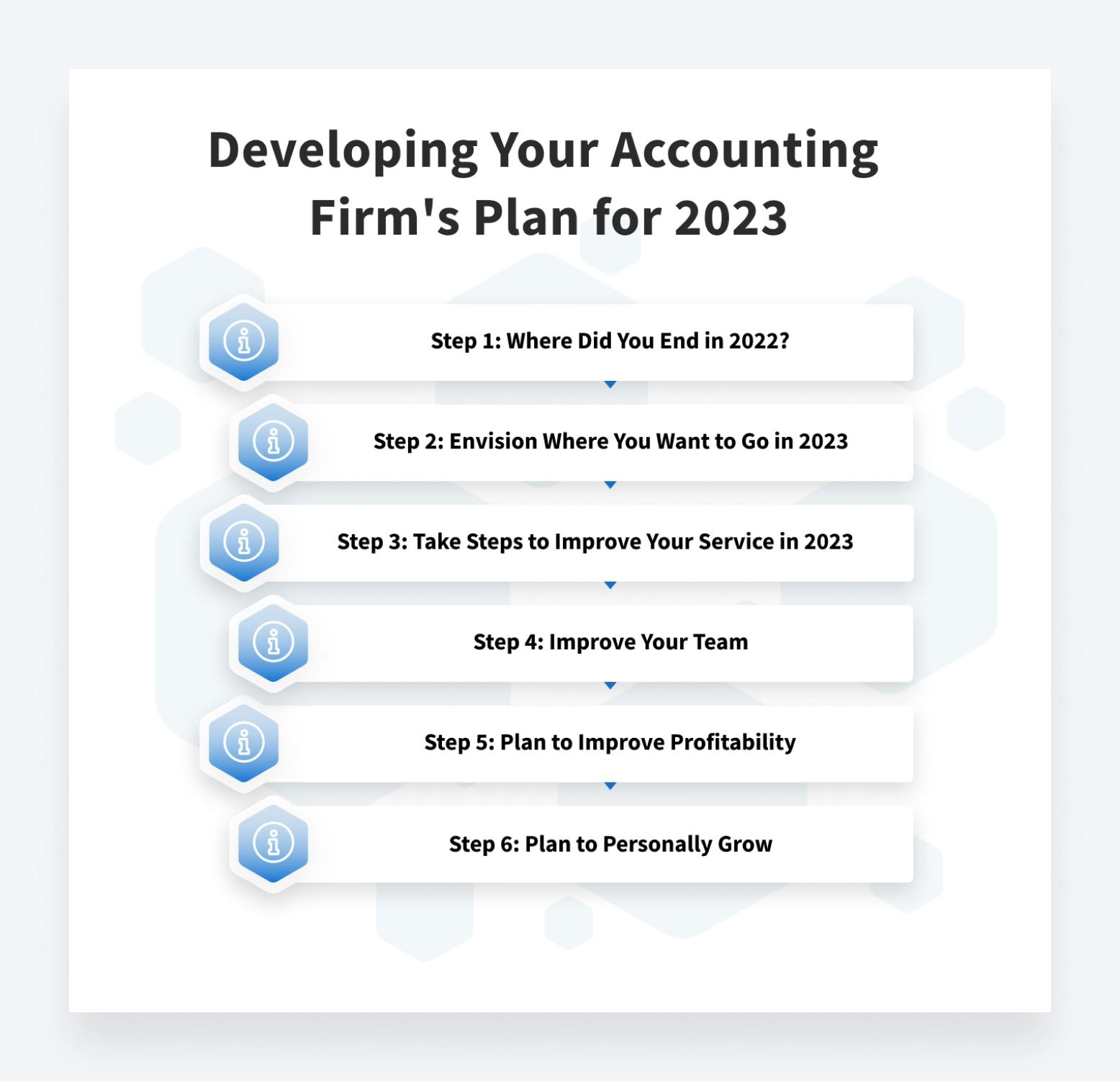

What are your accounting goals for 2023? Many firms want to grow and expand. However, other businesses want to focus on:

- Improving profit margins

- Boosting net profit

- Increasing revenue

Owners often find themselves stressed and unhappy because they don’t maintain a healthy work-life balance.

With the new year approaching fast, we recommend that you sit down and reflect on the past year before diving headfirst into your goals for the coming year.

Step 1: Where Did You End in 2022?

Accounting plans are completely reliant on where you are right now. With the 2021 year coming to an end soon, you have to consider the following:

- What goals and objectives did you meet?

- What goals and objectives didn’t you meet?

- What went wrong this year?

Hopefully, you had goals going into 2021 that you properly documented. If you did have objectives, did you reach them?

