IRS Form 2848 grants someone legal permission to represent a taxpayer in front of the IRS. In other words, it’s how you get a power of attorney for state tax-related matters, making it a crucial document for accountants and tax professionals.

In this article, we’ll guide you through the process of filling out form 2848, giving you the information you need to submit it with confidence. For a more general overview of Form 2848, check out our other article: What is IRS Form 2848: power of attorney? A detailed guide for accountants and tax pros.

How to file Form 2848: step-by-step instructions

Here, we’ll walk you through Form 2848 section by section, explaining exactly what information you need to provide and where.

Part I: Power of Attorney

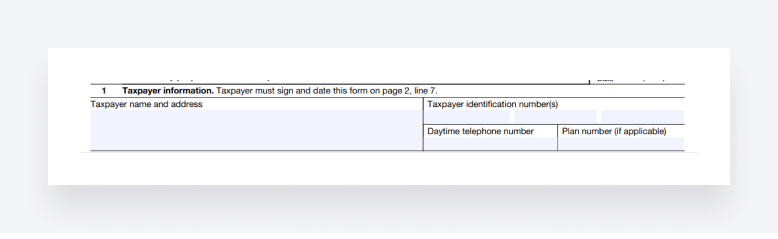

1: Taxpayer information

The first section is all about capturing the taxpayer’s relevant personal information. You’ll find boxes for filling in their:

- Name and address

- Taxpayer identification number (TIN)

- Telephone number

- Plan number (if applicable)

For more detailed information about what to put for specific types of organizations, see the IRS’s official instructions.

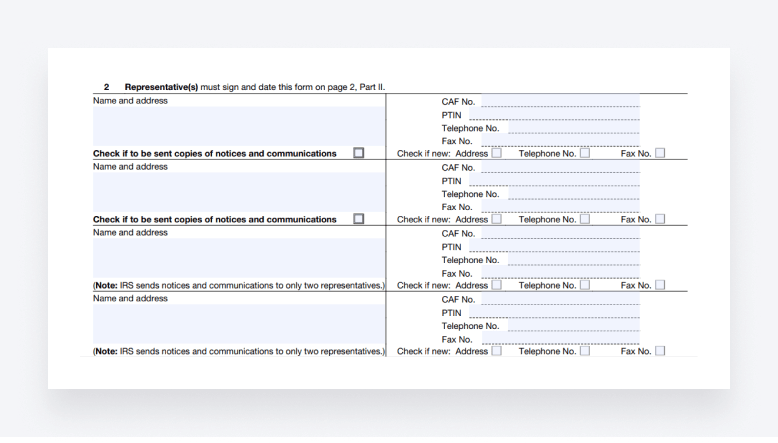

2. Representative(s)

Next up, you need to add all relevant information about the representative(s) who will be granted the power of attorney. This information includes their:

- Name and address

- Centralized Authorization File (CAF) number

- Preparer Tax Identification Number (PTIN)

- Telephone and fax numbers

If you (or any other representative) have not yet been assigned a CAF number, write “None”. The IRS will then issue one directly once the form has been processed. If the representative has applied for a PTIN but has not yet received it, write “Applied for” in the PTIN field.

At the bottom of each name and address box, you’ll see a checkbox that should be checked if that particular representative should receive copies of notices and communications from the IRS relating to the taxpayer. Please note that only two representatives can be selected to receive such communications.

There are also checkboxes that you can select if any of the addresses, telephone numbers or fax numbers you are providing are new.

You’ll also note that there is space for four representatives on Form 2848. If more representatives need to be added, you can attach a supplementary form 2848 with information about any additional representatives.

