Form W-9, also known as a Request for Taxpayer Identification Number and Certification form, is a tax form in the US that’s used to submit a Taxpayer Identification Number (TIN) to a requester.

If you have received a request to submit Form W-9, this guide provides step-by-step instructions on how to fill it out correctly, including tips for avoiding common mistakes.

- What is Form W-9?

- Who needs to fill out a W-9?

- Step-by-step instructions

- Special cases

- Sending Form W-9

- Common mistakes and how to avoid them

- FAQs

- Conclusion

What is Form W-9?

Form W-9 is a short IRS form for providing a TIN and other important information to a requester, including certification (a signature) that the information is correct.

By correctly submitting the form to a requester, the person filling out the form also declares that they are not subject to backup withholding — a 24% rate deducted from non-employment income and collected by the IRS.

For an in-depth explanation of the purpose of Form W-9 and when it is used, take a look at our blog post: What is Form W-9?

Who needs to fill out a W-9?

Form W-9 must be filled out by a US person or US resident alien (i.e. a foreign-born US resident who is not an American citizen) when it is requested from them.

This can be for a variety of reasons, but the most common scenario is when a business is receiving and paying for services from an independent contractor. In this case, a business will request Form W-9 from an independent contractor to be able to report the non-employment income to the IRS.

Form W-9 may also be requested for the purpose of real estate transactions, mortgage interest, acquisition or abandonment of secured property, cancellation of debt, and contributions made to an IRA.

Step-by-step instructions

Form W-9 is a short form, so it doesn’t take long to fill out. Still, it’s important to fill it out correctly to avoid backup withholding and other penalties, including a $50 penalty from the IRS for failure to provide a correct TIN.

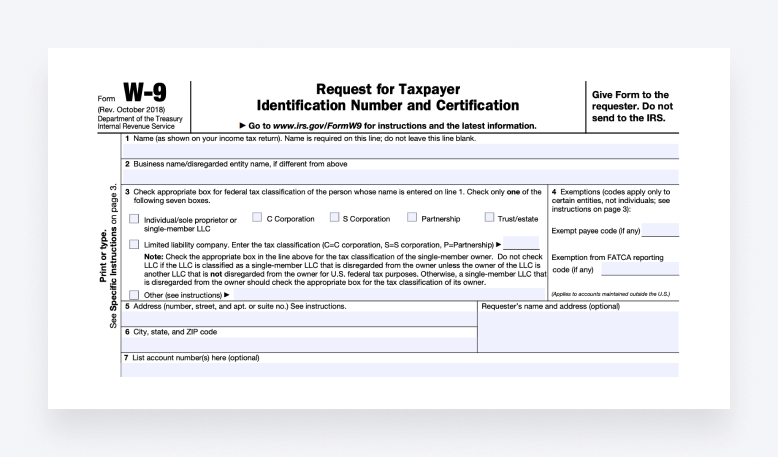

Form W-9 has six pages in total, but only the first page needs to be filled out. The required information spans three sections:

- US person details

- Part I: Taxpayer Identification Number (TIN)

- Part II: Certification

Find step-by-step instructions for filling out each section below.

US person details

The first section of Form W-9 is where you must provide information about yourself and your federal tax classification, including details of exemption if it applies to you.

Line 1: enter your name as it appears on your income tax return

Line 2: enter your business name or disregarded entity name if it is different from the name that you provided in line 1

Line 3: provide your federal tax classification by checking the appropriate box from the provided options (listed below)

- Individual/sole proprietor or single-member LLC

- C Corporation

- S Corporation

- Partnership

- Trust/estate

- Limited liability company: if you check this option, make sure to enter your tax classification

- Other: if you check this option, make sure to provide information on your federal tax classification

Line 4 (if applicable): for exemptions from backup withholding and FATCA reporting, enter your exempt payee code and/or exemption from FATCA reporting code in the appropriate boxes

Line 5: enter your address, including your house/apartment/suite number and street

Line 6: enter your city, state, and ZIP code

Requester’s name and address (optional): next to your address information, you can enter the requester’s name and address if desired

Line 7 (optional): enter any account numbers in the box that may be useful to your requester

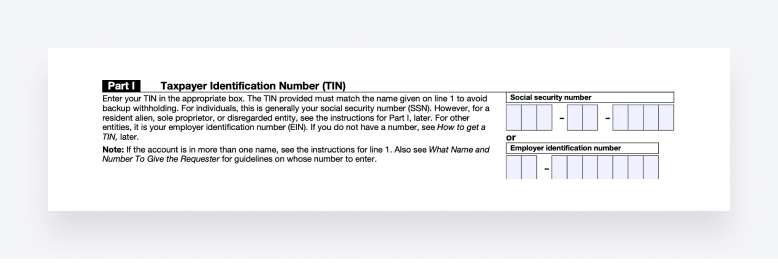

Part I: Taxpayer Identification Number (TIN)

Part I of Form W-9 is where you must provide your TIN.