Whether you didn’t or did reach these milestones, it’s important to ask: Why did you get these results?

Ideally, you’ll delve deep into the past year to better understand what’s working and not working for your firm.

Additionally, you’ll need to outline areas of discomfort.

These areas may include:

- Financials. Did you start running out of capital during the year? Did your cash flow slow?

- Personal. Was 2022 an uncomfortable year where you had to work longer, harder hours to meet milestones? Would you like to free up time so that you’re working less often?

Your plans for 2023 should be to find ways to alleviate the discomfort that you experienced. Perhaps you can free up time by delegating tasks and outsourcing. You might also want to incentivize early invoice payments by offering a 1% discount if invoices are paid in net 15.

Before you move on to the next step, you really need a crystal-clear understanding of where you are right now and why.

Step 2: Envision Where You Want to Go in 2023

You know where you’ve been, but now it’s time to figure out where you want to go in 2022. Accounting firms should focus on the things that worked so that they can continue to meet and exceed your goals in the coming years.

One recommendation is to:

- Create an annual goal for one major area of your firm.

- Create a variety of small milestones that you can meet along the way.

Take this time to reflect on a business plan for accounting firms that outline where you want the firm to go and what needs to be done to reach these goals.

Visualization and putting this information down on paper can truly improve your chances of reaching your goals.

Many firms make a major mistake because they have a singular, primary goal and no steps to reach it. For example, maybe you want to start putting systems in place to automate your business tasks to some degree.

TaxDome can help, but before you can reach your milestone, you must:

- Schedule a demo

- Learn how to use the platform

- Etc.

Another goal may be monetary. Let’s assume that you want to make $1 million. Your small goals or objectives may include:

- Introducing new products

- Generating higher recurring revenue

- Landing new clients

- Etc.

When you know where you want to go, you must take multiple steps to reach your destination. Don’t believe us? Click here to see how a firm can develop a step-by-step plan and grow 3x.

Step 3: Take Steps to Improve Your Service in 2023

What products, services and advancements did you have in your accounting business plan? Many firms, want to improve their service in 2022. You’ll want to take this time to analyze your current relationship with clients and customers.

You should examine:

- Customer satisfaction

- Customer experience

- Relationship with customers

Additionally, is your relationship with customers helping you to meet your growth strategy? Word of mouth is one of the most powerful forms of marketing.

Before adding new products or services in 2023, take the time to improve your offering for current clients.

When you can keep your clients happy and improve, the next clients will be more likely to love your service. Plus, when you keep clients content and offer them solutions that are crucial to their success, they’ll work to promote your business organically.

When you improve your service, you’ll differentiate yourself from the competition.

Step 4: Improve Your Team

If you analyze accounting firms that continue to maintain high market shares and grow their business, you’ll notice that they maintain a very strong team concept. This is because these firms master the process of leveraging each team member’s unique strengths.

As a business owner, you never want to lose the power of collaboration.

One mistake that a lot of new firms make is that they have a long chain of communication. As an owner, you’ll have a manager, team managers, supervisors and other stakeholders that pass information down a chain of command.

While this method may have its own unique benefits, it takes away your power and the team collaboration that can lead to growth.

Firms should work on using communication and tools that:

- help owners maintain their collaborative power

- offer teams a way of direct contact with you

If you can improve your team—and this includes training and other exercises—you’ll be improving your business at the same time.

Step 5: Plan to Improve Profitability

Annually, profits need to flow into your firm to keep operating. Increasing your profit year-over-year is a necessity, and one way to achieve this goal is to outline your ideal client. When you know your ideal client, you can:

- create services or offers to attract them

- realign your marketing goals to reach their clients

- build massive value

Catering your products and services to these clients will provide lasting value. Once you’ve done all of this, you can also forecast the number of these clients you’ll need to sign on to hit your profitability goals.

You can also increase profitability by cutting waste.

Click here to learn how to find your ideal client.

Step 6: Plan to Personally Grow

Business growth is not separate from personal growth. When your quality of life is high, your business quality will grow. If you’re not spending time on personal development, you’re doing your organization a disservice.

Owners that are happy and find enjoyment in life have the energy and drive to grow their businesses.

In fact, as part of your annual plan, you need to make yourself a priority. Perhaps you want to travel or take up other hobbies this year. Add these goals to your annual business objectives.

Conclusion

Developing an account firm plan for 2022 takes a lot of time and effort, but it’s crucial for your business’s success. When you have a plan to follow and goals to meet, you’ll have a clear path for the year ahead.

Thank you! The eBook has been sent to your email. Enjoy your copy.

There was an error processing your request. Please try again later.

Download our eBook to get the answers