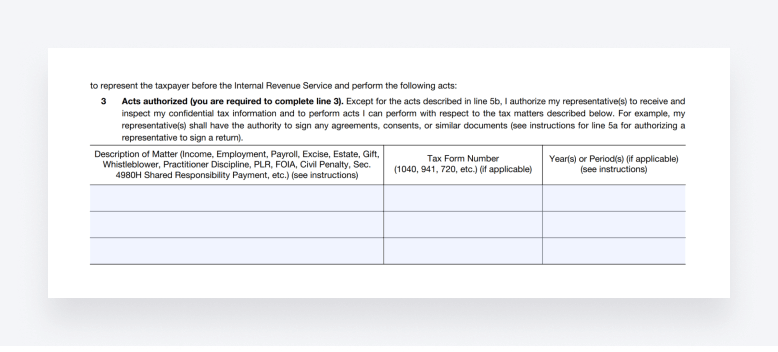

Section 3 is where you specify the scope of the power of attorney — what matters the representative(s) will be authorized to assist in and during which periods. There are three boxes to fill in:

- Description of matter

- Tax form number

- Year(s) or period(s)

For example, you could enter “Income”, “1040” and “2023” in the respective boxes if you want the power of attorney to cover the client’s individual income tax return.

The IRS has the following information and tips when it comes to filling out periods:

- Entering a year covers all four quarters for that calendar year

- To list consecutive periods (e.g. years or quarters), use “through”, “thru” or a hyphen

- For fiscal years, enter the ending year and month in the following format: YYYYMM

- Avoid general descriptions such as “All years”

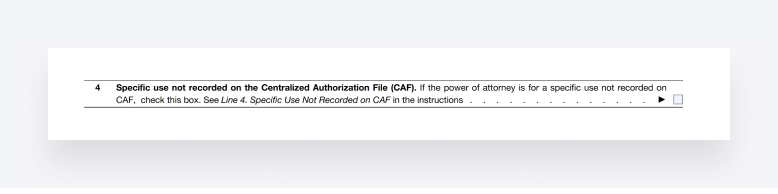

4: Specific use not recorded on the CAF

The IRS records powers of attorney on the CAF system, an IRS computer database that contains information about the authority granted to people through the power of attorney. However, there are some specific cases when the IRS does not record this information in the CAF system. You’ll find a list of those cases in section 4 of the IRS’s official instructions.

If the power of attorney you are applying for is for a use not recorded in the CAF system, you’ll need to check this box.

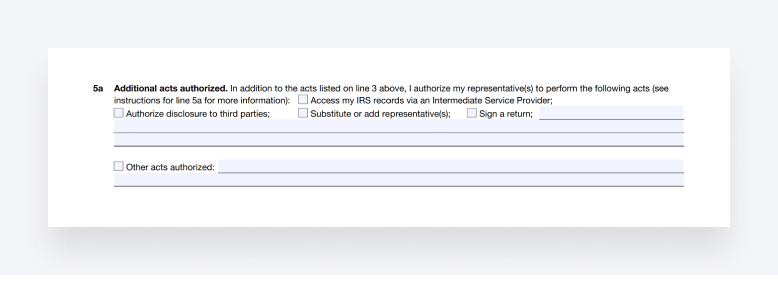

This section allows you to provide information about additional acts authorized. It includes checkboxes for the following acts:

- Access my IRS records via an Intermediate Service Provider

- Authorize disclosure to third parties

- Substitute or add a representative(s)

- Sign a return

- Other acts authorized

Check the relevant boxes that apply to you.

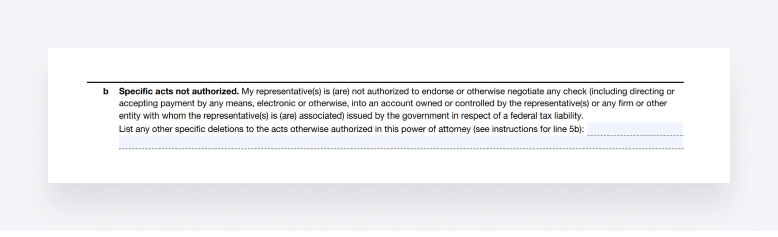

Form 2848 also allows you to explicitly name the acts that the representative won’t be authorized to perform. You can include any such examples in this section.

