Having the right CRM system is crucial for nurturing client relationships, from first contact to long-term retention. To help you choose the best tool, we’ve researched and compared the top 12 CRMs for accountants on the market.

In this article, we’ll focus on what features make an accounting CRM effective. Whether you’re shopping for your first system or upgrading an existing one, you’ll learn what to look for to take your firm to new heights.

Integrations with key software

Trying to manage client data across multiple systems often leads to inefficiencies. That’s why it’s important for an accounting CRM to easily integrate with your key software: tax preparation programs, payment processing services, business apps, and more.

For example, TaxDome offers more than 2,000 integrations with tax and accounting solutions, payment providers, marketing tools, schedulers, and more. The platform also has an official integration with the IRS.

By connecting your CRM to these core systems, you can keep all client information centralized and up-to-date, allowing you to work more efficiently and provide a better, more personalized service to your clients.

Client and account management

Client management is the core purpose of any CRM system. But the depth and sophistication of this feature are what make all the difference.

The ideal CRM for accountants should provide a comprehensive client management hub. This includes the ability to easily track contact details, communication history, account status, and other key data for both current and prospective clients. Advanced features such as custom fields, tags, filters, and bulk actions can help you configure the CRM to fit your firm’s unique workflows.

In TaxDome, you can view all this key information, including statuses, tasks, assignees, etc., on a single dashboard. This makes it simple to manage the full client lifecycle, from initial lead capture to ongoing service delivery.

Workflow automation

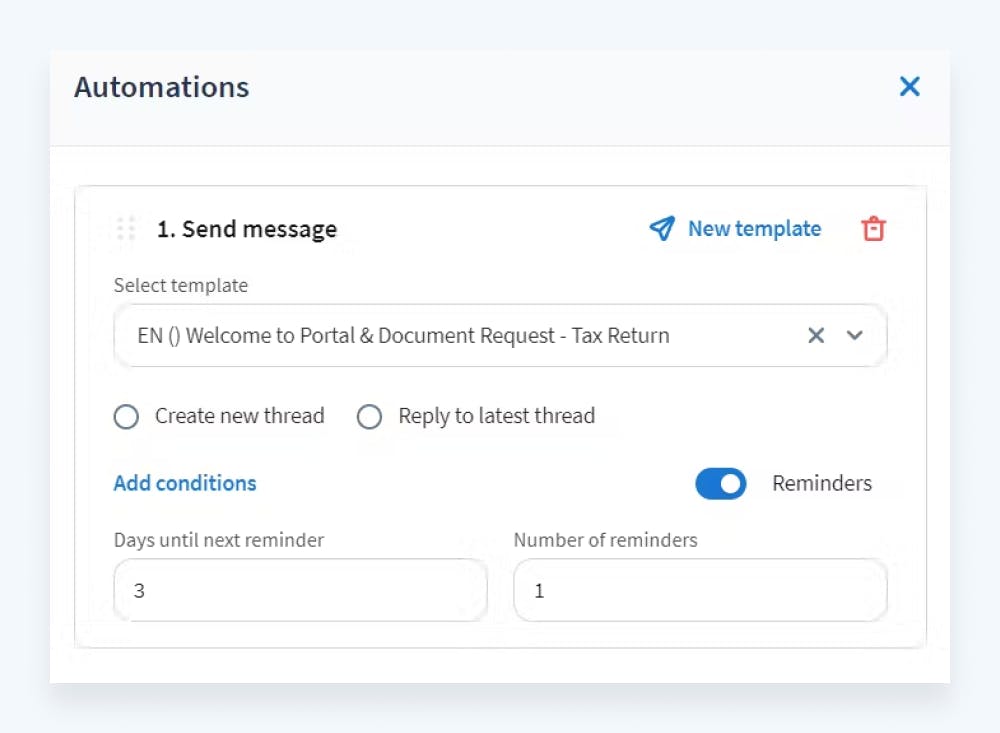

Chasing paperwork and issuing invoices are just two of the many repetitive admin tasks that accountants face daily. To save you time, an effective CRM should streamline at least some of these processes, such as:

- Client onboarding, with email and contract templates, e-signature capabilities, and secure document sharing

- Data management, with the ability to automatically store client data and documents in a centralized location

- Payment processes, with time tracking, billing, invoicing, and online payment processing features

This keeps clients on track without requiring constant manual outreach from your team.

