The tax preparation industry has experienced steady growth in recent years and shows no signs of slowing down in the foreseeable future. At the same time, tax codes grow increasingly complex each year, increasing demand for experienced tax preparation specialists.

This presents an appealing opportunity to start a tax preparation business from the comfort of your own home. We’re here to help you with that.

In this article, we’ll outline the key steps involved in starting your own tax preparation business and address the most common questions. We wrote this guide in partnership with David Forney, an experienced tax professional and owner of Mobile Tax. Read on to hear David’s insights and advice on starting a tax preparation business.

Understanding the role of a tax preparer

Tax is something that almost everyone has to deal with, but that very few understand. Hundreds of millions of taxpayers in the US alone need to file their returns accurately and on time each year. In most cases, people don’t have the know-how, confidence, or even time to tackle this themselves. This is where tax preparers come in.

Tax preparers help individuals and businesses navigate the complexities of tax preparation. This includes:

- Gathering all relevant financial and personal data

- Analyzing income, expenses, and deductions

- Completing and filing the relevant IRS forms

- Ensuring compliance with IRS regulations

In some cases, more experienced tax preparers may offer additional services. For example, CPAs and Enrolled Agents can represent their clients in front of the IRS in the event of audits or disputes.

In addition to relevant knowledge and experience, successful tax preparers tend to have the following qualities:

- Attention to detail

- Strong organizational and time-management skills

- Strong communication skills and a client-first mindset

- Professionalism and integrity

- Tech-savviness

The last point is particularly important in today’s professional landscape. In recent years, tax preparation has been transformed by disruptive technologies, including AI and automation. This has enabled tax preparers to wave goodbye to repetitive manual processes, giving them more time to focus on growing their businesses and handling complex cases.

Professional standards for tax preparers

To become a tax preparer, you must obtain a Preparer Tax Identification Number (PTIN). This is a special number that the IRS issues to identify a tax return preparer. If you are going to file 11 or more tax returns, you will be required to submit them electronically. This requires you to become an authorized e-file provider and to obtain an Electronic Filing Identification Number (EFIN) from the IRS.

While no specific license is required to begin tax preparation, consider upgrading your credentials if you want to provide more services to your clients. Tax preparers have varying levels of representation rights before the IRS:

- A PTIN-only preparer can only work on tax returns and cannot represent clients

- Annual Filing Season Program participants can represent clients, but only on returns they prepared and signed

- Enrolled agents, CPAs and attorneys can represent clients on any IRS matter but need a CAF number to act on their behalf

Some states have additional licensing and educational requirements for tax preparers. For example, in California, non-credentialed preparers must complete a 60-hour course and renew an annual registration with the California Tax Education Council (CTEC). Find out the certification requirements in your state.

Start your tax preparation business in 7 steps

Step 1. Find your niche

Before you start a tax preparation business, you’ll first need to consider the type of clients you want to serve. According to David Forney, choosing a well-defined niche can be a game-changer for your practice. “As you get more specific for your niche, you start seeing certain benefits,” he explains. “The first is that you can charge more for your services because your clients will like the services built specifically for them. The second is you can start to streamline your process.”

By specializing in a niche, you improve the quality of your services. Instead of being an all-rounder, you can become a leader in your chosen area. David neatly sums up the power of this approach with a simple analogy:

If you are playing baseball and you’re up to bat, you could have a curve ball, you could have a slider, or you could have a fastball. You don’t necessarily know what’s going to be coming down the pipe. But if you specialize in what you do and you know that every single pitch is going to be a fastball, well, now you’re playing Home Run Derby!

Here are some things to consider when choosing a niche:

1. Focusing on specific tax situations

You can focus on services that require specialized knowledge. By developing a deep understanding of complex tax issues, you can market yourself as a specialist. Here are some examples:

- Investment and capital gains or losses

- Preparing returns for Americans living abroad

- Estate and inheritance tax planning

- Maximizing charitable donation deductions

2. Targeting specific industries

You can focus on the specific tax concerns of people in a certain industry, such as:

- Small business owners who need assistance with business returns and payroll taxes

- Real estate professionals who require expertise around specific deductible expenses

- High-net-worth individuals looking for ways to reduce their tax liabilities

Step 2. Create a business plan

If you want to grow your tax practice, you’ll need a well-thought-out business plan. Here are some steps you can take to create one:

- Thoroughly research your local market and competitive landscape

- Set realistic financial projections using industry benchmark data

- Outline your niche, ideal customer, and competitive advantage

- Outline growth strategies — how will you scale your client base and services?

