The month-end close is one of the most important processes for an accounting department to get right. It helps ensure the accuracy of financial records, promotes better decision-making, and improves regulatory compliance.

However, the month-end close process can be full of challenges. Accountants must prioritize thoroughness and accuracy during every step of the process. At the same time, they must work quickly to meet reporting deadlines. With this in mind, how do you ensure a smooth month-end close process every time? One effective strategy is to use a month-end close checklist.

In this article, we’ll break down the entire month-end closing process for you. We’ll also provide you with a customizable checklist template to help you tackle your month-end close consistently and thoroughly.

Understanding the month-end close process

The month-end close process is a pivotal accounting procedure for every business, regardless of size or structure. Essentially, it refers to the steps and procedures carried out by a company’s finance team to prepare and finalize the company’s financial statements and books for the just-completed month. This involves:

- Closing out revenue and expense accounts

- Reconciling data across systems

- Recording adjustments

- Verifying the accuracy of financial data

The ultimate goals of the closing process are to generate updated and accurate financial reports that reflect the past month’s business operations and provide insights to guide future strategies.

Why is a month-end close checklist important?

Closing out the financial books is a critical monthly task for any finance team. However, various discrepancies, including misclassified expenses, unresolved payroll issues or unapplied customer credits, can undermine the accuracy of the numbers if processes are inconsistent.

This is why a standardized checklist is invaluable for efficient month-end closes, as it:

- Outlines the required tasks to verify completeness across all accounts and entries

- Safeguards accuracy by mandating thorough account reconciliation procedures

- Creates detailed documentation trails, aids regulatory compliance and provides clear auditability

- Aligns recorded transactions with actual business operations and enables reliable inputs to drive quality financial outputs

In summary, an accounting month-end close checklist fosters standardized workflows for precision, governance and insightful data to guide strategic decisions.

Creating a month-end close checklist: step-by-step

The month-end close process involves multiple steps. Each step comprises different tasks that must be completed thoroughly and in the right order. Without a clear system in place, the risk of error or oversight is huge. That’s why it pays to use a month-end close checklist.

By following the steps outlined below, you’ll be able to create a month-end closing checklist that drives speed, accuracy, and consistency each and every month.

1. Prepare for closing

Proper preparation is key for an efficient closing process. Initial steps focus on setting the groundwork:

- Back up accounting data to safeguard the business

- Outline all closing tasks on a calendar with deadlines

- Prioritize activities based on due dates to streamline work

- Set calendar reminders to help the team stay on track

- Assign closing procedure tasks to team members by areas of expertise

With responsibilities defined and sequenced, teams can progress effectively through the month-end workloads.

2. Record and reconcile revenue

Carefully validating and recording all revenue underpins accurate financial reporting. This critical step involves recording all sales, income, and accounts receivable entries to pull preliminary revenue totals.

Next, you can cross-check revenue postings against invoices and bank deposits to verify that they agree. Any discrepancies, such as missing customer payments, should then be investigated and rectified to reflect true cash flow.

3. Reconcile expenses

By auditing expense transactions, you can uncover potential duplicate postings or inaccuracies — and then correct them ahead of reporting. Make sure you review all expenses, accounts payable, and receipts to understand total outflows. You’ll also need to confirm that supplier invoices match entries prior to payment.

4. Reconcile balance sheet accounts

With income and expenses validated, accountants verify balance sheet continuity across all asset, liability and equity accounts. Verifying balance sheet account details is crucial across six areas:

- Bank and credit accounts: compare ledger postings to statement activity in order to research and resolve discrepancies or suspicious transactions

- Petty cash: count physical cash on hand and replenish if needed to match accounting system records

- Payroll accounts: verify employee payment details, including taxes, deductions and reimbursements, while ensuring accurate underlying payroll expense recording

- Loans: focus on matching liability account balances to lender statements, including up-to-date interest calculations and principal repayments

- Accounts payable: review aging reports to pinpoint unpaid supplier invoices or unrecorded liabilities for correction so payables align with the general ledger

- Accounts receivable: investigate variances, unapplied customer credits and other invoice issues to state receivables accurately

Careful verification across balance sheet accounts ensures credible financial position insights to guide decisions.

5. Complete inventory count

If you sell physical products, make sure you perform a full inventory check to count all of your stock items. You can then compare the results of your inventory check against your accounting records — and update the latter where necessary.

During this process, it’s a good idea to analyze your inventory data to identify fast-moving products, or slow-moving items near expiration dates. This will help you make smarter decisions about restocking and pricing your goods.

