Accurate and well-organized financial records are the cornerstone of any successful business, and a bookkeeper plays a central role in diligently overseeing your company’s fiscal matters. With their help, you will not have to worry about handling the company’s finances, freeing you up to focus on what really matters: running your business. However, the next issue is how much a good bookkeeper costs.

This article will provide a comprehensive guide to the bookkeeper fee landscape in2024, breaking down the various options available to you. Keep reading to learn what factors influence bookkeeping prices, the different types of fee structures, the average price, and how to find a cost-effective bookkeeper who can meet your business’s needs.

What do bookkeepers do for small businesses?

At its core, a bookkeeper’s purpose is to maintain the financial records of a business. This encompasses a wide variety of critical tasks and responsibilities, such as recording financial transactions, updating ledgers, reconciling accounts, and producing reports and statements. All of this provides the business owner with up-to-date visibility into the company’s fiscal health.

While bookkeepers perform these duties for companies of all sizes, their services provide particular value for small business owners. Here are some of the most common day-to-day responsibilities:

- Recording transactions: entering income, expenses and all financial activities into accounting software

- Managing invoices and payments: handling customer invoices, payments and vendor bills for smooth cash flow

- Handling payroll: running payroll, making tax payments, and ensuring compliance for employees and contractors

- Reconciling accounts: regularly checking bank and credit card statements for inconsistencies

- Preparing financial statements: creating key reports such as income statements, balance sheets and cash flow reports

- Ensuring compliance: guaranteeing records and reporting follow accounting principles and regulations

- Identifying problems: detecting issues such as duplicates, errors and suspicious charges to prevent costly mistakes

Factors affecting bookkeeping costs

Bookkeeper rates can vary widely based on a number of key factors. Understanding them will help you budget appropriately and set realistic expectations when pricing services.

Rather than getting fixated on a single monthly or hourly rate, it’s essential to take a holistic view and understand the variables at play. The “right” cost depends on:

Business size and complexity

Larger companies require more time and effort from bookkeepers. For example, a 50 employee manufacturing company with multiple locations will need more work than a 5 employee professional services business. More transactions, accounts, inventory to track, etc. increase costs. Complex structures with multiple business entities or revenue streams also drive up fees.

Scope of services required

Some businesses only need the basics, such as recording transactions and paying bills, while others require monthly closings, reporting and analyzing financials for insights. Advanced budgeting and forecasting, audit support, or staff controller services add to costs even further. Defining the exact scope is key.

Frequency of services

Do you need bookkeeping services monthly, quarterly, annually? Ongoing monthly services have minimum hourly commitments that increase overall costs versus quarterly or annual services. Less frequent services may cost less per month. Monthly needs also vary by business, based on sales cycles and operations. Evaluation of workload fluctuations helps match the right frequency and hours to your budget.

