If you own a small business, S corporation status is worth considering for reasons that include saving on taxes and attracting investors.

But before you can elect to become an S corporation, also called S corp, you need to meet the eligibility requirements and file Form 2553 with the IRS.

You’re not alone if you find IRS forms complicated. So we’ve put together this guide on everything you need to know about Form 2553, from eligibility to form completion.

Below, find the advantages of becoming an S corporation, step-by-step instructions for filling out Form 2553 correctly, what to expect after filing Form 2553 and more.

CONTENTS TABLE

- Introduction to Form 2553

- The benefits of filing Form 2553 for S corp status

- Eligibility criteria for filing Form 2553

- Preparation before filing Form 2553

- How to file Form 2553

- Form 2553 submission guidelines

- Post-filing procedures for Form 2553

- Frequently Asked Questions (FAQs)

- Additional resources

Introduction to Form 2553

Form 2553 is an IRS form that a business entity must file to acquire S corporation status. It’s up to the IRS to determine if a business that elects for S corp status will be approved.

An S corporation is both a business structure and tax designation that can benefit certain companies, especially when it comes to finances. For example, shareholders of an S corporation can choose a “reasonable salary” to be taxed on and avoid the double taxation subject to C corporations.

In short, the main steps to becoming an S corporation include meeting the eligibility criteria, filing Form 2553 and receiving approval from the IRS.

Since an election for S corp status can be rejected, it’s important to understand what becoming an S corporation involves for your business, the various S corporation requirements and how to file Form 2553 correctly.

The benefits of filing IRS Form 2553 for S corp status

S corporation status can offer many advantages. However, that doesn’t mean an S corporation is more advantageous than an LLC (limited liability company) or C corporation, as the advantages depend on various factors. These include:

- Business size

- Business structure

- Taxation

- Investment potential

- Liability

In general, the main benefits of being an S corporation are:

- Pass-through taxation: S corporations do not pay corporate income tax (federal income tax). The shareholders of an S corporation pay tax on their share of the profits or losses after paying themselves a “reasonable” salary (according to the IRS, this is an amount of compensation similar to what other businesses pay in the same industry for similar work)

- Business scaling: Compared with LLCs, S corporations have greater potential for shareholder investment as this business structure allows for up to 100 shareholders

Despite that, being an S corporation is not without a few potential disadvantages:

- Ownership restrictions: Compared with C corporations, S corporations are limited to 100 shareholders. S corporation shareholders must also be US residents or citizens

- More formalities: As a corporation, S corporations generally have more formal obligations, including more forms to complete and annual shareholder meetings with minutes

The differences between S corporation, C corporation and LLC

The main difference between S corporations, C corporations and LLCs is the business structure and how the owners pay tax. See more differences below:

| LLC | S Corporation | C Corporation | |

| Business structure | Generally no shareholders

Members can be unlimited individuals or entities |

Limited shareholders

Up to 100 shareholders, which must be resident US individuals or qualified domestic trusts |

Unlimited shareholders

Shareholders can be non-domestic individuals or entities |

| Stock class | Cannot issue stock | One stock class | No stock class limitation |

| Taxation | Pass-through taxation

No corporate income tax. Instead, members pay taxes on their share of profits |

Pass-through taxation

No corporate income tax. Instead, shareholders pay tax on a “reasonable” compensation |

Double taxation

C corporations pay corporate income tax and personal income tax on dividends |

| Administration requirements | Least administration for compliance with laws, rules and regulations | Some administration for compliance with laws, rules and regulations | Most administration for compliance with laws, rules and regulations |

| Meeting minutes requirements | No board meeting obligations and not required to provide minutes | Must hold annual board meetings with minutes | Must hold annual board meetings with minutes |

S corporation vs. LLC vs. C corporation

S corporation status is the most popular choice for small companies due to the tax savings it can offer. It’s also a great choice for small businesses looking to scale, as the S corporation business structure allows for up to 100 shareholders.

If your business is currently an LLC or C corporation, find some of the main advantages of transitioning to S corporation status below.