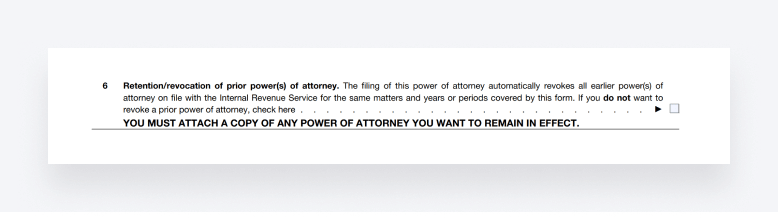

6: Retention/revocation of prior power(s) or attorney

Once the IRS records your new power of attorney in the CAF system, they will revoke all previously granted powers of attorney for the same matters and periods automatically. You can specify, however, that you do not want the IRS to revoke existing powers of attorney by checking the box in this section.

Be sure to attach a copy of the power(s) of attorney you wish to stay active.

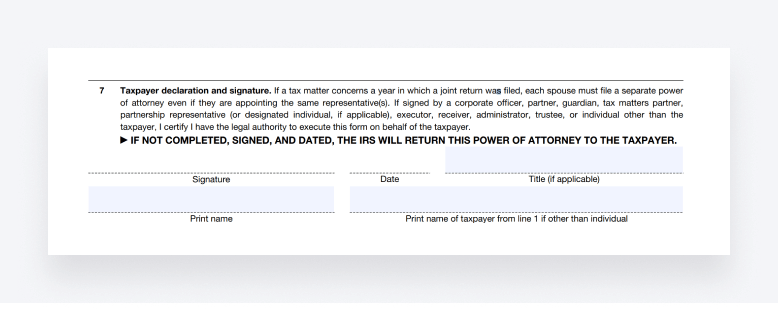

7: Taxpayer declaration and signature

To wrap up the power of attorney part of Form 2848, you need to get your client to sign and date the form. If you are submitting the form by mail or fax, signatures must be handwritten. But if you are sending it digitally, you can use e-signatures as well.

For individuals, this part is straightforward. But if the taxpayer is an entity, the IRS provides specific instructions on who should sign:

- Corporations and associations: an officer with legal authority should sign

- Partnerships: all partners must sign and enter their exact titles

- Estates: the executor (or one co-executor if there are multiple) should sign

For more detailed information, see the IRS’s official instructions.

Please note that the taxpayer should sign Form 2848 first, before any representatives sign it.

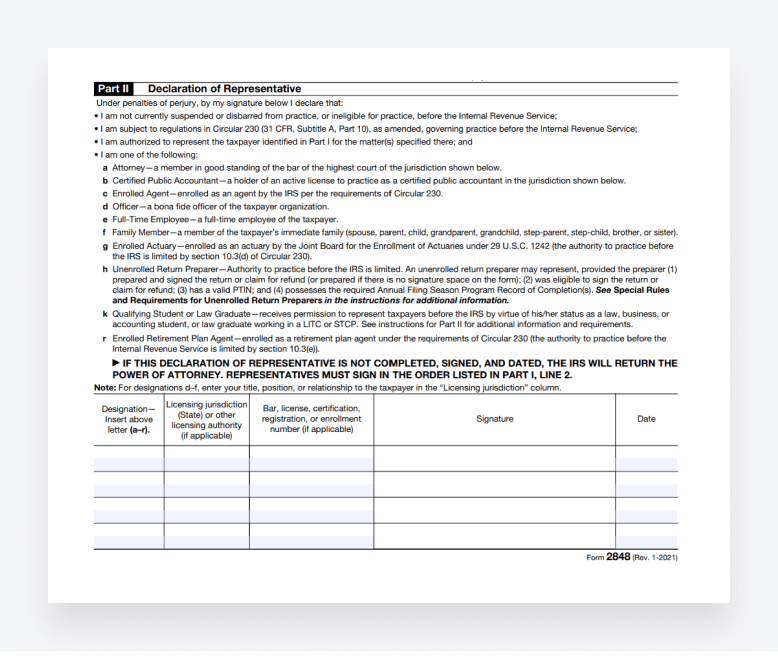

Part II: Declaration of representative

The second part of Form 2848 is the representative’s declaration. Here, you officially declare that you are fit to represent the taxpayer in the matters outlined in the form. If there are multiplied representatives, they must sign this section in the order outlined in section 2.

