We’re delighted to announce the release of SMS communication in TaxDome. This new feature will enable you to communicate with your clients in a way that is highly familiar and convenient. In this article, we’ll explore everything you need to know about SMS communication, including:

- The benefits it will bring to your firm

- Communication best practices

- How SMS communication works in TaxDome

We recently hosted a live webinar covering this major new release. In case you missed it, you can check out this blog post, where you’ll find a recording of the event as well as a transcript of the Q&A session. You can also take a closer look at how SMS works in TaxDome in this video explainer:

SMS communication — the benefits for your firm

Before we look at how SMS works in TaxDome, let’s consider why you’d want to use SMS to communicate with clients in the first place. Here are the major benefits that SMS will bring to your firm.

1. Improved reach

If you are updating your clients on important announcements or news, you want to ensure that your messages get seen by as many people as possible — and as quickly as possible.

With 98% of SMS messages opened and read within three minutes of being sent, SMS is head and shoulders above alternative communication methods when it comes to getting seen fast. For comparison, only 20% of emails ever get read.

2. Communicate in a highly familiar way

SMS communication allows you to meet your clients where they are — on their phones. While our client mobile app is another great way to do this, and we recommend that all client communication moves toward the app for its ease of use and security, not all of your clients are tech-savvy or comfortable using new apps, regardless of how user-friendly they are.

With our new SMS feature, you can communicate with clients in a way that’s highly familiar and convenient. Virtually everyone already knows how text messaging works — there’s no learning curve, no help required, nothing to download, and no login to remember.

