The pace of modern business leaves little room for stumbling in strategic decision-making. Yet for growing companies, the cost of a full-time CFO remains out of reach. This is where the virtual CFO comes in.

Read on to learn about the demand for virtual CFOs, how they differ from their traditional counterparts, the services they offer, and how to launch your own remote practice.

What is a virtual CFO?

Virtual CFOs provide financial leadership and strategic guidance on an outsourced, remote basis. This allows companies to access the expertise of a CFO but structured flexibly based on their budgets and needs.

Such arrangements may include:

- Project-based consulting around initiatives such as implementing financial systems or conducting due diligence for mergers and acquisitions

- Ongoing guidance on a part-time basis, such as optimization of cash flow, financial reporting, and fundraising support

- A few hours per week or month to address specific needs, such as financial modeling to inform investment decisions

The rise of virtual CFO services

Demand for flexible interim leadership, including virtual CFOs, has skyrocketed in recent years. According to the 2023 High-End Independent Talent Report, requests for on-demand senior expertise jumped 116% year-over-year. This enormous growth stems from several key factors:

1. Cost efficiency

While financial leadership fuels growth, average hourly CFO pay exceeds $125 per hour, which is often unaffordable for smaller companies. However, average virtual CFO pay sits around $25 per hour — over 80% lower. This massive discount makes strategic guidance cost-attainable for growing organizations.

2. Technological enablement

Increased automation through accounting software and AI simplifies tracking, reporting, and analysis — making robust finance insights more accessible. Cloud platforms also facilitate remote collaboration, supporting virtual engagements.

3. Remote work adoption

COVID-19 normalized remote work, proving many services can be delivered virtually. Without physical office constraints, location no longer limits access to financial expertise.

Taken together, budget limitations, tech-enabled automation, and the normalization of remote work have fueled the rise of virtual CFOs. This model adequately addresses modern business needs at sustainable price points, offering strategic financial solutions to growing companies that would otherwise lack guidance.

Services provided by virtual CFOs

Virtual CFOs deliver similar strategic services to traditional CFOs but in more limited or specialized capacities customized to client needs and budgets. Common areas of support include:

- Financial planning and analysis: providing planning forecast models, competitive benchmarking, risk assessment and growth projections without day-to-day trend tracking

- Accounting oversight: establishing accounting frameworks, policies, and reporting structures with no daily accounting management

- Cash flow optimization: guidance on strategic liquidity planning rather than routine cash flow tracking

- Capital planning: evaluating funding options at critical junctures without continuous capital structure maintenance

- Risk mitigation: pinpointing key financial vulnerabilities instead of extensive audits

- Investor relations: producing reporting artifacts and presentations with no direct investor interactions

- Strategic guidance: translating growth ideas into financial plans and models

- Compliance support: designing processes for regulatory adherence rather than internal policy setting

Comparing virtual and traditional CFOs

While virtual and in-house CFOs both provide invaluable strategic finance guidance, some key differences exist:

1. Role and responsibilities

Virtual CFOs take on specialized or interim strategic finance priorities, while in-house CFOs oversee extensive day-to-day responsibilities and company-wide initiatives. To learn more about the traditional CFO role, see our article, What does a CFO do? Definition and key responsibilities.

2. Services and impact

Virtual CFOs concentrate high-level expertise around critical initiatives that fuel growth. In-house CFOs also guide daily operations and cross-functional decisions with a broader impact.

3. Accessibility and fit

The on-demand model makes access to executive guidance affordable for most growing businesses. But virtual CFOs may not meet the needs of mature enterprises.

Let’s compare virtual and in-house CFOs across key dimensions:

| Virtual CFO | In-house CFO | |

| Cost | $20.43 – $27.40 per hour | $67.79 – $192.31 per hour |

| Availability | On-demand, <40 hrs/mo | Full-time 40+ hrs/wk |

| Scope | Specialized / Interim | Company-wide / Ongoing |

| Impact | Targeted strategy and decisions | Broad operations and vision |

| Fit | Startups and small/medium companies | Medium/large enterprises |

How to become a virtual CFO

Delivering exceptional virtual CFO services requires thoughtful preparation across five key areas: technologies, offerings, marketing, innovation, and automation. Let’s dive deeper into each of them.

1. Employ the right tools

When it comes to sharing data and collaborating remotely, cloud technology is the standout option. This makes it easy to synchronize and transfer information between different systems, access real-time reporting and analytics, and gain insight into a client’s financial condition. Look for accounting practice management software that’s accessible anytime, anywhere, so you can offer virtual CFO services from any location.

