Key takeaways:

- If your client receives a penalty from the IRS for late tax filing or payment, they may be able to claim first-time penalty abatement.

- First-time penalty abatement enables taxpayers with a clean compliance history to have IRS penalties reduced or waived altogether.

- One of the best ways to achieve this is through a first-time penalty abatement letter — a formal request that explains how the taxpayer qualifies for this type of penalty abatement.

- You can speed up this process using a first-time penalty abatement letter template.

- Practice management software can help your clients avoid penalties in the first place through features such as automated reminders and customizable forms for gathering client data and documents.

Managing tax deadlines can be stressful for accountants and clients. Sometimes, mistakes happen. Clients may fail to provide the necessary information on time, resulting in late filing — and penalties from the IRS.

Thankfully, there’s a potential solution to help clients avoid paying hefty fines in such cases: first-time penalty abatement.

In this article, we’ll provide you with a free first-time penalty abatement (FTA) letter template. We’ll also explain the criteria for penalty abatement, how to write a successful FTA letter, and how the filing process works.

What is a first-time penalty abatement letter?

A first-time penalty abatement letter is a formal letter sent to the Internal Revenue Service (IRS) requesting the dismissal or reduction of any penalties incurred for failing to meet tax obligations. As the name suggests, this type of letter is specifically for taxpayers with a history of compliance who have been fined by the IRS for the first time.

The IRS typically issues penalties when a taxpayer fails to meet certain tax filing deadlines. For example, a taxpayer may be fined for filing their income tax return late, or for late payment of their outstanding tax amount.

A first-time penalty abatement letter typically includes basic information about the taxpayer, tax year, and penalty in question. In addition, the letter outlines the reasons why a taxpayer qualifies for an abatement. It can also be used to provide a clear, concise explanation of the circumstances or issues that resulted in the taxpayer missing the deadline.

Successfully obtaining a penalty abatement can make a huge difference for your clients. In addition to relieving the financial burden of paying a fine, it can help preserve the taxpayer’s record, ensuring that they remain in good standing with the IRS.

Criteria for IRS first-time penalty abatement

So what criteria does a client need to meet to qualify for first-time abatement? First of all, the penalty should apply for one of the following reasons:

- Failure to file a tax return

- Failure to pay tax owed by the due date

- Failure to deposit employment tax deposits on time, in the right amount, or in the right way

To apply for first-time penalty abatement, you must be able to prove that your client has a history of good tax compliance. According to the IRS, a taxpayer meets this requirement if they:

- Filed the same tax return type (i.e. an individual, partnership, or S Corp tax return) for the past three years before the tax year in which they received the penalty

- Didn’t receive a penalty during the previous three tax years — or if they did, the penalty was waived for a legitimate reason other than first-time penalty abatement

In addition to first-time penalty abatement, a taxpayer can qualify to have their penalties reduced or waived altogether by claiming what the IRS calls “reasonable cause”. This essentially allows the taxpayer to explain the reasons why they didn’t file a tax return or pay their taxes on time. Examples of valid reasons include:

- A health emergency or bereavement

- Inability to access records

- Natural disasters or civil disturbances

- Technological issues that delay e-filing or payment

If a taxpayer can prove that they didn’t file or pay on time due to events beyond their control, a taxpayer may qualify for penalty relief. However, the taxpayer won’t qualify for such relief if they miss tax deadlines due to ignorance, errors, oversight, or reliance on a tax professional.

If the client requests penalty relief through the “reasonable cause” route but their records show that they qualify for first-time penalty abatement, the IRS will automatically apply first-time penalty abatement to their case.

Sample first-time penalty abatement letter (downloadable template)

To save you time, we’ve put together a first-time penalty abatement letter template that you can download and use for free. Simply click on the link below and copy the text into a new Google doc. Once it’s ready, you can save it as a PDF.

Download your free first-time penalty abatement letter template here >>

How to write a first-time penalty abatement letter (with examples)

Writing a first-time penalty abatement letter requires attention to detail and clarity. For your request to be successful, you need to include all relevant information for the IRS to make a decision, and explain any reasoning as clearly and succinctly as possible. In this section, we’ll run through the key components of a successful first-time abatement letter.