For example, TaxDome’s automation features include the ability to automatically notify clients about pending organizers, contracts, invoices, chat messages, signatures, approvals, and more.

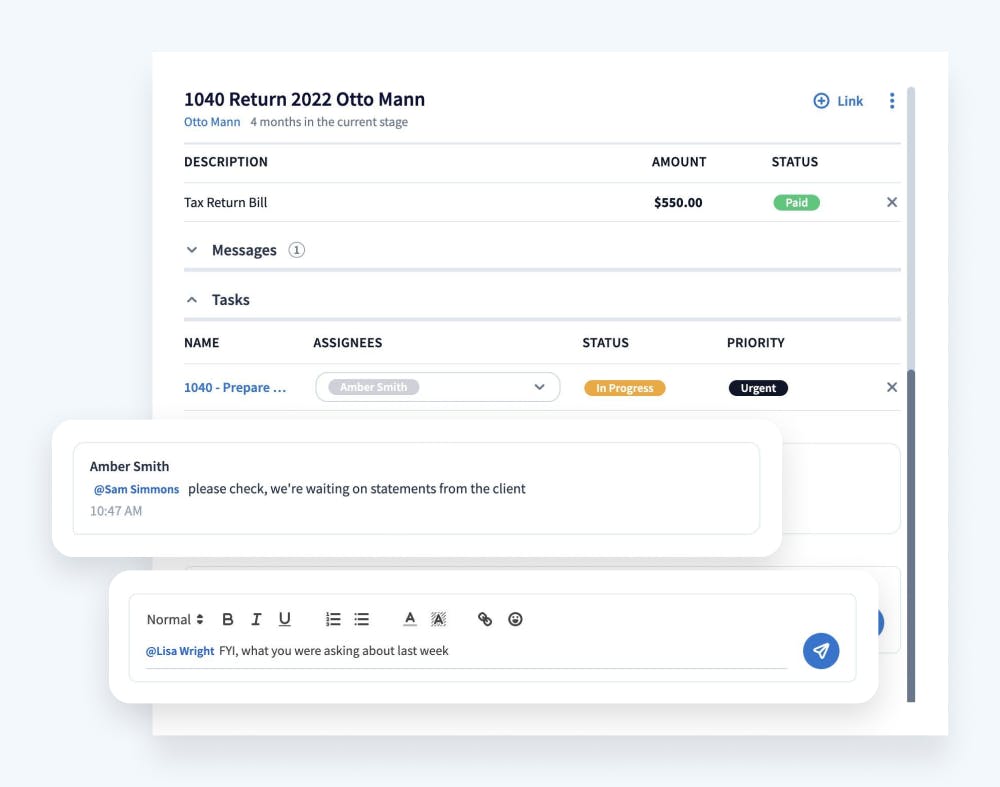

Team collaboration

Accounting is a team sport — but siloed communication can hinder even the most talented professionals. An effective CRM should provide the collaborative tools to keep your staff focused, aligned, and working in harmony.

This includes the ability to connect tasks, check responsibilities, and set deadlines so everyone knows what needs to get done. Flexible role-based permissions let you control access and visibility across the team. And the ability to mention colleagues across jobs, tasks, chats, and other contexts fosters stronger coordination.

With TaxDome, you can expand the limits of teamwork. It allows users to “follow” client accounts, staying updated on their activities. Customizable notifications also help everyone stay in the loop based on their individual preferences.

