The tax preparation industry has experienced steady growth in recent years and shows no signs of slowing down in the foreseeable future. According to the Global Strategic Business Report, it is expected to grow at a 4.3% CAGR through 2030. At the same time, tax codes grow increasingly complex each year, increasing demand for experienced tax preparation specialists.

This presents an appealing opportunity to capitalize on by launching a home-based tax business. And we are here to help you with that—our comprehensive guide outlines key steps for establishing your own tax practice and addresses the most common questions. Read on to take advantage of this growing industry and start generating income on your own terms.

Professional standards for tax preparers

A tax preparation business provides assistance to individuals and businesses in preparing and filing their tax returns. Tax preparers help clients understand tax regulations, identify deductions and ensure that their returns are accurate and complete.

To become a tax preparer, you must obtain a Preparer Tax Identification Number (PTIN). PTIN is a special number that the IRS issues to identify a tax return preparer. If you are going to file 11 or more tax returns, you will be required to submit them electronically. This requires you to become an authorized e-file provider and to obtain an Electronic Filing Identification Number (EFIN) from the IRS.

While no specific license is required to begin tax preparation, consider upgrading your credentials if you want to provide more services to your clients. Tax preparers have varying levels of representation rights before the IRS:

- A PTIN-only preparer can only work on tax returns and cannot represent clients

- Annual Filing Season Program participants can represent clients, but only on returns they prepared and signed

- Enrolled agents, CPAs and attorneys can represent clients on any IRS matter but need a CAF number to act on their behalf

Some states have additional licensing and educational requirements for tax preparers. For example, in California, non-credentialed preparers must complete a 60-hour course and renew an annual registration with the California Tax Education Council (CTEC). Find out the certification requirements in your state.

Start your tax preparation business in 7 steps

Step 1. Find your niche

Choosing a well-defined niche makes it easier to market your services and establish your expertise. When determining your niche, consider:

- Focusing on specific tax situations

Tax preparers can focus their services on specific tax situations that require specialized knowledge. For example, you may build expertise around investment and capital gains or losses taxes, preparing returns for Americans living abroad, estate and inheritance tax planning or maximizing charitable donation deductions. Developing a deep understanding of the complex tax issues in one of these areas allows you to market yourself as a specialist for clients with those particular tax needs.

- Targeting client industries

Get to know tax concerns of a particular group of clients or clients in a certain industry, such as:

- Small business owners who need assistance with business returns, payroll taxes and often personal returns as well

- Real estate professionals who require expertise around deductible expenses such as mortgage interest and depreciation

- High net worth individuals with large tax liabilities need advisors who understand tax reduction strategies for top earners

Step 2. Create a business plan

If you want to grow your tax practice, you’ll need a well-thought-out business plan:

- Thoroughly research your local market and competitive landscape

- Set realistic financial projections using industry benchmark data

- Describe your niche, ideal customer and competitive advantage clearly

- Outline growth strategies—how will you scale your client base and offerings?

- Leverage business planning tools and resources, including the SBA and Score.org

With a comprehensive roadmap, you can confidently establish and grow your tax preparation firm.

Step 3. Set up your business

Before serving clients, complete key steps to establish your tax preparation business:

- Get your PTIN: apply online for your Preparer Tax ID Number from the IRS and renew it annually

- Choose a business structure: select either sole proprietorship, LLC, S-corp or other structure based on liability protection needs and tax implications and file the appropriate documents with your state

- Obtain an EIN: acquire a free Employer Identification Number, required to open bank accounts for a business

- Open a bank account for your business: research local community banks and national banks for affordable small business services

Step 4. Establish a home office environment

Configuring a professional, distraction-free home office requires thoughtful attention to these key areas:

Equipment

- Desktop computer or laptop with latest OS and remote data backup

- High-speed internet connection

- Secure physical and cloud storage for tax records

- Comfortable desk and chair

- Office supplies – tax forms, pens, calculators, folders, computer accessories

Safety and security

- Install secure locks and fireproof locking file cabinets to protect physical tax records

- Encrypt devices, use VPN, avoid public WiFi to keep data safe

- Obtain cyber liability insurance in case of a data breach

Step 5. Select the right software

Investing in professional tax preparation software enhances productivity and accuracy when filing client returns. Software such as Drake Tax and ATX Tax makes completing taxes more efficient. Explore these and other options in our review of the best tax software for small accounting firms.

