An agreement that clearly states the expectations both for your clients and your firm is likely at the top of your mind. For the sake of stability, it is important to list the services you provide and how much these will cost — upfront.

This is where an accounting engagement letter comes in. Below we explain what an accounting letter is, why you should always have one and which mistakes you should avoid. And just so you also have a reference point, there’s a template at the bottom of the article you can use. First things first though.

What is an accounting engagement letter?

An engagement letter in accounting is a legally binding contract between you and a client. It outlines your relationship and defines crucial details, such as fees, scope of services and responsibilities.

Engagement letters are a great way to entice prospective clients and clearly lay out your terms and conditions. This allows clients to easily understand what you’re offering and what’s required on their side, which can also save you time.

Why you should always have an engagement letter

It’s a good idea to offer an accounting engagement letter to each client for several reasons. An engagement letter:

- Outlines the scope of your work

- Makes your agreement legally binding

- Helps avoid misunderstandings

- Prevents clients from asking for services which were not included in the letter

Last but not least, consider drafting separate engagement letters for different services – for the sake of clarity.

What to include in an accounting engagement letter

There are a couple of things you should consider when writing an engagement letter. Here are some of the most important things to keep in mind:

Expectations

Outline them as clearly and thoroughly as possible. The main expectations include:

- Timeline. Simply put, the most important milestones of the work you do — after the client signs, and provides, all the necessary documents.

- Pricing. Fees and payment terms fall into this category. If you offer multiple services, make sure to provide a price breakdown for each.

- Deadlines. When is your work due? You can also throw in stipulations that state the client must provide all the necessary documents before a certain date and time in order for the deadline to be met.

- Scope. The scope of your work and the particular services you’re offering.

Outlining mutual expectations helps eliminate potential misunderstandings in the future.

Responsibilities

Both you and your client will have certain responsibilities. The most likely ones are:

- Client supplying accurate information

- Client providing all crucial financial documents

- Firm delivering reports and/or documents

- And more, depending on individual circumstances

Your entire relationship with the client for the duration of you working together will be transparent and predictable — if you spend time outlining responsibilities.

Service Details

Your accounting firm may offer a variety of services to meet the needs of your clients. Detailing those services can help prevent misunderstandings and clarify expectations. When defining service details you can also include deadlines and fee structures.

If you find yourself looking for a convenient way to list the services you offer, TaxDome can help you out.

Want to learn more?

You can easily draft and send contracts & engagement letters using TaxDome. Just ensure that both parties fully understand and agree to the services you offer by listing them.

Other considerations when drafting an engagement letter

Update engagement letters annually

You should send new engagement letters every year, as the services you offer will surely evolve and change. Updating your letters to reflect these changes will also:

- Limit your liability for prior years

- Ensure all potential price increases are reflected

- Exclude services you no longer offer — or your client doesn’t need

Make engagement letters part of client onboarding

Proper client onboarding is vital for both sides. And you can easily make the engagement letter part of the process with TaxDome.

After your clients are done signing up for our portal, you can send the letter as the last step of onboarding. Once it’s signed, you can start providing the services your client needs.

Throw in these little nuggets

You should consider adding some (or maybe all!) of these to your letter:

- Your record retention policy (how long you store client info, where, and how you dispose of it when time’s up)

- Consequences and fees arising from late payments

- Mention that work results depend on the accuracy of info the client provides

What to avoid when writing an engagement letter

Customer experience and satisfaction is the order of the day: so we went ahead and rounded up some mistakes you’ll want to avoid when writing an engagement letter.

Sending it in Google Docs

Google Docs is a great tool for collaboration but relying on it for engagement letters might not be the best idea. You can neither brand nor enable e-signing with Google Docs. However, you can do both of these when using TaxDome. Which leads us to the next point…

Forcing clients to use a wet signature

Physically signing a document is neither necessary nor user-friendly. When you force clients to print and sign your letter, they’ll put it off until they have free time. The ensuing waiting period will benefit no one.

Instead, enable your clients to e-sign documents via the client portal right after onboarding — by making use of our e-signing feature. You can use go with either a simple e-signature, or rely on knowledge-based authentication (KBA). The latter is needed for IRS-compliant signatures and will require your client to pass an identification check.

