxDome’s custom-branded client portal is available on desktop or mobile.

7. Hiring and retaining top talent

For larger firms, building a team of talented and motivated accountants is key to success. But this is easier said than done. The US and the wider world are currently experiencing a growing accounting shortage. In recent years, hundreds of thousands of accountants have left the profession. As a result, less than 1% of firms say they can find enough staff.

All of this means that accountants are in high demand. This makes hiring and retaining them even more challenging than usual. Accounting firms are in direct competition not only for clients but also for talent.

The solution

There are all sorts of strategies you can implement to make your firm a more attractive place to work for accountants. These include:

- Creating a positive and healthy workplace culture, with a strong focus on wellbeing

- Providing opportunities for career development and growth

- Offering flexible work models, such as hybrid or remote work

One of the most important factors in an accountant’s day-to-day work experience is the technology they use, however. Make sure you choose software that automates the repetitive manual tasks that can be a drain on an accountant’s time.

TaxDome enables accounting teams to automate entire accounting workflows, including client communication, document gathering, task management, invoicing, and much more. At the same time, accountants can collaborate easily on tasks and gain visibility into what their teammates are working on. The result is a happier, more productive team.

8. Payroll errors

Payroll is essential to get right. Underpaying staff, or paying them later than expected, can lead to poor morale and reputational damage. But payroll is highly complex. Some firms have teams made up of salaried employees, seasonal staff, and freelancers. Then there are benefits, bonuses, and tax deductions to consider. The potential for payroll errors is huge.

The solution

You can eliminate manual errors by using payroll software to automatically calculate staff wages, taxes, and benefits. There are plenty of standalone payroll tools available, but accounting software such as QuickBooks Online and Xero also come with payroll capabilities built-in.

Besides pay-related calculations, payroll software facilitates transactions, ensuring that staff are paid on time, every time. They also generate timely payroll reports and help ensure compliance with the latest tax laws and employment regulations.

9. Endless back-and-forth communication

Client communication can be a huge drain on resources. Clients often want updates on progress. At the same time, clients may not provide all the information or documents accountants need to complete the work, leading to more back-and-forth communication. The more clients your firm has, the more time you waste on back-and-forth communication — and the more likely delays become.

The solution

Many of the questions your clients may have can be answered at the start of the relationship. In your proposal and engagement letter, you can provide detailed information about how you work, your communication channels, and what clients can expect from you.

To ensure clients are always kept in the loop, however, you need to leverage technology. With the right practice management platform, you can automate client communications entirely. Automated client communication is a win-win. For firms, it means less time spent on admin, and more time spent bringing value to the firm. For clients, it means peace of mind and improved transparency.

In TaxDome, emails, SMS messages, or secure chats can be sent when a certain action is triggered. For example, when the client signs an engagement letter, a message can be sent automatically confirming the signature and outlining the next steps. These communications can be created quickly using templates — and personalized using shortcodes.

Secure chats in TaxDome. Messages can easily be automated and customized.

Beyond direct communication, TaxDome provides an easy way to update clients on progress: client-facing job statuses. These are fully customizable messages that display the current status of a job — e.g. “done”, “in progress”, or “pending”. What’s more, you can set them to update automatically as a job moves through a pipeline.