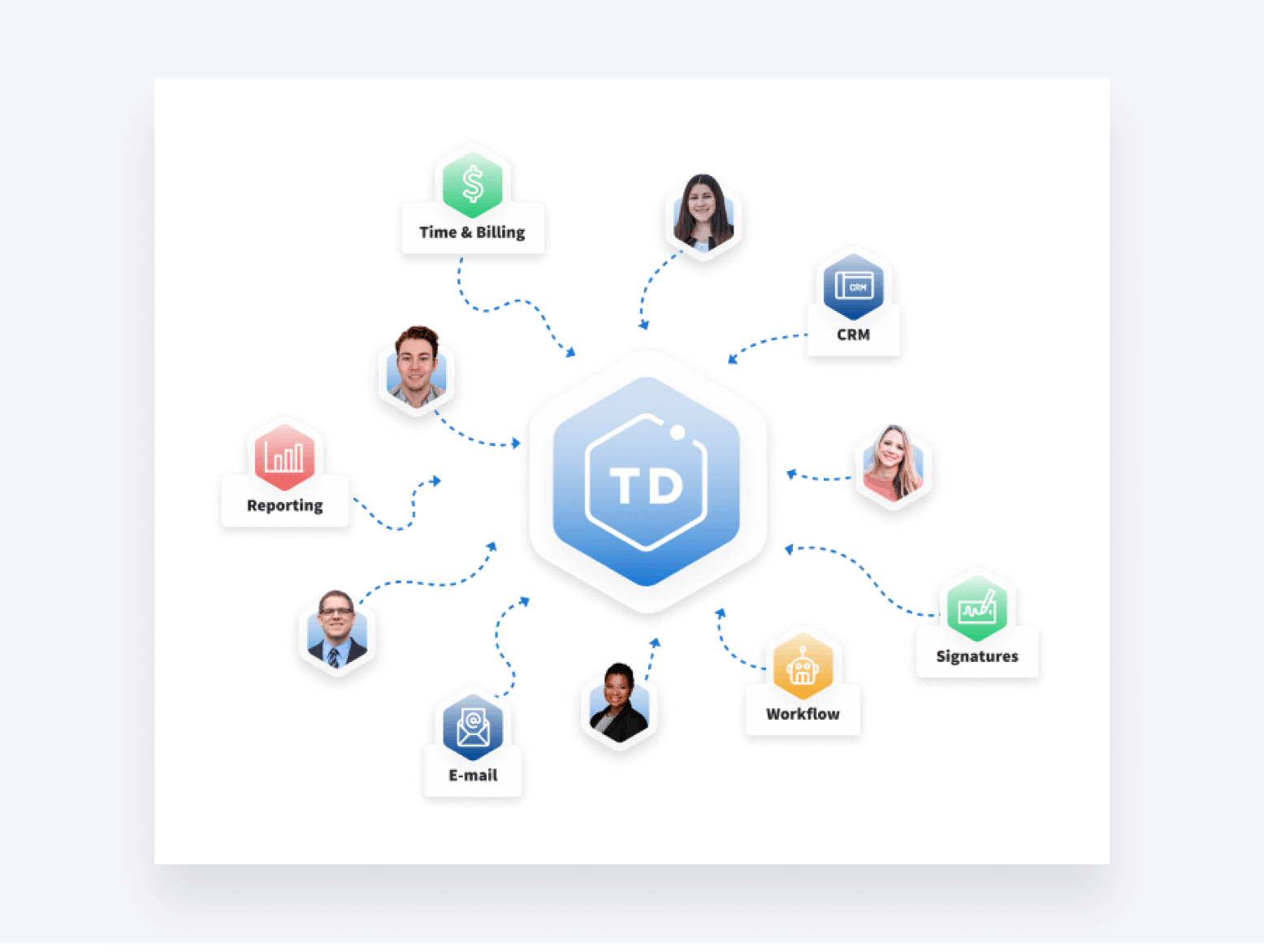

Beyond tax prep software, organizing your practice operations using practice management software can further boost your capacity to take on more clients and increase income. One highly rated solution is TaxDome. It provides comprehensive tax practice management, including workflow automation, billing, a client portal, time tracking and more, to save you time. Book a free demo to see if it’s a good fit for your new tax business.

