Becoming a chief financial officer (CFO) requires the skill, experience, and vision to steer an organization’s financial strategy, growth, and stability. Those who manage to reach this much sought-after position are rewarded handsomely for their efforts.

While the path presents many challenges, they can be navigated with proper planning. That’s why we’ve created this comprehensive guide that pulls back the curtain on the CFO role and career trajectory.

Read on to discover how to gain the critical skills, experience, and visibility needed to rise to CFO.

Understanding the role of a CFO

As the highest-ranking finance professional within any organization, CFOs lead all aspects of financial strategy, forecasting, analysis, and compliance. Their specialized focus allows them to quantify business ideas, model budget scenarios, and monitor performance.

On a daily basis, CFO tasks may include:

- Analyzing revenue and cost trends

- Managing cash positions

- Scheduling capital needs

- Mitigating financial vulnerabilities

At the crossroads of financial and operational knowledge, chief financial officers balance present needs with long-term vision. This makes the CFO’s role one of the most important in terms of strategic planning and financial decision making.

For an in-depth overview, see our article, “What does a CFO do? Definition and core responsibilities of a chief financial officer”>>Educational background and qualifications

CFO positions typically call for candidates with a bachelor’s degree in a business, economics, accounting, or finance-related field. This educational foundation equips candidates with the necessary knowledge and analytical abilities to meet day-to-day job expectations.

Popular undergraduate degree choices that fit the CFO prerequisites include:

- Bachelor of Science in Finance

- Bachelor of Science in Accounting

- Bachelor of Arts in Economics

While an undergraduate education establishes a strong base, obtaining advanced credentials and certifications can further augment qualifications on the path to becoming a CFO. Common options include:

- CPA: becoming a Certified Public Accountant demonstrates extensive accounting expertise and technical skills. The CPA license involves passing a rigorous four-part exam and meeting experience requirements.

- CFA: Chartered Financial Analyst certification indicates proficiency in finance and investment management through three sequential exam levels focused on analytics, valuation, reporting, and ethical standards.

Along with the CPA and CFA designation, many other specialized accounting credentials can help augment professional qualifications on the path to becoming a CFO. See our guide on the top certifications for more information>>

- MBA: earning a Master’s of Business Administration provides additional management, leadership, and strategic expertise to complement financial capabilities. MBAs with an accounting or finance concentration tailor their relevance to the CFO role.

Aspiring CFOs can also look into specialized course certificates and online programs to build capabilities while gaining work experience. For example, the Stanford Graduate School of Business offers online certificates in management and strategy. Their in-person 'Emerging CFO Strategic Financial Leadership' program also imparts the latest skills for data-driven leadership.

The key is demonstrating extensive expertise in both core finance disciplines through credentials such as a CPA as well as leadership abilities via MBAs, business programs, and management tenure. The most qualified CFO candidates check all the educational boxes.

Essential skills and professional experience

Beyond formal education, those seeking to become CFOs must demonstrate certain critical skills and professional experiences.

Key skills

- Financial expertise: a thorough understanding of areas such as accounting, analysis, reporting, budgeting, and forecasting

- Strategic leadership: the ability to guide major decisions, manage teams, set ambitious visions, and drive organizational alignment

- Communication fluency: adept at explaining complex financial concepts to both C-suite executives and frontline employees with varying degrees of financial literacy

- Analytical aptitude: proficiency with data modeling, trend identification, and intelligence gathering to uncover actionable insights from metrics

- Risk appraisal: evaluating vulnerabilities, stress testing various scenarios, and crafting mitigation strategies to ensure stability

- Innovative outlook: continuously improving processes by integrating emerging technologies and frameworks that increase efficiency

- Strategic orientation: the ability to balance technical expertise with big picture thinking to connect financial decisions with overarching corporate objectives

- Business intelligence: performing competitive analysis, market forecasting, and external threat and opportunity monitoring to enhance adaptability

- Proficiency with financial technology: fluency in deploying the latest fintech tools and AI innovations to propel value creation in the organization’s financial function

Professional experience

Those aspiring to become CFOs can pursue developmental roles such as:

- Financial analyst, to build the foundational data analysis, modeling, and reporting skills critical for financial planning and strategy

- Controller, to gain vital accounting oversight experience while refining cross-functional collaboration abilities

- Finance manager, to manage financial teams and processes firsthand while honing communication skills to relay insights

- VP of Finance, to get exposure to executive teams and strategic decisions while deepening operational finance knowledge

By progressing through positions entailing increasing levels of responsibility, financial expertise, leadership capabilities, and business alignment, seasoned professionals position themselves as top CFO candidates.

