Forms W-9 and 1099 are related to one another but serve different purposes. For businesses and independent contractors in particular, it’s important to understand the differences between them and what each form is for.

In this guide, we’ll explore the key differences between Form W-9 and Form 1099, their purposes, and how to submit them correctly.

- Understanding Form W-9

- Understanding Form 1099

- The key differences between W-9 and 1099

- Usage scenarios: W-9 vs. 1099

- Issuing forms: do you need a W-9 to issue a 1099?

- FAQ

- Conclusion

Understanding Form W-9

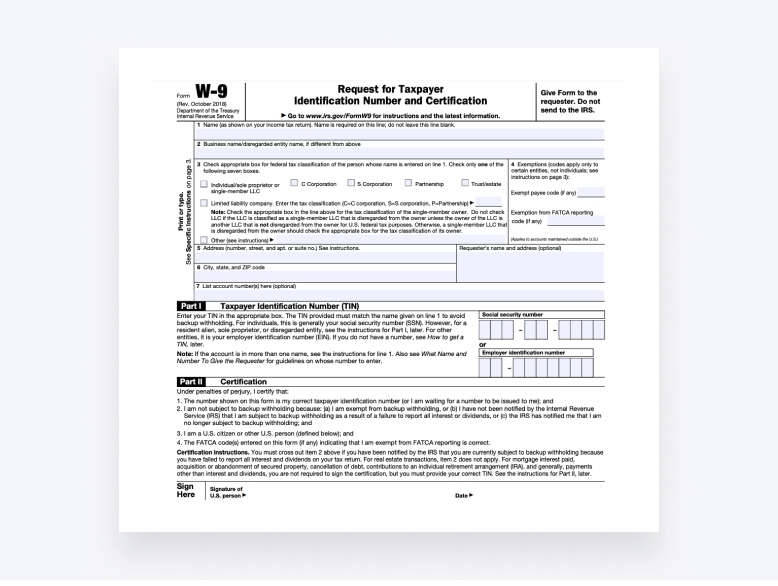

IRS Form W-9, Request for Taxpayer Identification Number and Certification, is a type of information return. It’s used for the submission and certification of a Taxpayer Identification Number (TIN), most commonly when it is requested from an independent contractor by a business.

Through Form W-9, an independent contractor will submit their TIN and other relevant information to the requester. As a result, Form W-9 is not submitted to the IRS but to the requester, who can then use the provided information to file Form 1099.

For an in-depth explanation of the purpose of Form W-9, visit our blog: What is Form W-9?

Understanding Form 1099

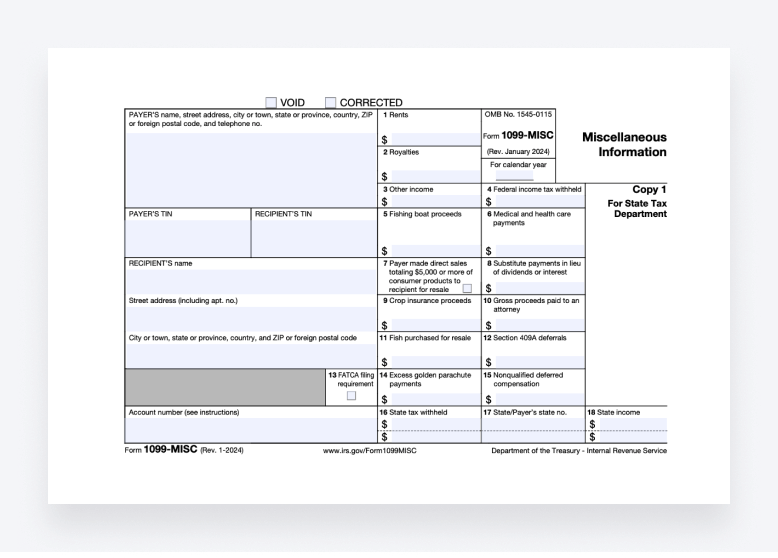

Form 1099-MISC, better known as Form 1099, is a year-end information return that’s used to report payment information to the IRS. A common scenario is when a business has to report a payment made to an independent contractor for their services.