Location

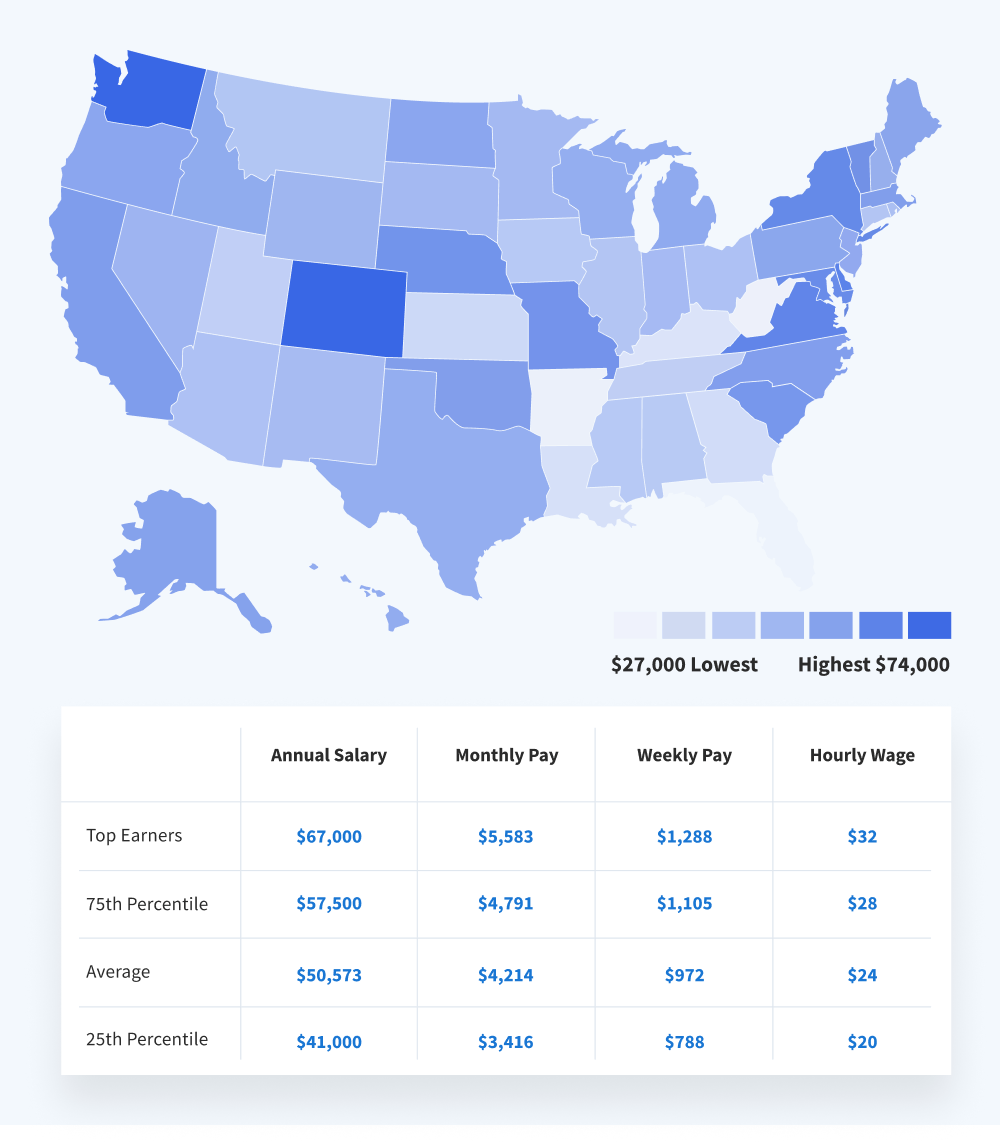

Location is also a major factor impacting bookkeeper salaries and costs. According to ZipRecruiter data, Palo Alto, CA, has the highest typical bookkeeper salary at $65,010 – 28.5% above the national average of $50,573. Other high-paying cities include Scotts Valley, CA ($62,412) and Stanford, CA ($63,712). In major metropolitan areas like these, businesses may expect to pay premium rates for bookkeeping services compared to more rural regions.

Bookkeeper experience and qualifications

Proper qualifications are a must, but more experience also costs more. Experienced bookkeepers can charge more than $25 per hour, while entry-level bookkeepers make around $19 per hour on average. More than 5 years of experience typically results in command rates that are 25-50% higher.

Additional services

Beyond core bookkeeping duties, many businesses also require help with additional services that carry added costs, such as:

- Tax preparation: gathering documentation, organizing records, preparing schedules and forms, filing taxes and audit support can run $200-$500 per month during tax season

- Payroll: payroll administration, tax payments, new hire reporting and compliance can increase monthly expenses by $10 to $25 per worker, on average

- Financial analysis: covering profitability, budgets, cash flow, KPIs, growth opportunities and other finance topics can add to your check

- Controller services: overseeing all finance operations and personnel may cost between $25 and $60 an hour, according to Zippia.

- Software implementation: assisting with accounting software setup, data migration and training can cost $300-$1,000+ as a one-time fee

Types of bookkeeping fee structures

When researching bookkeeping services, one of the most important factors to understand upfront is how the bookkeeper charges for their work. There are several models and fee structures that price services in different ways. The right fee model balances predictable costs with aligning charges to the actual time and resources required. Some of the most common bookkeeping fee structures include:

Hourly rates

Many bookkeepers charge strictly by the hour. Such billing allows you to pay only for work done, but rates can add up quickly. Ensure you have clarity on what services are included.

Monthly packages

Rather than hourly billing, some professionals offer flat monthly fees for defined packages of services. The monthly fee depends on factors such as estimated hours, scope of services and experience level. Packages can help budget predictably but may cap hours if more work is required.

Per transaction pricing

Rather than a flat rate, bookkeepers sometimes have fee structures tied to the number of transactions processed each month. This correlates costs to workload, but it can be hard to estimate upfront.

