A balance sheet is a key financial statement that provides a snapshot of a company’s financial position. Containing information about assets, liabilities, and equity, balance sheets enable accountants to understand and assess the financial health of a company at any point in time.

While creating a balance sheet from scratch can be time-consuming and fiddly, using a personalized template can streamline the process, ensuring that your balance sheets are always consistent and accurate.

In this article, we’ll explore the benefits of using a balance sheet template, what to include, and how to use it. And to speed things up, we’ll even provide you with a link to a free template, which you can download and customize to suit your business’s needs.

Why use a balance sheet template?

Using a balance sheet template can help you systematize your reporting process, bringing numerous benefits along the way, including:

- Improved consistency: standardizing your balance sheet ensures consistent reporting, providing a solid foundation for comparing financial performance over time

- Time-efficient preparation: with a template, there’s no need to prepare and format your balance sheet from scratch each time

- Improved accuracy: by offering pre-defined fields and formulas, a well-designed balance sheet template reduces the risk of human error and inaccurate financial statements

What to include in a balance sheet template

So what elements should you include in your balance sheet template? While each company will have their own approach to formatting and structure, we’ll look at some essential information to include in this section.

Assets

Assets are any resources owned by a business that have economic value. They can be tangible assets, such as inventory, equipment, or buildings, or intangible assets, such as intellectual property or a well-known and much-loved brand.

Assets on a balance sheet are divided into two categories: current and long-term. Current assets are generally liquid assets that can be converted into cash or used within one year. They include:

- Cash and cash equivalents

- Marketable securities, such as stocks, bonds, and money market instruments

- Accounts receivable — i.e. money owed to the business by customers/clients

- Inventory, including goods for sale or raw materials for production

- Prepaid expenses — i.e. payments made in advance for goods or services yet to be receive

Long-term assets are assets that will benefit the company for more than one year. They include:

- Property, such as office space, plants, and warehouses

- Equipment, such as machinery, vehicles, hardware, software, office furniture, etc.

- Intangible assets such as patents, trademarks, copyrights, client lists, and brand names

- Long-term investments, such as real estate

Liabilities

Recorded on the other side of the balance sheet to assets, liabilities are something that a company owes. Like assets, liabilities can be categorized as current or long-term. Current liabilities are those that are due within one year. For example:

- The portion of any loan repayable within the next 12 months

- Interest payments

- Staff wages, salaries, bonuses, and benefits

- Customer prepayments for products or services they haven’t yet received

- Accounts payable, such as amounts due to vendors or suppliers

Long-term liabilities are those that are expected to be paid in 12 months or more. They include:

- Long-term loans and debt

- Deferred tax liabilities

- Bonds payable — i.e. long-term debt securities issued by the business

- Post-employment benefits and pensions

- Warranty liability — i.e. the estimated cost associated with repairing products under warranty

Equity

Also known as shareholder equity (or owners’ equity for privately owned companies), equity is the money that would have to be returned to shareholders or owners if the company were to be liquidated and all its debts paid off.

In other words, equity is the total net worth of a company and can be calculated by subtracting total liabilities from total assets. Depending on the financial position of the company, equity can be positive or negative. Examples of equity include:

- Paid-in capital, such as the investment made by the owner or shareholders

- Retained earnings — i.e. profits that the business chooses to retain rather than distribute to shareholders as dividends

Additional sections

While assets, liabilities, and equity are all crucial components of a balance sheet template, you may want to supplement and customize your template by adding additional sections, such as:

- Notes and supplementary information that provide clarity to the numbers on your balance sheet

- Comparative information — key financial data and insights from previous accounting periods that can provide additional context to the current balance sheet

