Small businesses are the driving force in today’s economy, making up 99.9% of all businesses in the US.

One of the reasons they can thrive in a competitive market is through a combination of technology, customer interactions and new ideas. The ability to adapt fast, deliver unique products and get to know customers on a personal level gives small businesses an advantage over many enterprises.

But there are plenty of bumps along the road to small business success. One such example is keeping up with tax paperwork, which can be a significant management headache.

Thankfully, there’s a game-changing solution to that particular problem: QR codes.

Receipts with QR codes are now changing the way small businesses prepare tax paperwork. They improve speed, accuracy and transparency while eliminating paper use and simplifying data integration.

Let’s explore the advantages of using QR codes for digital receipts, including:

- Integration with accounting and bookkeeping software

- The benefits for small businesses

- Concerns and challenges — and how to address them

Advantages of digital receipts

From workflow automation to AI tools like ChatGPT, we often hear how technology is streamlining business processes. Yet despite this trend, traditional paper-based receipts are still widely used. Here are the advantages of using digital receipts.

- Easy access and storage. Digital receipts are stored electronically and can be accessed easily through email, apps or online platforms. They are easy to find, sort and view when needed. No more trawling through piles of paper!

- Reduced clutter. Paper receipts quickly pile up, making wallets, purses and filing boxes messy. Digital receipts eliminate paper mess and make tracking transaction records easier and cleaner.

- Convenience. After a transaction has been completed, digital receipts are immediately sent to your email or a particular app. This makes it easier for customers and companies because they no longer have to ask for and keep track of paper receipts.

QR codes in digital receipts

Using QR codes in digital receipts enhances the overall transaction experience for customers while also improving efficiency, data insights and marketing possibilities.

This is how QR codes can be integrated with digital receipts:

QR code generation

A QR code is generated that has information about the transaction written into it. Many software tools or APIs can be used to create QR codes.

QR code integration

The generated QR code is then added to the digital record for the transaction. This is possible either by making the QR code part of the digital receipt or by making it a clickable link.

Storing relevant transaction data within the QR code

The QR code gathers important information when a customer makes a purchase. This includes the date, time, items purchased, prices, payment method and other helpful metadata.

Use of QR codes in scanning apps or smartphone cameras

The number of smartphone users in the United States who used a QR code scanner on their mobile devices from 2020 to 2025.

According to Statista, about 89 million smartphone users in the US scanned a QR code on their phones in 2022. This is a 26% increase from 2020. The number of people using mobile QR code scanners is expected to keep increasing, reaching over 100 million in the US by 2025.

Integration with accounting and bookkeeping software

Tax documentation is vital in every business, regardless of size. With QR code-enabled digital receipts, it becomes easier for companies to track documentation.

Learning about tax documentation and incorporating QR codes for digital receipts can be more challenging than it first appears, however. You’ll need relevant knowledge, which you can gain through accounting or bookkeeping courses. These days, there are tons of great courses online, such as a doctorate in education.

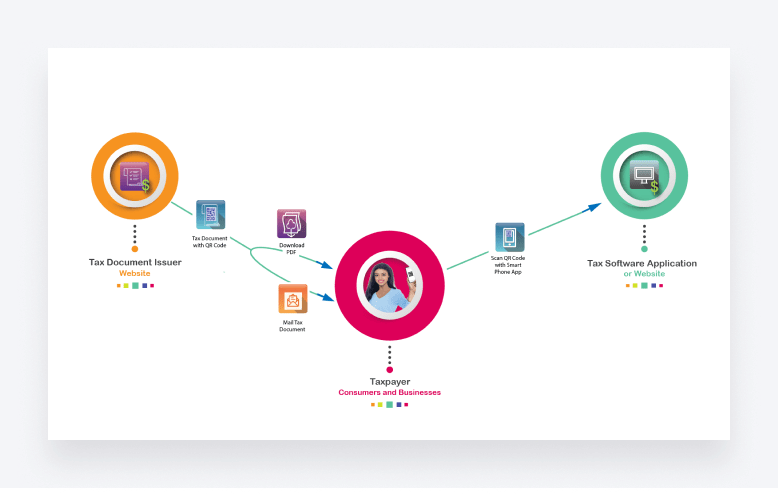

QR codes store information as a set of square pixels in a grid. Computer devices like smartphones can quickly read this information. Document information can be encoded as QR codes on yearly tax forms. Smartphone tax software apps can then read that information and add it to individual and business tax returns, creating a more unified accounting workflow.

