Today’s business landscape grows more complex by the day. Turbulent markets, rapidly evolving technologies and intricate regulations create no shortage of obstacles for organizations. Yet the most successful CEOs realize that partnering with an exceptional chief financial officer (CFO) helps turn uncertainty into opportunity.

This article illuminates exactly why exceptional CFOs prove indispensable partners for organizations. Continue reading to gain critical perspectives on core CFO qualifications, responsibilities, career progression and compensation that clarify the source of their wide-ranging impact.

What is a chief financial officer (CFO)?

As the top finance executive, the CFO is in charge of all financial operations, including planning, reporting, forecasting, and risk management. In basic terms, a CFO acts as the head accountant and financial strategist across the enterprise, although the functions extend far beyond simply number crunching.

CFOs occupy a unique space where financial expertise intersects with business operations. Leveraging data and metrics to inform recommendations, CFOs constantly balance present needs with long term visions, holding one of the most critical roles within a company’s senior leadership team.

Though they collaborate closely with CEOs and financial controllers, CFOs enjoy relative independence compared to other C-suite members.

Differences between CFO, CEO and financial controller

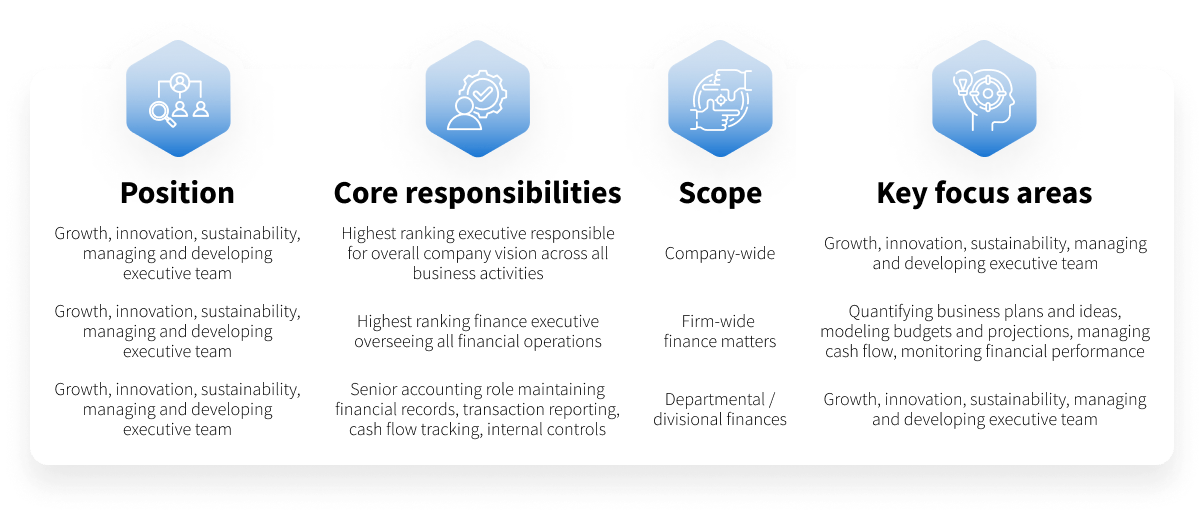

While CFOs, CEOs and financial controllers all provide vital leadership governing company finances, where they sit within organizations and how they spend their time differs significantly:

- CEOs are in charge of all corporate strategy and operations as the top executive

- CFOs lead financial planning and analysis firm-wide to inform strategic plans

- Financial controllers oversee business unit accounting and reporting

Responsibilities may be similar, but the level of financial oversight is what differentiates them. Explore the nuances in greater detail:

In summary, CFOs operate from an elevated position, not quite as broad as the CEO but more cross-functional than controllers. Meanwhile, financial controllers concentrate on tip-of-the-spear accounting execution based on guidelines established by CFOs.

For more in-depth information, please check our blog article “CFO vs CEO” and “CFO vs Financial Controller“.

With a clearer understanding of how the CFO role contrasts with the CEO and financial controller positions, we can now discover the core duties tied specifically to CFOs.