The advantages of transitioning from LLC to S corporation:

- Become a corporation with the potential to scale: S corporations can elect a board of directors or shareholders as investors

- Pay less tax: Shareholders of an S corporation can pay less tax by allocating themselves “reasonable” compensation. In this case, taxes are paid at the employee level, not the corporate level

- Sell shares without consent: S corporations have no consent restrictions on shareholders selling their shares, unlike members of an LLC

The advantages of transitioning from C corporation to S corporation:

- Avoid double taxation: S corporations do not pay corporate income tax. Instead, the shareholders of an S corporation only pay personal income tax on compensation that’s considered an employee salary

Eligibility criteria for filing Form 2553

To be eligible for S corporation status, your business or corporation must:

- Be a domestic corporation or identity

- Have no more than 100 current shareholders

- Only have shareholders that are resident individuals or qualified domestic trusts and estates

- Have only one class of stock

- Not be an ineligible corporation, which can include certain financial institutions, insurance companies and domestic international sales corporations

Remember: Filing Form 2553 without meeting the above eligibility requirements will likely result in a rejection by the IRS.

Preparation before filing Form 2553

In addition to meeting the eligibility requirements for S corp election, there are several things to confirm before filing Form 2553. First, make sure that:

- All current owners/shareholders consent to sign Form 2553 to elect S corporation status

- All current owners/shareholders agree on the tax year the S corporation status should take effect

- You understand which owners are family members that will be treated as one shareholder

It’s also important to double-check that all owner or shareholder information is correct before filling in Form 2553. For each owner or shareholder, this includes:

- Name and address

- Stock owned or the percentage of ownership

- Employer Identification Number or social security number

- Tax year end (month and day)

Lastly, it’s worth gathering all relevant documentation to verify shareholder details. In certain events, such as a rejection for S corp status, you may need to submit this documentation to the IRS.

How to file Form 2553: a detailed guide

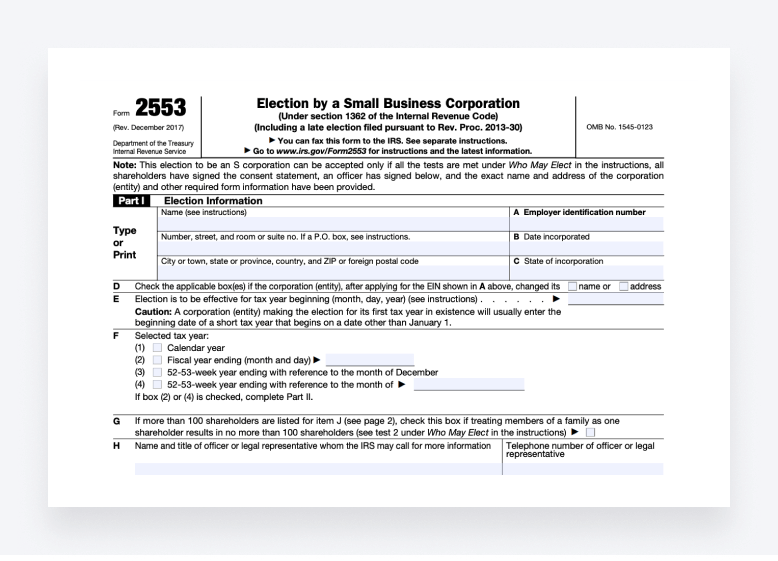

Excluding a cover page that details address and fax number information (where to file Form 2553), Form 2553 is a four-page form with four parts:

- Part I: Election Information

- Part II: Selection of Fiscal Tax Year

- Part III: Qualified Subchapter S Trust (QSST) Election Under Section 1361(d)(2)

- Part IV: Late Corporate Classification Election Representations

Part I and Part II have lettered items, from A to R, to fill out. However, Part II and Part III are optional, depending on your business. Part IV provides information and does not require filling in.

We’ll go into detail on what each page is for below, along with step-by-step instructions for how to fill in Form 2553 correctly.

Take note: You can type or print to fill out Form 2553, but the IRS does not accept the use of e-signatures.

Part I: Election Information

Part I of Form 2553 is for submitting election information, including the details of your corporation and all shareholders.