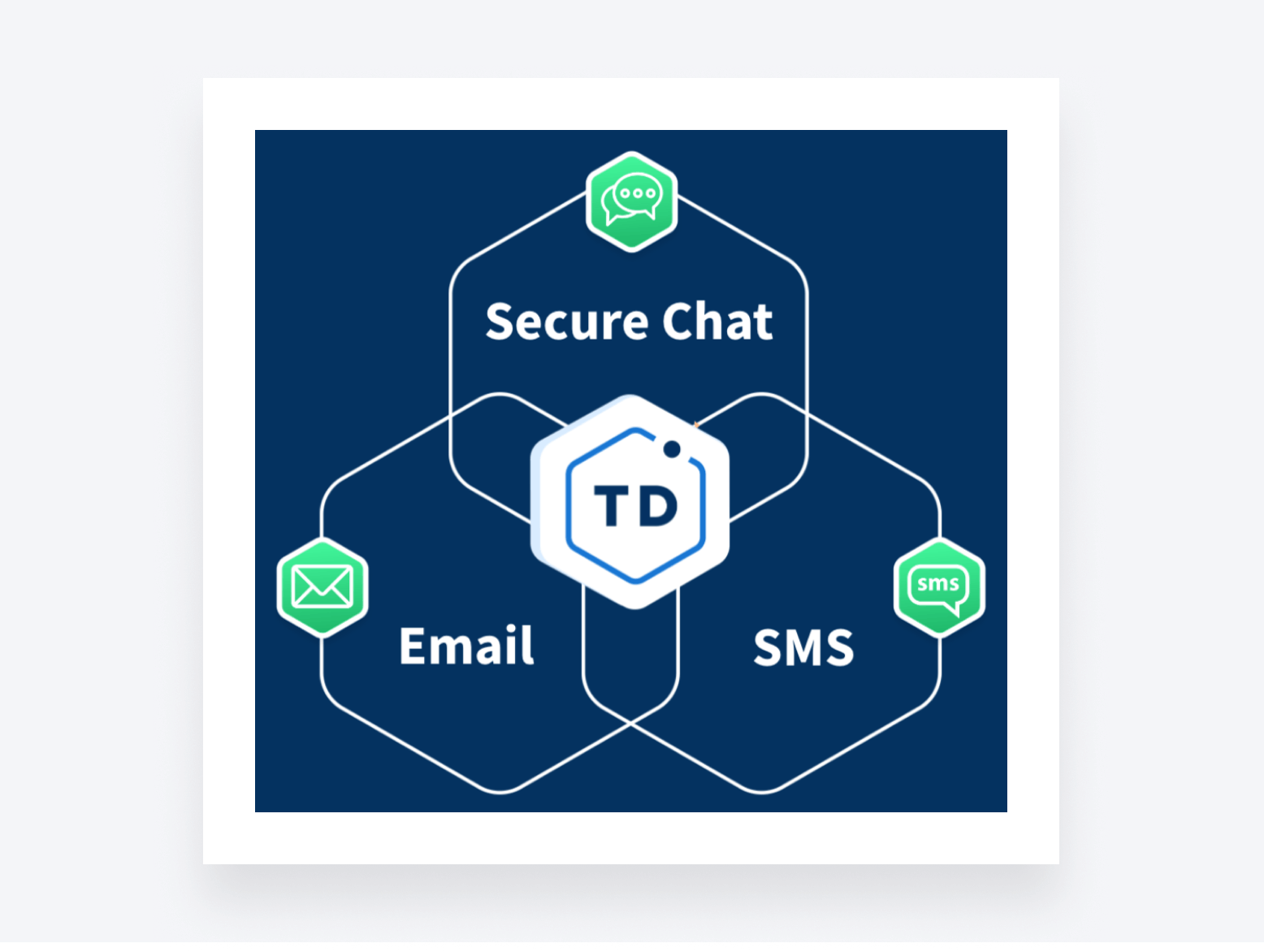

3. A complete communication ecosystem

SMS completes the TaxDome communication ecosystem. Alongside secure chats and integrated email, you now have access to the three most popular communication channels on one easy-to-use platform.

All three of these communication channels bring different qualities and use cases, giving you the flexibility to interact with clients in the most effective way at all times.

When should you use SMS?

SMS offers unique qualities and benefits, making it ideally suited to certain types of client communication, but not others. Due to its incredibly high open rate and familiarity, it’s an excellent choice when you want your message to be seen as quickly as possible.

Here are some examples of where SMS is particularly effective:

- Reminders and follow-ups for appointments, important events, etc.

- Urgent notifications about impending deadlines, critical updates, or time-sensitive requests

SMS isn’t the ideal choice in other situations, however. Given its less secure nature, it’s not a good choice for sending highly sensitive information, for example. Thankfully, in TaxDome, you have the right communications tools for every occasion.

When should you use secure chat (and the mobile app)?

Like WhatsApp and other instant messaging tools, TaxDome’s chat feature allows you to communicate with clients in a real-time, conversational way. It’s also highly secure, making it the perfect tool for sending:

- Sensitive personal and financial information

- Contracts, tax documents, and other paperwork

Secure chats are also the best way to go if you want to enjoy a seamless mobile experience. Using our new firm mobile apps (iOS & Android), you can communicate with clients via a simple chat interface, manage client tasks, and send documents on the go.