CFO responsibilities

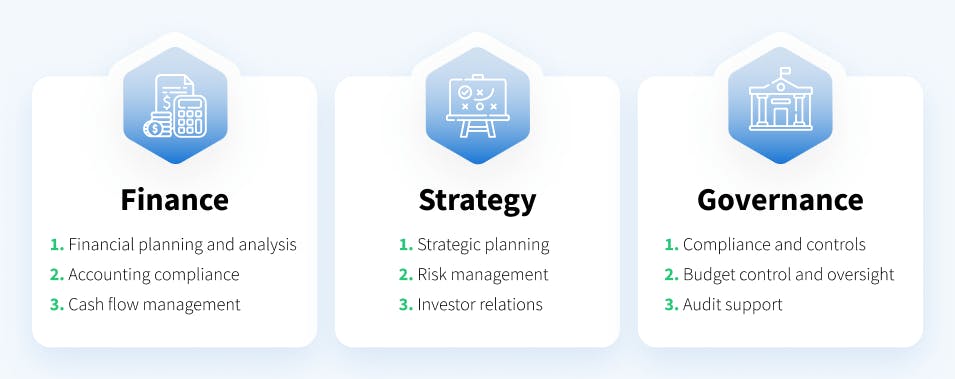

1. Financial planning and analysis

The CFO’s role involves conducting financial planning and analysis to examine past performance and forecast future growth potential. CFOs provide ongoing visibility into revenue and cost trends, as well as risk factors that may impact key objectives across planning horizons.

However, these responsibilities pose multiple difficulties that savvy CFOs learn to navigate, such as:

| Challenge | Solution |

| Forecasting costs and revenues for a new product with no historical data | Build forecast models incorporating multiple growth assumptions, competitive pricing research, and cost comparisons to existing products |

| Creating projections with high uncertainty due to industry disruption | Develop probability-based forecast scenarios mapping out pessimistic, optimistic and base case possibilities |

| Isolating impact of expansion plans across current performance | Model current business as steady-state, then layer incremental growth estimates on top |

2. Accounting

While financial controllers handle day-to-day accounting ledgers, CFOs establish overarching accounting policies, procedures and external reporting structures for balancing the books. Ensuring accounting and financial reporting stay compliant with regulatory standards remains an essential CFO duty.

These tasks may also bring about numerous challenges:

| Challenge | Solution |

| Maintaining compliance through an ERP system implementation | Thoroughly test integration and conduct data migration dry runs, update accounting policies for new system |

| Redesigning reporting structures after a merger between different accounting systems | Blend systems with detailed management of merged accounts and new combined chart of accounts |

| Institutionalizing automated accounting processes to cut errors | Phase in shared services center, implement RPA and AI for account reconciliations |

3. Cash flow management

The two most important CFO duties related to liquidity are tracking cash positions and scheduling anticipated capital needs to meet expenses. Managing cash flow can be demanding, given the many pitfalls. Some challenges are:

| Challenge | Solution |

| Navigating liquidity shortages due to seasonal revenue swings | Build 12-month rolling cash flow forecasts and secure access to credit to cover cyclical gaps |

| Aligning Accounts Payable and Accounts Receivable cycles | Negotiate extended supplier payment terms and optimize customer incentive structures |

| Freeing up working capital from inventory build-ups | Institute just-in-time ordering and improve demand forecasting to cut excess stock |

4. Capital structure

Between weighing debt versus equity issuances and balancing investment portfolio mixes, CFOs architect the optimal financial scaffolding to support company growth. Such intricate procedures necessitate overcoming numerous obstacles, including:

| Challenge | Solution |

| Funding an acquisition by weighing debt vs equity tradeoffs | Model cash flows under different capital scenarios and outline risks of alternate structures |

| Providing financial flexibility for shifting market conditions | Maintain a balanced mix of short and long-term debt obligations |

| Optimizing weighted average cost of capital | Continuously evaluate debt refinancing options, capital asset divestitures, and equity issuances or buybacks |

5. Risk management

CFOs constantly assess financial vulnerabilities across multiple spheres: economic conditions impacting markets, cybersecurity threats, supply chain logistics bottlenecks, compliance oversights carrying fines and more. Addressing diverse risks presents CFOs with many difficulties:

| Challenge | Solution |

| Mitigating supply chain disruptions that threaten operations | Diversify supplier base, optimize inventory levels, and identify alternate sourcing |

| Minimizing probability of a cybersecurity attack | Institute cyber insurance, conduct network security auditing and train employees on safe practices |

| Navigating changing compliance and regulatory landscapes | Actively monitor new regulations, dedicate resources to adaptation, and ensure transparency |

