If you’re not sure if you need to file Form 5472, this guide is here to help.

IRS Form 5472 is a US tax form for foreign-owned corporations engaged in US trade or business. The form is filed to report certain information to the IRS, such as ownership details and transactions.

You might need to file Form 5472 if you’re an expat business owner, or if your business is owned by a foreign national.

We’ve made this Form 5472 guide as straightforward as possible. Let’s take a closer look at the purpose of Form 5472, who needs to file Form 5472, the filing requirements and more.

What is IRS Form 5472?

The IRS wants information about US businesses with foreign ownership — and it collects that information through IRS Form 5472.

The form mainly applies to US corporations that have at least 25% foreign ownership, as well as foreign corporations that carry out trade and business in the US.

For these corporations, the IRS requires an annual filing of Form 5472 (under U.S. Code section 6038A and U.S. Code section 6038C) to collect information about ownership, business structure and transactions with foreign related parties.

Who needs to file Form 5472?

You’ll need to file Form 5472 if your business is one of the following:

- A US corporation with 25% or more of its stock owned by a non-US person or entity

- A disregarded entity (such as a single-member LLC) with 25% or more of its stock owned by a non-US person or entity

- A foreign corporation conducting trade or business in the US

Even if your business had temporary 25% foreign ownership at any time of the tax year, you are still required to file Form 5472.

Important to note: If your business is required to file Form 5472 but you fail to file it correctly or when due (by the deadline), it can result in a penalty from the IRS of $25,000.

Form 5472 examples

Expanding on the above, here are a few examples of businesses that would be required to file IRS Form 5472:

- Business A is US-based but has a foreign shareholder (an individual or entity) that owns 25% or more of the corporation’s total stock, so it must file Form 5472

- Business B is US-based, but had a foreign shareholder at one point during the tax year who owned 25% or more of the corporation’s total stock, so it must file Form 5472

- Business C is a US-based LLC treated as a disregarded entity, but because it is foreign-owned, it must file Form 5472

- Business D is not based in the US, but as it sells most of its products to customers living in the US, it must file Form 5472

If these examples are comparable to your own business, then it’s likely that you will need to file Form 5472.

Key components of Form 5472

Form 5472 is a three-page form, with nine parts and a total of 52 lines that can be filled in. However, you might not need to fill in all of Form 5472, as some parts and lines do not apply to all businesses.

To give you a brief overview, Form 5472 consists of the following parts:

- Reporting Corporation

- 25% Foreign Shareholder

- Related Party

- Monetary Transactions Between Reporting Corporations and Foreign Related Party

- Reportable Transactions of a Reporting Corporation That Is a Foreign-Owned U.S. D.E

- Nonmonetary and Less-Than-Full Consideration Transactions Between the Reporting Corporation and the Foreign Related Party

- Additional Information

- Cost Sharing Arrangement (CSA)

- Base Erosion Payments and Base Erosion Tax Benefits Under Section 59A

Form 5472 filing requirements and deadlines

You must file Form 5472 as an attachment to your income tax return. As a result, the address and deadline for filing Form 5472 are the same as the address and deadline for your income tax return.

For foreign-owned US-based disregarded entities (that do not have to file income tax returns), the filing requirements are different. Foreign-owned US-based disregarded entities are required to file Form 5472 with Form 1120. In this case, the deadline for foreign-owned US-based disregarded entities filing Form 5472 is the same as the deadline for filing Form 1120.

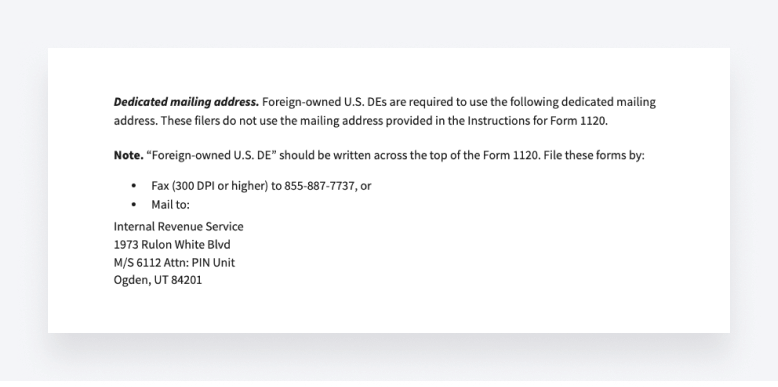

In addition, foreign-owned US-based disregarded entities must file Form 5472, along with Form 1120, to an IRS address (shown below) that’s different from the address stated in Form 1120.