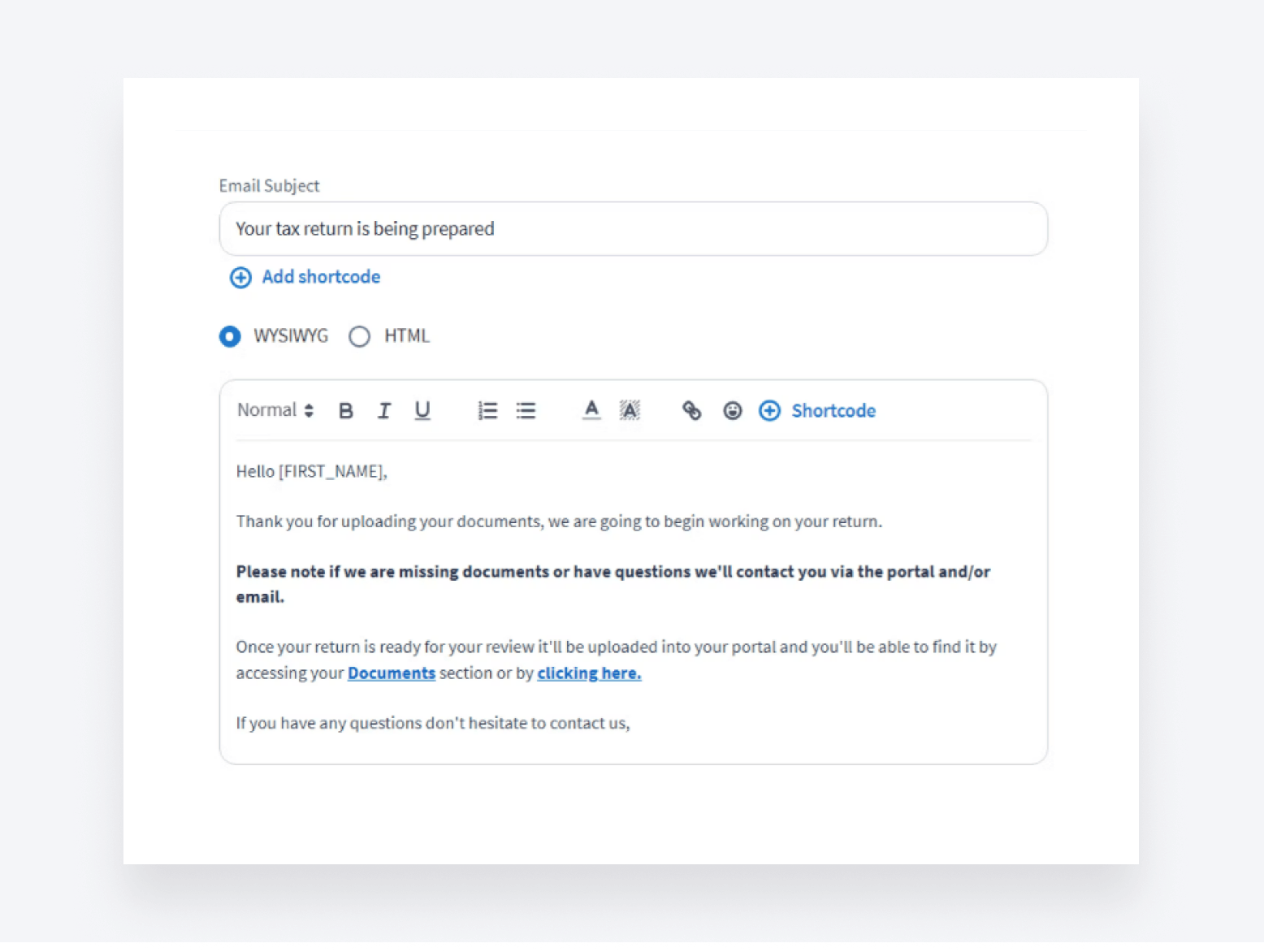

When should you use email?

Despite the unique advantages that SMS and secure chats offer, email is still an important tool in your communication toolbox.

Like SMS, it’s highly familiar to even the most tech-averse clients. It’s not great for conversational communication — email threads don’t offer the best user experience, and your messages can soon get buried at the bottom of ever-expanding inboxes. But there are situations where it comes into its own, such as:

- In-depth or long-form information

- Formal communications such as welcome emails

- Scheduled communications — newsletters, major updates, etc.

How SMS communication works in TaxDome

Now, let’s look at how SMS communication works in TaxDome, from registration to sending and receiving text messages.

Registering your brand

We’re working with a third-party service provider called Twilio to bring you SMS integration. In order to protect consumers from spam, carriers use a standard called A2P 10DLC. As a result, there are a number of costs associated with sending SMS.

All of the Twilio and campaign registration fees (totaling $30.15) as well as the monthly phone rental fee are fully passed on to Twilio and the Campaign Registry.

The $30.15 is broken down as:

- A2P Brand registration (First 3 attempts) — 4$

- Campaign registration — 15$

- Monthly payment for campaign — 10$

- Monthly phone number rent — 1.15$

You can read more about the fees associated with setting up SMS communication with Twilio in this article: SMS: Processing fees.

With regards to usage, pricing is competitive with other industry options (we’ll save you the googling — Simpletexting, Textcellent are a few) and will always be based on usage amounts.

When services don’t clearly state a usage amount, there is fine print that tells you how much is included and they can charge you if you go beyond that usage amount, which, when divided by amount of SMS provided, is the same exact cost but just bundled into a bigger monthly fee.

Importantly, this is a fully optional feature, and is in addition to TaxDome’s other communication tools — secure chat (including the client mobile apps on iOS and Android) and integrated email, all of which are provided by TaxDome and carry zero additional fees, usage limits or restrictions.