1. Under Election Information, fill in your corporation’s name and address

2. Item A: Fill in your corporation’s Employer Identification Number (EIN)

3. Item B: Fill in the date of incorporation

4. Item C: Fill in the state of incorporation

5. Item D: Check name or address if your corporation changed either of these after applying for its EIN

6. Item E: Fill in the date you want the S corp election to come into effect

7. Item F: Check the checkbox for the tax year your corporation will use

8. Item G: Check this checkbox if any shareholders are members of a family who want to be treated as one member

9. Item H: Fill in the name and telephone number of a legal representative. Whether it’s you or someone else, the legal representative may be contacted by the IRS for more information

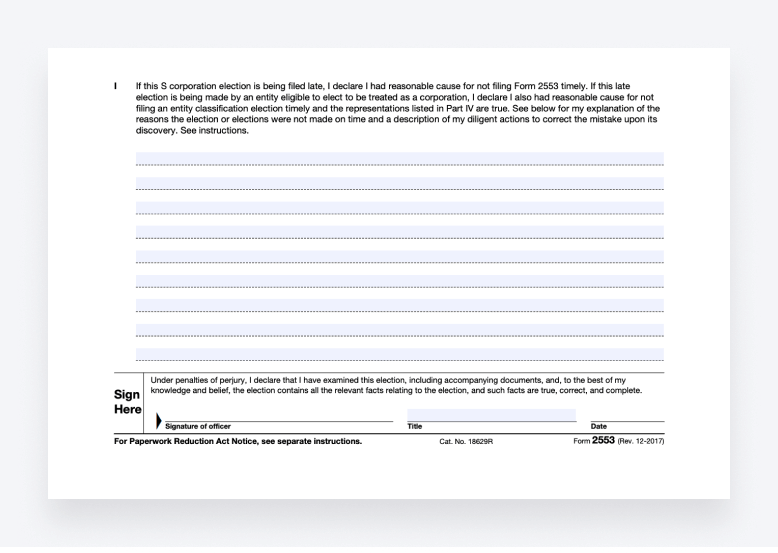

10. Item I: If you are late filing Form 2553, declare the reason with a detailed explanation. Below this section, include the signature of officer, title and the date of signing

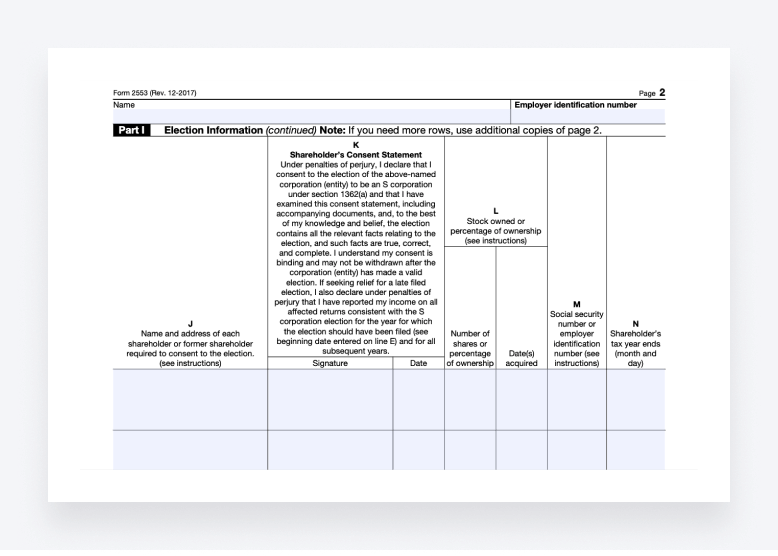

Part I, item I, is on the second page of Form 2553. This section is for filling in the various details of all company shareholders, who must also give their consent to the S corporation election.