The representative(s) will also have to provide details about their licensing jurisdiction, as well as any professional identification numbers (if applicable).

Common mistakes to avoid when filling out Form 2848

To get your power of attorney granted as smoothly as possible, you’ll need to ensure that you fill out Form 2848 with diligence and attention to detail — or face unnecessary delays and issues further down the road.

In this section, we’ll highlight some of the most common mistakes to avoid when filling out Form 2848.

Incomplete or inaccurate information

One of the most common mistakes people make when filling out Form 2848 — or any IRS form for that matter — is failing to provide accurate and complete information on the form. This could include details about the taxpayer, representative(s) and the specific tax matters covered.

Inaccuracies or omissions can lead to delays in processing and may result in the IRS rejecting the form.

Specifying an inadequate or incorrect scope of authority is another common mistake. Make sure you clearly define the matters you are authorized to handle on behalf of the client. Failing to do so may result in you being unable to address certain issues, leaving the client vulnerable.

Unspecific or vague information

We touched on this earlier, but it’s worth repeating. When defining the tax matters and periods you want your power of attorney to cover, make sure you are as specific as possible. Being vague or too general could lead to confusion, misunderstanding and delays.

Outdated or expired forms

Using outdated or expired versions of Form 2848 is a surprisingly common mistake. The IRS regularly updates its forms, and using an obsolete version can lead to rejection or processing delays.

Make sure you always use the most up-to-date version of the form.

Incorrect signatures

Both the taxpayer and the representative must sign Form 2848. Failing to obtain the required signatures, or having signatures that do not match the names on file, can render the form invalid.

If there are multiple representatives, it’s also important to make sure that they sign in the order they are written in section 2 of the form.

Neglecting updates and changes

Tax situations evolve, and clients’ circumstances may change. Failing to promptly update Form 2848 with relevant information can lead to misunderstandings and missed opportunities.

Where to file Form 2848

There are three ways you can submit your Form 2848:

- Electronically

- By mail

- By fax

To submit your form electronically, you’ll need to create a Secure Access account with the IRS. You can then submit the form via the portal.

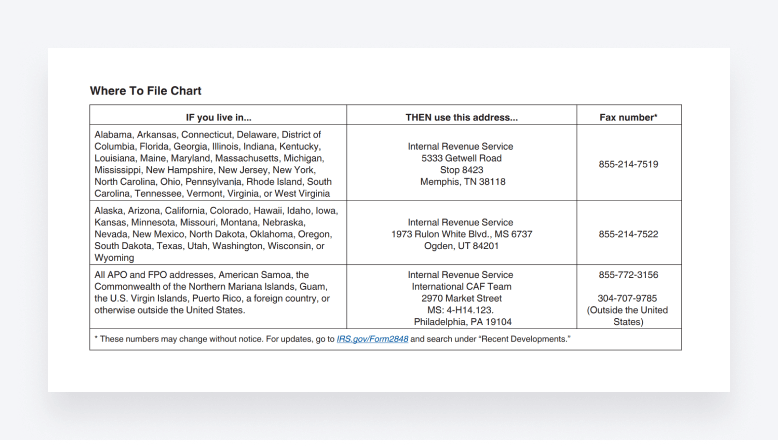

To mail or fax your form, you’ll need the right mailing address or fax number, respectively. Here’s the guidance from the IRS instructions:

Conclusion

Form 2848 is an essential tool in any US-based accountant or tax professional’s toolbelt. It gives you the legal authority to act on behalf of your clients in matters relating to the IRS. But to avoid unwanted delays or issues, you must fill it out with information that is relevant, complete and accurate.

We hope this guide will help you do just that.

Thank you! The eBook has been sent to your email. Enjoy your copy.

There was an error processing your request. Please try again later.

What makes the best accounting firms thrive while others struggle to keep up? We analyzed our top 20 TaxDome firms, representing over $100M in combined revenue, to uncover the strategies driving their success.