This process is visualized in this simple diagram:

Integrating QR-code digital receipts with accounting and banking software can help in several ways. It makes the process more efficient and accurate while also making it easier to keep track of money.

Generating QR code receipts

For each purchase, businesses generate a digital receipt with a QR code. These receipts can contain important information about the transaction, like the date, items bought, quantities, prices, tax information and payment method.

Accounting and bookkeeping software

Your accounting, bookkeeping or practice management software should have an API (application programming interface) or integration features that make it easy for third-party programs to talk to each other and share data.

For example, TaxDome allows you to connect to popular third-party tools like QuickBooks Online, Stripe and Calendly through ready-made integrations. Alternatively, you can connect to thousands of other apps using TaxDome’s Zapier integration.

QR code reading and data extraction

Create a system that can read QR codes and gather the information needed. You could do this with a QR code scanning app or by adding the feature to your current mobile app or point-of-sale (POS) system.

Data transformation and mapping

Once the QR code has been read and the information has been extracted, it needs to be changed into a format that your accounting software can use. Companies could link the data fields in the QR code to the same areas in your software’s database.

Remember that this kind of integration could require technical skills. You may need to work with software engineers or talk to experts at putting software systems together.

Also, the APIs and integration steps differ between different accounting software, so you’ll need to adapt your approach to match the software you are using.

Benefits for small businesses

Digital receipts with QR codes can help small businesses in many ways, including improving the customer experience, making operations more efficient and saving money.

Here are some of the advantages:

- Efficient transaction processes: QR code receipts make transactions faster because you don’t have to print paper receipts or type transaction information by hand. Users can quickly scan the QR code with their phones, and the ticket is then sent to their email or saved in an app.

- Cost savings: paper, ink and printer maintenance can add up when you print paper receipts. Switching to digital receipts cuts those costs and helps the environment by eliminating paper waste.

- Data collection and customer insights: digital receipts provide small companies with valuable data that can help them better understand how customers act, what they like and what they buy. This information can help with marketing strategies, managing inventory and strategic decision-making.

- Inventory management: integrating QR code notes with inventory systems can make it easier for small businesses to track what they’ve sold and how much they have in stock. This real-time information can help managers decide which items to replenish and when.

Addressing concerns and challenges

There are always challenges when businesses adopt new technologies. Here are some common concerns and how to mitigate them.

Data security and privacy

When customers scan QR codes on receipts, they might worry about giving out personal information. This could lead to issues relating to data privacy and security breaches.

Mitigation: Explain what information you gather and how you use it in your privacy policy. To protect customer information, use strong data encryption and security methods. Make sure you adhere to relevant data security rules, like GDPR and CCPA.

Technical issues and accessibility

Some customers may need smartphones that can scan QR codes, which could prevent them from enjoying the benefits. Alternatively, customers could be upset if they don’t receive their digital receipts as a result of technical problems or system breakdowns.

Mitigation: Use a digital receipt method that has been tested and works well. Have backup plans in place so that technical issues can be fixed quickly. Ensure customer service is always ready to help customers with problems.

Using QR codes for digital receipts to reinvent small business tax documentation

Embracing digital technology is one of the best ways to advance small businesses and create new opportunities. People are always looking for smarter, more efficient processes, and they’ll likely stick with something that works.

Small businesses can improve their efficiency, accuracy and tax compliance using digital receipts with QR codes. Not only will this transform the way they handle tax documentation, but it will also free them up to focus on growing their business.

Thank you! The eBook has been sent to your email. Enjoy your copy.

There was an error processing your request. Please try again later.

Looking to boost your firm's profitability and efficiency?

Download our eBook to get the answers