6. Investor relations

Though CEOs claim top billing with investors, CFOs hold direct accountability for producing financial statements, earnings reports and performance metrics that dictate stakeholder relations and satisfaction levels. Managing external financial communications and fielding investors’ questions present multiple tests for CFOs, including:

| Challenge | Solution |

| Explaining poor quarterly earnings performance | Clearly communicate external factors while outlining growth prospects and profitability goals |

| Articulating complex financial information and trends to non-finance stakeholders | Focus on conveying key takeaways tailored to audience’s knowledge level |

| Maintaining trust and credibility with analyst community | Ensure transparency, admit mistakes and provide context around failures |

7. Strategic planning

While the overall vision may originate from CEOs, bringing strategic plans to fruition depends heavily on the diligent CFO’s translation of broad growth ideas into granular, measurable action plans tied to budget realities. But turning strategy into reality has several challenges, such as:

| Challenge | Solution |

| Cascading the broad strategic vision into detailed operational plans | Map strategic pillars to specific financial forecasts, investments, metrics, and milestones |

| Building agility into long-term strategic plans | Develop alternate scenarios tied to key uncertainties and integrate contingent responses |

| Aligning strategic plans with annual budgeting | Tie budget line items directly to strategic growth and investment priorities |

8. Compliance and controls

From establishing internal policies governing spending limits, documentation standards and auditing protocols to ensuring strict adherence to finance and accounting regulations, CFOs bear ultimate responsibility for company-wide compliance and financial controls.

These processes come with many obstacles, for example:

| Challenge | Solution |

| Enforcing financial controls across a complex global organization | Standardize accounting systems, policies, documentation and auditing mechanisms |

| Instilling and measuring ethical financial behavior | Repeatedly train staff on policies and test with monitoring exercises and discipline issues |

| Adapting to evolving compliance regulations | Actively monitor regulatory environment, dedicate resources to adaptation and ensure transparency |

Skills and qualifications of CFOs

Beyond educational credentials and years of accounting experience, excelling as a top-tier CFO involves cultivating multifaceted skill sets spanning both technical qualifications and soft skills.

On the technical side, core competencies include:

- Deep expertise in financial accounting principles and standards

- Advanced data analysis skills to glean strategic insights

- Sophisticated financial and operational modeling abilities

- Adept at financial forecasting and long-term strategic planning

- Keen risk assessment and mitigation capabilities

- Fluency in financial technologies and fintech innovations

In order to serve as a strategic advisor and leader for the executive team, this prowess must match vision and leadership abilities to:

- Interpret complex financial data and communicate insights

- Influence and persuade executive peers

- Provide unbiased, data-driven recommendations

- Exercise savvy political and relationship-building instincts

Pursuing additional credentials, such as an MBA, CPA, CFA and other accounting certifications, can further augment qualifications to reach the CFO ranks.

For those aspiring to become CFOs, here are some tips to advance your career:

- Earn a bachelor’s degree in finance, accounting or a related field to build a strong educational foundation

- Gain extensive accounting experience and get licensed as a CPA to demonstrate technical expertise

- Take on roles with increasing management responsibility to showcase leadership abilities

- Develop strong communication, presentation and storytelling skills to relay financial insights to diverse audience

- Understand your organization’s industry and operations inside and out; don’t silo yourself in finance

- Build relationships and allies across departments and functions

- Stay on top of the latest financial technologies, tools and innovations

- Balance technical skills with strategic vision and the ability to be a collaborative advisor to the executive team

How much do CFOs earn?

CFOs rank among the highest-earning C-suite positions thanks to the tremendous value they instill within organizations. According to Salary.com, the average chief financial officer salary in the United States reaches $437,711 annually. However, pay can range from $331,593 at lower levels up to $561,559.

Exact earnings depend on variables such as years of experience, education credentials, certifications, company size, industry and geographic region. Seasoned CFOs at enterprise corporations in major cities, including New York and San Francisco, sit at the peak of compensation scales.

