We’re excited to announce that we released a direct integration with the IRS, enabling firms to access IRS transcripts directly from TaxDome. Additionally, this month has seen a host of exciting improvements and feature releases, including an easier way for clients to pay invoices, auto-retries if recurring payments fail, and a myriad of improvements to manage scheduled work (job recurrences) on a global scale and within each individual account.

We also rolled out significant enhancements to our CRM, client portal and client messaging, as well as some UX improvements as part of Project Apollo, our ongoing initiative to optimize the TaxDome user experience for firms and clients alike.

Sneak peek:

Our Early Access Community got their hands on the following new features, which will be available for regular release soon:

- Proposals and engagement letters (formerly Contracts): firms can now set expectations, pitch their services and secure timely payments — all in one place (more in this video on proposals)

- New client mobile app for iOS and Android: featuring a revamped homepage, reorganized tabs, an improved chat interface and more

- Tags overview: users can now see how tags are utilized across their workspace

Watch a video overview of all our new features and improvements:

➕ Direct IRS integration

Access transcripts directly from TaxDome

Thanks to our new IRS integration, you can now access your clients’ essential financial information through TaxDome. Not only does this save time, but it also boosts productivity and reduces the administrative burden during tax season.

Here’s how it works:

- Download transcripts directly from TaxDome without visiting the IRS website

- Enter your IRS e-services login — the info will be stored for future access

- Receive alerts when new transcripts differ from previous versions

Find out more about how our new IRS integration works >>

💰 Time & billing

Clients can pay invoices without logging in

Your clients can now pay invoices without needing to log into the TaxDome client portal. Here’s how it works:

- Your client receives an email with the invoice

- By clicking Pay Now, they are taken to the newly designed payments page

- They enter their bank or card details, then click Pay Invoice

This improvement makes it easier and faster for clients to pay invoices. They can also send the link to their spouse, business partner or anyone else who should be making the payment.

As a team member, you can copy the payment link from your workspace and send it via email or a messaging app to get paid even faster.

We’ve also updated the invoices page and user flow. If issued multiple invoices, clients can settle them with a single click.

This update is currently available for one-time invoices, and we have plans to launch it for recurring invoices in future releases.

Add reminders to invoice templates

You can now set invoice reminders at the template level. Simply toggle on Send reminders to clients and select when and how many reminders you want to send. Invoices created using this template will then automatically include the reminders you have set in the template.

If you use this template in a pipeline, for example, the reminders you set will be added by default. If you want, you can then fine-tune the reminder settings when adding the Send invoice automation — or toggle them off altogether.