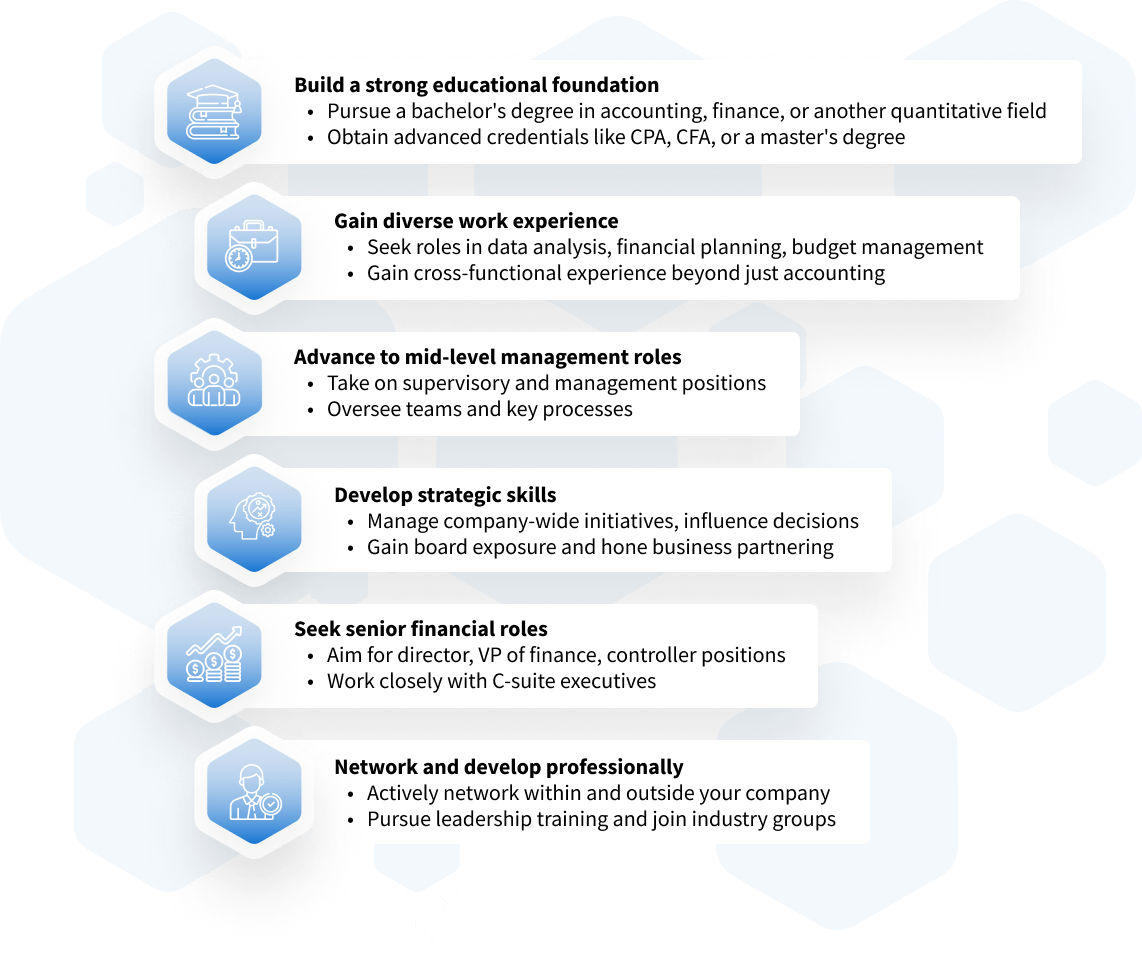

The 6 essential steps to becoming a CFO

To help you chart your course for professional success, we have outlined the following six steps:

1. Build a strong educational foundation

Pursuing a bachelor’s degree in accounting, finance, or other quantitative fields establishes core knowledge. Augmenting that knowledge with advanced credentials such as a CPA, CFA, or specialized master’s degree demonstrates extensive expertise.