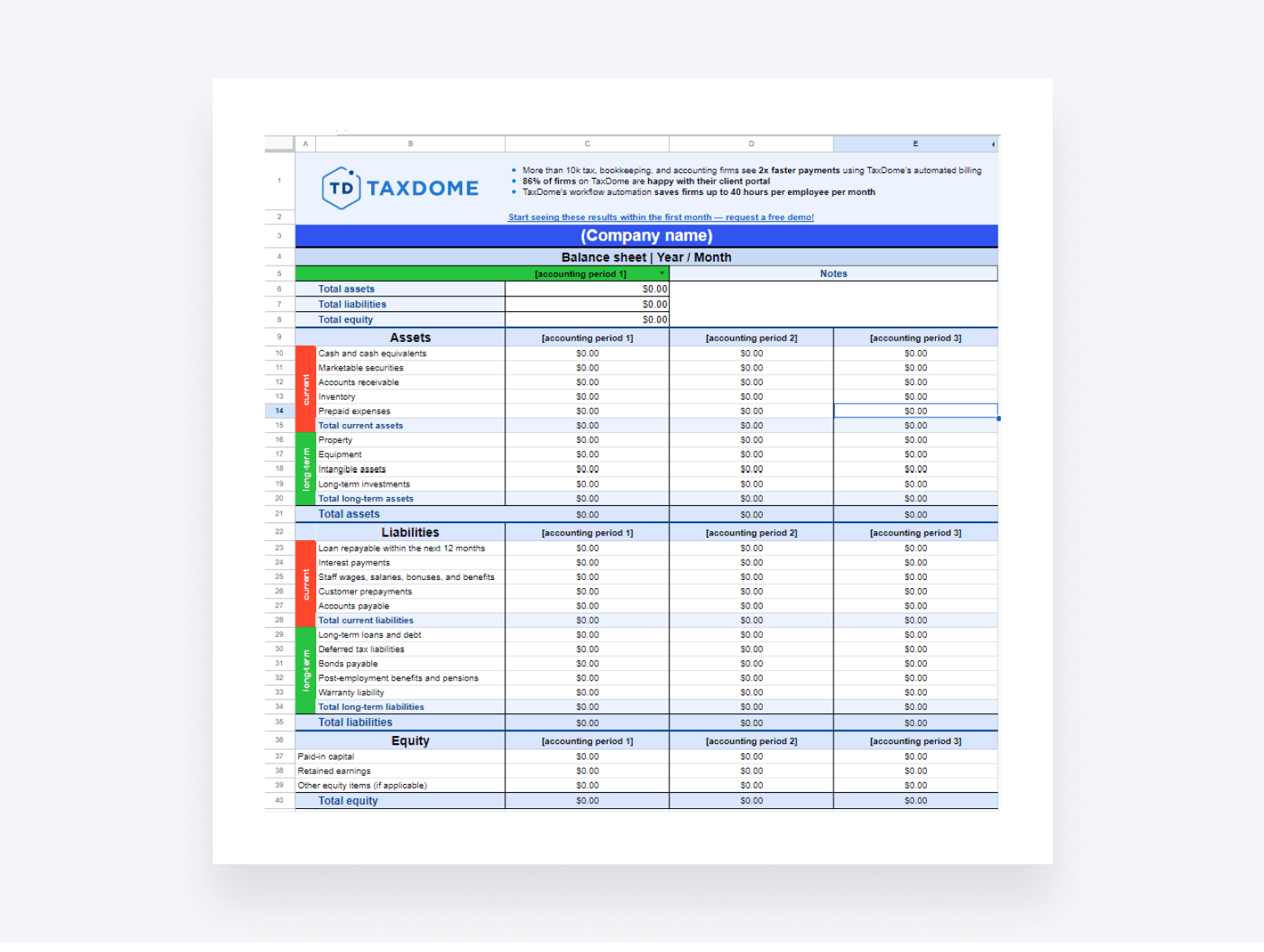

Free downloadable balance sheet template

To help you save time and improve consistency in your financial reporting, here’s a free balance sheet template you can use. Simply download it using the link below. Once in the document, click “File” in the top-left corner, select either “Download” or “Make a copy”, and start using the template!

Tips for using the balance sheet template

To make the most of our free balance sheet template, here are some tips designed to help you boost accuracy and efficiency in your financial reporting.

Customize to suit your needs

Our template is a great starting point, but because no two businesses are the same, it’s important to customize it to your specific needs. You can do this by:

- Adding your company logo

- Adjusting column headers to match your reporting requirements

- Adding new sections that are relevant to your business, or removing ones that aren’t

Take accuracy seriously

It goes without saying, but accuracy is paramount in financial reporting. Make sure you double-check every asset, liability, and equity entry to ensure that each figure is accurate and correctly categorized. Automating the process of compiling balance sheets will help mitigate the risk of human error.

Update regularly

Remember to update your balance sheet template to reflect the current financial situation of your business. You can schedule regular reviews, such as every quarter or year, to ensure that your template is optimized to capture your financial data as effectively as possible.

Speed up data entry with formulas

Make use of the spreadsheet formula functions, which allow you to automatically calculate totals. Not only does this speed up the process of entering data, but it also ensures that your totals are always correct — assuming the input data has been double-checked first!

Prioritize collaboration and transparency

Collaboration is essential to effective financial reporting. Make sure you make our free balance sheet templates available to all your team members, enabling multiple users to access and edit the document simultaneously.

Technology can help make this process seamless and efficient. With cloud-based practice management software such as TaxDome, you can attach templates and other relevant documents to tasks, which can then be automatically assigned as part of an automated workflow.

At the same time, your entire team can gain visibility into job progress and who’s working on what. And with TaxDome’s secure document management, you can rest assured that your financial statements and other sensitive documents are safe at all times.

To sum up

The balance sheet is a fundamental document in financial management, providing accountants with an overview of a business’s financial position at any given point in time. By using a balance sheet template, you can take a systematic approach to financial reporting, ensuring efficiency, accuracy, and consistency across different reporting periods.

We hope you found this article useful — as well as the free balance sheet templates included. If you want to take your accounting workflows to the next level with smart automation, seamless collaboration, and improved transparency, give TaxDome a try. Request a free demo today!

Thank you! The eBook has been sent to your email. Enjoy your copy.

There was an error processing your request. Please try again later.

What makes the best accounting firms thrive while others struggle to keep up? We analyzed our top 20 TaxDome firms, representing over $100M in combined revenue, to uncover the strategies driving their success.