Electronic filing of Form 5472

It’s possible to file Form 5472 electronically. You can do this by filing Form 5472 through an Approved IRS Modernized e-File (MeF) Business Provider.

However, for businesses that are foreign-owned US disregarded entities, it’s not possible to file Form 5472 electronically.

Extensions and amending Form 5472

Extensions for Form 5472

As mentioned above, Form 5472 must be filed with your income tax return, before the deadline of that income tax return. An IRS-approved extension you have for filing your income tax return is therefore an extension for filing Form 5472.

So, if you need an extension for filing Form 5472, you must apply for an extension for filing your income tax return.

For foreign-owned US-based disregarded entities filing Form 5472 with Form 1120, an IRS-approved extension for filing Form 1120 is an extension for filing Form 5472.

Amending Form 5472

Unfortunately, there are no official IRS guidelines on how to amend Form 5472. If you think you have made a mistake, it’s best to contact the IRS directly to avoid any issues.

The IRS may ask you to resubmit Form 5472 with the amended information and a written explanation of any mistakes and corrections.

Try to avoid the hassle – plus the risk of receiving a penalty. Like any form, it’s always worth taking the time to double-check the form requirements and the details you have provided before filing Form 5472.

FAQs about Form 5472

Who is required to file Form 5472?

US-based corporations and foreign-owned US disregarded entities with 25% foreign ownership, at any time of the tax year, must file IRS Form 5472. Foreign corporations that conduct significant business in the US must also file Form 5472.

What are the consequences of not filing Form 5472 or filing it late?

Failing to file Form 5472 or filing it past the deadline can result in a penalty from the IRS of $25,000. Failing to file Form 5472 for another 90 days after being notified by the IRS can result in an additional penalty of $25,000.

Are there any exemptions from filing Form 5472?

There are some exemptions from filing Form 5472 for certain businesses. As an example, your business can be exempt from filing Form 5472 if it has no reportable transactions that need to be reported to the IRS during a given tax year.

What information is required on Form 5472?

If your business needs to file Form 5472, some of the information that’s required on Form 5472 includes details about your corporation, foreign shareholders and related parties, plus additional information required in part seven of Form 5472.

Form 5472 differs from other IRS forms related to foreign entities, such as Form 8865 and Form 5471, as it is the primary IRS form for collecting information about certain US corporations with foreign ownership and foreign corporations conducting business in the US.

Can Form 5472 be filed electronically, and if so, how?

You can file Form 5472 electronically through an Approved IRS Modernized e-File (MeF) Business Provider. However, if your business is a foreign-owned US disregarded entity, it is not possible to file Form 5472 electronically.

What should I do if I realize I made a mistake on my filed Form 5472?

If you think you have made a mistake, it’s best to contact the IRS directly to avoid any issues, including penalties. The IRS may ask you to resubmit Form 5472 with the amended information and a written explanation of any mistakes and corrections.

Are there any specific deadlines for filing Form 5472?

The deadline for filing Form 5472 is the same as the deadline for filing your income tax return, as both must be submitted together. For foreign-owned US-based disregarded entities, the deadline for filing Form 5472 is the same as the deadline for filing Form 1120.

How can I amend a previously filed Form 5472?

If you need to amend a previously filed Form 5472, it’s best to contact the IRS for instructions on which steps to take. This can help you avoid any issues, including penalties. You may be asked to resubmit the form with a written explanation of the mistakes and amendments.

Where can I find more information or assistance with Form 5472?

You can find more information and assistance with Form 5472 on the IRS website, including form instructions and details for telephone assistance. You can also receive help with filling in and filing Form 5472 by consulting a tax professional.

Conclusion

To wrap up, IRS Form 5472 is used to collect information about certain foreign-owned corporations in the US, as well as foreign corporations that trade or conduct business in the US.

Filing Form 5472 is required for corporations that have 25% foreign ownership at any time of the tax year, foreign-owned US-based disregarded entities, and foreign corporations that do business in the US.

Don’t forget: If your business is required to file Form 5472, failing to file it can result in penalties.

We hope this guide helped you better understand Form 5472 – what it’s for, who it’s for and the filing requirements.

Thank you! The eBook has been sent to your email. Enjoy your copy.

There was an error processing your request. Please try again later.

Looking to boost your firm's profitability and efficiency?

Download our eBook to get the answers