2. Gain diverse work experience

Don’t silo yourself in just accounting. Seek roles involving data analysis, financial planning, budget management, and project leadership. Cross-functional experience allows you to understand company operations beyond finance and equips you to contribute strategically.

3. Advance to mid-level management roles

After gaining some foundational experience, take on supervisory and management positions. Overseeing teams and key processes helps develop leadership, communication, and collaboration abilities. This mid-level experience prepares you for executive roles.

4. Develop strategic skills

Beyond financial acumen, CFOs need strategy capabilities. Seek lateral moves into roles that allow you to manage company-wide initiatives, influence executive decisions, and hone business partnering skills. Also, look for opportunities to gain board exposure.

5. Seek senior financial roles

Parlay your well-rounded experience into senior management positions such as finance director, VP of finance, or controller. These roles immerse you in strategic planning and give you visibility when working with C-suites.

6. Network and develop professionally

Actively network both within and outside your company. Seek leadership training, executive coaching, and access to thought leadership to continuously develop. Join industry conferences and build relationships. Tap into educational resources, such as podcasts, to let your knowledge grow on the go.

Overcoming challenges on the path to CFO

Aspiring CFOs often face hurdles on their journey to the executive suite. Here are some of the most common obstacles and ways to tackle them:

| Challenge | Solution |

| Narrow industry background | Make lateral moves across different industries to diversify your experience and broaden your network |

| Insufficient strategic orientation | Take business partner training to shift your mindset from task-focused to big-picture strategic thinking |

| Weak personal brand | Raise your profile by publishing thought leadership content and networking with key stakeholders |

| Weak stakeholder relationship building | Identify key stakeholders and proactively foster partnerships through regular touchpoints and by adding value |

| Over reliance on technical skills | Take on non-finance rotational programs focused on leadership development and strategic thinking |

With proper planning and perseverance, potential CFOs can navigate these challenges and steadily advance along their career journey.

Frequently asked questions (FAQs)

- Can I become a CFO without a traditional finance background?

While uncommon, some senior leaders transition into CFO roles, leveraging extensive executive experience managing complex P&Ls, overseeing corporate functions, and spearheading major initiatives. However, most possess formal education and direct finance management backgrounds.

- How long does it typically take to become a CFO?

The pathway spans 15-20 years, starting as an accounting and finance analyst before advancing through manager and then senior director positions. Fast track timeframes still require 7-10 years, factoring in educational investments and demonstrative leadership impact.

- How critical is international experience for a CFO?

Increasingly vital for large multinational corporations but less essential for domestic firms. Global rotation stints provide helpful diversity in developing regional financial strategies and mitigating cross-border risk.

- Can I become a CFO by starting in a different field, like consulting or entrepreneurship?

Possible but challenging, lacking direct finance tenure. May require interim finance-specific roles pre-CFO to establish credentials. Consultants who advance to partner demonstrate clear leadership potential, which will certainly help.

- What is the typical career path to becoming a CFO?

Financial analyst > Accounting/Finance Manager > Senior Finance Director > VP Finance > CFO. Gaining controller experience and an MBA are also common along the path.

Wrapping up

The journey to becoming a CFO is a long but rewarding one for finance professionals with the drive and determination to reach the top. By building a strong educational foundation, gaining well-rounded experience, seeking leadership development opportunities, and actively networking, potential CFOs can steadily navigate the path to success.

The goal may seem distant, but it is certainly attainable for those willing to invest in themselves and stay focused on delivering stellar results in every progressive role. With the right balance of patience, persistence, and self-development, the CFO dream can become a reality.

Stay encouraged and continue advancing your capabilities and impact. The C-suite is within reach.

Thank you! The eBook has been sent to your email. Enjoy your copy.

There was an error processing your request. Please try again later.

Looking to boost your firm's profitability and efficiency?

Download our eBook to get the answers