Linking TaxDome to your QuickBooks Online account automatically syncs all invoices and payment details between both platforms, making it easy for you to track your income and expenses, automate your invoice process, and keep all documents and payments in one place for your clients.

Recently, we made a host of improvements to our QuickBooks Online integration. These updates allow you to seamlessly send more data from TaxDome to QuickBooks Online, easily keep tabs on sync status and ensure your synced data is always up to date.

To maximize our QuickBooks Online integration, have a read on everything we’ve updated and improved below.

The benefits of QuickBooks Online integration in TaxDome

If you use QuickBooks Online, connecting your account with our integration allows you to sync your data from TaxDome to QuickBooks, with automation that helps make the entire process seamless.

Our QuickBooks Online integration automatically syncs payment details, invoice details, paid status, sales tax amount and more — saving you time by eliminating the need to manually enter any data.

This also reduces the risk of inaccurate or missing data entries, while keeping all documents and payments in one place for your clients in their Client portal.

Once synced, you will then have the ability to track, manage and organize your payments and invoices quickly and easily on both platforms, which will also unify your invoicing process and put you in the driver’s seat for accurate reporting and reconciliation.

New features

Take a look at the new features we’ve recently added to our QuickBooks Online integration, helping you increase the amount of data you can send from TaxDome to your QuickBooks account.