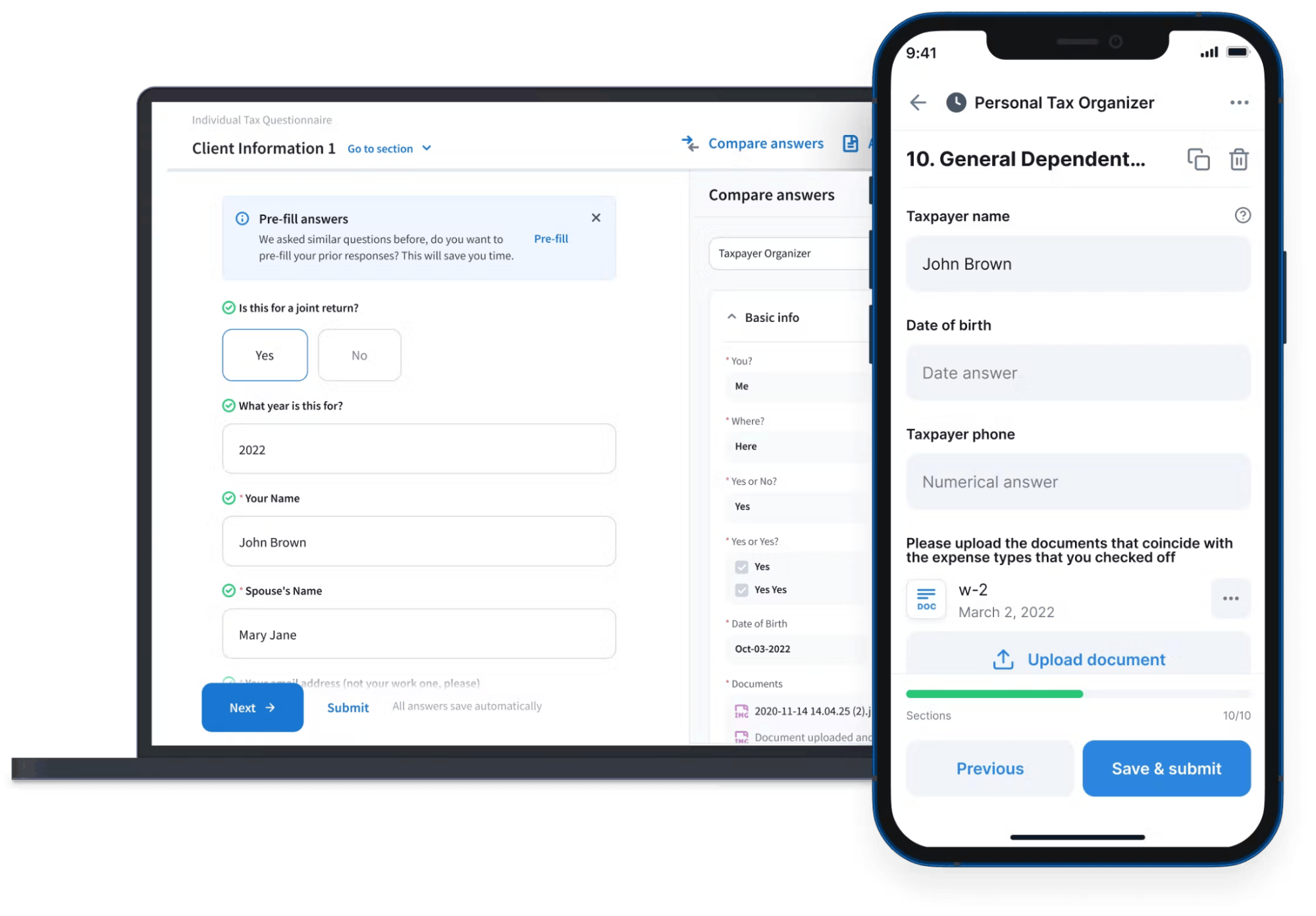

Technology can also reduce back-and-forth communication related to information gathering. Instead of capturing client data and documents via cobbled-together spreadsheets or email, you can use slick digital forms that guide clients through the process step by step.

Again, TaxDome can help here. Our customizable organizers automate the process of gathering client information and documents. They’re intuitive, secure, and easy to complete on desktop or mobile devices. Once you’ve got the information you need, it can be automatically added to your CRM — no need for manual data entry.

TaxDome’s customizable organizers automate the process of gathering client information and documents on any device.

10. Cybersecurity threats

Accountants regularly work with sensitive personal and financial information. This makes accounting firms susceptible to cybercrime and data breaches. The average cost of a data breach is almost $5 million in 2024. But beyond the direct financial impact, cybercrime can have a hugely detrimental impact on your firm’s reputation, resulting in a loss of trust.