Project-based pricing

Some bookkeepers offer project-based pricing for one-off jobs rather than an hourly rate. This involves accounting performed on a per-project basis, tracking specific components such as budgets, costs, billings, and profitability. Common projects include financial audits, IPO preparation, M&A services, forensic evaluations and documenting internal controls.

The benefit of project pricing is that it allows for close tracking of costs and revenue at each milestone. This provides visibility to optimize cash flow and margins. Compared to standard bookkeeping, project pricing gives more focused, day-to-day financial insights.

Hybrid models are also common, combining a monthly base fee with per-transaction or hourly overage charges.

Average bookkeeping costs

How much should you expect to pay now that you know the main factors that affect bookkeeping rates and the various pricing models used? While specific prices depend on your unique business circumstances, below are some overarching averages to use as general benchmarks when budgeting and evaluating options. Keep in mind that these are range-wide approximations, and your business may fall above or below the averages.

Hourly rates

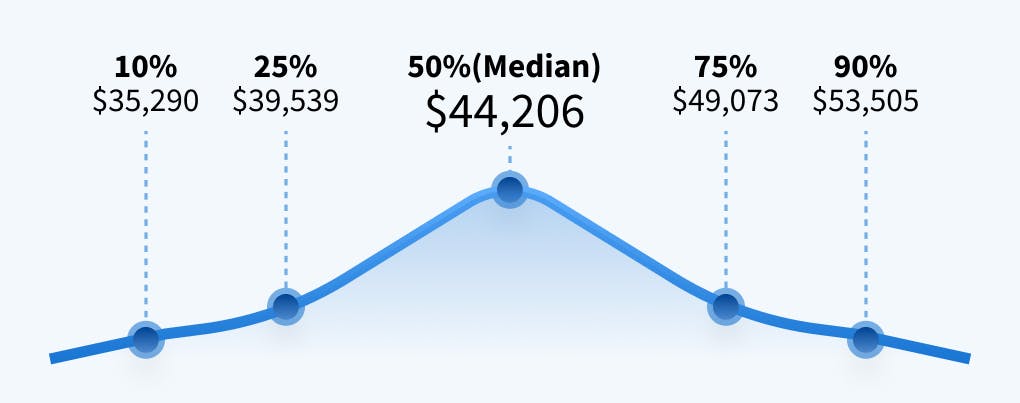

The average hourly rate for a bookkeeper is approximately $21 based on Salary.com data as of February 2024. Hourly rates typically range between $19-$24. Geographic differences also impact rates, with some states having averages 28% above or below the national level.

Monthly packages

We examined monthly package pricing from the top online bookkeeping services featured in a recent Forbes Advisor article and found the costs can vary greatly.

- Entry-level packages from 1-800Accountant and Botkeeper focus on core services such as transaction processing and basic reporting. These start as low as $139-$155 per month.

- Mid-range options from providers including Bookkeeper.com and Pilot provide additional capabilities: payroll, online support, budgeting and forecasting. Their expanded packages run $400-$1000 monthly.

- Ignite Spot and Bookkeeper360 offer full-service packages for larger businesses that include advanced reporting, forecasting, tax services, and financial analytics. These comprehensive packages cost over $1000 per month.

To summarize, the cost of monthly bookkeeping packages is quite variable among providers. Rather than assuming a set price range, it’s important to evaluate each firm’s specific offerings. Make sure to clarify what’s included at each tier and determine what meets your business’ particular needs before making a decision.

Per transaction pricing

The average rate paid per transaction is about $1.20, however, these rates can go down if transaction volume increases. For example, 200 monthly transactions may only cost $0.75 each, or around $150 total.

Some bookkeepers also offer transaction pricing in tiered blocks – you may pay a flat $39 monthly fee for up to 30 transactions and only $0.95 per transaction beyond that. Carefully estimating your typical monthly transaction volume will help identify the most cost-effective per transaction pricing.

Project-based pricing

For project bookkeeping services such as financial statement audits or implementing new accounting software, costs are typically in the range of $500 to $7,500 per project. In this case, companies only pay for the specific services utilized, so there are often cost savings versus hourly or monthly fees.

Basic projects such as compiling financial documents for tax season may fall at the lower end of the range, while extensive undertakings, including IPO preparation, can reach the higher end of the spectrum.

Outsourcing vs in-house bookkeeping

One of the most fundamental decisions business owners face is whether to outsource bookkeeping tasks or hire an in-house bookkeeper. Both options come with pros and cons.