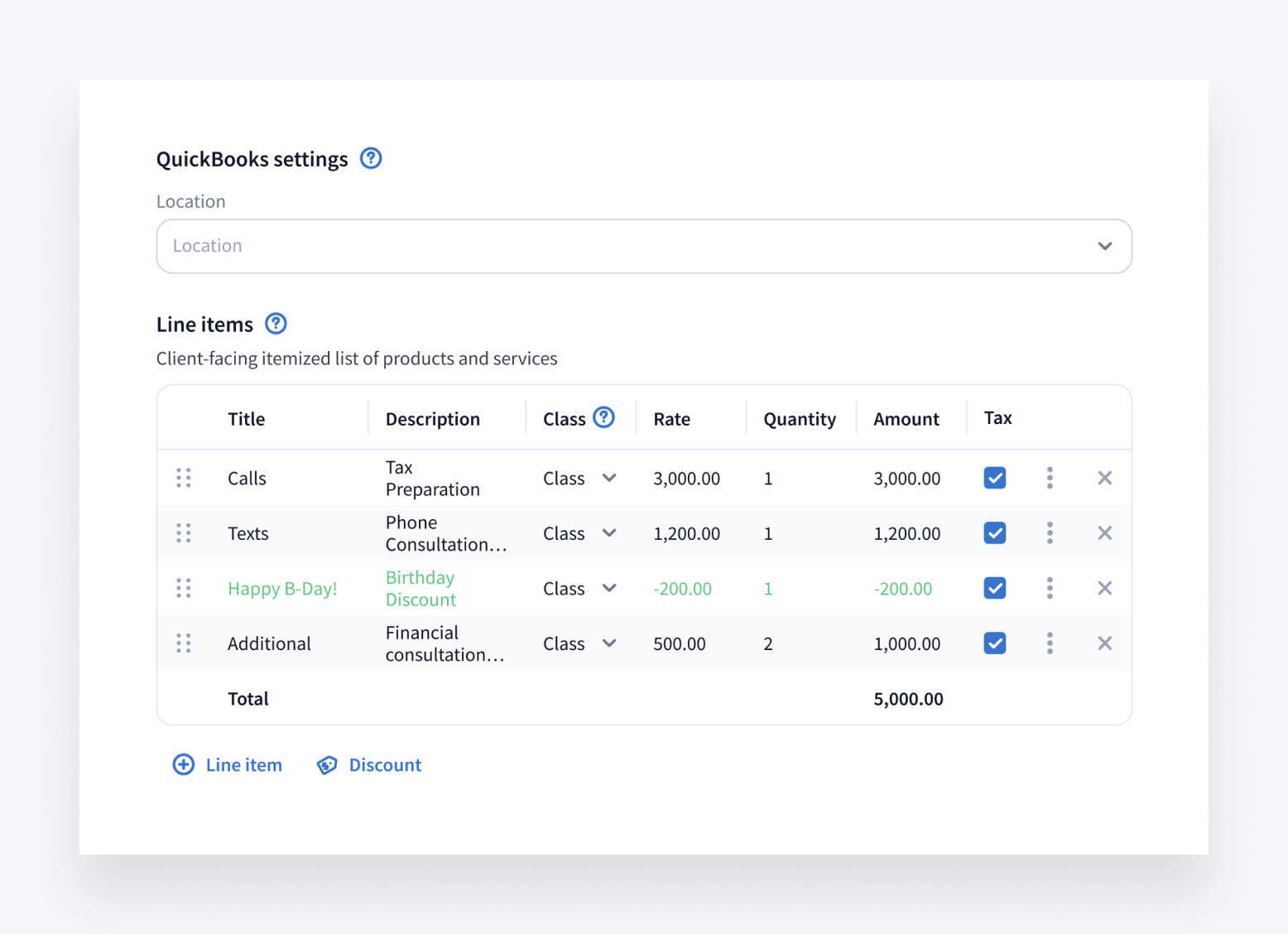

Set up class and location tracking

We’ve added class and location tracking to our QuickBooks Online integration. This feature allows you to add class and location data to your invoices in TaxDome, making it easier to organize your transactions.

Set up class and location tracking in QuickBooks Online to make it available in TaxDome when you create an invoice or invoice template. From then on, the classes and locations of invoices that you create in TaxDome will be automatically sent to QuickBooks.