E-signing documents brings improvements in several key areas:

- Security goes up by 40%

- Productivity does likewise

- Speed of signing increases by 35%

Adding “in effect” clauses

A contract should keep your liability current. If you have a contract that states it’s in effect until one party cancels it, this can lead to liability gaps.

Using generic wordings

You should write an engagement letter using language that is succinct and precise. If the wording you rely on when describing the scope of your work is vague or broad, it will expand said scope. That might lead to disputes over what your accounting firm promised vs. what it eventually delivered.

Deploying jargon

Your client is unlikely to be familiar with legal or accounting jargon. As an accounting professional, it’s easy to forget that clients may not understand the abbreviations or complicated language in your engagement letter.

Therefore, make sure to review your letter and remove (or clearly explain):

- Legal definitions

- Abbreviations

- Terms only a CPA would know

Ensure your clients can read and understand the engagement letter in its entirety, and tweak the language if necessary.

Promoting your services

Some firms use engagement letters as a final sales push. However, we would advise against that: it’s a contract you are offering your clients, not a promotional flier. At best, your effort to sell additional services might look out of place. At worst, clients might think you are tricking them into paying extra for something that is not in line with what you discussed.

Free accounting engagement letter template

Below you can find TaxDome’s free accounting engagement letter template. We have dozens more where this one came from — and that’s just one of the cool things we offer for accounting, bookkeeping and tax firms. Check out how you can grow and automate your practice below.

Accounting engagement letter[Company Name] 2024 Letter of Engagement [Your Name] [Your Address] [City, State, Zip Code] [Date] [Client’s Name] [Client’s Company Name] [Client’s Address] [City, State, Zip Code] Dear [Client’s Name], We are pleased to confirm our understanding of the terms and objectives of the accounting services we will be providing to you, [Client’s Name] (hereinafter referred to as “Client”). This letter will serve as the formal agreement outlining the scope of work, responsibilities, and other relevant details related to the engagement. 1. Scope of Services: We will provide the following accounting services to the Client:

2. Responsibilities of the Client: The Client agrees to provide the following information and cooperation necessary for the performance of the services:

3. Fees and Payment Terms:

4. Term of Engagement: This engagement will commence on [Start Date] and will continue until [End Date] unless terminated by either party with [Specify notice period, e.g., 30 days] written notice. 5. Confidentiality: Both parties agree to maintain the confidentiality of any information exchanged during the course of this engagement. 6. Termination: Either party may terminate this engagement with written notice if the other party breaches any material term of this agreement. 7. Governing Law: This agreement will be governed by and construed in accordance with the laws of [Specify your jurisdiction]. This Agreement is fully and voluntarily entered into by the Parties. Each Party states that he, she, or it has read this Agreement, has obtained advice of counsel if he, she, or it so desired, understands all of this Agreement, and executes this Agreement voluntarily and of his, her, or its own free will and accord with full knowledge of the legal significance and consequences of this Agreement. Please indicate your agreement with the terms and conditions outlined in this letter by signing and returning the enclosed copy no later than [Due Date]. You can also sign this document electronically. Should you have any questions or require further clarification, please do not hesitate to contact us. We look forward to a successful and collaborative relationship. Sincerely, ____________________________ [Your Name] [Your Title] [Your Contact Information] ACCEPTED AND AGREED TO BY: [Client Name] By:__________________________ Client signature Date:________________________ |