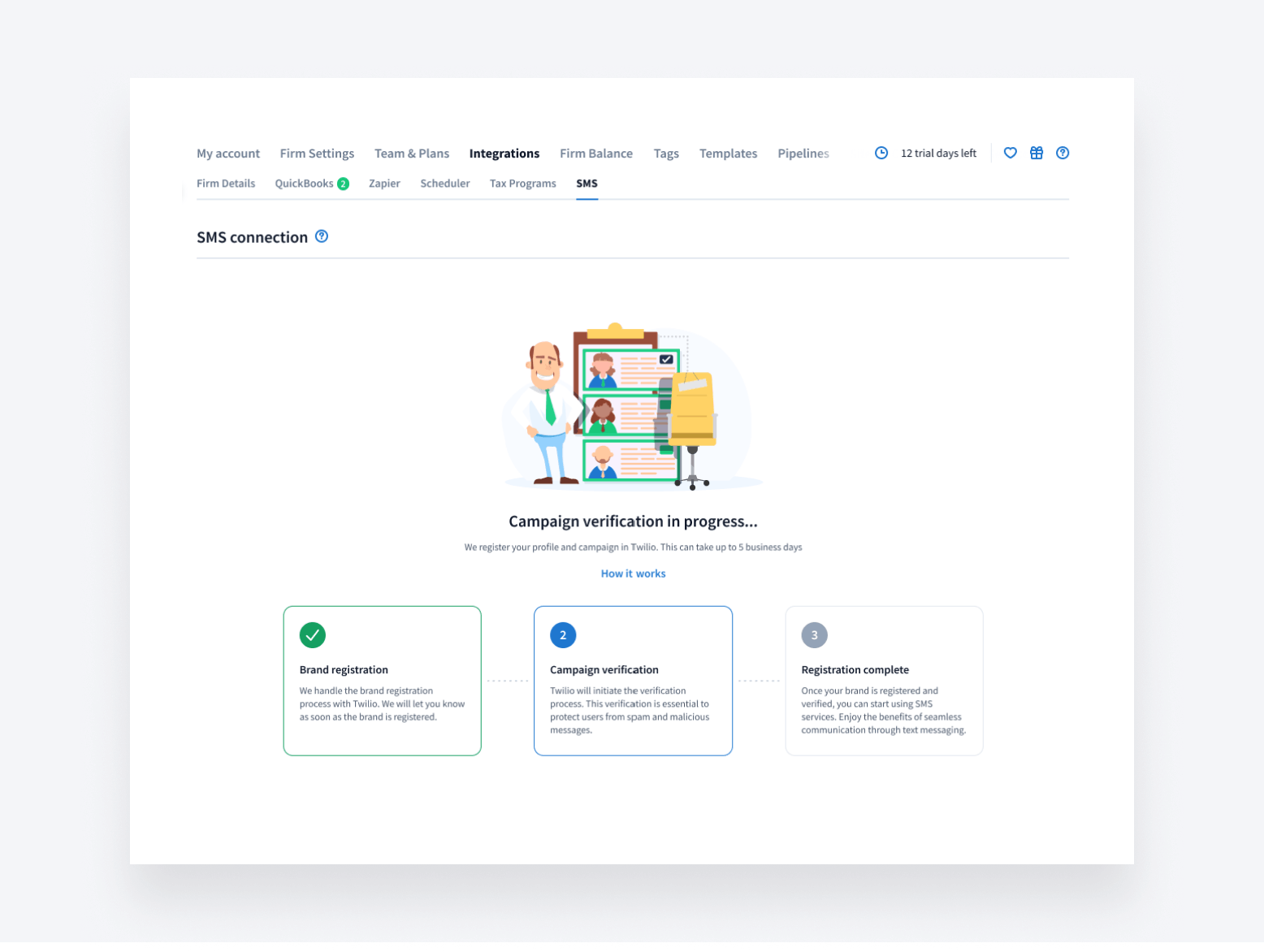

If you want to opt into SMS communication, you need to complete the simple registration process in your TaxDome portal. Here’s how the registration process works:

- Register your firm’s brand with Twilio

- The registration process can take up to 30 days to complete

- Once completed, you’ll receive a new phone number for SMS messaging in TaxDome

Read more about the registration process in this article: SMS: Connection and Twilio verification.