The solution

There are multiple ways you can protect your firm against cyber attacks. First, we recommend implementing strong cybersecurity measures at the technology level. Choose software that offers:

- Multi-factor authentication and biometrics

- Data encryption in transit and at rest

- Regular data backups

There are strategies you can implement at the operational level as well, including regular security audits. With over 80% of incidents caused by human error, education is also crucial. Hold regular training sessions to inform your staff about security best practices and the role they play in keeping data safe.

11. Fraud and embezzlement

Accounting fraud and embezzlement remain a huge problem in the business world. We all know about the high-profile examples of accounting fraud, such as Enron and Lehman Brothers, but the issue is surprisingly widespread. Over 40% of businesses are estimated to report misleading financial data.

The negative impact of fraud and other financial crimes can be severe. These are serious criminal offenses, often resulting in huge fines or even jail time for those responsible. Then there’s the reputational damage, which can be longstanding and hard to quantify.

The solution

There are several strategies you can implement to avoid becoming yet another accounting fraud headline. These include:

- Implementing strong internal controls, including segregation of duties, authorization protocols, and systematized processes

- Conduct regular internal and external audits

- Leverage technology, including audit software and practice management platforms that improve accuracy, efficiency, and transparency

- Organize employee training to help staff recognize and report suspicious activity

- Establish a culture that prioritizes ethical decision-making and transparency

12. Poor decision-making

Poor decision-making can hamper the growth and success of any business, and accounting firms are no different. In what is a highly competitive market, every decision a firm makes counts — from day-to-day accounting decisions to major strategic changes.

So what causes poor decision-making? In most cases, it’s a result of people making decisions that aren’t backed by actual data. Without data as a guiding force, decisions are highly subjective. Often, they amount to nothing more than guesswork.

The solution

The solution to poor-decision making is simple: data analytics. Accounting firms have access to an abundance of data. By turning that data into actionable insights, firms can make smarter decisions that drive business and accounting success. Compared to competitors who fail to harness the power of data, data-driven companies are:

- 23x more likely to acquire new clients

- 7x times likely to retain clients

- 19x more likely to be profitable

When it comes to the financial side, most accounting platforms come with robust analytics capabilities. With dynamic dashboards and real-time reports, you can gain insights into your finances. Predictive analytics takes this a step further, enabling you to make accurate forecasts and predictions based on historical data.

Data analytics doesn’t just improve financial decisions, however. Accounting firms also have access to a treasure trove of data on the operational side. This includes data relating to client behavior, team performance, time and billing, and more. The best practice management platforms enable you to transform this data into powerful insights.

TaxDome, for example, comes with AI-powered reporting and analytics. Using it, firms can answer important questions such as:

- How is my team performing compared to this time last year?

- Which team members are the most productive?

- Which customers drive the most revenue?

- Which services are the most lucrative?

- What major bottlenecks are holding us back?

The answer to these questions can help shape strategic decisions around staffing, service offerings, pricing, and more. The result is a more profitable and efficient accounting firm.

AI-powered reporting and firm analytics in TaxDome.

To sum up

Accounting is full of challenges, even on the best of days. While some issues are inevitable in such a complex and fast-changing field, others can be avoided with the right strategies in place. In what is a highly competitive industry, the success of an accounting firm depends on its ability to foresee problems and implement strategies to avoid or mitigate them.

The accounting problems and solutions we’ve outlined in this article are all common. Some can hamper productivity or client satisfaction, while others can destroy your firm’s reputation. All need careful consideration. By implementing the solutions we’ve talked about in this article, you’ll be on the right path to success.

If there’s one major takeaway from this article, it’s that technology plays a central role in overcoming or avoiding most of the major accounting problems that firms face. The better the tech, the more likely your firm is to thrive.

With a comprehensive practice management platform such as TaxDome, you can overcome issues such as poor team management, constant back-and-forth communication, sub-par client experiences, and poor decision-making. TaxDome has the tools you need to build a truly efficient and profitable firm.

To see for yourself, request a demo today.

Thank you! The eBook has been sent to your email. Enjoy your copy.

There was an error processing your request. Please try again later.

Looking to boost your firm's profitability and efficiency?

Download our eBook to get the answers