Growing your accounting business can be a challenge if you are taking on too many new clients. You and your team can quickly become overwhelmed by the excess of projects and the number of deadlines that you find yourselves contending with. There must be a better way.

The fact is, your accounting firm can grow by not accepting more clients but by raising prices per client. It is understandable that a new accountant might be hesitant to ask for a higher rate. However, charging more per client is possible if you initiate the right strategies. Here, we will take a look at effective ways that you can charge more per client and grow your accounting business without overwhelming your firm’s workload.

Negotiating on bookkeeping or accounting services is harder than it is for other services. Here’s why:

First, it is important to learn where your firm has pricing flexibility. One of the places where your firm may not be able to raise prices is in the area of bookkeeping and accounting. That’s because there is major competition with both of these services. Therefore, it will be harder to negotiate a higher rate. The solution? Expand your firm by adding services that offer better pricing flexibility.

What an accounting or bookkeeping firm can offer to charge more

In short, you can charge more for services with less competition. Therefore, your accounting firm should look for ways to offer specialized services. This will not only give you the opportunity to raise your rates, but it will also allow you to grow with your clients. All too often, a small accounting firm will lose a client when the client “outgrows” them. With a wide range of services, you can show your clients that you have the ability to grow with them.

Wider range of services

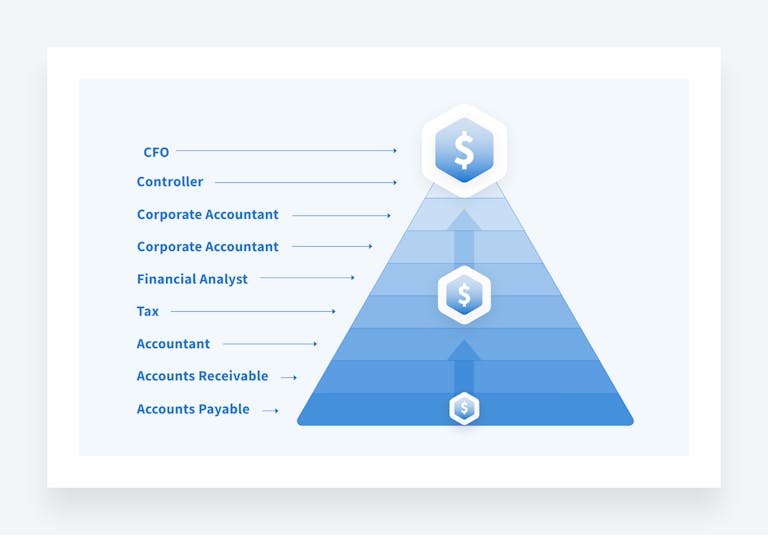

There are a number of services that you can offer with better pricing flexibility. Here is a look at some of the more popular accounting specialty services that your accounting firm can offer:

Take the CPA exam if you’re an EA

If you are an enrolled agent or EA, then you should take the opportunity to take the CPA exam and become a certified public accountant. As a CPA, you can offer a wider range of services, and you will be able to charge more.

Expand your expertise

As a CPA, you can expand your expertise, which will allow you to offer a broader range of services. For instance, you can work as a tax professional as well as a business consultant.

As a business consultant, you can help new businesses set up their financial planning. You can also be hired to assist a company that is struggling with financial issues. You can even be retained to advise a company as it expands its operations.

You can also work as a financial planner. Your financial planning services can include assisting those who are looking to handle their immediate financial needs as well as plan for the future. The great thing about being a financial planner is that you can enter a long-term relationship with a client who is looking for financial expertise throughout their lifetime.

Another area of expertise to consider is forensic accounting. There are a number of companies and individuals who need to have irregularities investigated in their accounting books. You can become a valuable asset to a client who needs to quickly sort out any issues with their accounting.

Finally, you can offer valuation services. For instance, let’s say that a company is looking to make an acquisition. That company may need your services to check the target company’s books to see if that company is worth its valuation price.

As you can see, there are many different avenues you can take as a CPA to offer services with a higher rate. Therefore, you can easily grow your accounting firm without having to add to your workload.

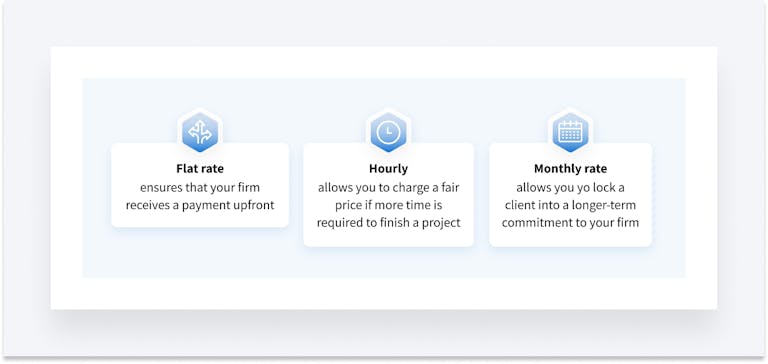

Define your pricing model

When it comes to growing an accounting firm, it is important that the firm have the right price model. Too many accounting firms make big mistakes when it comes to their pricing. All too often, accounting firms end up not charging what they are worth. Here are some tips to help your accounting firm price itself accordingly.