6. Review profit and loss statement

With underlying transactions validated, it’s time to review the integrity of your profit and loss statements. This process will help improve margin analysis and lead to better operating decisions.

Start by checking that revenues and expenses align with your chart of accounts. If there are any discrepancies, you’ll need to investigate them and make adjusting entries where necessary.

7. Generate financial statements

The outputs of all closing activities are fully updated financial statements reflecting the latest business transactions:

- Prepare accurate balance sheet based on reconciled account balances

- Finalize month-end profit and loss statement after validation and adjustments

- Compile the full set of required financial reports for publication

These state the financial position and performance of the company for managerial strategy and external reporting.

8. Close accounting period

Finally, the finance team reviews deliverables, approves final adjusting journal entries and closes the period on the accounting system. Completed checklists, manager approvals and archived files provide the audit trail for regulators. With the books fully reconciled and closed, leadership can rely on these buttoned-up financials to guide operations and growth strategies.

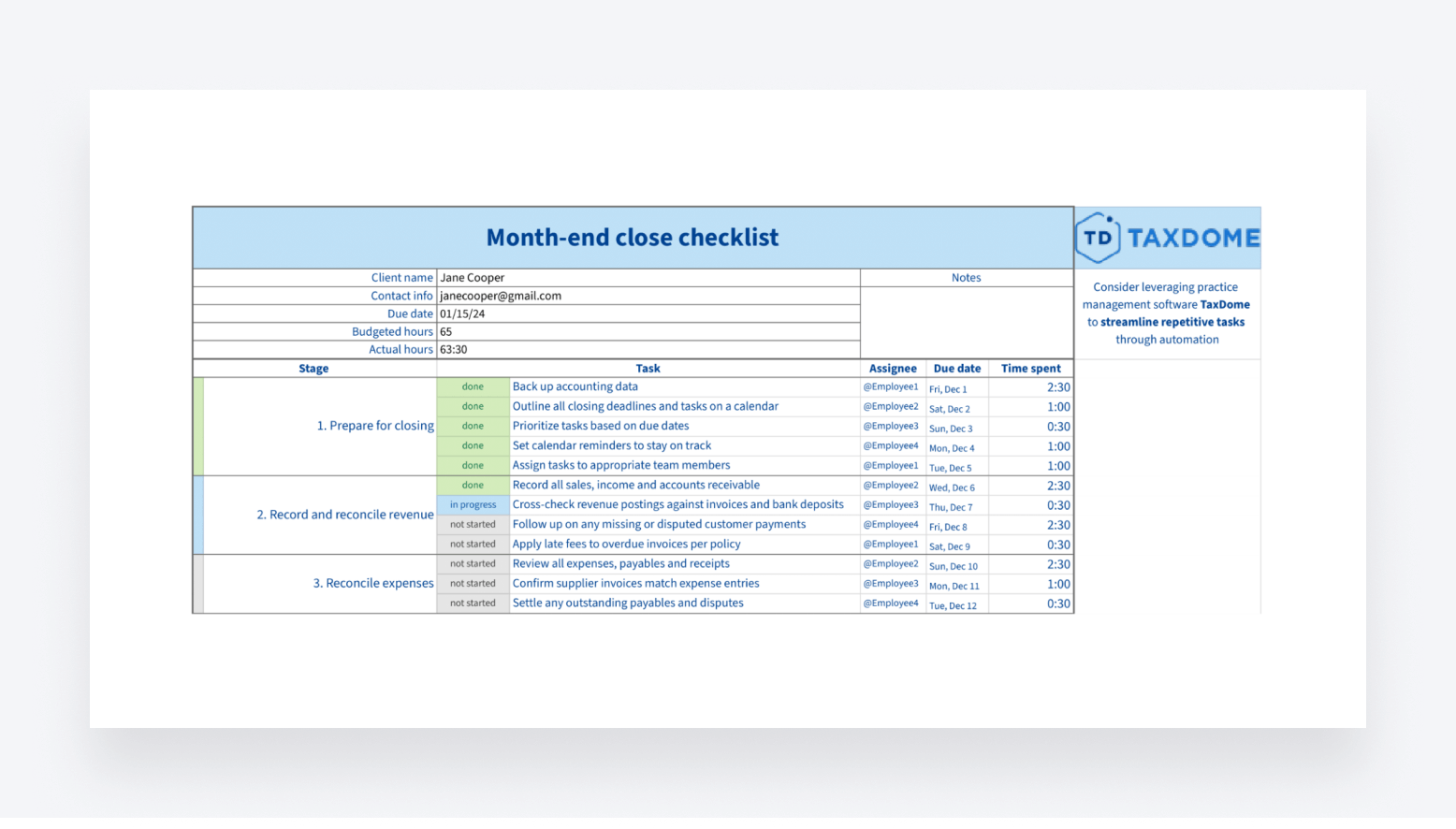

Month-end close checklist template

Best practices for a smooth month-end closing

The success of your month-end depends largely on the systems you have in place. By following these best practices, you can ensure smooth and consistent month-end closing every time.