- Leverage business planning tools and resources, including the SBA and Score.org

Step 3. Set up your business

Starting a tax preparation business involves the following key steps:

- Get your PTIN: apply online for your Preparer Tax ID Number from the IRS and renew it annually

- Choose a business structure: select either sole proprietorship, LLC, S-corp, or other structure based on your liability protection needs and tax implications

- Obtain an EIN: acquire a free Employer Identification Number, required to open a bank account for your business

- Open a bank account for your business: research local community banks and national banks for affordable small business services

Step 4. Establish a home office

To start a tax preparation business from home, you’ll need to create a professional, distraction-free space. This requires attention in these key areas:

Equipment

- Desktop computer or laptop with the latest OS and remote data backup

- High-speed internet connection

- Secure physical and cloud storage for tax records

- Comfortable desk and chair

- Office supplies — tax forms, pens, calculators, folders, computer accessories

Safety and security

- Install secure locks and fireproof filing cabinets to protect physical tax records

- Encrypt devices, use a VPN, and avoid public WiFi to keep data safe

- Obtain cyber liability insurance in case of a data breach

Step 5. Select the right software

Investing in professional tax preparation software enhances productivity and accuracy when filing client returns. Software such as Drake Tax and ATX Tax makes completing taxes more efficient. Explore these and other options in our review of the best tax software for small accounting firms.

Beyond tax prep software, streaming your operations using practice management software can further boost your capacity to take on more clients and increase income.

