Meet Shane Mason, co-founder of Brooklyn FI. Shane’s been a CPA for over 10 years and started off doing tax returns as a side business. But over the last 3 years, Shane & team have widened the pool of services Brooklyn FI provides: from tax only to accounting, advisory & strategy. This gives Brooklyn FI a predictable stream of income and allows them to scale.

We were amazed at how fast Brooklyn FI scaled: from a solopreneur to 5 staff in two years and growing to 13 people during their first year with TaxDome. We asked him how they achieved that:

“In terms of scaling the service based business, we have landed on a model that works really well. Process, workflows, how often we communicate with and the deliverables we give to the clients as well as the prices we charge. It’s important to manage expectations, our staff, and bring on clients that will fit into our wheelhouse. This will keep everything on track and allow us to grow exponentially.”

Shane also has ambitious plans for further growth:

“I’d expect 25 people within 2 years. I expect there to be a Director of Tax, Director of Accounting, and a Director of Financial Planning, which would each be in charge of scaling their own verticals.”

Workflow comes first

If a firm wants to replicate what Brooklyn FI has done, Shane recommends focusing on tools that help them build out processes.

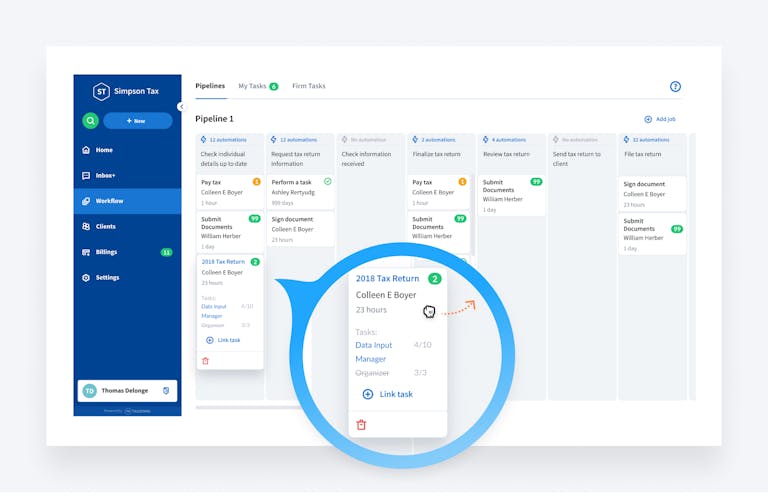

“You have to figure out how to allow someone else with less experience than you, less domain expertise than you to do your job. Go all in on processes, delegation, workflow tools. Make sure your system allows for iterations in processes easily and quickly. Ie, you may get templates, but you need to be able to modify them easily. The automation in TaxDome has allowed us to create repeatable processes that are not dependent on an individual – this is critical in allowing us to grow.”

Check out how Boundless Tax fully automated their client onboarding workflow.

As they grow, Brooklyn FI requires more and more functionality to provide best service to their clients and streamline internal processes. As such, Shane’s team strives to use as few tools as possible and TaxDome’s been a great help on that.

“The more tools a product can offer — the better. By using TaxDome, we no longer use QBO, Jetpack Workflow, Trello, and Intuit Link. We are able to work fully remotely — and we do not do in person meetings anymore.”

Track progress of your jobs in one simple view.

When asked about onboarding himself & team to TaxDome, Shane advised that TaxDome was fairly intuitive for their team to pick up.

“It’s fairly easy to find everything even as a new user. It took us about 3 months to get fully up to speed. And there are so many new features being rolled out so we’re always iterating to implement new functionality.”

One of the other things Brooklyn FI looks at in terms of workflow is integrations, especially Zapier. It’s a good way to add new integration as other tools become best in class.

Growing in a startup mode

From a business perspective, having a business partner was a big deal to Shane. He and his co-founder AJ Ayers have a great relationship and hold each other accountable to the plans they make.

“I’m the ideas person and my business partner focuses on implementation. That synergy is critical and allows us to grow so fast. There’s a book called Rocket Fuel I would recommend – it’s all about how to get traction in your business, especially those who plateau after having a few employees.”

We asked Shane what Brooklyn FI uses to onboard new team members without slowing down the process.

“For onboarding we use a lot of Loom videos and Guru for internal wiki on processes and workflow. And TaxDome, of course, — all of our processes are within our CRM Tool.”

Shane Mason with his business partner AJ Ayers.

Improving client communication

Keeping clients in the loop on all the work going on behind the scenes was one of the most challenging things to Brooklyn FI.

“We work really hard to get the info from clients and we work hard to put together an accurate representation of their year. We want to communicate that to the client so they are aware of why they pay us. It takes us a week or two to get their return prepared and they are always wondering what’s going on. Keeping them in the loop was a challenge.”

