As the sun rises on another hectic tax season for accountants, many wish they had a magic wand to do some of the busy work. One such task is creating and sending tax return letters to clients.

Sending out a tax return letter to your clients before tax season establishes clear and formal communication, ensuring that everyone understands and is aligned on expectations, deadlines and the requirements to move forward. It’s also a friendly reminder to clients that you’re actively working for them.

In this article, we will provide you with the necessary information to create an engaging and comprehensive letter — and even provide you with examples and a template to use in your upcoming busy tax season.

What is a tax return letter?

A tax return letter is an engagement letter you send to clients to initiate the process of preparing their returns. It serves as a reminder to clients of what to expect and details the steps and requirements for a successful filing.

It can also serve as a form of marketing, reminding clients of your services and fees — and that you’re ready to help. Of course, in the digital age, you can also email a tax return letter.

Key components of a tax return letter

While each firm’s letter may vary slightly, there are several key components you’ll want to include.

- A professional header and greeting: include your firm’s branded header and open your letter with a kind and formal salutation that sets a professional tone.

- An introduction of your purpose: the opening paragraph(s) should clearly state the letter’s purpose. It introduces the upcoming tax season and your firm’s role.

- An outline of services: detail the specific services you provide. This could range from basic tax return preparation to more comprehensive services like tax planning and consulting for the future.

- Your fee structure: provide a summary of how you bill for your services. Include any additional fees, required deposits and payment terms. Providing as much transparency as possible helps keep clients happy and returning.

- Terms and conditions: these include the formal terms of the engagement, outlining the responsibilities and expectations of both your firm and the client, and any legal considerations relevant to the services you provide.

- A document checklist: offer clients a comprehensive checklist of what they need to get started. This makes the process easier for you and the client, preventing endless back-and-forth communication and missing documents.

- Key deadlines and time frames: remind clients of the deadline for when their taxes must be filed and inform them of when you’ll need to receive their documents in order to file on time. Also, offer them approximate time frames for how long you will take to prepare their taxes once you receive all the necessary documents. Inform them that if they cannot provide the documents by the deadline, you’ll have to file for an extension, adjusting the time frame for when their taxes will be complete and possibly incurring additional fees.

- An accuracy declaration: ultimately, a client is responsible for the accuracy of their tax return, so remind them they’ll need to review it before signing.

- Closing remarks and contact information: conclude your letter with a polite closing and contact details, encouraging them to contact your firm if they have any questions.

- A signature field: provide a field for your clients to formally accept the terms of your service by signing and dating at the end.

Examples of tax return letters to clients

If you want to create your own tax return letter template, here are a few examples of tax return letters that businesses have created for clients.

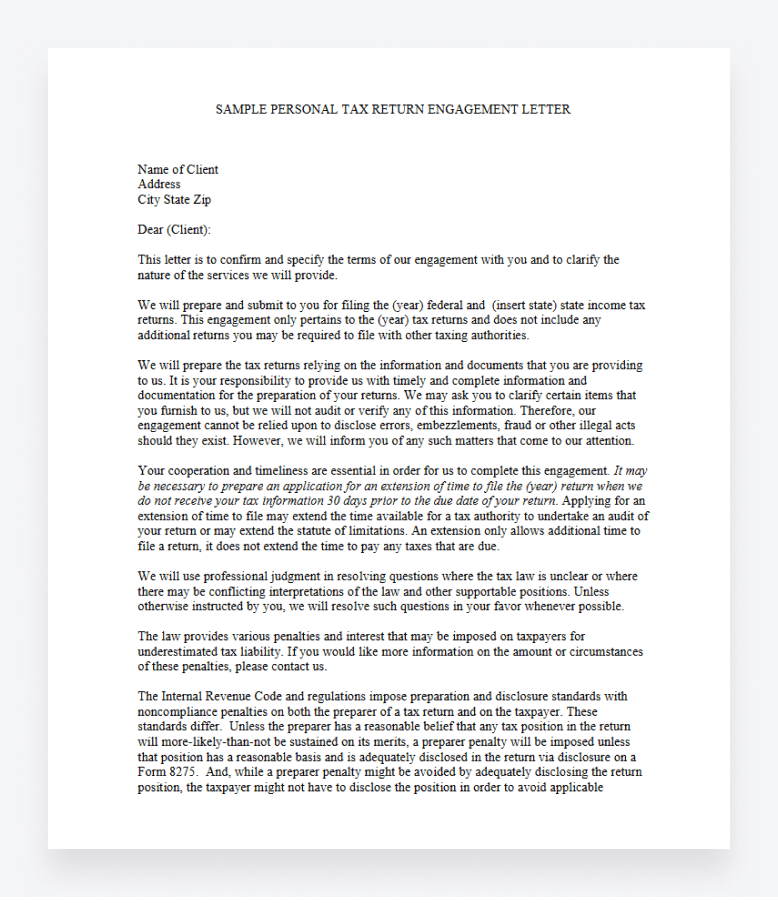

This letter from Markel, a global specialty insurance provider, outlines the client’s responsibility to provide complete and accurate information, legal information the client should be aware of, and a specific time frame for the firm to receive documents if the client wants the tax preparation to be completed by the initial IRS due date.