11. Item J: Include the name and address of each shareholder or former shareholder required to consent to the election

12. Item K: Include the signature and date under the Shareholder’s Consent Statement

13. Item L: Include the stock owned or percentage of ownership for each shareholder and the date(s) it was acquired

14. Item M: Include each shareholder’s security number or Employer Identification Number (EIN)

15. Item N: Include the date (month and day) each shareholder’s tax year ends

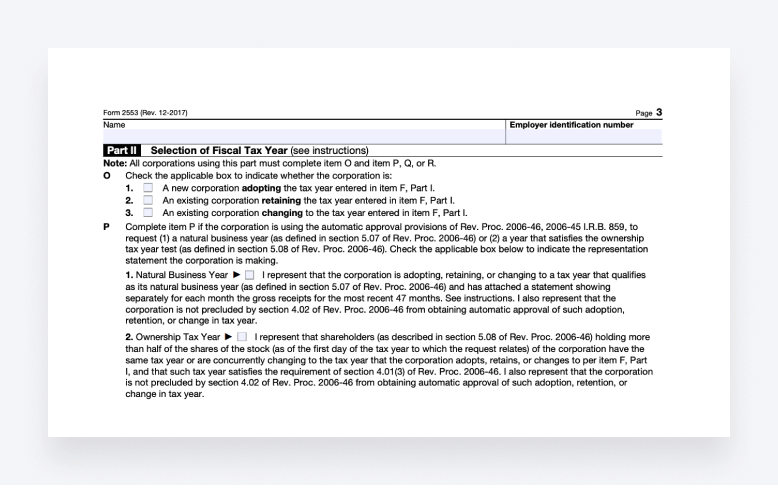

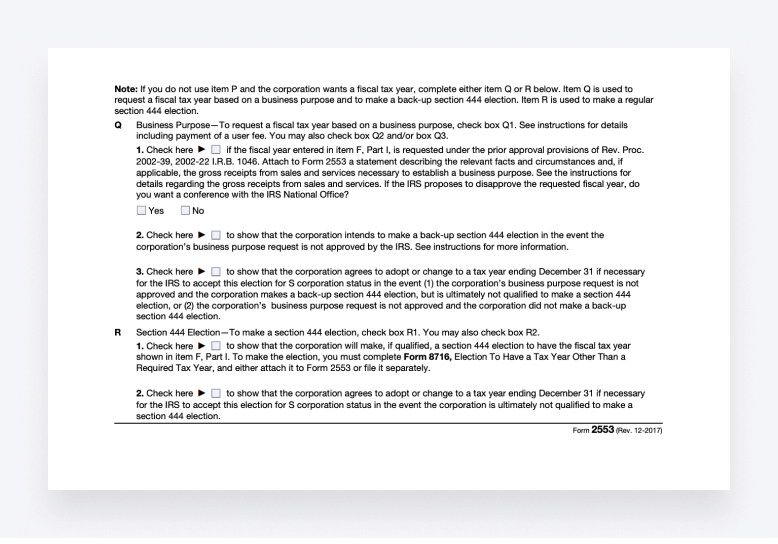

Part II: Selection of Fiscal Tax Year

Part II of Form 2553 is for further information about the fiscal tax year. You only need to complete Part II of Form 2553 if you checked checkbox (2) or (4) in Part I, item F, which designates the chosen tax year your corporation will use.

1. Item O: Check the appropriate checkbox to provide further information about your selected fiscal tax year in item F, Part 1

2. Item P: Check the appropriate checkbox if your business uses the natural business year or ownership tax year (fiscal tax year)

3. Item Q: Check the appropriate checkbox if your business does not use the natural business year or ownership tax year but wants to request using the fiscal year

4. Item R: Check the first checkbox if your corporation intends to make a section 444 election, and the second checkbox to agree to adopt or change your tax year ending December 31 if your corporation is not qualified to make a section 444 election

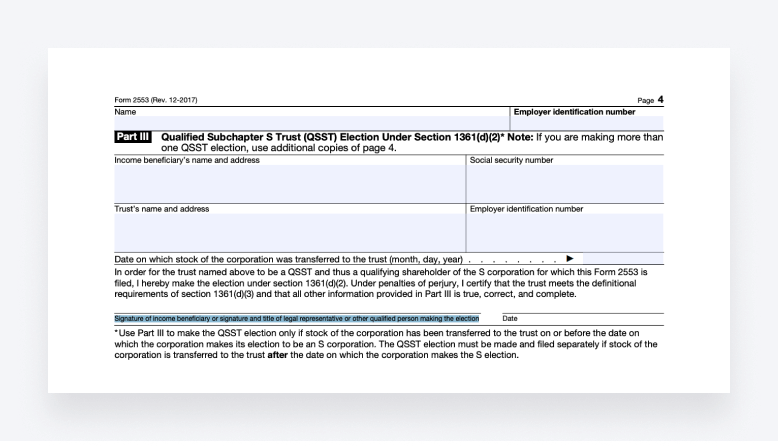

Part III: Qualified Subchapter S Trust (QSST) Election

Part III of Form 2553 is optional; it only applies to you if you want to elect qualified trusts as shareholders of your corporation.