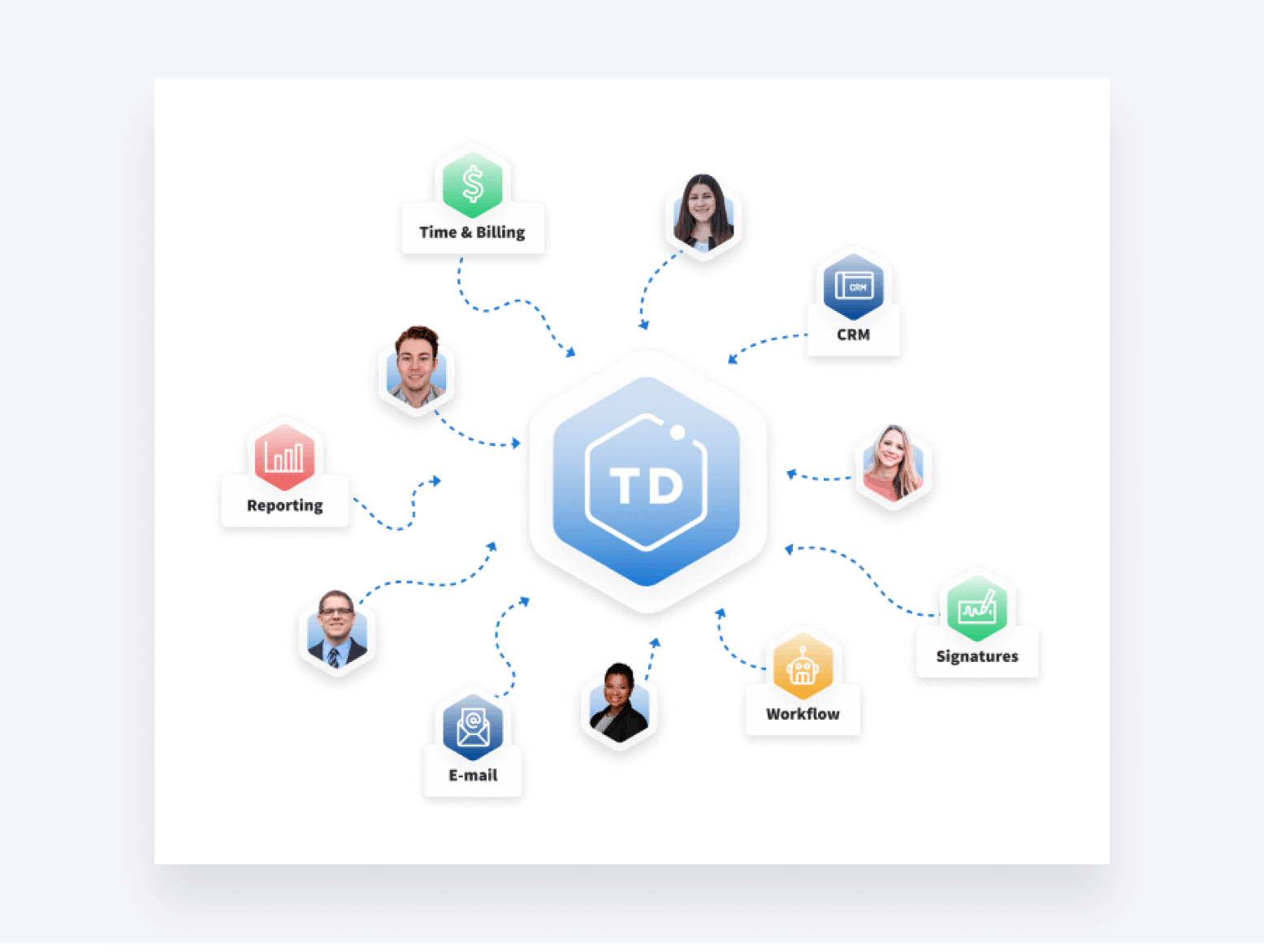

One highly rated solution is TaxDome

. It helps accounting professionals do more with less by offering comprehensive automation features, such as:

- Workflow automation: the next step of your job automatically begins once you finish a step. This could include updating a client, sending an invoice, or requesting an e-signature.

- Follow-ups: if a client isn’t responding to your requests, you can set an automatic reminder. This reminder will be sent to them when you choose without having to manually contact them.

- Tax organizers: when you begin jobs, you can automatically send an organizer to clients that gathers vital documents and stores them within each client’s accountant — no more manually collecting and organizing documents.

By eliminating manual tasks with automation, you’ll have more time to take on more clients.

As the most comprehensive practice management software on the market, TaxDome helps more than 10,000 tax, accounting, and bookkeeping businesses work smarter and faster — including David Forney’s Mobile Tax. Here’s what he had to say:

For practice management software, my preference is Taxdome. It will help you get organized and minimize your tech stack because it’s an all-in-one platform with e-signatures, document management, invoicing, client communication, and more. When you have multiple users, everybody can speak the same language by using it.

Step 6. Price your services

When establishing your fee structure, David Forney recommends researching what local tax preparers charge for similar services. “I literally walked into the other CPA and tax preparation companies in town to find out what their pricing is,” he explains.

As a new business, it can be tempting to undercut the competition with low prices. David warns against this approach, however. “New tax preparers will come in and they won’t charge enough,” he points out. “If they try to compete for the bottom, they’re not going to have the necessary profits to provide the improvements to the business that they’ll need to provide a better service for their clients.”

Initially, pricing in line with the local market rates may make sense, until you gain experience. You can justify higher hourly or package rates if you hold advanced credentials, for example, if you are an enrolled agent or CPA.

You’ll also need to factor in your outgoings and the amount you need to make to turn a decent profit, as David points out. “I consider my margin. So I know how much profit I want to make, and then I work backwards from there and figure out the pricing.”

You may want to consider offering tiered pricing, with higher fees for complex business and investor returns versus more basic 1040 preparation. Providing flat fee quotes upfront can help new clients understand the expected costs involved. You could also explore monthly retainer options for business clients who need year-round tax preparation and advisory services.