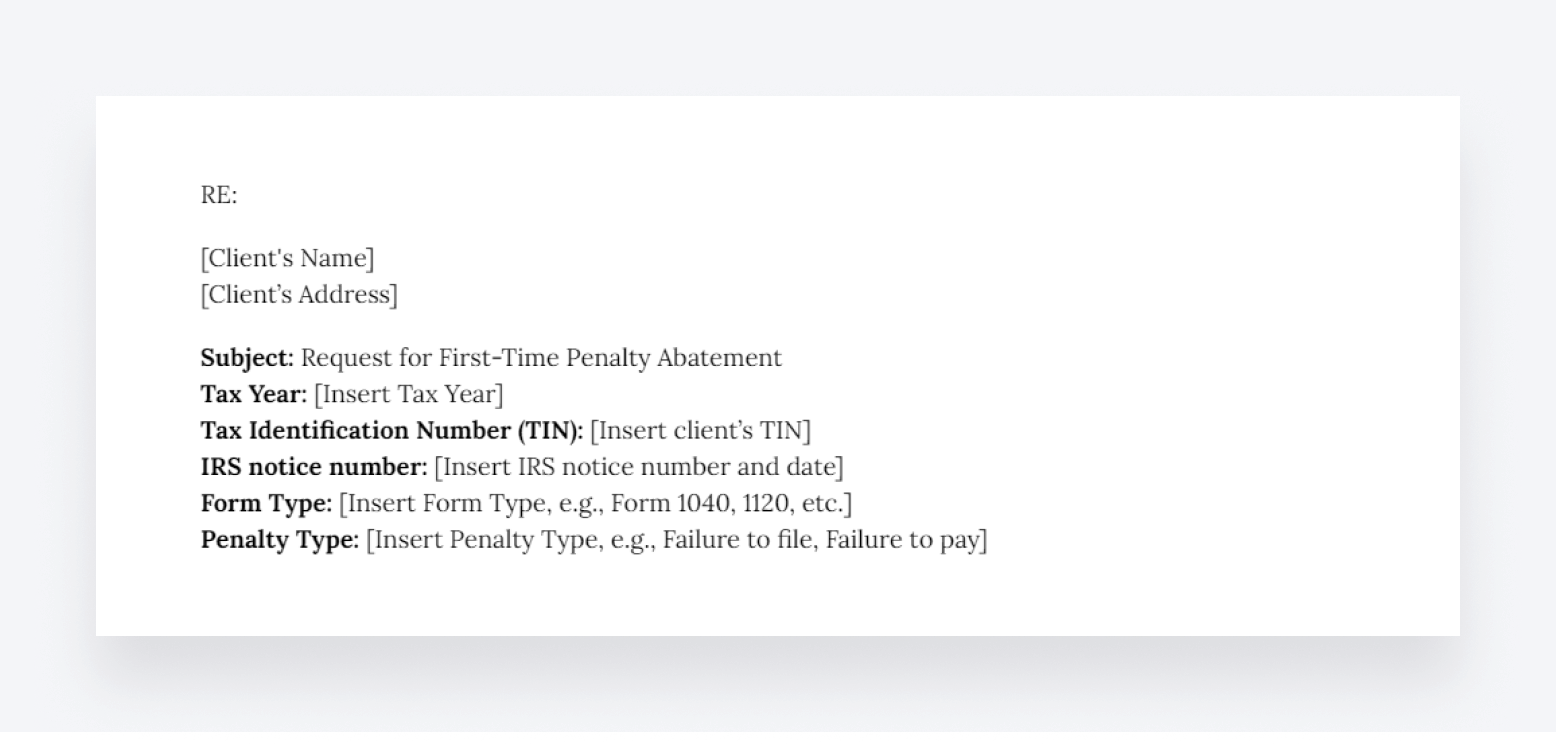

Information about the taxpayer and penalty

Start your letter with all the relevant information about the taxpayer, including their TIN and the specific penalty you are seeking abatement for. Here’s an example of what to include from our free first-time abatement letter template:

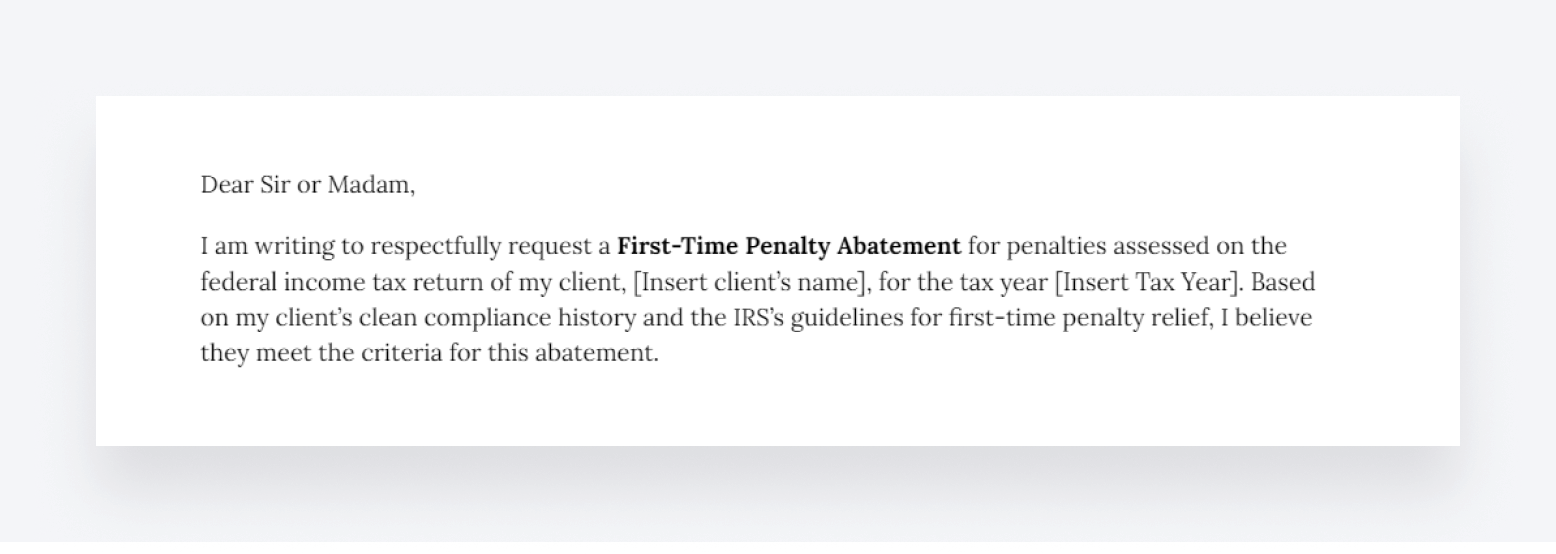

Introductory paragraph

Include a formal introductory paragraph, explaining the purpose of the letter — i.e. abatement of penalties levied against your client by the IRS. In this section, you should make it clear that you are an accountant working on behalf of the taxpayer. Here’s the intro paragraph from our free template:

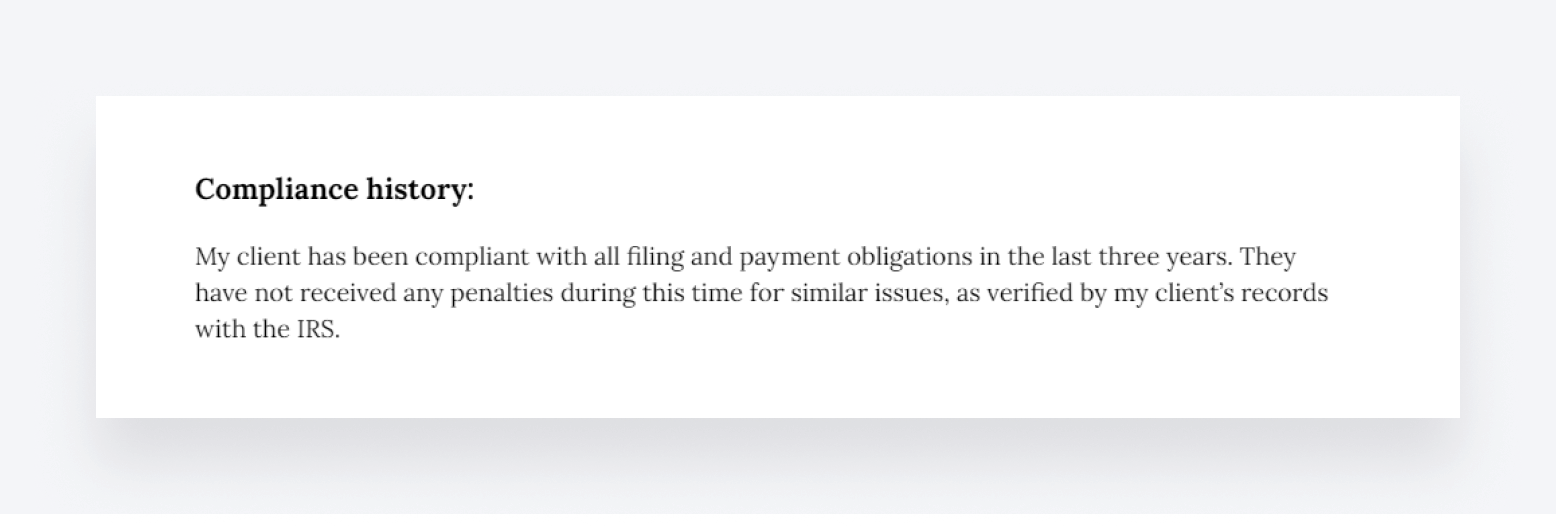

Explanation of compliance with IRS criteria for first-time abatement

Next, explain how your client complies with the criteria set out by the IRS for first-time abatement. Specifically, you should make it clear that your client has a history of good tax compliance — and provide reference to any supporting documentation or evidence in this regard. Here’s an example from our free template:

Explanation of reasonable cause (optional)

If there is a specific reason why your client failed to file or pay their income tax return on time, you can include it in an additional section. This only makes sense if the reason was due to circumstances beyond your client’s control. If they simply forgot, it’s best to omit this section altogether and focus purely on proving their history of good compliance. Here’s an example from our free template:

Summary paragraph and salutations

Finally, you can briefly state what you would like the IRS to do — i.e. waive all penalties in line with first-time abatement criteria. Mention once again that you have attached or provided all relevant supporting documentation, and provide a contact number or email address should they need additional information. Be sure to sign off with your name, job title, and the name of your accounting firm.