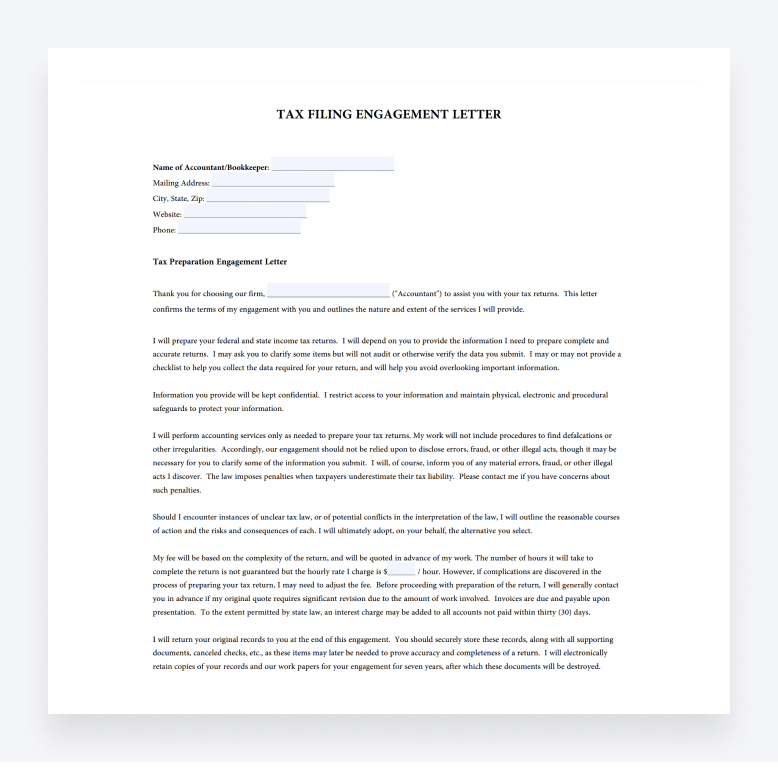

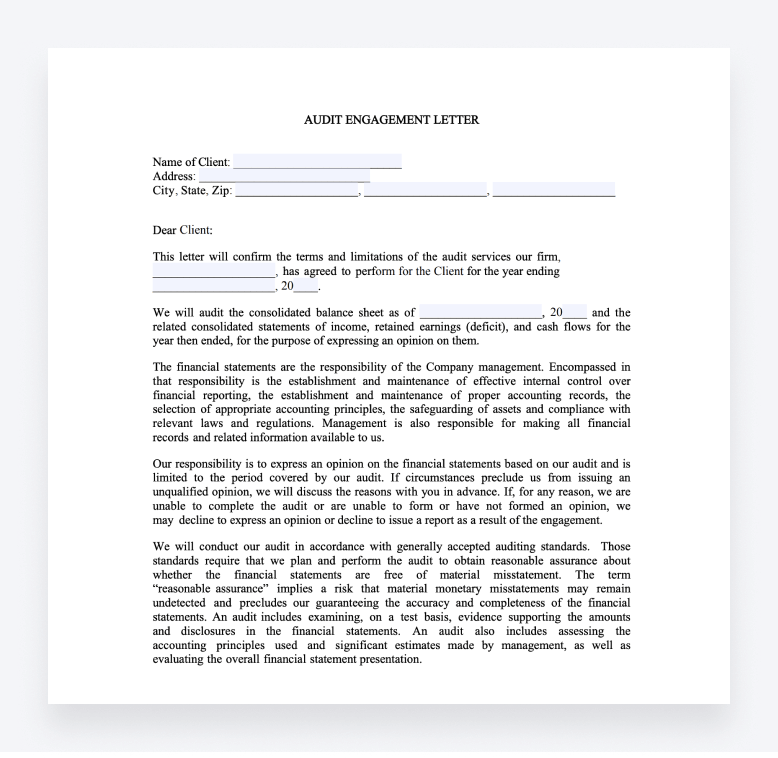

Tax filing and audit engagement letter examples

Besides a general accounting engagement letter, there are two other types that are popular in the industry: tax and audit engagement letters. So we went ahead and found some neat examples, just in case you get stuck on either one of those.

- Tax Filing Engagement Letter: a useful example of an accounting engagement letter for tax returns that outlines the services to be provided as part of the agreement, services that come at an additional cost, the terms and conditions of payment and the client’s expected responsibilities.

- Audit Engagement Letter: a useful example of an engagement letter for auditing that outlines the services to be provided, the company’s responsibilities as part of the agreement, how the client will be billed and the legal process in the event of a dispute that cannot be settled through non-binding mediation.

Final thoughts

An engagement letter is a legally binding document that protects both your firm and your client. It outlines the scope of the work you do, states the fees for your services, and incorporates mutual responsibilities and other important details. Done right, such a letter ensures a great customer experience, minimizes the risk of misunderstandings arising — and protects your firm from potential liability.

You should aim to avoid things such as sending the letter in Google Docs, making physical signing the only option, using vague language (or jargon), as well as making the letter a promotional tool.

We hope our piece will help you do exactly that. We want to wrap by providing a template engagement letter you can use — just make sure to consult a legal expert when finalizing it.

Thank you! The eBook has been sent to your email. Enjoy your copy.

There was an error processing your request. Please try again later.

Download our eBook to get the answers