Step 7. Market your practice

Growing your tax preparation business requires executing an integrated marketing plan that deploys various tactics to reach potential clients. Here are some key actions to take:

- Create a professional website to establish your online presence and make it easy for prospects to learn about and contact your business

- Leverage social media platforms to demonstrate your expertise and run ads targeted at local clients

- Network by joining the Chamber of Commerce, introduce yourself at local community centers to gain referrals, and partner with other businesses for cross-referral relationships

- Distribute branded marketing materials to get your name out there

- Incentivize referrals from existing clients through discounts or rewards programs

- Advertise offline and online for more exposure to potential clients

Once you have some new clients, David Forney recommends spending some time to understand how they found your business. “By testing and measuring where your best leads are coming from, that will shine a light on where you need to focus your marketing efforts,” he explains.

For David, the vast majority of his new clients come in as referrals.. “I joined some local networking groups and let them know very specifically what I do. When they come across potential clients, they’re happy to refer me because there’s just such high demand right now for good tax preparers.”

Start a tax preparation business from home the right way, with TaxDome

Don’t start a tax preparation business with piles of paperwork in your home office and time-consuming manual tasks. TaxDome helps accounting professionals do everything online. Our practice management software has helped more than 10,000 firms worldwide create an accounting practice that’s efficient, organized, automated, and profitable.

Frequently asked questions

How do I stay updated on changing tax laws and regulations?

Use resources such as the Checkpoint Edge database from Thomson Reuters, which provides authoritative information from the IRS, AICPA, FASB and more. Attend accounting conferences and network with colleagues to discuss changes and impacts. David Forney also recommends Pronto Tax School.

What are the startup costs for a tax preparation business?

With minimal overhead, startup costs are low. Budget for IRS PTIN registration, tax training courses, marketing materials, tax software, supplies and optional items such as specialized books. Startup costs often total well under $2,000.

What tax forms will I work with most often?

As a tax preparer for individuals, you’ll likely use Form 1040 for individual returns along with common schedules, including Schedules A, B, C, D, E. For businesses, expect Forms 1120, 1120S, 1065. Payroll forms include W-2, 940, 941.

Do I need a license to become a tax preparer?

You don’t need a specific license to practice as a tax preparer. That said, you will need a Preparer Tax Identification Number (PTIN) from the IRS to prepare federal tax returns. In addition, you may need additional certification to perform certain tax-related services. For example, to represent your clients before the IRS, you’ll need to become either a CPA or an Enrolled Agent.

How long does it take to start a tax preparation business?

I can take a few weeks to several months to set up your tax preparation business. During this time, you’ll need to get your PTIN, set up a business structure, choose the right software, and acquire your first clients. Of course, effective planning can help speed up the process of starting a tax preparation business.

Can I run a tax business part-time?

Yes! It’s possible to run a tax preparation business part-time. For example, you could take on clients during tax season to supplement other income. That said, running a part-time business will hamper your ability to grow and find new clients over the long term.

What software does a tax consultant need?

Tax consultants typically use professional tax preparation software, such as TurboTax, TaxSlayer Pro, or Drake Tax. In addition, practice management software such as TaxDome can be a game-changer, providing all the tools you need to manage the operational side of your business.

How much should tax consultants charge for their services?

It depends on factors such as your location, your clients’ needs, and your level of expertise and experience. Tax consultants typically charge anywhere from $200 to $500 for individual returns and higher fees for corporate or complex filings. Some tax accountants choose to charge hourly rates, which can range from $100 to $300.

Key takeaways

The growing need for qualified tax preparers presents you with a lucrative chance to put your expertise to use while giving you the freedom to work from anywhere.

While starting a tax preparation business requires careful research and planning, this guide outlines the key steps to get you started on solid ground. With passion for the work, commitment to ongoing learning and smart leveraging of available technology, you can establish a thriving home-based company that allows you to prosper while making a difference in clients’ lives.

Thank you! The eBook has been sent to your email. Enjoy your copy.

There was an error processing your request. Please try again later.

What makes the best accounting firms thrive while others struggle to keep up? We analyzed our top 20 TaxDome firms, representing over $100M in combined revenue, to uncover the strategies driving their success.