In this situation, Form 1099 must be filed to the IRS for each independent contractor who was paid $600 or more during the tax year. Before a business can file Form 1099 to report a payment, it must first request Form W-9 from the independent contractor to receive their TIN and other important information.

The key differences between W-9 and 1099

There are several key differences between Form W-9 and Form 1099, which revolve around:

- The purpose of each form

- Who is required to fill out each form

- Where each form must be submitted

- When each form must be submitted

To understand these key differences, take a look at the table we’ve provided below.

| Form W-9 | Form 1099 | |

| What is the form’s purpose? | Form W-9 is used to submit a TIN | Form 1099 is used to submit payment information of $600 or more |

| Who fills out the form? | Form W-9 is filled out by independent contractors | Form 1099 is filled out by businesses |

| Where is the form submitted? | Form W-9 is submitted to the requester | Form 1099 is submitted to the IRS |

| When must the form be submitted? | Form W-9 must be submitted after it is requested | Form 1099 must be submitted at the end of the tax year |

Usage scenarios: W-9 vs. 1099

The most common usage scenario for Forms W-9 and 1099 is when a business entity receives services from an independent contractor. In this case, a business entity will request Form W-9 from an independent contractor before receiving their services.

Once the independent contractor submits the completed Form W-9, the business will use the provided information, including the TIN and address, to report the payments made to the independent contractor that total $600 or more for that tax year.

Issuing forms: do you need a W-9 to issue a 1099?

Receiving a correctly completed Form W-9 is important for businesses and companies that need to file Form 1099. Form 1099 requires certain information, such as a TIN, that must be officially submitted to them through Form W-9.

A business must therefore request Form W-9 before accepting and paying for the services of an independent contractor. At the end of the tax year, the business can then report all payments to the IRS through Form 1099 — a requirement if the total is $600 or more.

If an independent contractor does not submit Form W-9 upon request or fails to provide a correct TIN, the business must resort to backup withholding: a 24% rate deduction from the independent contractor’s payment that is paid to the IRS.

FAQ

What’s the difference between W-9 and 1099?

While Form W-9 is used for the submission of a TIN and other important information to a requester, Form 1099 is used to report miscellaneous payments to the IRS for tax purposes. In most cases, Form W-9 is needed to be able to file Form 1099.

Is a W-9 essentially the same as a 1099?

Form W-9 and Form 1099 are not the same. While both forms are information returns used for tax purposes, each form serves a different purpose and requires different information from separate parties.

When do I need to use a W-9 versus a 1099 form?

A W-9 form is needed for the submission of a TIN and other important information about a US person. A 1099 form is needed to report payments of $600 or more to the IRS, using the information provided in a submitted W-9 form.

Are there any scenarios where both W-9 and 1099 are used?

Form W-9 and Form 1099 are both used when a business accepts and pays for services from an independent contractor. The business will request Form W-9 from the independent contractor and then use the submitted information to report the payment by filing Form 1099.

What are the legal implications of confusing W-9 with 1099?

Confusing forms W-9 and 1099 can result in penalties from the IRS. Failing to submit Form W-9 can result in a $50 penalty and backup withholding. If a requester does not resort to backup withholding when Form W-9 is not submitted, the requester can receive penalties from the IRS.

Conclusion

While Form W-9 and Form 1099 tend to get mixed up, the two IRS forms are not the same. Form W-9 is used for the purpose of requesting and submitting a TIN, while Form 1099 is used to report payments of $600 or more at the end of the tax year.

Both forms are commonly used by businesses and independent contractors. A business will request a W-9 form from an independent contractor to receive their TIN and other information. Once submitted, the business can then use the provided information to file a 1099 form and report the payment(s) to the IRS.

Failing to submit these forms correctly can result in penalties — so it’s important to understand the differences and how each form is used. If you need assistance, you can always reach out to a tax professional for personalized advice.

Thank you! The eBook has been sent to your email. Enjoy your copy.

There was an error processing your request. Please try again later.

Looking to boost your firm's profitability and efficiency?

Download our eBook to get the answers