We are thrilled to announce that TaxDome has been recognized not once, but twice on Accounting Today’s prestigious 2024 Top New Products list for two of our latest releases: our IRS integration and our Proposals & Engagement Letters (ELs) feature.

This recognition is a testament to our commitment to excellence in serving accounting firms worldwide. At TaxDome, our company ethos is centered around continued innovation and improvement. We believe in staying ahead of the curve, constantly seeking ways to help firms take their growth and client service to the next level.

Our IRS integration and Proposals & ELs feature are just two of hundreds of product updates we’ve released in the last year. Let’s take a closer look at what they do — and why they’ve been singled out for praise.

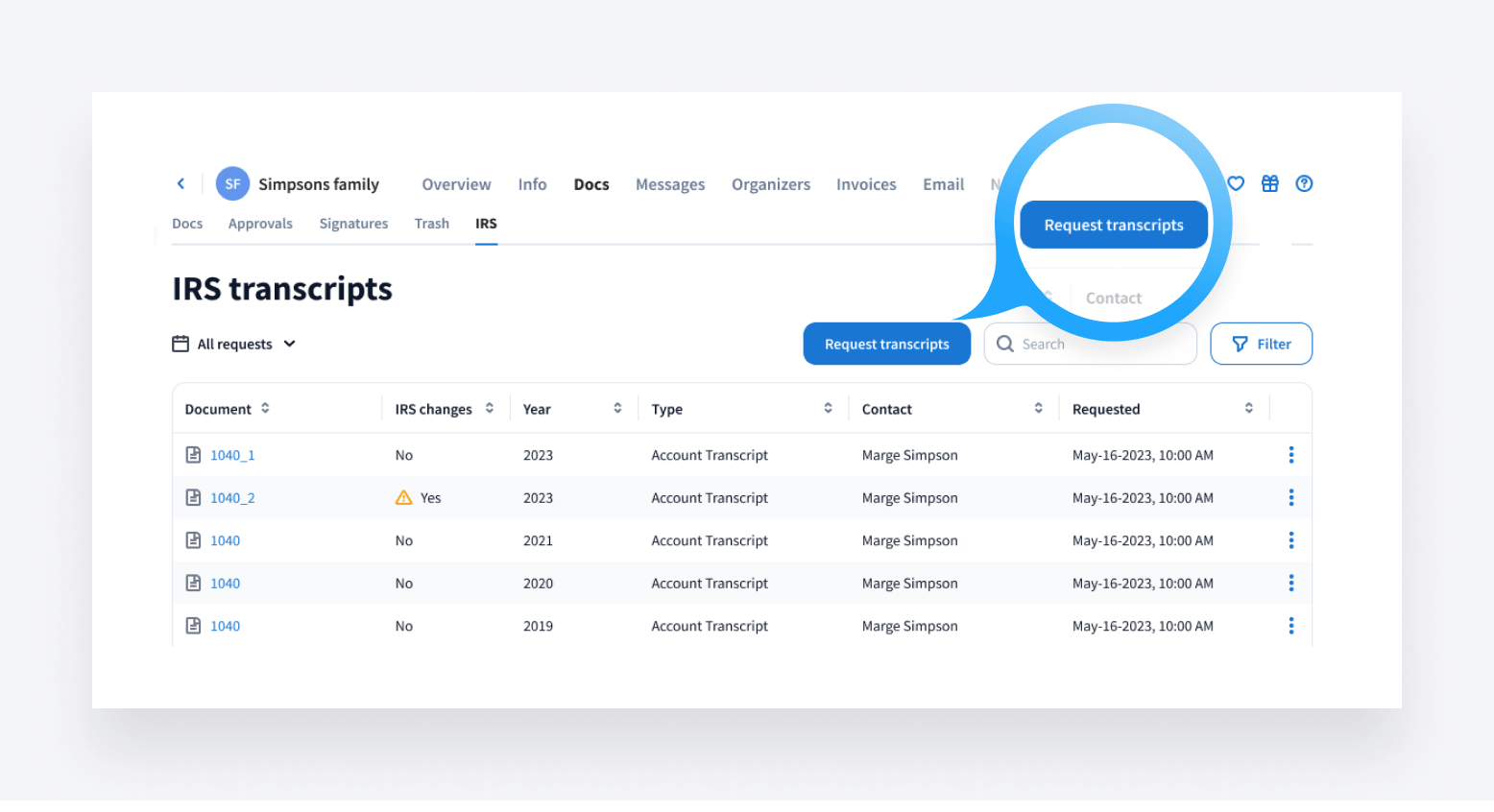

IRS Integration

Our native IRS integration allows users to seamlessly access IRS transcripts directly from their TaxDome workspace, saving valuable time and streamlining the process for accounting professionals.

IRS transcripts are crucial in the world of accounting, representing the official data maintained by the IRS for taxpayers. Previously, accountants and tax professionals had to navigate the IRS portal to access these transcripts. Now, they can do that directly from their TaxDome portal.

As a result of its success in beta testing, our IRS integration was made available to all TaxDome users at no additional cost on September 11, 2023.