More on adding reminders to invoice templates >>

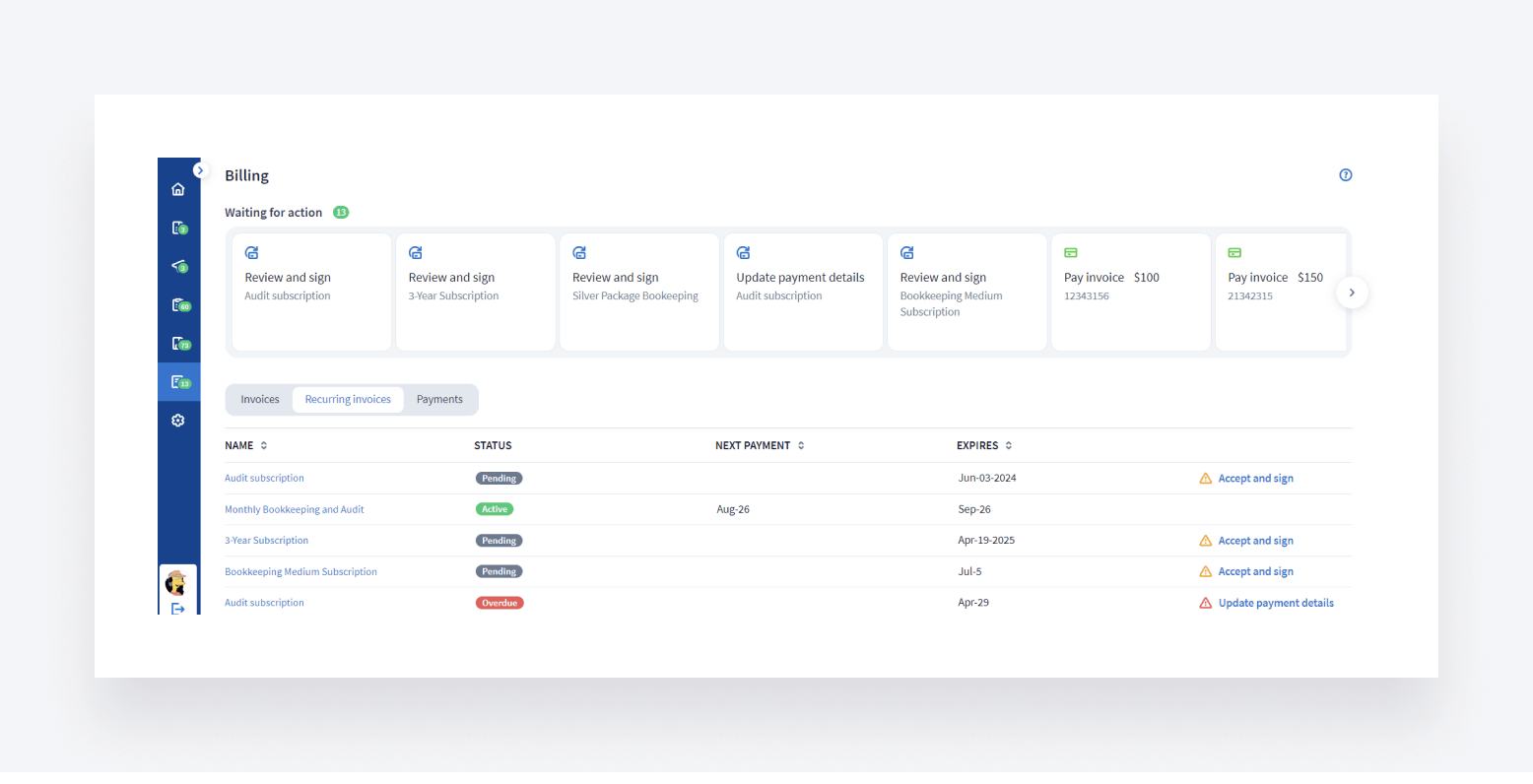

Recurring invoice updates

There are two updates to recurring invoices: automatic retry when a payment fails, and clients can update payment methods.

Should a payment attempt on a recurring invoice fall through, we’ll now make four attempts after it does, the last three 24 hours apart. This update removes the need to manually chase a failed payment, giving your clients time to check their balance or card details.

Secondly — clients can now update payment details at any point — not just if a payment on a recurring invoice falls through.