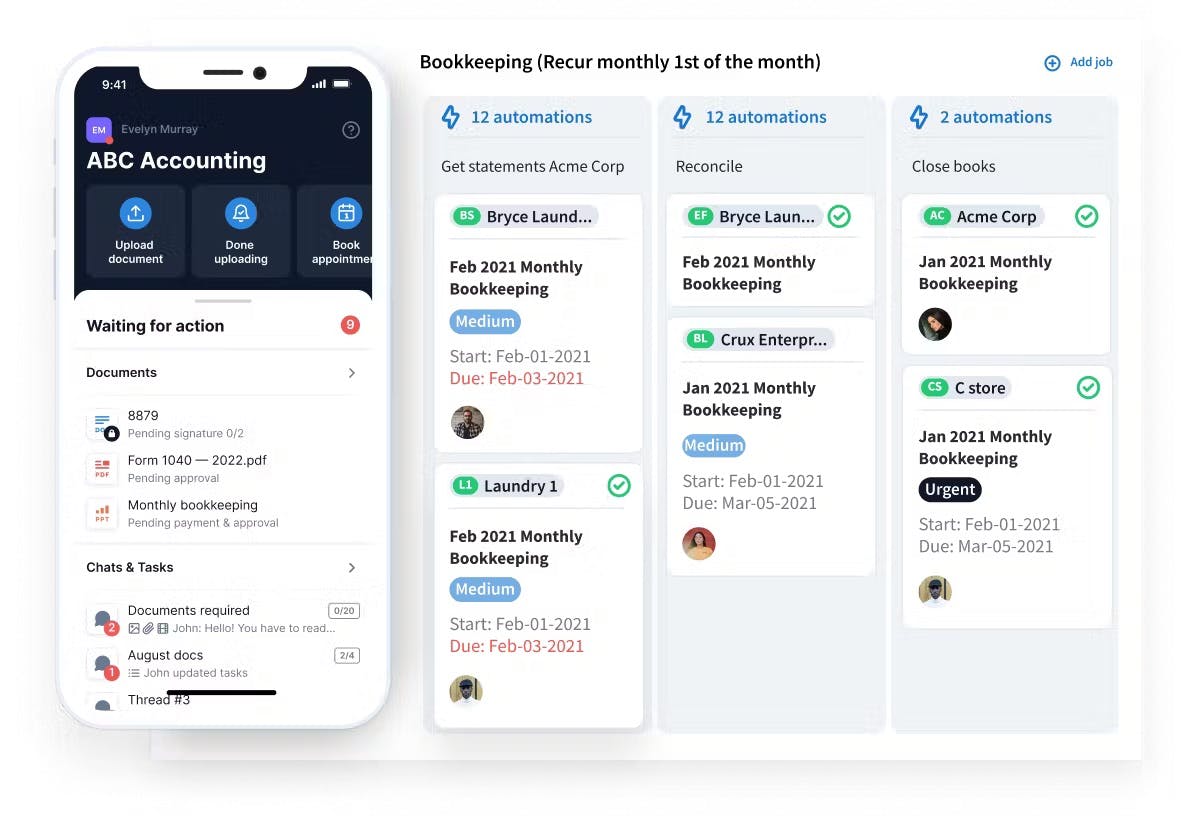

One of the best options on the 2024 accounting software market is TaxDome, a powerful solution to manage teams, clients, and projects. Its key features, such as centralized data, automated workflows, and robust reporting, simplify processes and make work more efficient.

2. Decide on services and pricing

Determine which CFO services play to your strengths rather than trying to operate like a full-time employee. Offer specialized areas where you have proven expertise.

When pricing independent services, consider the value of your industry knowledge and professional network built over time. Avoid pricing based solely on time spent. Develop packages and fee structures aligned to the level of guidance and complexity required.

3. Execute a marketing and client outreach strategy

- Inform current and past clients about your virtual CFO services; leverage your immediate network first

- Request testimonials and referrals from past employers and colleagues; highlight specialized skills in their feedback

- Prepare comprehensive case studies showcasing your experience that prospects can review

- Promote services on social media, your website, email lists, and freelance platforms to drive visibility and attract clients

- Partner with established virtual CFO firms to gain experience before going fully independent

4. Commit to continuous learning

Honing an innovative mindset around the latest technologies, approaches, and accounting trends proves critical as landscapes shift. Pursue courses, conferences, industry reading, etc. to avoid stagnation.

5. Leverage AI

Explore AI accounting tools addressing routine tasks such as data entry, report generation, and analytics. Embrace automation to focus high-level human judgment on complex business decision making. Read our guide on exploring AI opportunities in accounting and real-life examples to implement leading-edge solutions.

Conclusion

The virtual CFO model grants growing companies access to strategic financial leadership at affordable price points through flexible, on-demand arrangements. By concentrating skills around targeted initiatives — be it modeling growth scenarios or optimizing cash flows — virtual CFOs fuel data-driven decisions without the overheads of a full-time resource.

In summary, major takeaways include:

- Strategic, executive-level financial guidance at roughly 20% of the cost

- Customizable, on-demand expertise catered to evolving priorities

- Enhanced decision making, risk mitigation, and growth trajectory

- Stage-appropriate for most startups and small/medium companies

- Remote specialized support without geographic constraints

For leadership teams that recognize gaps in their financial strategy but lack the budget for a traditional CFO, the virtual CFO levels the playing field. With an infusion of world-class expertise at an affordable price, companies of all sizes can be set on a sustainable path to prosperity.

Thank you! The eBook has been sent to your email. Enjoy your copy.

There was an error processing your request. Please try again later.

Looking to boost your firm's profitability and efficiency?

Download our eBook to get the answers