- At the top, fill in the name of the trust and its Employer Identification Number

- Fill in the income beneficiary’s name and address (in the same textbox), followed by the social security number

- Fill in the trust’s name and address (in the same textbox), followed by the Employer Identification Number (EIN)

- At the bottom, include the signature of the income beneficiary, or the signature and title of the legal representative or other qualified person making the election, as well as the date of signing

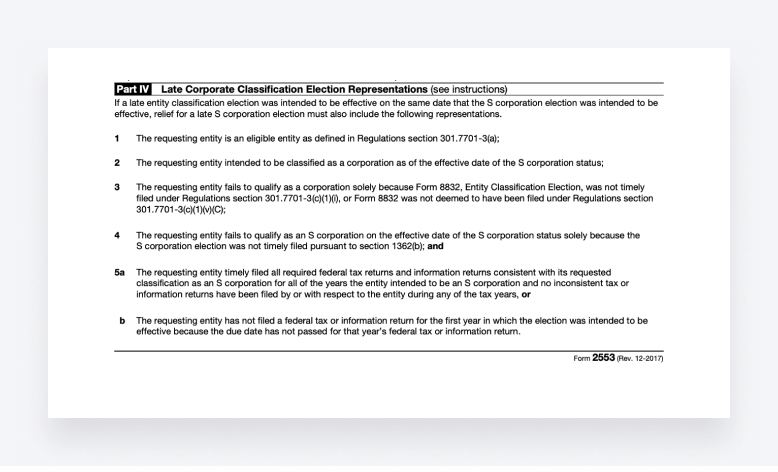

Part IV: Late Corporate Classification Election Representations

Part IV of Form 2553 details representations that must be included if your corporation is requesting relief from a late election. You can ignore reading this page if you are filing Form 2553 within the deadline.

Form 2553: common mistakes to avoid

As mentioned earlier, making a mistake when filing Form 2553 to elect S corporation status can result in a rejection by the IRS. This makes it vital to ensure all your details are accurate and correctly provided when filling in Form 2553.

Here are some of the most common Form 2553 mistakes:

- Not meeting the S corporation eligibility criteria

- Forgetting to declare spouses who may be owners (with or without stock/shares) that also do not meet the eligibility requirements

- Not filing Form 2553 in time for the provided date you want the S corporation election to become effective

To avoid making mistakes when filing Form 2553, verify and double-check all the details, give yourself enough time to fill in the form before the deadline, and have a professional check, or help you complete, the form before filing.

Form 2553 submission guidelines

There are two separate IRS addresses and fax numbers for filing Form 2553, and you will need to file the form with the correct address or fax number depending on where your principal business, office, or agency is located.

Remember: Form 2553 cannot be filed online or electronically.

| Location of principle business, office or agency | Address or fax number for filing Form 2553 |

| Connecticut, Delaware, District of Columbia, Georgia, Illinois, Indiana, Kentucky, Maine, Maryland, Massachusetts, Michigan, New Hampshire, New Jersey, New York, North Carolina, Ohio, Pennsylvania, Rhode Island, South Carolina, Tennessee, Vermont, Virginia, West Virginia, Wisconsin | Department of the Treasury Internal Revenue Service Kansas City, MO 64999

Fax # 855-887-7734 |

| Alabama, Alaska, Arizona, Arkansas, California, Colorado, Florida, Hawaii, Idaho, Iowa, Kansas, Louisiana, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Mexico, North Dakota, Oklahoma, Oregon, South Dakota, Texas, Utah, Washington, Wyoming | Department of the Treasury Internal Revenue Service Ogden, UT 84201

Fax # 855-214-7520 |

The best time to file Form 2553

Stated on the first page (cover page) of Form 2553, you must file Form 2553 within two specific timeframes, depending on when you want the S corporation status to come into effect. These are:

- No later than 2 months and 15 days after the beginning of the tax year the election will take effect

- Any time during the tax year before the tax year the election will take effect

Post-filing procedures for Form 2553

After filing Form 2553, you can generally expect a response from the IRS within 60 days. This will be a letter that will include the verdict on whether you have been approved for S corporation status.

If the letter is a confirmation of your approval for S corporation status, make sure to safely store it as your proof of acceptance.

If you have filed Form 2553 to the correct address or fax number and have not heard back from the IRS within 60 days, it’s best to directly reach out to the IRS via telephone.

In such an event, make sure to have several important details ready, such as the date you filed Form 2553, your business name, Employer Identification Number (EIN) and address.

Frequently Asked Questions (FAQs)

What if I miss the deadline to file Form 2553?