1. Keep data organized

The more organized your financial data is, the simpler and more accurate your month-end close process will be. We recommend maintaining structured files, folders, and consistent naming conventions for all documentation. Electronically storing your documents in a centralized file management system is also a must.

2. Automate recurring tasks

Automation is a game-changer for accountants. With modern accounting software, you can automate many of the tasks involved in the month-end process while improving accuracy. Practice management software can help you streamline workflows and improve internal collaboration. We also recommend using templates to speed up processes and ensure greater consistency.

3. Enhance team skills

For a smooth month-end close, your team must be equipped with the knowledge and expertise to manage every aspect of the process. Make sure you provide detailed training as part of your onboarding process, covering both the steps involved and the technologies you use to streamline them. You could also schedule refresher sessions on reconciliation processes and accounting standards.

4. Communicate expectations

Clear communication is crucial throughout the month-end close process. Make sure everyone understands their responsibilities, timelines, and key milestones from the outset. We also recommend having protocols in place for scheduling time off, so you have ample time to plan coverage and ensure continuity.

Common mistakes to avoid

Month-end success requires diligence and attention to detail every step of the way. By avoiding these common mistakes, you’ll be well on your way to a smooth, hassle-free month-end process.

Procrastinating on reconciliations

Putting off reconciliations until the last minute can cause you to rush reviews and miss errors. Instead of sleeping on reconciliations, we recommend regularly reconciling accounts throughout the month. This will help ensure accuracy while reducing the pressure at month-end.

Overlooking small discrepancies

In accounting, seemingly small discrepancies can have a significant impact, leading to inaccurate financial records. Over time, these inaccuracies can compound. If you spot a discrepancy, no matter how small, make sure you investigate and resolve it as soon as possible.

Failing to document processes

Without clear documentation, month-end closing can become inconsistent and prone to error. Make sure you keep a record of your reconciliation steps, adjustments, and approvals. This helps standardize your processes and ensures accountability. It also makes your month-end process resistant to staff turnover.

Frequently asked questions

How long does a typical month-end closing process take?

Depending on the size of your business, month-end processes can take anywhere from a few days to several weeks. The larger your business, the more complex the process, and the longer it takes.

How can technology streamline the month-end close process?

Accounting software can be configured to automatically reconcile transactions, send reminder notifications, and establish approval workflows. Dashboards give leadership real-time visibility into the percentage of tasks fully completed. Using macros and templates within systems expedites journal entries. Shared drives facilitate financial statement collaboration across closing owners.

For more in-depth information on how to automate your accounting processes, check out this blog post.

What are the risks of a delayed or inaccurate close?

A delayed close shrinks the window leadership has to analyze results and make data-driven decisions for the current period. Information relevance declines sharply after 30 days. Common impacts include improper revenue recognition, undetected fraud, unreliable metrics for investors and regulatory non-compliance. Rating agencies may downgrade companies demonstrating close inconsistencies or weaknesses over time.

How can I improve my efficiency during the month-end close?

Download our closing checklist and follow it step-by-step to improve efficiency. This prescribed checklist covers all necessary reconciliations and approval steps to ensure nothing gets missed.

Wrapping up

The month-end close is a crucial accounting process that ensures the accuracy of financial accounts and statements. While this process is full of challenges, you can avoid last-minute drama and potential issues with the right preparation and processes.

By following the advice in this article, you’ll be well on track for a successful, hassle-free month-end closing. In particular, we recommend that you make use of the checklist template we’ve provided. This will help you standardize your process and drive efficiency.

In addition to checklists, you need the right tech. With a platform like TaxDome, you can automate your accounting workflows while improving organization and transparency. So when the month-end comes, you’ll have the tools and systems you need to make it a breeze.

Thank you! The eBook has been sent to your email. Enjoy your copy.

There was an error processing your request. Please try again later.

What makes the best accounting firms thrive while others struggle to keep up? We analyzed our top 20 TaxDome firms, representing over $100M in combined revenue, to uncover the strategies driving their success.