CFOs and CEOs play distinctly different — yet equally critical — leadership roles for organizations. This article will explore the key priorities, responsibilities, interactions, and skill sets that distinguish the financial stewardship of CFOs from the strategic guidance CEOs provide across the entire business.

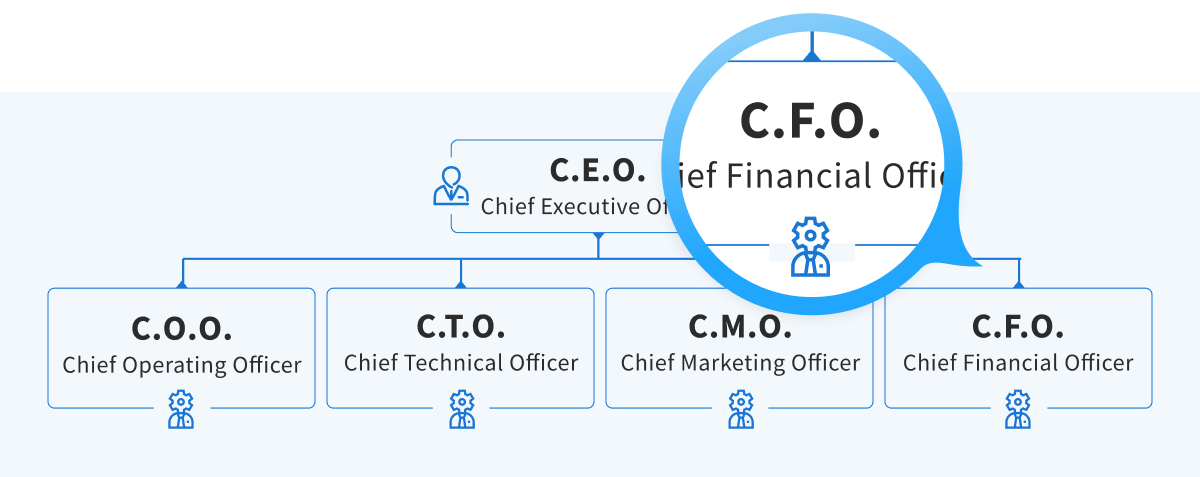

What is a CFO?

A chief financial officer (CFO) is the top-ranking corporate officer overseeing all financial operations within an organization. As the head finance professional, core responsibilities include financial planning, cash flow management, risk mitigation, financial reporting, and ensuring accounting compliance.

On a day-to-day basis, CFOs:

- Conduct quantitative analysis to develop financial forecasts, models, and operational metrics

- Meet with department leaders to advise on financial matters and discuss performance

- Optimize working capital through cash flow and inventory management

- Oversee the preparation and filing of financial statements and regulatory reporting

- Manage banker and investor relationships and communication

To learn more in-depth about the duties and qualifications of successful CFOs, see our article, What does a CFO do?

Overall, CFOs use their leadership skills and knowledge of the company’s finances to advise the executive team on long-term strategies and data-driven insights. Their multifaceted financial oversight and planning help organizations turn uncertainty into opportunity.

What is a CEO?

A chief executive officer (CEO) is the highest-ranking executive and leader responsible for managing strategy across all business functions and operations company-wide. As the top decision-maker, the core duties of CEOs include shaping the organization’s vision and direction, leading the executive team, driving growth, and ensuring sustainability.

On a day-to-day basis, CEOs:

- Set performance goals and objectives across all departments to execute strategic plans

- Make major corporate decisions related to new initiatives, expansion plans, budgets, etc.

- Lead executive team meetings and oversee management to ensure alignment

- Represent the public face of the company to investors, media, and external stakeholders

- Direct corporate social responsibility and ESG (environmental, social, governance) strategies

CEOs combine strong leadership qualities with business expertise to provide guidance and oversight across all aspects of the organization. Their broad executive purview ranges from innovation and operations to talent development.