How to calculate your accounting firm’s prices

When growing your accounting firm, it is important to set the right price for your services. Here’s a five-step process that you can use to determine the right price:

1. Calculate your Cost of Sales (COS)

First, you will want to calculate your cost of sales (COS) or your cost to provide your specific services. For instance, if you are offering financial planning services, then you may need to hire an assistant for that particular service as well as pay for special financial planning software. Be sure to list out all of the costs associated with a specific service to get your firm’s COS.

2. Determine your overhead percentage

Beyond your COS, you will also have to calculate the overhead percentage. That’s because you need to make sure that your price covers both your COS and your overhead percentage. Your overhead percentage is the amount that you will use to cover the overhead of running your business. That includes everything from the cost of your workspace to the cost of your marketing, computer systems, staff, software, etc.

To calculate your overhead percentage, you will need the following:

Your annual gross revenue

Your annual operating expenses (excluding your COS)

Now, use this formula to calculate your overhead percentage:

Expenses/Gross Rate=X

X*100= Overhead expenses

For example, if your annual revenue is $300,000 and your overhead expenses are $100,000, then your overhead percentage is 33%.

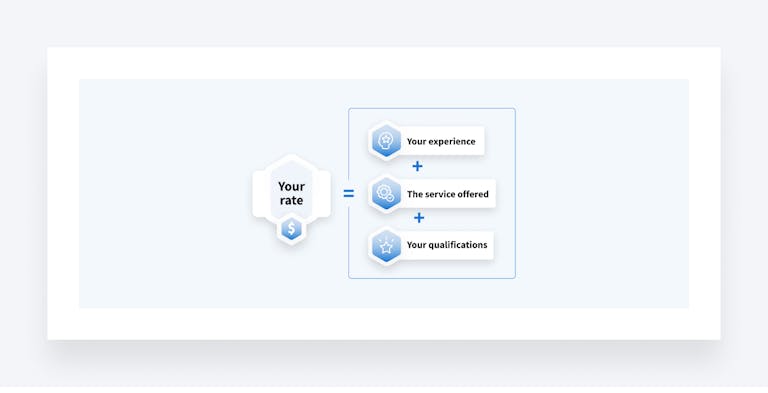

3. Determine your rate

Now, you will want to determine your rate or how much you would like your firm to be compensated. In order to determine your rate, you should consider the following factors:

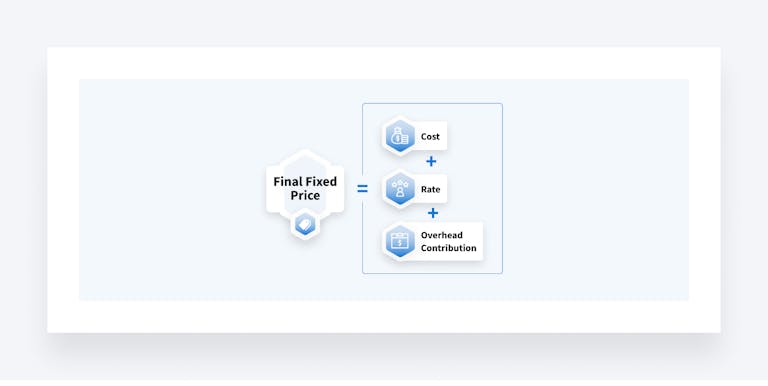

4. Calculate your price

Now that you know your cost of services, your overhead percentage, and your rate, you can calculate the price that you will charge. First, start by adding the cost to the rate:

Now, multiply your baseline rate by your overhead percentage to determine how much you need to add to the price to cover your firm’s overhead percentage:

Baseline Fixed Price x Overhead Percentage = Overhead Contribution

Finally, add your baseline fixed price to your overhead contribution:

Baseline Fixed Price + Overhead Contribution = Final Fixed Price

5. Adjust your price

Finally, you will want to adjust your price to make sure that it is competitive with the market rate. Don’t try to undercut the competition and squeeze your own firm’s profit. Just be sure that you are not radically mispricing your services.

Ready to get started pricing your firm’s cost? Use this handy pricing calculator.

Growing an accounting firm the smart way

Growing an accounting firm doesn’t require adding work hours to your week. By simply expanding your services, pricing your services properly, and standing firm on your rates, you can see big growth in your firm’s bottom line. Get started today for a more prosperous accounting firm tomorrow.

Watch Cassandra Centeno of Total Tax Services on doubling client base with TaxDome:

Decrease time spent on manual tasks with TaxDome. Join our daily demo:

Join demo

Thank you! The eBook has been sent to your email. Enjoy your copy.

There was an error processing your request. Please try again later.

Looking to boost your firm's profitability and efficiency?

Download our eBook to get the answers