This is your Social Security number (SSN) if you are classed as an individual or your Employer Identification Number (EIN) if you are classed as another entity.

You only have to enter one of the above — just make sure it matches the name you provided in line 1 to avoid backup withholding.

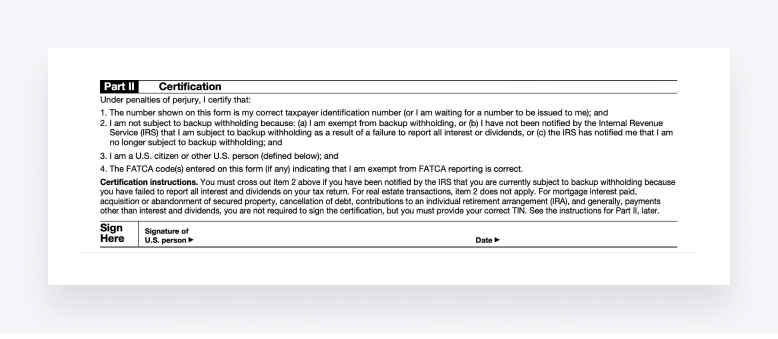

Part II: Certification

Part II is the final section of Form W-9 where you must provide your signature and the date of signing. This is for certification that you:

- Have provided the correct TIN

- Are not subject to backup withholding

- Are a US citizen

- Have provided the correct code for exemption from FATCA reporting

Special cases

For certain individuals and businesses, there are special considerations to be aware of when filling out Form W-9.

For single-member LLCs, it’s important to check the box for “individual/sole proprietor or single-member LLC” and not “limited liability company” in line 3.

Other entities, such as C corporations, S corporations, partnerships and trusts/estates, must also make sure to check the correct box for federal tax classification and provide an Employer Identification Number (EIN as the TIN.

Sending Form W-9

You must submit Form W-9 to the person who requested it from you, not the IRS. You can do this by:

- Sending the completed W-9 form by post

- Sending the completed W-9 form electronically (for example, by email)

- Handing over the completed W-9 form in person

If you choose to send your W-9 form by post, ensure that your information remains protected by using a secure service, such as Registered Mail.

Common mistakes and how to avoid them

Common mistakes on Form W-9 include:

- Not checking the right box for federal tax classification

- Not entering a federal tax classification that matches the name provided in line 1

- Not entering the exemption codes in the correct boxes

- Not entering the correct TIN

- Not entering a TIN that matches the name provided in line 1

These mistakes can be avoided by double-checking that the information you have provided is correct. This also ensures that you won’t be subject to backup withholding and penalties.

FAQ

What should I do if I’m asked for a W-9 but don’t have a business?

If you are classed as an individual and not a business, make sure to fill out Form W-9 with the appropriate federal tax classification. You must also provide the correct TIN. For individuals, this is a Social Security number (SSN).

What are the most common mistakes to avoid when filling out a W-9?

Some of the most common mistakes made on Form W-9 include not entering the correct TIN and not selecting the correct federal tax classification. You can avoid these mistakes by double-checking the information you have provided before submitting Form W-9.

How can I securely send my completed W-9 to the requester?

You can securely send your completed W-9 form to the requester by email or post. If you choose to send it by post, make sure it’s sent using a secure service, such as Registered Mail. You can also hand over your W-9 form to the requester in person.

Do I need to fill out a new W-9 form each year?

You only need to fill out a W-9 form when it is requested from you, such as when you are providing your services to a company as an independent contractor. Form W-9 must be submitted to the requester and not to the IRS.

How does being an independent contractor affect how I fill out a W-9?

If you are an independent contractor, make sure to select the appropriate federal tax classification when filling out Form W-9. It’s also important to provide the correct TIN. For individuals, this is a Social Security number (SSN).

What information do I need to provide for different federal tax classifications on a W-9?

It’s important to provide your correct federal tax classification on Form W-9. Simply check the correct box from the provided options, which include individual/sole proprietor or single-member LLC, C corporation, S corporation, partnership, trust/estate, limited liability company, or other.

If I’m filling out a W-9 as part of a business, what details are required?

If you are part of a business and have been requested to submit Form W-9, make sure to provide the correct business name/disregarded entity name, federal tax classification and TIN.

What are the implications of providing incorrect information on a W-9?

Providing incorrect information on Form W-9 can result in the requester resorting to backup withholding — a deduction of 24% from non-employment income. Not providing a correct TIN can also result in a penalty of $50 from the IRS.

Conclusion

Incorrectly submitting Form W-9 to a requester can result in backup withholding and penalties — so it’s important to provide the correct information and double-check that it’s correct before submitting it.

If you have been requested to submit Form W-9, follow the step-by-step instructions we have provided in this guide to ensure you fill out the form correctly. For further assistance, you can always reach out to a tax professional for personalized advice.

Thank you! The eBook has been sent to your email. Enjoy your copy.

There was an error processing your request. Please try again later.

Looking to boost your firm's profitability and efficiency?

Download our eBook to get the answers