Key differences between CFOs and CEOs

Here is an overview that contrasts the key aspects of the CFO and CEO roles:

| CFO | CEO | |

| Primary responsibilities | Financial oversight, including forecast modeling, accounting, liquidity planning, and interacting with auditors | Company-wide decisions around growth initiatives, budgets, and departmental guidance |

| Strategic impact | Translates strategic priorities into budgets, investments, timelines, and risk assessments | Charts out overarching strategic vision and high-level priorities |

| Stakeholder collaboration | Collaborates with finance team members, controllers, and auditors | Collaborates across the entire executive team and is the public face of the company for external stakeholders |

| Seniority | Reports directly to the CEO | The highest executive, superior to all department heads, including CFO |

| Talent management | Builds and develops finance teams | Nurtures leadership capabilities across departments |

| Accountability | Narrower accountability related to financial metrics like forecast accuracy, budget control, and cost containment | Broader accountability for overall growth, revenues, market share, and brand value |

| Background and qualifications | CPAs and controllers promoted based on finance and accounting skills plus leadership abilities | MBAs with extensive executive experience across departments |

| Salary and compensation | Median base salary $437,800 with fixed income | Median base salary $832,600 with significant bonuses and equity upside |

Now let’s explore these differences in greater depth:

Primary responsibilities

As chief executives, CEOs spend their days driving company-wide decisions, from new growth initiatives to budget allocations, while providing guidance across departmental heads for marketing, technology, operations, and beyond.

CFOs dedicate their daily agenda to financial oversight — whether modeling forecasts, ensuring accounting compliance, liquidity planning, or interacting with investors and external auditors.

While CEOs focus on holistic performance, CFOs fulfill specialized finance duties.

Strategic impact

Operating at the frontier of corporate strategy, CEOs play the lead role in charting out an overarching strategic vision centered on which markets, segments, and products to target for growth and innovation.

Once plans take shape, CFOs step in to translate high-level priorities into actionable budgets, investment tradeoffs, milestone timelines, and risk assessments grounded in financial realities.

Stakeholder collaboration

CEOs collaborate broadly across the entire executive team, from CFOs to CMOs, while interacting externally with investors, communities, partners, and the board.

CFOs predominantly liaise with internal finance peers, divisional controllers, and auditors to instill financial discipline across planning. Where CEOs align a diverse range of players toward strategic outcomes, CFOs ensure budget integrity.

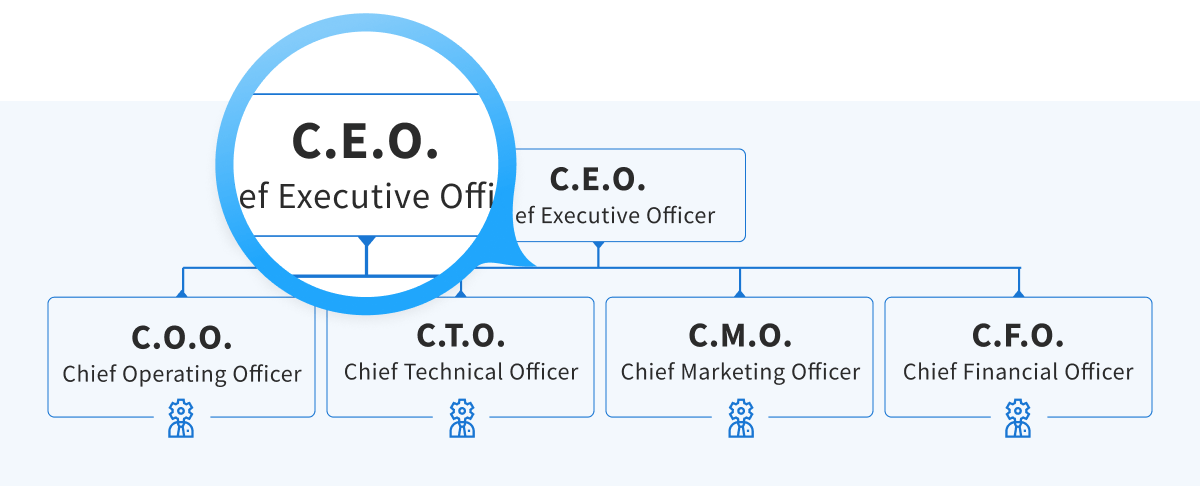

Seniority

While both roles report to the board, CEOs rank as chief executives, superior to all other C-suite leaders, including CFOs. As financial stewards, CFOs answer directly to CEOs about enacting strategic objectives and tuning financial parameters.