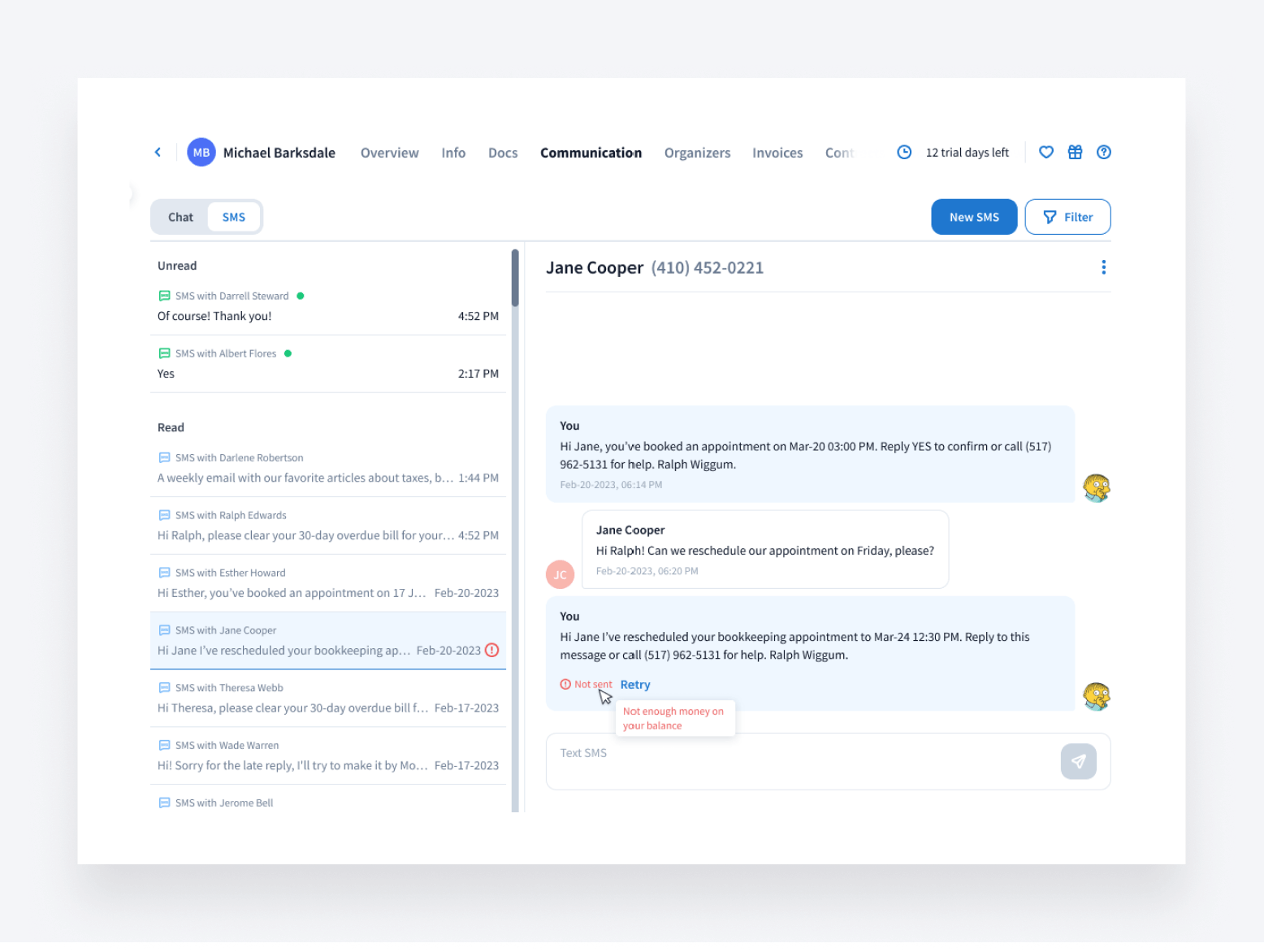

Enjoy two-way SMS communication

Once the registration process is complete, you’re all set to start sending and receiving SMS messages in TaxDome. You send and receive SMS messages directly in your TaxDome portal (either on web or mobile), but your clients send and receive SMS messages on their phones — no app required.

To send an SMS to a client, you must have them stored as a contact in your TaxDome CRM. You can have multiple numbers stored for each contact, but SMS is currently only available for firms and clients in the US and Canada.

Sending bulk SMS

You can send text messages to contacts either individually or in bulk. For bulk messages, it’s simple to filter recipients using tags, teams, jobs, dates and more.

To speed up message creation, you can create your own SMS templates — and use shortcodes to customize your messages for each contact. You’ll also find SMS templates from accounting and tax pros across the world in TaxDome Marketplace. Think of it like the App Store, but for TaxDome templates.

Ongoing fees and billing

Besides the one-off fee for registering your brand with Twilio, there are the following recurring fees associated with your SMS usage:

- Ongoing monthly fee paid to Twilio: $11:15

- Fee per each sent or received SMS message, paid to TaxDome: $0.04

These fees are taken automatically from your firm’s balance in TaxDome. To ensure that you don’t miss any payments, auto top-up is triggered when your balance falls below a certain amount.

If you have any questions about SMS in TaxDome that haven’t been answered in this post, check out our Help article: SMS communication FAQs.

What’s next for SMS in TaxDome?

Following this initial release, we plan to add some exciting new functionality to our SMS service in the near future.

First up, SMS automation, which will allow you to build SMS messaging into your TaxDome workflows. This will allow you to send automated SMS messages to clients once certain actions are triggered — signing a document, reviewing a document, or completing a task, for example.

We also plan to redesign the TaxDome interface, making it easier than ever to navigate your client communications.

Stay tuned for more updates!

Thank you! The eBook has been sent to your email. Enjoy your copy.

There was an error processing your request. Please try again later.

What makes the best accounting firms thrive while others struggle to keep up? We analyzed our top 20 TaxDome firms, representing over $100M in combined revenue, to uncover the strategies driving their success.