Read more about auto-retries for failed payments >>

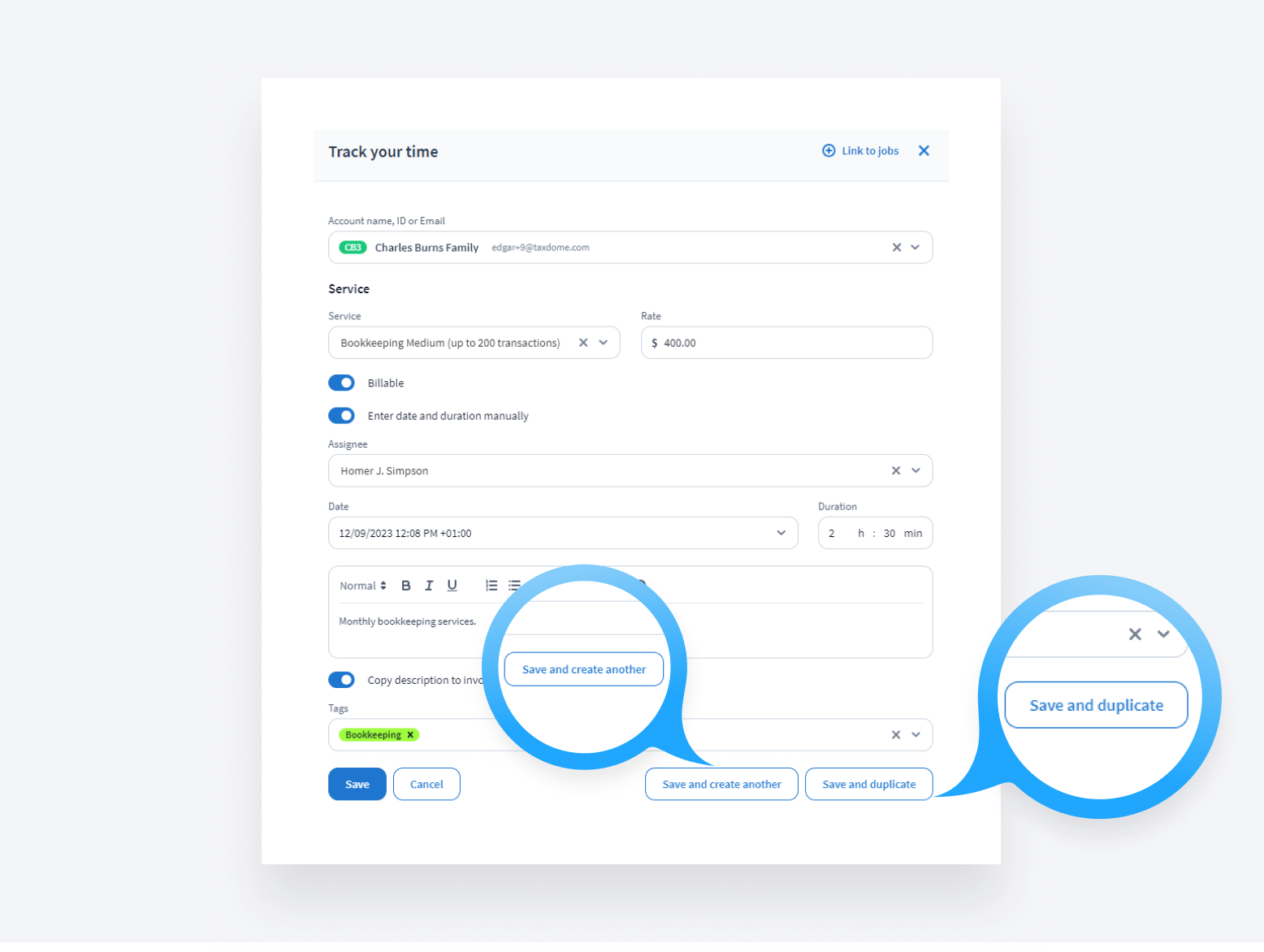

A simpler way to create multiple time entries

We’ve made it easier to submit multiple time entries by adding two new buttons to the existing Save button:

- Save and create another

- Save and duplicate

So instead of creating multiple new time entries manually, you can now save your current entry and simultaneously create a new one with a single click. The new entry can either be blank (i.e. ready to be filled) or a duplicate of the saved version.

This improvement saves you time and reduces the number of clicks when logging multiple time entries.

Find out how new buttons within time entries work >>

Choose which payments to send to QuickBooks Online

You now have more flexibility in controlling which TaxDome payments sync with QuickBooks Online.

In your firm settings, a new toggle lets you avoid syncing manual payments by default.

When creating individual manual payments, you can also check a box to exclude specific payments from syncing.

Everything you need to know about syncing payments with QBO >>

View jobs that are linked with time entries

We’ve made a UX improvement to the way time entries are displayed. Once you link a job to a time entry, it will appear in the JOBS column (see below).

This update makes it easier to see how many jobs are linked to a particular time entry. Instead of going through each entry individually to find this information, you now have a global view.

Learn more about linking jobs to time entries >>

🚀 Project Apollo

Create complex queries with revamped filters

In September we launched Project Apollo, a usability initiative designed to help you and your clients work faster and more efficiently.

As part of this initiative, new filters have been released, enabling you to create complex queries with multiple conditions (is, is not, greater than, less than, and more). These new filters will be added to other areas of your workspace, the first release is for the Accounts page. As before, you can save filters to access them quickly in the future.

Example: find new clients with the tag “1120” who are not assigned to Bob, Mary, or Keith — and have outstanding e-signature requests.

📞 CRM

We also made an important improvement to our CRM, enabling you to apply Account and Contact tags during import.

Previously, the simplest way was to create all your tags in TaxDome, segment a CSV into separate parts for each tag and then import each segment separately. Now, you can avoid this workaround by adding a column for tags in your CSV file and choosing the Tags option during the mapping process. To apply multiple tags, separate them with commas in the spreadsheet.

🤖 Workflow

New job recurrences page: view and manage all job schedules across all accounts

To improve workflow and oversight, we added a new job recurrences page where you can view and manage all job schedules, across all accounts, in one place.

On the new job recurrences page, you can:

- Gain an overview of employee schedules and monitor all job recurrences inside one table

- Filter schedules by assignee, account name, next recurrence and more

- Change individual schedules or use bulk-edit to modify multiple schedules with one click

- Simplify reporting — export recurrence schedules as CSV files for in-depth analysis

This update simplifies and speeds up the process of adding new job recurrences by reducing the number of steps as well as providing an overview of existing scheduled workflows.

Learn more about the job recurrences page >>

Manage job recurrence within account view

The job recurrences page allows you to have a birds eye view of all scheduled work across your firm, with the ability to drill down into it. You can also view and manage job recurrences when working within the context of one account.

This improvement is particularly useful for team members who primarily interact with TaxDome via client profile pages. In addition to the overall schedule page, it is now very convenient to see and manage all planned jobs within your workspace.

Learn how to set up recurring jobs here >>

📚 Documents

Clients can organize documents and choose subfolders when uploading

Clients can now choose to upload documents to any folder they have access to, including subfolders, helping to keep your DMS organized.

Previously, clients were not provided this option and could only upload documents to the parent folder. If you wanted those files to be in a subfolder, you’d have to move them manually yourself. This update saves you the time and hassle involved in that process.

See more on how clients can upload documents here >>

🏢 Firm management

Require 2FA for entire team

Firm owners can now make it mandatory for all team members to use two-factor authentication (2FA) when signing into TaxDome.

This provides an extra layer of security across your entire organization.

See more on setting up 2FA for team members here >>

All of the above — plus 73 more tweaks and fixes! Join our Facebook Community to ask questions, request features or chat with other TaxDome users.

In case you missed it, here’s a summary of the major features we covered in our previous post.

Thank you! The eBook has been sent to your email. Enjoy your copy.

There was an error processing your request. Please try again later.

Looking to boost your firm's profitability and efficiency?

Download our eBook to get the answers