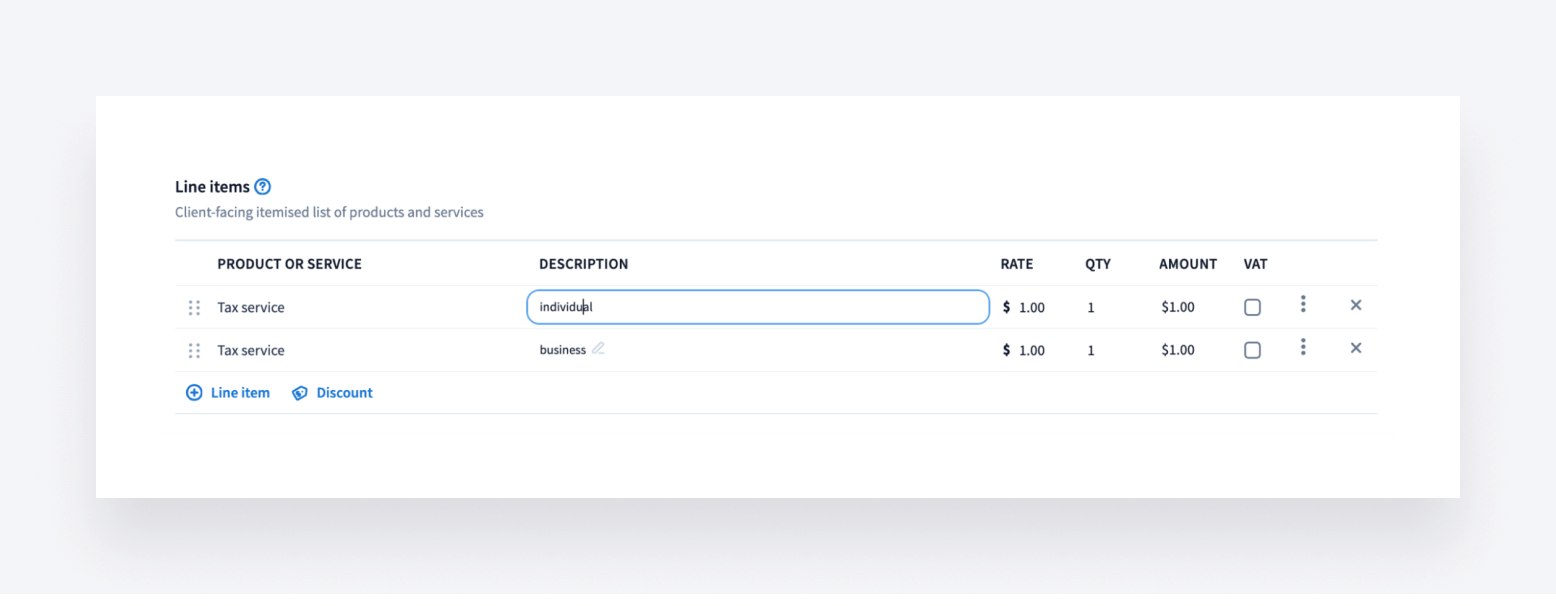

Sync line item descriptions to QuickBooks Online

You can now automatically sync line item descriptions to QuickBooks Online. This saves time and ensures your services are listed accurately for corresponding invoices, which also makes it easy to analyze your invoices at a later date.

To sync line item descriptions, type your text in the description field when you create an invoice in TaxDome. Once the invoice is created, the line item description will automatically sync to the service description field in QuickBooks Online.