Switching to TaxDome was a relief for both sides.

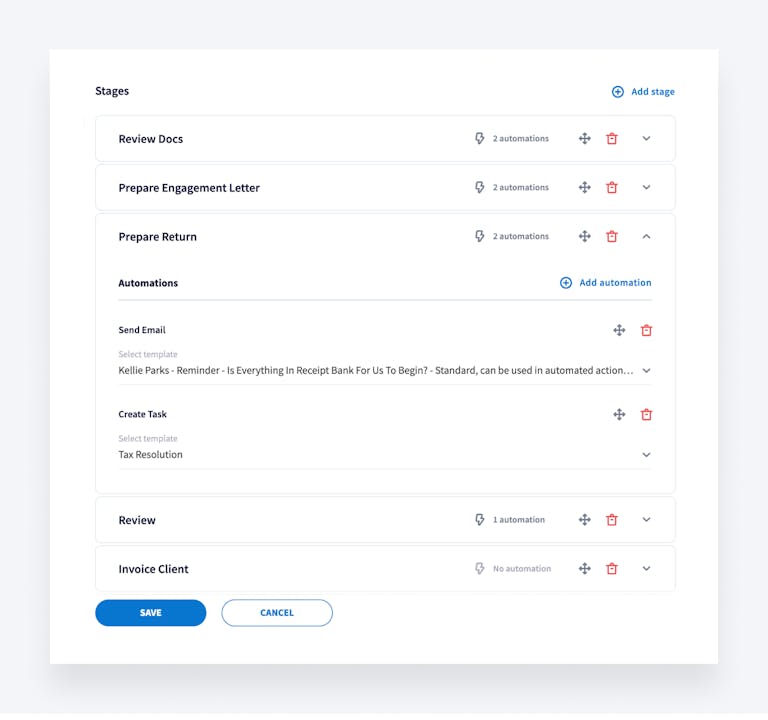

“As with any business, there is a lot that goes on behind the scenes that clients are not privy to — reviewing, preparing, review, finalizing. With TaxDome, we have automated emails that are set up every time a client moves into that step in the workflow — so the client is in the know what’s going on behind the scenes. This used to require a ton of manual work so keeping our clients in the loop is now a real thing.”

With automated actions you can keep clients in the loop automatically.

With automated actions you can keep clients in the loop automatically.

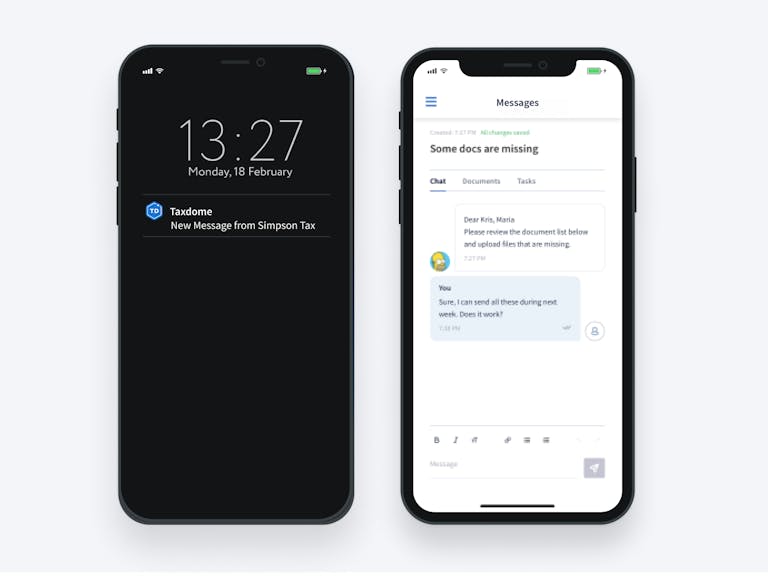

The usage of the TaxDome’s client portal has also solved another important issue — having a portal that was easy to use and also a delight for clients.

“We were using another tool with Intuit — password reset was an issue. It wasn’t white-labled and it didn’t have the functionality that we needed. Now we’ve only gotten positive feedback from clients. Generally clients don’t talk about portals, so having people talk positively about it is welcome.”

Client portal is as easy as Whatsapp or other apps your clients are using.

Commenting on the industry as a whole, Shane recognizes that one of the biggest complaints about accountants is a lack of communication — clients are always wondering what’s going on. As Brooklyn FI continues to scale, having such repeatable processes allows them to be more impressive to clients and set apart from others. Follow the Brooklyn FI experience to scale your practice and automate as many processes as you can. Need help with that? Join our live daily demo with Q&A!

Thank you! The eBook has been sent to your email. Enjoy your copy.

There was an error processing your request. Please try again later.

Download our eBook to get the answers