If you miss the deadline to file Form 2553—typically no later than 2 months and 15 days after the beginning of the tax year the election will take effect—it’s possible that the IRS will grant relief if failure to file on time was due to a reasonable cause. This reason must be declared on item I of Form 2553.

How do tax implications vary with S corp election through Form 2553?

The main tax implication of electing S corp status through Form 2553 is a change of tax status. S corporations have pass-through taxation and therefore do not pay corporate income tax, as the profits and losses are passed through to the shareholders. All shareholders of an S corporation pay personal income tax rates instead.

Are there state-specific guidelines for filing Form 2553?

Some states have their own S corporation election forms, which must be filed to confirm S corporation status within that state. These states include Arkansas (Form AR11003), New Jersey (Form CBT-2553) and New York (Form CT-6). Businesses in these states must file the relevant state form in addition to IRS Form 2553.

Can I file Form 2553 electronically?

It’s not possible to file Form 2553 electronically. Form 2553 must be filed to the IRS address or fax number that applies to your state, depending on where your principal business, office, or agency is located. Form 2553 details two sets of submission addresses and fax numbers for different states, so it’s important to file Form 2553 to the correct address or fax number.

What should I do if my Form 2553 is rejected?

If you file Form 2553 for S corporation status and it is rejected by the IRS, the first step is to understand why it was rejected. If the reason is due to errors and not because of ineligibility, it’s possible to correct the errors and resubmit the form with supporting documentation and an explanation of the corrections you have made.

What are the benefits of transitioning to an S corporation through Form 2553?

Some of the main benefits of transitioning to an S corporation through Form 2553 include pass-through taxation, allocation of shareholder income, limited liability and potential investment. S corporations do not pay corporate taxes and are allowed up to 100 shareholders, which can attract investors.

How do I correct a mistake on a submitted Form 2553?

If you have made a mistake on a submitted Form 2553, it’s best to contact the IRS directly. You may be asked to resubmit Form 2553 with the correct information and a written explanation that details the corrections. After doing this, it’s also worth following up with the IRS to ensure that they have received the corrected information.

How does Form 2553 impact my business’s tax situation?

Electing your business for S corporation status through Form 2553 can have a varying impact on how you pay taxes, depending on the current tax status of your business. Transitioning to an S corporation will implement pass-through taxation, meaning all shareholders can pay tax on their personal income and not at the corporate level.

What is the process for late filing of Form 2553?

If you are late filing Form 2553, it’s important to declare the reason on item I of Form 2553. Depending on the reason you provide, the IRS may grant relief. The earliest deadline for filing Form 2553 is no later than 2 months and 15 days after the beginning of the tax year the election for S corporation status will take effect.

Can a single-member LLC file Form 2553?

A single-member LLC (SMLLC) can file Form 2553 to elect S corporation status. The IRS will grant the transition to an S corporation as long as the single-member LLC meets the eligibility requirements. Some S corp requirements include being a domestic entity, having one class of stock and no more than 100 shareholders.

Additional resources

Official IRS links

- IRS Form 2553 (PDF)

- Instructions for Form 2553 (PDF)

- IRS requirements to qualify for S corporation status

- IRS Telephone and Local Assistance

Other links (legal documents)

- U.S. Code § 1362 - Election; revocation; termination

- U.S. Code Subchapter S - Tax Treatment of S Corporations and Their Shareholders

Conclusion

The above information can be a lot to take in, but we hope this guide has helped you better understand Form 2553 – its purpose, how to fill in the form and file it correctly, and the potential advantages of transitioning to S corporation status.

To wrap up, here are the key takeaways:

- Form 2553 must be filed with the IRS to elect S corporation status

- Being an S corporation offers key benefits that include pass-through taxation and shareholder expansion

- Despite the benefits of S corporations, S corp status is not right for every business

- In general, S corporation status is a popular business structure and tax status for small businesses

Of course, filing forms such as Form 2553 can be complicated, both from a legal perspective and the information you need to provide. If you need assistance, it’s worth consulting a business adviser for personalized advice.

Thank you! The eBook has been sent to your email. Enjoy your copy.

There was an error processing your request. Please try again later.

What makes the best accounting firms thrive while others struggle to keep up? We analyzed our top 20 TaxDome firms, representing over $100M in combined revenue, to uncover the strategies driving their success.