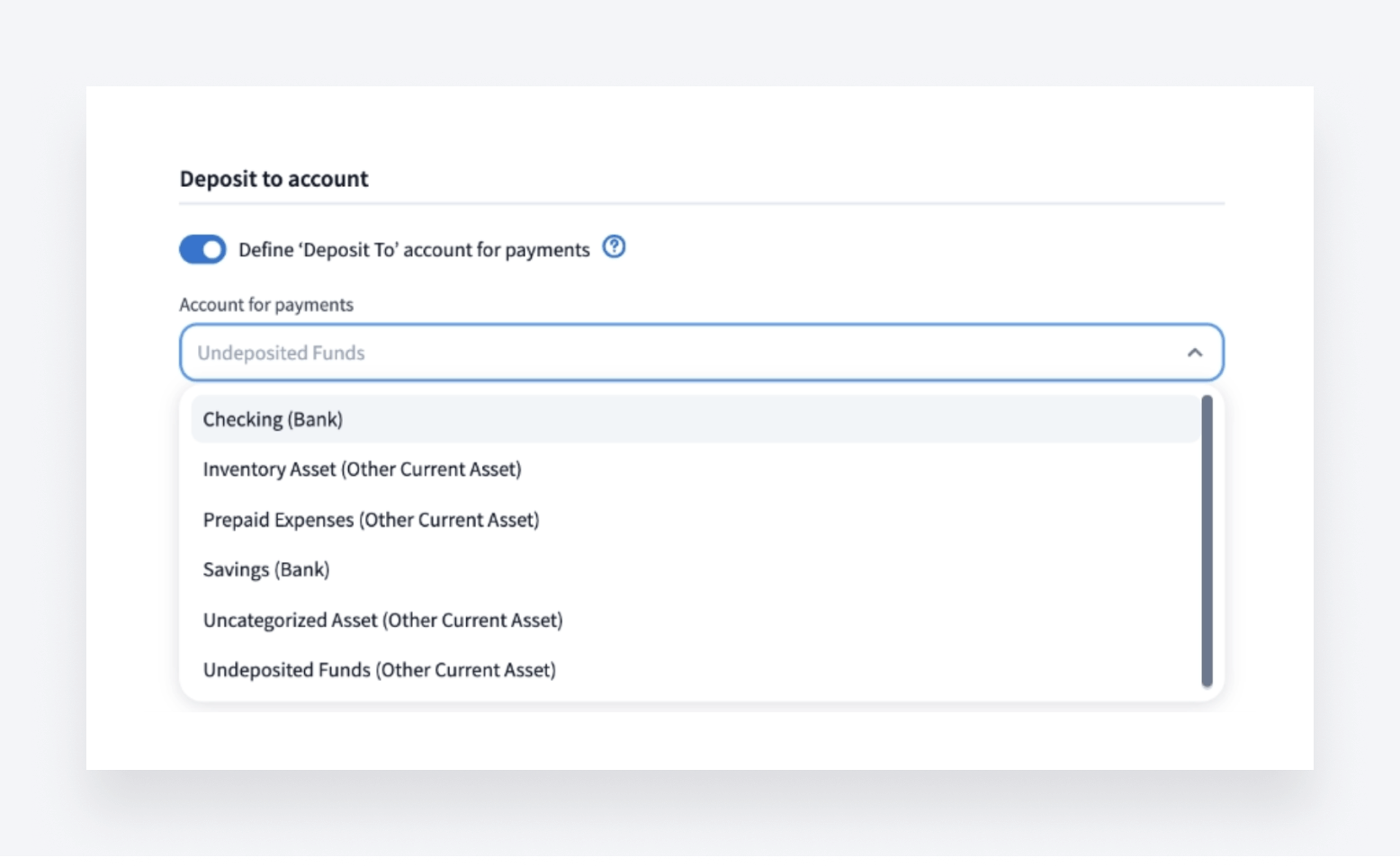

Route payments to income accounts in QuickBooks Online

Keep your books organized and accurate with the new ability to route your payments to designated income accounts in QuickBooks Online.

You can choose where to route your payments by selecting your “Deposit To” account in Settings > Integrations > QuickBooks > Deposit to account. Enable the toggle, then choose your account from the drop-down menu. By default, all payments are routed to Undeposited Funds in QuickBooks Online.