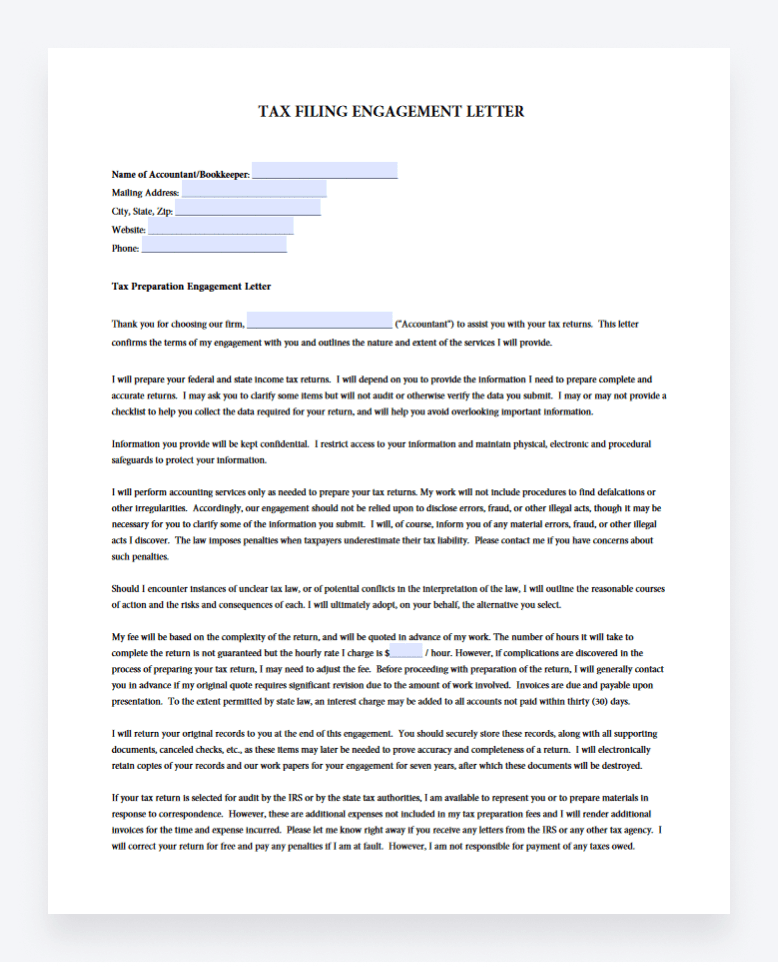

This letter from eForms, a site for free legal forms and documents, offers a more concise version. It provides straightforward information about hourly compensation for the accountant’s services, what services are and aren’t available, and various legal disclaimers.

Free tax return letter template

Creating your own template can be challenging and time consuming, even with the above examples as inspiration. Use this free tax return letter template from TaxDome to build your firm’s unique letter to clients.

____________________________

[Firm logo]

Client: [Client name]

[Date]

Dear [Client name],

I hope the new year is treating you well.

[Your company] understands that each new year brings excitement but also some stress as tax season approaches. Don’t worry – as professional tax preparers, we’re here to help relieve the stress of tax season so you can focus on the year’s new goals.

____________________________

Below, we describe everything you need to know to get your tax return started, as well as what we offer as your professional accounting firm.

Services

We offer a comprehensive range of accounting services tailored to meet your specific tax needs, including but not limited to:

- Tax Return Preparation

- E-filing

- Tax Planning and Consulting

- [Other Services if applicable]

Pricing

Our fees are built to address the complexity of your tax situation and the time required to prepare your return. We’ve attached a comprehensive breakdown of our pricing structure so that you know what to expect when you hire us as your professional accounting firm.

Terms and conditions

We aim to provide you with everything you need to know before you send us your tax documents. That’s why we’ve also included a full explanation of our terms and conditions as an additional attachment to this letter.

Document checklist

To prepare a thorough and accurate tax return, please provide the following documents:

- W-2s, 1099s, and other income statements

- Records of expenses and deductions

- [Additional items as necessary]

Key deadlines and time frames

To provide you with timely service and to adhere to IRS deadlines, we request that all documents be submitted by [specific date]. Once we receive all documents, we aim to complete your tax return within [time frame].

Please be advised that if the full list of your documents is not submitted by [specific date], we cannot guarantee that your tax return will be completed by the official IRS tax deadline, and we will file an extension for you.

Accuracy and completeness

The IRS holds individual taxpayers responsible for the accuracy of their fillings, so please verify that all documents and information you submit are complete and accurate to the best of your knowledge.

Thank you for choosing us as your trusted tax partner this year and we look forward to working with you. If you have any questions or need assistance, please reach out to us at [your phone number] or email me at [your email]. If you would like to move forward, please sign below and return this letter to us.

____________________________

Sincerely,

[Your Name]

[Your Title, Your Company Name]

[Contact information]

Accepted and agreed to by

[Client Name] Date:

____________________________

Conclusion

Crafting an effective tax return letter streamlines your accounting workflow during tax season and enhances the professional relationship between accountants and clients. By incorporating the key elements discussed and utilizing the provided template, your firm can save time creating individual tax letters for each client and begin tax season with a smooth first step.

Thank you! The eBook has been sent to your email. Enjoy your copy.

There was an error processing your request. Please try again later.

Looking to boost your firm's profitability and efficiency?

Download our eBook to get the answers