As accountants get closer to retirement age, they start thinking about a continuity plan or selling off their CPA firm. There’s value in the firm that you’ve built and in the client list that you maintain.

What does it mean to sell your practice?

For many, it means selling at a low multiple of just 1x. You’ve put a lot of time and energy into your firm, so it’s natural to want to maximize your sale multiple. Strong underlying financials and a robust set of services can help you sell at a higher multiple.

Let’s look at an example:

- Your firm brings in $100,000 in revenue.

- At a 1x multiple, you’ll sell your business for $100,000.

- At a 4x multiple, you’ll sell your firm for $400,000.

If you’re wondering “how do I sell my accounting practice and maximize my sale multiple?” you need to know about the common misconceptions when making a sale and a few tips to raise the sale value of your firm.

When Should I Sell My Accounting Practice?

A lot of firm owners think about selling their firm too late. If you’re planning on retiring next month, you haven’t allowed yourself much time to correct internal processes to make the firm attractive to buyers.

When asked on Facebook, one survey found that out of 38 respondents, the following was true:

- 63% knew someone who sold their firm for 100% of their revenue (1x multiplier)

- 19% knew someone who sold their firm for 120% of revenue (1.2x multiplier)

- 11% knew someone who sold their practice for 110% of revenue (1.1x multiplier)

- 5% knew someone who sold their practice for 130% of revenue (1.3x multiplier)

- 2% knew someone who sold off their firm for 80% of revenue (0.8x multiplier)

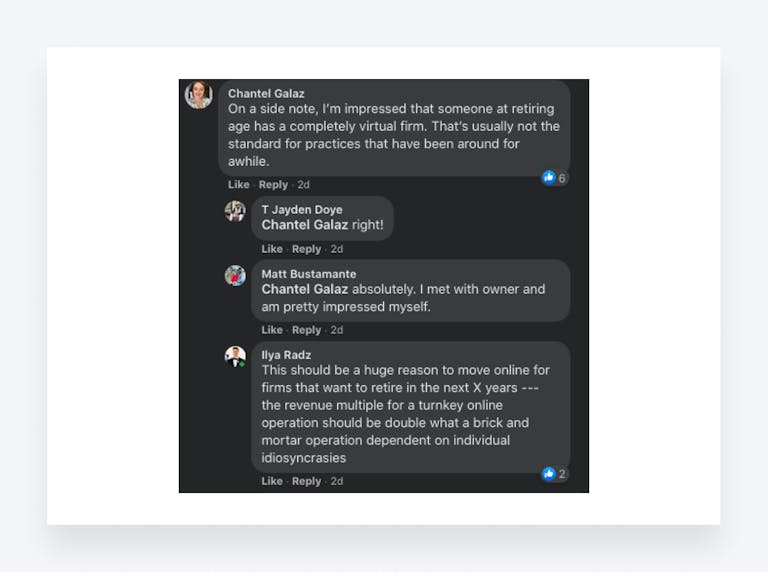

Older firms often have a steady client list and high retention rates, but they’ve also neglected one key factor: going virtual.

Source: Facebook

Why?

Your firm may not need an online presence. You’re comfortable with the revenue that you generate, so you see no need to change what’s working this close to retirement age. The issue is that firms that sell with an online operation often sell for twice the amount of those with just a brick-and-mortar operation.

Buyers want to enter a turnkey operation, and it’s easier to streamline a firm that operates online than it is to streamline a brick-and-mortar operation for which you’ve become the face of the business.

You need to allow yourself enough time before retirement to:

- Fix internal processes

- Move processes online

- Integrate online processes into your business

Depending on your operation, you may need one, two, or three years to put all of these elements in place. A buyer who can look through financials and see strong revenue driven by virtual sales and operations will pay more for your practice.

Watch Amber Gray from Tax Therapy talking on moving the tax business online before selling her accounting practice:

What Does it Mean to Sell Your Practice?

If you’re selling your practice, you likely have a lot of misconceptions of what a sale actually means. We’re going to cover a lot of misconceptions owners have when selling a firm, including the following:

- How long you’ll stay during the transition

- Who the best buyer for the firm might be

- What the average selling price for a practice is

And those are just a few of the misconceptions we’ll clear up to ensure that you know exactly what it means to sell your accounting practice.

3 Common Misconceptions When Selling Your Practice

Selling an accounting practice is a little different than many owners assume. A few of the most common misconceptions are as follows:

1. Sellers Need to Assist with the Transition for Months or Years

Sellers can help with a transition, but two- or three-week transition periods benefit all parties.

Why?

Buyers need the opportunity to build strong relationships with clients and put their own internal processes in place. Selling, for a buyer, means you’re done being an accountant and moving on to a life of retirement.

Tell your clients about the new buyer, let them know that they’re in good hands and, effectively, quit.

2. Buyers Should be an Accounting Firm

For many sellers, the right buyer of their firm is the person who offers the most money for the practice. However, the right buyer isn’t necessarily another accounting firm. A lot of energy and resources go into the operation of your firm.

Individuals, many of whom have worked for larger firms and want to start their own, will be good buyers.

These individuals see the value in purchasing a firm and have the drive and energy to make the purchase a success. You should consider all offers for your practice and make a choice to sell to the person or firm that doesn’t expect you to have an integral role in the business.

3. Average Selling Prices are Created Equal

Unless you have experience selling an accounting practice, it’s easy to assume that average selling prices dictate the value of your practice. Instead, there are a lot of factors to consider, including the following:

- Location

- Client list

- Staff

- Profits

- Technology in place

If you use averages rather than valuing your firm specifically, you may be selling your business for less than it’s worth or overvaluing your business, making it difficult to sell.

Tips for Selling Your Accounting Practice

Once you know what misconceptions exist, it’s time to sell your practice. But how? Here are a few tips that can help you sell your firm, get the most value from the practice that you’ve built, and also make the sale easier:

- Time the sale for you. What are your retirement goals? Do you want to retire at 65, 68, 70? Try and decide when you want to sell, and if an offer comes in beforehand that is too good to pass up, be sure to consider it. The market has its ups and downs, and your firm may be worth less three years from now.

- Consider virtual elements. Buyers want to limit their risk when making an acquisition, and if the firm is virtual, this lowers risks and makes the transition easier for the buyer.

- Modernize. Along with virtual elements, be sure to modernize your practice. Use automation, electronic filing systems, and other tools to help the buyer start running your business easily from day one. Cloud software and state-of-the-art technology are a major bonus for buyers.

- Develop continuity. Buyers want some form of continuity from clients. If all of your buyers leave the business following your departure, the sale was not a good choice. Relationships make or break firms, and staying on as a consultant or doing your part to ensure continuity of client relationships can help make your sale more successful.

- Create a good team. If you’re a single owner who is in control of every aspect of the business, you can expect buyers to pay less for your business. Before retiring, try and make sure that you have a good team in place if you don’t want to stay for a long transition period.

A lot of sellers also recommend working with a broker who may have a few buyers lined up to purchase a practice.

Bottom Line

Buyers are plentiful, and there’s almost always a shortage of sellers trying to sell their practice. Adding value to your practice and going virtual will position your firm as an attractive option for buyers.

TaxDome is a system that allows you to manage clients, employees, and tasks at one price. Virtualize your practice to increase your sale multiple and be far more attractive to buyers.

Thank you! The eBook has been sent to your email. Enjoy your copy.

There was an error processing your request. Please try again later.

Looking to boost your firm's profitability and efficiency?

Download our eBook to get the answers