For detailed breakdowns beyond these averages, exploring CFO salary ranges and pay-influencing factors, check out our article>>Future prospects and evolving roles of CFOs

The role of the CFO is rapidly evolving and expanding in scope to meet the demands of the modern business landscape. While traditional responsibilities in financial reporting, planning and compliance remain core functions, CFOs are increasingly taking on more strategic guidance and leadership.

Some key trends shaping the future of the CFO role include the following:

- Taking a more holistic view of the business to connect financial implications to operations, marketing, technology, etc.

- Serving as a change agent and transformation leader during times of disruption

- Overseeing analytics, business intelligence and technologies that enable more informed decision-making

- Partnering with heads of newer functions, such as cybersecurity, as risk management expands

- Developing more robust ESG frameworks, metrics and disclosures

Specialized CFO roles are also emerging, such as the virtual CFO model, where financial executives work on a flexible, remote basis across multiple organizations. This allows smaller companies or startups to benefit from high-level strategic financial guidance.

To learn more about the virtual CFO model and how part-time, temporary CFOs can drive value, see our detailed article>>Frequently asked questions about CFOs

- What does a CFO do on a day-to-day basis?

A CFO’s daily activities can include financial planning and analysis, cash flow management, financial reporting, budgeting, risk mitigation, capital allocation, investment appraisals and strategic guidance to the executive team. Meetings, presentations, calls and compliance work fill out the CFO’s schedule.

- What are the key skills and qualifications needed to become a CFO?

Typical qualifications include an advanced degree such as an MBA or CPA certification, extensive accounting expertise, financial modeling, forecasting, data analysis, communication abilities and leadership experience managing teams.

- How do CFOs contribute to financial planning and budgeting?

CFOs oversee the preparation of budgets by providing frameworks, assumptions and models. They ensure alignment between budgets and strategic priorities. During planning, CFOs provide insight into cost management, capital allocation, growth projections and investment returns.

- What digital tools and technologies do CFOs commonly use?

From data visualization and business intelligence software to ERP systems and financial modeling programs, CFOs must be adept at various technologies. Excel is ubiquitous. Cloud-based tools are popular for insight and collaboration.

- Can I become a CFO after working in an accounting role?

Yes, accounting provides vital foundational skills. But you must gain additional experience in financial planning, analysis, forecasting and strategic decision-making to be considered for CFO roles. Leadership capabilities are also critical.

- What educational background is typically preferred for CFO roles?

Most CFO positions require at least a bachelor’s degree in finance, accounting or a related quantitative field. An MBA, or master’s degree, dramatically improves prospects. CPAs are highly desirable.

- Are there specific industries where CFO opportunities are more prevalent?

CFO jobs exist across all industries. But high-growth sectors, including technology, healthcare, financial services and manufacturing, are particularly active. Startups and smaller firms also need virtual CFO guidance.

- What are the latest trends and challenges for CFOs?

Trends include taking on more tech integration and analytics, balancing short-term constraints with long-term strategy, overseeing ESG metrics and accountability, and collaborating across more business functions.

- Who does the CFO report to in a company?

The CFO typically reports directly to the CEO as a member of the executive leadership team. They may also have reporting responsibilities to the board of directors.

Conclusion

As the highest-ranking finance professional within any organization, the chief financial officer role remains both highly complex and critically integral to strategic decisions and performance.

Key takeaways:

- CFOs lead all aspects of financial strategy, planning, reporting, analysis and compliance for an organization

- While working closely with CEOs, CFOs concentrate narrowly on finances versus broader company-wide operations

- Core CFO duties range from cash flow optimization and risk planning to budgetary control and investor relations

- Leading CFO skills include financial expertise, leadership capabilities, strategic orientation and communication skills

- Future trends see CFOs taking on more holistic, change-focused roles with expanded technology integration

- Those aspiring to become CFOs should seek extensive accounting experience plus management responsibility

- With salaries averaging over $430,000 annually, CFOs rank among the highest earning C-suite members

By understanding the multifaceted value extraordinary CFOs impart to organizations, professionals can better appreciate how the role continues to evolve while securing financial stability and spurring data-driven growth amidst economic uncertainties.

Thank you! The eBook has been sent to your email. Enjoy your copy.

There was an error processing your request. Please try again later.

Looking to boost your firm's profitability and efficiency?

Download our eBook to get the answers