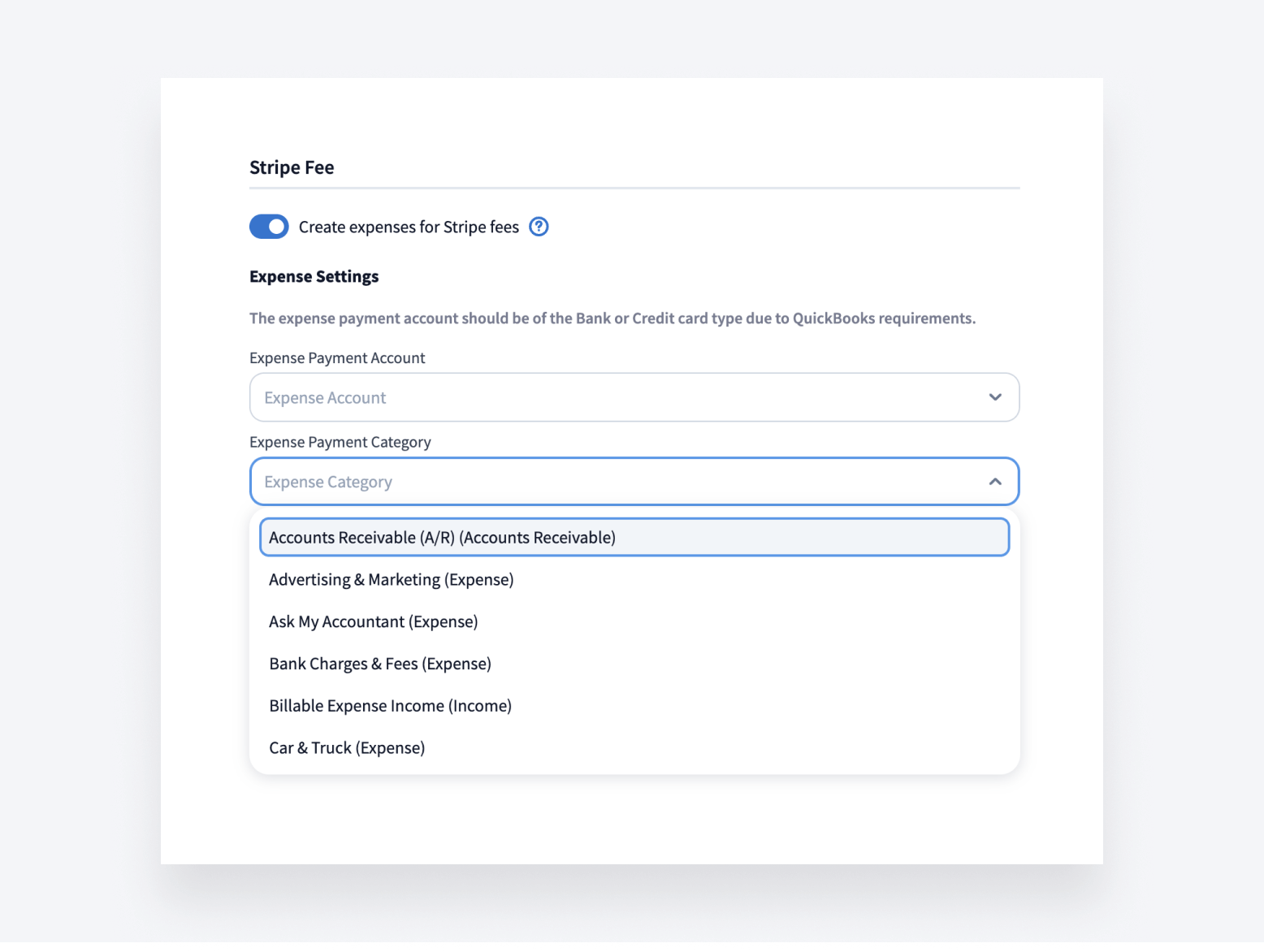

Set up expenses for Stripe fees

If you use Stripe as one of your payment methods in TaxDome, you can now set up expenses for Stripe fees that will automatically sync to QuickBooks Online.

To do this, navigate to Settings > Integrations > QuickBooks as a firm owner. In the Stripe Fee section, enable the toggle for Create expenses for Stripe fees. You can then choose the Expense Payment Account and Expense Category from the two drop-down menus.

New improvements

In addition to the above, we’ve also made a handful of improvements to our QuickBooks Online integration. These enhance data accuracy and make it easy for you to both monitor and manage your synced data.

Automatically sync recurring invoices only when they are due

We’ve improved how recurring invoices sync to QuickBooks Online. Now, recurring invoices only sync to QuickBooks Online when they are due, ensuring that your books only display recurring invoices that have been issued in TaxDome.

Automatically sync payments only when they are completed

We’ve also improved how payments in TaxDome sync to your QuickBooks Online account. Now, payments only sync when they have “Paid” status — so only completed or processed payments will display in QuickBooks Online. You also have the ability to unsync payments accordingly.