The first-time penalty abatement (FTA) process

Requesting first-time penalty abatement is a relatively straightforward process. That said, a successful request requires careful attention to detail and a solid understanding of the eligibility criteria. In this section, we’ll break the process down into simple steps.

1. Assess your client’s eligibility

The first step is to assess whether your client qualifies for first-time penalty abatement. As we’ve discussed, the IRS requires taxpayers to prove that they have a history of good tax compliance — and confirming this is the first step in the process. Work with your client to confirm that:

- They have a clean compliance history, with no penalties levied in the past three years

- All of their tax returns are currently filed and up to date

- Any outstanding taxes have been paid in full

If your client meets these criteria, there’s a good chance they’ll be eligible for abatement. Additionally, you can potentially strengthen your request for abatement if there is a “reasonable cause” — i.e. events outside of your client’s control — for late filing or payment.

2. Customize and submit the FTA letter

Once you have confirmed your client’s eligibility, the next step is to finalize your FTA letter. Thanks to our free template, there’s no need to draft this letter from scratch. Simply fill in the blanks to customize it to your needs. You can also add, remove, or change any other part of the template as you see fit.

3. Submit your FTA letter

Once ready, you can submit the letter using the appropriate IRS channel. FTA letters can be sent by post. Make sure you enclose all supporting documentation needed to prove your client’s eligibility for first-time penalty abatement.

The IRS may take several weeks to process your request, especially during busy filing seasons or if your case is particularly complex. It’s a good idea to follow up if you haven’t heard back within a month or so. You can call the IRS at 1-800-829-1040 to check on the status of your request — but be prepared for potentially long hold times.

4. Alternatives to an FTA letter

An FTA letter isn’t the only way to secure penalty abatement for your clients. If you don’t want to submit a formal letter or need a faster resolution, there are two alternative routes you can take:

- Call the IRS directly. Your client can call the IRS at 1-800-829-1040 to request a first-time penalty abatement over the phone. They should be prepared with all relevant taxpayer information, including their TIN, the tax period, and IRS Notice details.

- Submit IRS Form 843. This form allows a taxpayer to formally request abatement of penalties and interest. You can mail it to the IRS along with supporting documents and any applicable forms.

How TaxDome can help you avoid penalties

While first-time penalty abatement is a valuable option for your clients, the best approach is to ensure that they avoid late filing and penalties altogether. Technology is the key to achieving this.

With practice management software such as TaxDome, you can manage your clients, staff, projects, and workflows on one centralized hub. Our award-winning platform comes with a host of powerful features that can help boost organization and efficiency in your firm — and help clients remain in good standing with the IRS. Here are some examples:

- Automated workflows. Put your client onboarding and tax filing workflows on autopilot to ensure maximum efficiency and timely communications.

- Secure client communication. Send automated messages and reminders to ensure your clients are always in the loop about tax filing processes and deadlines.

- Customizable organizers. Automate the collection of client information and data with intuitive digital forms and questionnaires, ensuring timely tax filing.

- Document management. Store, manage, and exchange client documents in a secure environment. Request KBA e-signatures for compliance with the IRS.

- Secure client portal. Provide a secure environment where clients can communicate with you, upload and e-sign documents, and view tax filing progress — either on desktop or our top-rated client mobile app.

- Forms and templates. Streamline your accounting processes with a library of useful forms and templates, covering everything from client emails to entire workflows.

The bottom line

Everyone makes mistakes from time to time. When your clients are hit with fines for late tax filing or payment, it’s your job as their accountant to help where possible. If you can prove that your client has a history of good compliance, first-time penalty abatement is a great option to pursue.

We encourage you to download the free FTA letter template provided in this article. With placeholders for all the key information you need to send the IRS, you’ll save the time and hassle of drafting a letter from scratch. And that’s not all — TaxDome offers an entire library of handy templates and forms you can use to streamline your day-to-day work.

TaxDome also offers the tools you need to help your clients avoid IRS fines in the first place. With powerful features that enhance client communication, document management, accounting workflows, and more, TaxDome can help your team and clients stay organized and in the loop.

Thank you! The eBook has been sent to your email. Enjoy your copy.

There was an error processing your request. Please try again later.

What makes the best accounting firms thrive while others struggle to keep up? We analyzed our top 20 TaxDome firms, representing over $100M in combined revenue, to uncover the strategies driving their success.