Read more about our IRS integration in this blog post >>

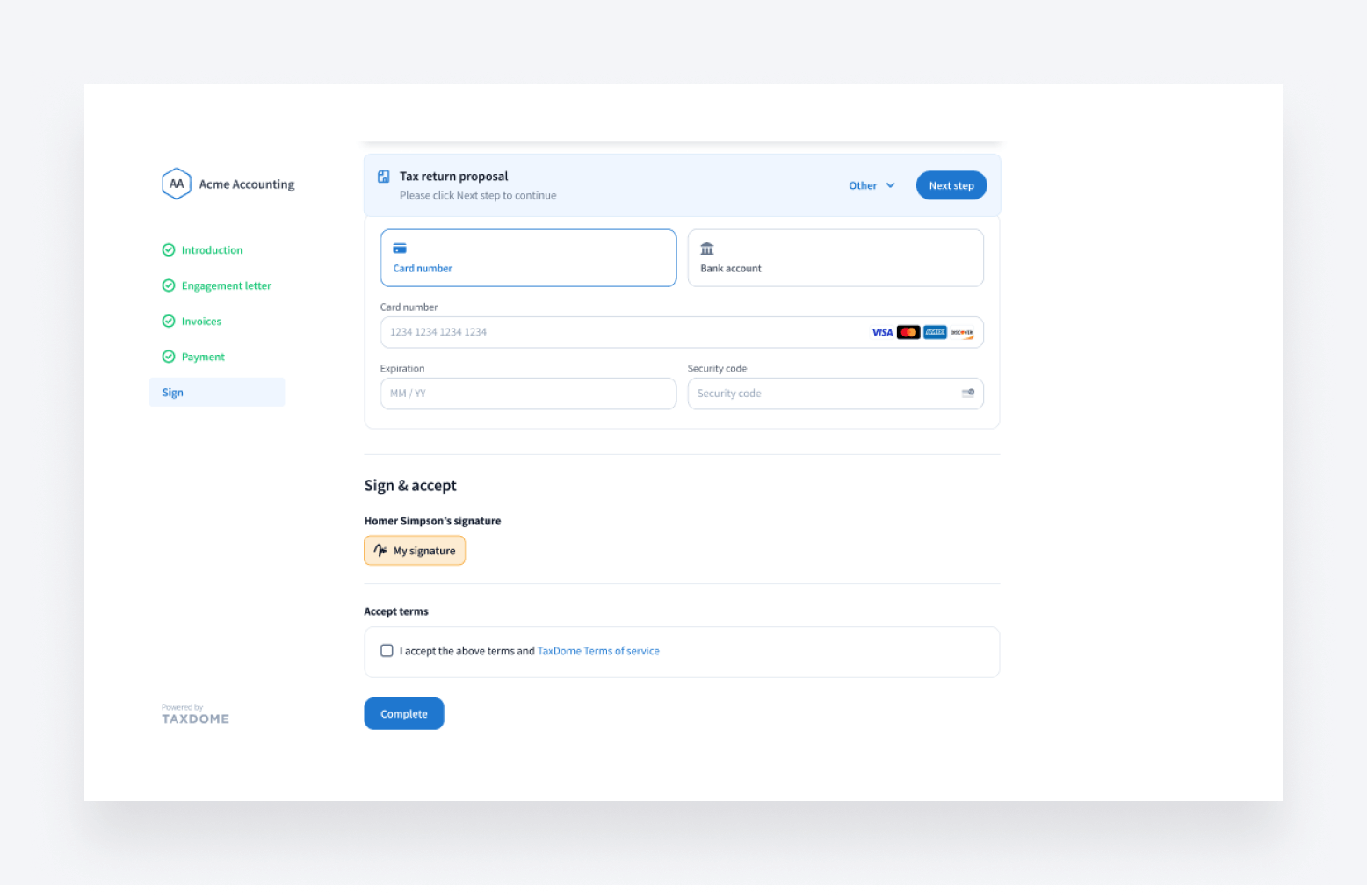

Proposals & Engagement Letters

Client onboarding is a critical step in establishing successful client relationships, and our Proposals & ELs feature simplifies this process for tax, bookkeeping and accounting firms.

With TaxDome, you can now create professional proposals and engagement letters tailored to each client’s specific needs in a matter of minutes. This enables your firm to streamline the entire proposal process — from first contact with clients to getting paid.

With Proposals & ELs, you can:

- Elevate your brand: stand out from the crowd with highly polished and personalized proposals and engagement letters

- Set expectations: clearly define your terms and conditions from the very start

- Pitch your services: show potential clients who you are, what you offer, and how much it will cost

- Secure timely payments: request payment upfront or upon the client e-signing the proposal, request payment details in order to sign, and set up automated payment collection for recurring invoices (credit card or bank debit)

Read more about Proposals & ELs in this blog post >>

We’re delighted that both our IRS integration and Proposals & ELs feature have been highlighted by Accounting Today. This recognition reflects our ongoing commitment to delivering cutting-edge technology and unparalleled value to our clients worldwide.

Stay tuned for more exciting updates as we continue to innovate and evolve!

About TaxDome

TaxDome is a complete practice management platform for tax preparers, bookkeepers and accounting professionals. Trusted by 10,000+ firms in 25+ countries, more than 3 million clients use TaxDome to communicate with their accountants in 10+ languages.

About Accounting Today

Founded in 1987, Accounting Today is a leading publication in the accounting industry. It is read by over 325,000 accounting, bookkeeping, and tax professionals worldwide. Its articles cover the latest news, changes, events, and technology impacting the industry.

Thank you! The eBook has been sent to your email. Enjoy your copy.

There was an error processing your request. Please try again later.

Looking to boost your firm's profitability and efficiency?

Download our eBook to get the answers