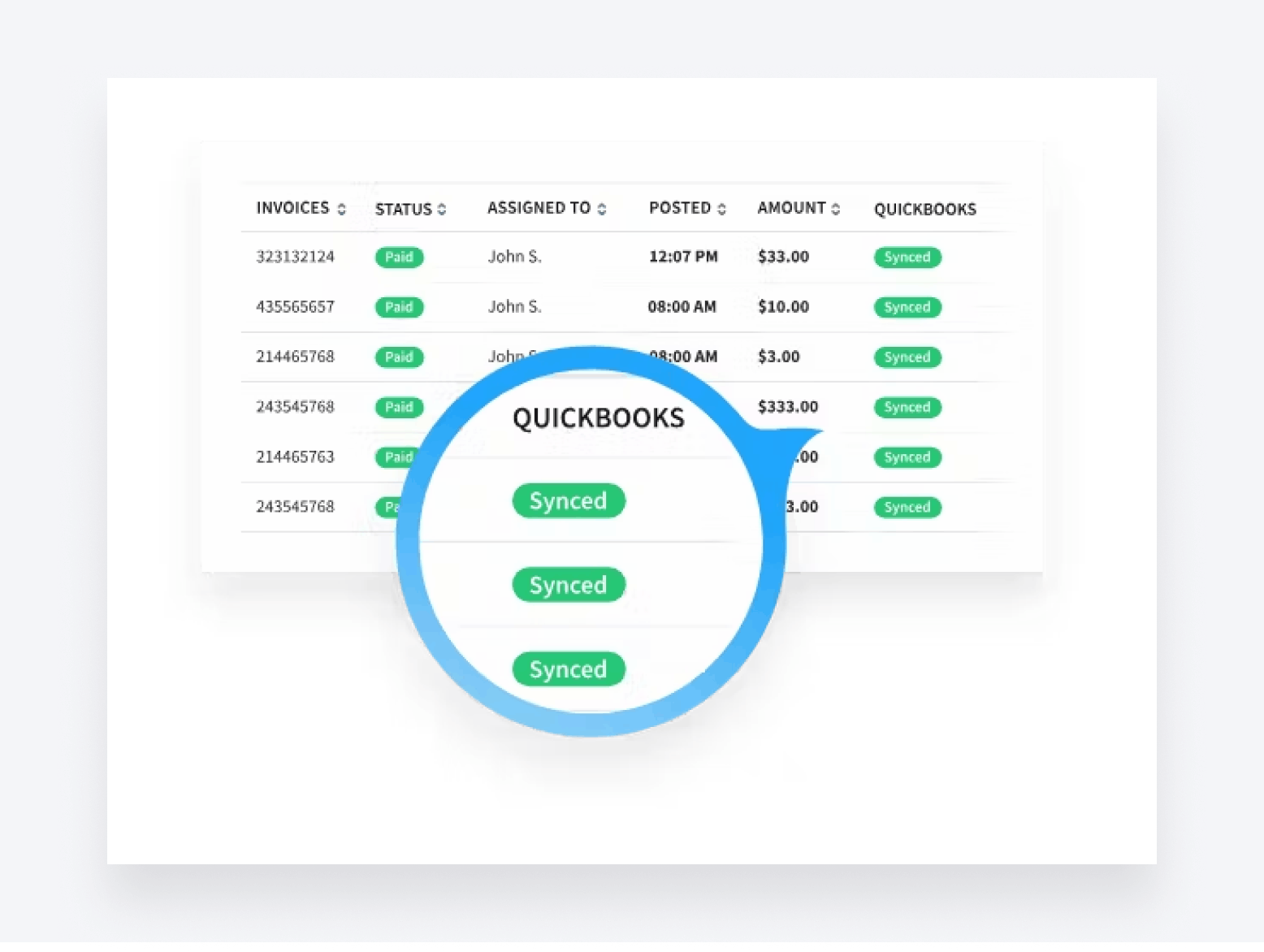

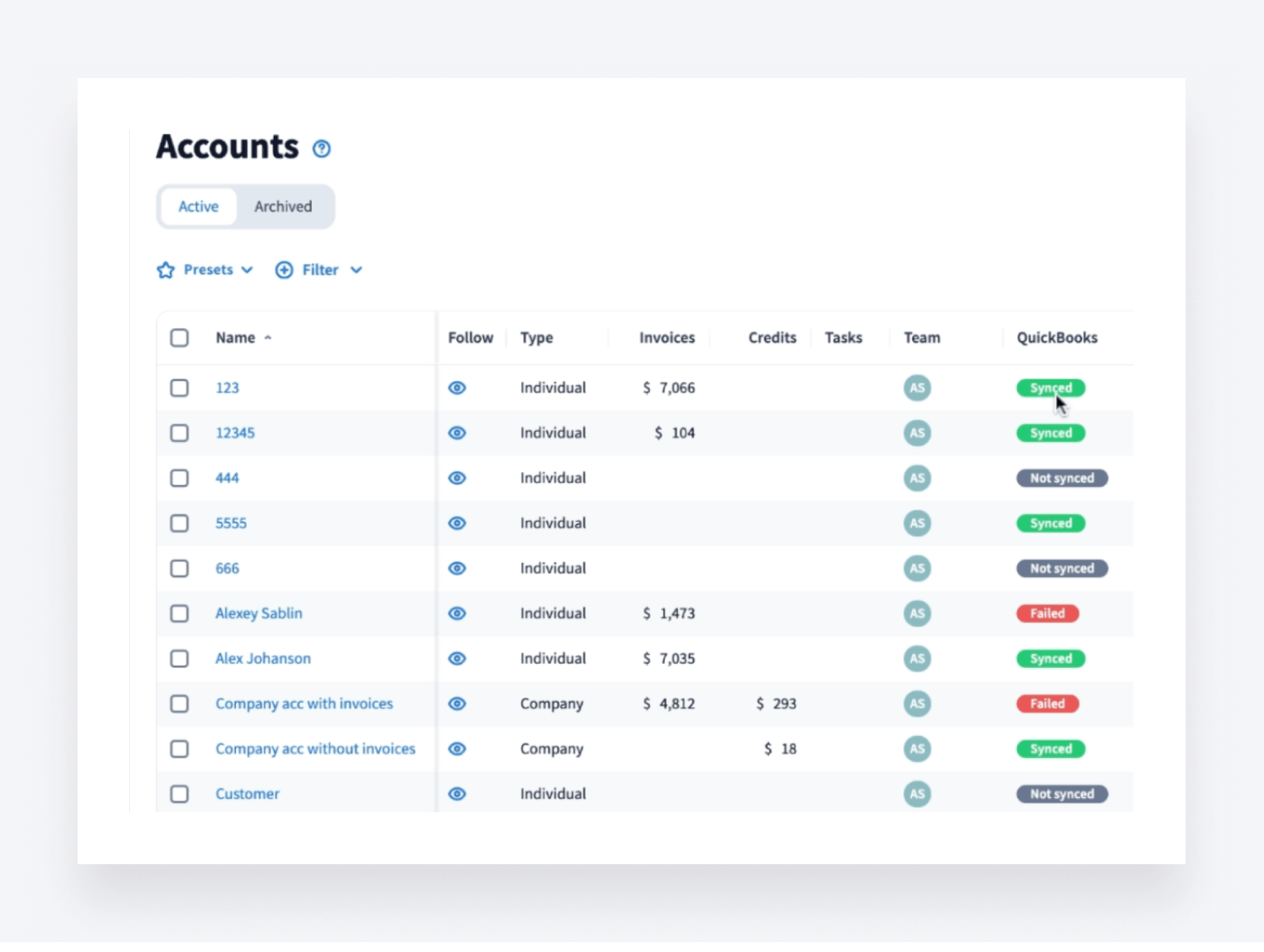

Track QuickBooks Online sync status in Accounts, Invoices, Payments and Services

Keep tabs on your synced data and stay informed on what has synced and what hasn’t. It’s now possible to view QuickBooks sync statuses in more locations: Accounts (in your accounts list, in addition to within client accounts), Invoices, Payments and Services. This allows you to easily monitor your synced data “on the go” as you complete your daily routine.