Cost comparison

Outsourcing typically costs less than hiring a full-time employee. Outsourced bookkeepers have no overhead expenses and charge only for work performed. Hourly rates often range from $30 to $50. Packages run $150-$1,500 monthly.

In-house bookkeepers require salary, benefits, taxes and office space. Average salaries range from $39,000- $48,000 annually.

Benefits of outsourcing

- Expertise and scalability: stay up to date on regulations and best practices, flexibly accommodate seasonal workflow variations

- Additional capabilities: supplement in-house staff with controllership or other functions as needed

- Cost and burden reduction: shift expenses for compliance, software, labor and more

Benefits of in-house

- Oversight and control: closely monitor financials and data, access immediately when needed

- Institutional knowledge: benefit from a bookkeeper’s evolving understanding of your business

When each approach works best

Startups, small and medium-sized businesses with a seasonal or otherwise unpredictable workload and those without in-house accounting expertise can all benefit from outsourcing.

While in-house bookkeeping may be better for large, established companies in highly regulated industries, rapidly growing organizations and businesses require a consistent, predictable workflow.

Comparison of bookkeeping fees

| Fee structure | In-house cost | Outsourced cost | Pros | Cons |

| Hourly rate | $19-40 | $15-25 |

|

|

| Monthly package | $3000-4000 | $500-$2,500 |

|

|

| Per transaction | $0.75-1.20 |

|

|

|

| Project-based | $500-$7,500 |

|

|

|

Tips for finding a cost-effective bookkeeper

Balancing cost considerations with maximizing value requires doing thorough research upfront. There are several best practices you can follow to secure qualified bookkeeping services:

Define your needs

First, clearly outline your specific bookkeeping needs so you don’t overpay for unnecessary services. Define must-haves versus nice-to-haves. Provide details including your average monthly transaction volume, frequency of reporting needed, accounting software used, inventory tracking requirements and any industry specific needs. This helps match the right bookkeeper’s expertise and service level to your business.

Get multiple quotes

Reach out to 3-5 recommended local bookkeepers for quotes based on your defined scope of work. Provide the same information to each prospect. Compare rates, fee structures, included services and packages side-by-side in a spreadsheet. For example, one may charge $30 per hour while another offers an all-inclusive monthly fee.

Check references and reviews

Vet the shortlisted bookkeepers thoroughly before deciding. Ask for and contact 2-3 client references to confirm the quality of work and responsiveness. Research online reviews on Google, Facebook and Yelp to verify a trusted reputation. This provides insight into real customer experiences.

Have an open conversation with prospective bookkeepers to disclose any potential hidden fees or limitations upfront so there are no surprises. Understand if there are caps on service hours or transactions included in monthly fees. Ask if tasks such as financial analysis or tax preparation incur additional charges.

Consider software and technology

Discuss how bookkeepers leverage software, automation, and AI tools to maximize efficiency and minimize manual work. This can result in significant time and cost savings that get passed on to you. For example, reconciliation software, invoice automation and receipt tracking apps.

Recognizing the significance of practical application in bookkeeping, we’ve ensured our software, TaxDome, can be tailored to your practical needs. To learn how to set it up for efficient bookkeeping, download our checklist.

Utilize advisors

Simplify your search for the perfect bookkeeping services by tapping into platforms such as the TaxDome Advisor Directory. These resources allow you to search based on the service you need or the location you prefer, ensuring that you can find the perfect fit whether you’re looking for local or remote assistance.

Wrapping up

Determining the true cost of bookkeeping requires careful consideration of a number of factors rather than focusing solely on fees. Rates can vary widely based on elements such as a business’ size, industry, location and specific needs.

The array of pricing models, including hourly, monthly, per transaction and project-based, offers many options to strike the optimal balance between predictable costs and aligning charges with workload. Certain choices, such as outsourcing, lend themselves better to flexibility and scalability as needs fluctuate, while others, such as in-house bookkeeping, provide better control. Assess these alternatives and define requirements upfront to match the best solution to your priorities.

By taking the time to thoroughly research options, check references, and ask the right questions, small businesses can secure reliable bookkeeping at cost-efficient rates. The ideal partner goes beyond crunching numbers, serving as a strategic advisor and steward of financial health.

Thank you! The eBook has been sent to your email. Enjoy your copy.

There was an error processing your request. Please try again later.

Looking to boost your firm's profitability and efficiency?

Download our eBook to get the answers