Step 6. Price your services

When establishing your fee structure, research what competing local tax preparers charge for similar services. Initially, pricing in line with the local market rates may make sense, until you gain experience. You can justify higher hourly or package rates if you hold advanced credentials, for example, if you are an enrolled agent or CPA.

You may want to consider offering tiered pricing, with higher fees for complex business and investor returns versus more basic 1040 preparation. Providing flat fee quotes upfront can help new clients understand the expected costs involved. You could also explore monthly retainer options for business clients who need year-round tax preparation and advisory services.

Allowing some flexibility to negotiate rates for client referrals or those with limited incomes enables you to cover costs while attracting new business. Taking these factors into account as you establish pricing can serve your tax preparation business well.

Step 7. Market your practice

Growing your tax preparation business requires executing an integrated marketing plan that deploys various tactics to reach potential clients. Here are some key actions to take:

- Create a professional website to establish your online presence and make it easy for prospects to learn about and contact your business

- Leverage social media platforms to demonstrate your expertise and run ads targeted at local clients

- Network by joining the Chamber of Commerce, introduce yourself at local community centers to gain referrals and partner with other businesses for cross-referral relationships

- Distribute branded marketing materials to get your name out there

- Incentivize referrals from existing clients through discounts or rewards programs

- Advertise offline and online for more exposure to potential clients

Frequently asked questions

How do I stay updated on changing tax laws and regulations?

Use resources such as the Checkpoint Edge database from Thomson Reuters, which provides authoritative information from the IRS, AICPA, FASB and more. Attend accounting conferences and network with colleagues to discuss changes and impacts.

How much income can a tax preparer bring in?

Income potential depends on your market and ability to attract clients. With low overhead, you can charge competitive rates. Revenue also grows as your skills and expertise expand, allowing you to handle more complex returns and command higher fees.

How long does it take to become a seasoned tax preparer?

It takes about 1-2 tax seasons to learn the basics of preparation. After three years, most preparers can work independently. Within five years, niche expertise will develop to differentiate your services. Continuing education is key. Check out our guide on how to succeed during busy season.

What are the startup costs for a tax preparation business?

With minimal overhead, startup costs are low. Budget for IRS PTIN registration, tax training courses, marketing materials, tax software, supplies and optional items such as specialized books. Startup costs often total well under $2,000.

What are the most common federal tax returns?

The main federal individual income tax return is Form 1040. Other common returns include Form 1040-SR for seniors, 1040-NR for nonresidents, 1040-NR-EZ for foreign students or scholars and 1040-X for amending previous filings.

What tax forms will I work with most often?

As a tax preparer for individuals, you’ll likely use Form 1040 for individual returns along with common schedules, including Schedules A, B, C, D, E. For businesses, expect Forms 1120, 1120S, 1065. Payroll forms include W-2, 940, 941.

What should I know about filing business tax returns?

Learn how business entities are taxed differently. Understand common deductions like employee expenses, mileage, utilities, etc. Ask clients for all required documents and consider specializing in a particular type of business.

How do I protect sensitive client tax information?

Use encryption, strong passwords and secure networks. Store physical files in locked, fireproof cabinets. Sign confidentiality agreements with clients and follow IRS Publication 4557 on safeguarding data.

Can I deduct business expenses on my own taxes?

Yes, self-employed tax preparers can deduct eligible home office, mileage, training, supplies, software, marketing and other business expenses. Keep diligent records.

Do I need business insurance as a tax preparer?

Tax preparer liability insurance protects you if clients sue over errors. General liability also covers property damage. Evaluate the risks to choose appropriate policies.

Key takeaways

This growing need for qualified tax preparers presents you with a lucrative chance to put your expertise to use while giving you the freedom to work from anywhere. You can create a successful tax preparation business if you:

- Obtain the necessary credentials

- Establish a legal entity and home office

- Implement client acquisition strategies

- Deliver niche services or value beyond just tax prep

While launching a tax business requires research, planning and upfront work, this guide outlines key steps to get you started on solid ground. With passion for the work, commitment to ongoing learning and smart leveraging of available technology, you can establish a thriving home-based company that allows you to prosper while making a difference in clients’ lives.

Thank you! The eBook has been sent to your email. Enjoy your copy.

There was an error processing your request. Please try again later.

Looking to boost your firm's profitability and efficiency?

Download our eBook to get the answers