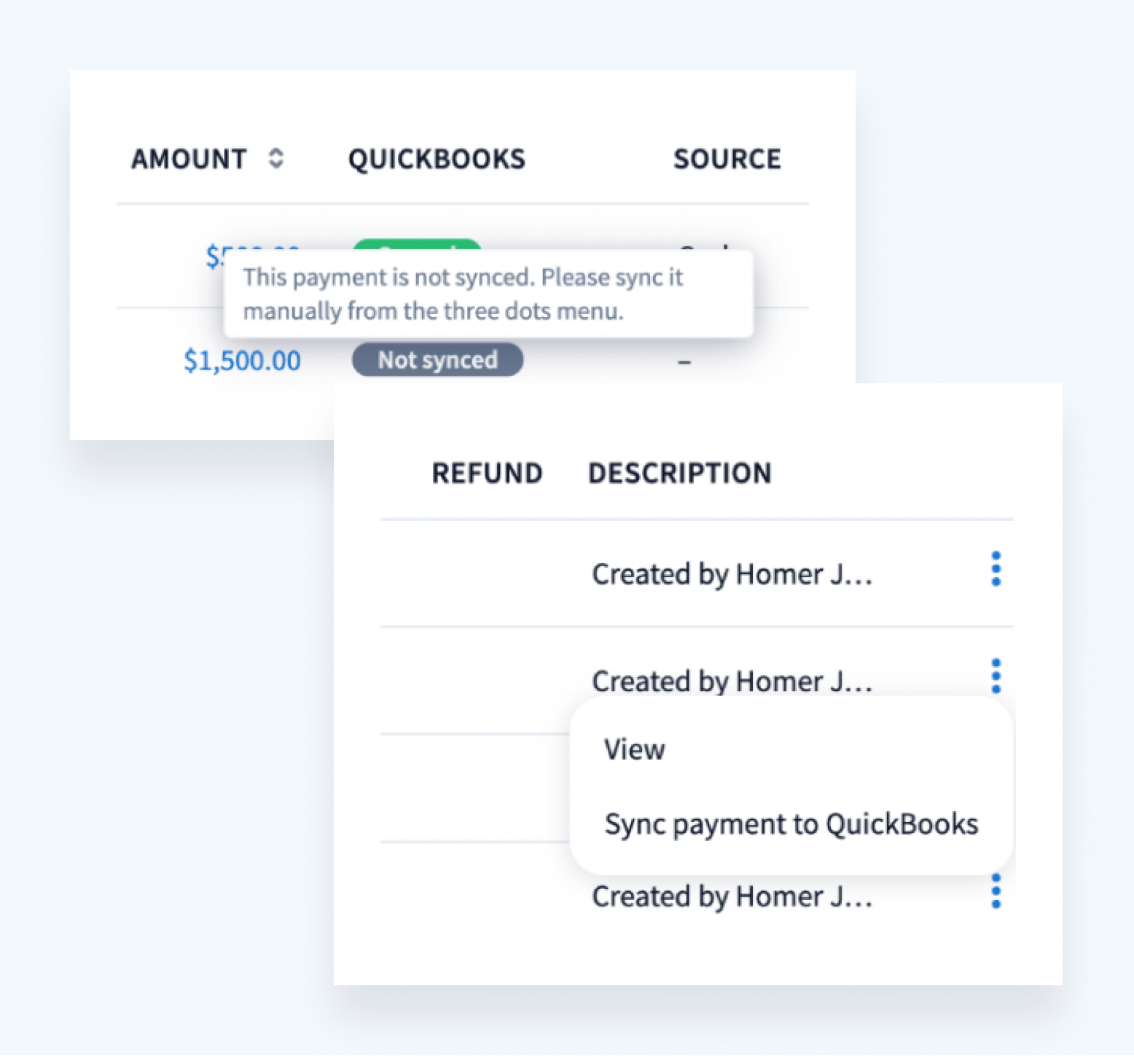

Manage sync status

Lastly, we’ve added helpful hints to give you more information about each sync status. To view these hints, simply hover over any QuickBooks sync status in the Accounts, Invoices, Payments and Services sections.

In addition, when a sync status reads “Not synced” or “Failed”, you can quickly restore “Synced” status with the option to manually sync payments and invoices. Simply click on the three dots menu on the far right, then Sync to QuickBooks. By manually syncing, all entities related to the account will also sync automatically.

How to connect to QuickBooks Online in TaxDome

If you’re a firm owner, you can connect TaxDome to your QuickBooks Online account in four straightforward steps:

- Click Settings > Integrations > QuickBooks > Connect to QuickBooks

- Select the accounts to sync and the earliest date from when you would like to sync

- Enter your QuickBooks Online Email/User ID and password, then click Sign In

- Click Connect to give TaxDome access to your QuickBooks Online data

That’s it. Once connected, you can also choose whether to sync scheduled invoices (recurring invoices) by enabling the toggle under Scheduled Invoices.

Find more information on connecting TaxDome to QuickBooks Online in our Help article >>

Future plans for QuickBooks Online integration

We’ll continue to update and improve our QuickBooks Online integration, including speeding up the sync process. This will further increase accurate data exchange and improve general reliability and stability, making integration with QuickBooks faster and more robust.

Do you have any suggestions for improving QuickBooks Online integration in TaxDome? Let us know through our feature request board! We’re always interested to hear from you

More future plans: Xero Integration in TaxDome

In addition to expanding our QBO integration, we’re planning an integration with Xero. Stay tuned for more information!

Thank you! The eBook has been sent to your email. Enjoy your copy.

There was an error processing your request. Please try again later.

Looking to boost your firm's profitability and efficiency?

Download our eBook to get the answers