Talent management

CEOs hold the reins for talent decisions across the entire C-suite and company. They nurture leadership capabilities firm-wide by attracting, developing and promoting executive talent as rising stars gain exposure to diverse functions.

CFOs specifically build and develop the finance teams below them by attracting controllers, analysts, and accountants. They may advise CEOs on hiring other department heads.

Accountability

Whereas CEOs bear responsibility toward shareholders for broad performance metrics tied to revenues, market share, brand value, and stock performance, CFOs carry narrower yet more acute specialized accountability for financial execution. CEOs are judged on overarching growth, while CFOs manage specific targets around forecast accuracy, budget control, cost containment, risk mitigation, and audit transparency.

Background and qualifications

The path to becoming CEO includes advanced business degrees such as MBAs coupled with extensive executive leadership experience across multiple departments to assume broad oversight.

CFOs reach the top by sharpening their financial and accounting acumen as CPAs and controllers before demonstrating analytical, strategic, and managerial competencies. Their technical grounding must pair with communication and leadership skills.

Salary and compensation

As the highest level of leadership, average CEO compensation is nearly double CFO pay. CEOs earn a median base salary of $832,600 with lucrative performance bonuses and equity upside compared to CFO’s $437,800 and largely fixed income. The gap reflects CEOs’ more comprehensive value and skill requirements.

FAQs

What is the main difference between a CFO and a CEO?

The CEO spearheads high-level strategic decisions that impact the entire company, while the CFO oversees specialized financial operations like accounting, reporting, and budgeting. The CEO takes a broad approach to guiding all departments, while the CFO focuses narrowly on managing finances.

Do CFOs report to CEOs?

Yes, CFOs directly report to the CEO, given the CEO’s senior executive ranking above all other C-suite leaders. The CEO provides guidance to the CFO on enacting strategic objectives financially.

How do CEOs and CFOs collaborate within an organization?

The CEO articulates the broader strategy, and the CFO enables budgeting to support those plans. The CFO also informs the CEO of financial risks, opportunities, and realities to shape decision-making. Frequent collaboration allows them to align on growth plans that are financially feasible.

Can a CFO become a CEO, and vice versa?

Yes, it’s common for CFOs to rise to CEO roles after proving financial leadership and gaining broader business acumen. Similarly, CEOs may step into CFO roles later in their careers to leverage extensive management experience and financial fluency. The skills are transferable with proper training.

Can a CFO also serve as CEO simultaneously?

It is rare but possible for a CFO to concurrently serve as CEO, usually temporarily. This interim dual role requires the versatility to steer finances while guiding overall operations until a new CEO is appointed. A long-term dual appointment poses challenges given the differing nature of the two roles.

Conclusion

While CFOs and CEOs collaborate closely to drive organizational success, their focus areas differ significantly, making them perfectly complementary executive roles.

Key differences between them:

- CEOs set broad strategic direction, while CFOs oversee financial operations

- CEOs take an expansive view across all departments, while CFOs concentrate on finances

- CEOs interface extensively both internally and externally, while CFOs coordinate the finance function

- CEOs have the superior executive role, while CFOs directly report to them

- CEOs hold wider people management authority compared to finance-focused CFOs

- CEOs are accountable for organization-wide performance, a while CFOs manage financial metrics

The symbiotic CFO-CEO relationship underscores the importance of both panoramic strategic vision and meticulous financial planning for organizational prosperity. Their unified leadership bridges high-level growth priorities with ground-level operational realities.

Thank you! The eBook has been sent to your email. Enjoy your copy.

There was an error processing your request. Please try again later.

Looking to boost your firm's profitability and efficiency?

Download our eBook to get the answers