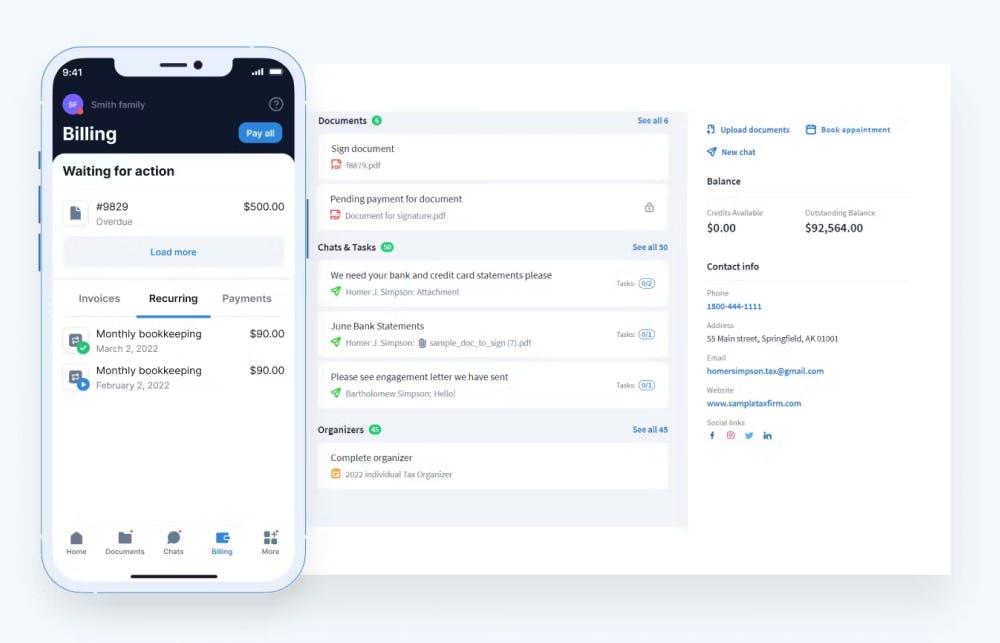

Client self-service tool

By empowering clients to self-serve, you can free up your team to focus on higher-value work. The client also benefits from a more convenient experience as they independently access information and perform key tasks, such as uploading documents or paying invoices.

For example, TaxDome’s client portal allows clients to communicate, e-sign docs, and even track the status of their work — all within a centralized workspace.

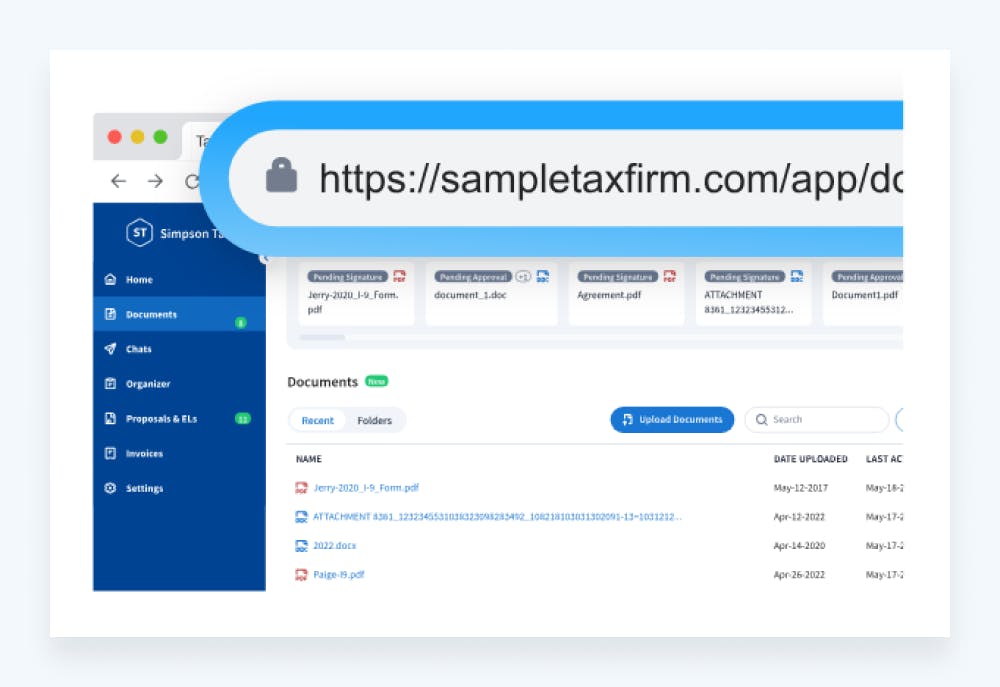

Security

Data security and regulatory compliance are critical considerations for accounting firms dealing with sensitive financial information. A good accounting CRM should provide:

- Secure document management with encryption and access controls

- Adherence to regulatory requirements, including GDPR and SOC 2

- Two-factor authentication and role-based permissions

- Secure client portals and data-sharing channels

- Data backup and recovery measures

By prioritizing robust security protocols, accounting firms can safeguard client data, mitigate risks, and build trust around data-handling practices.

Brand-building

Make sure your CRM strengthens rather than detracts from your brand. You might want to choose one that lets you add your firm’s visual identity to the client-facing experience, from the login page to the mobile app. These platforms, such as TaxDome, feel like an extension of your accounting practice, not a third-party tool.

Reporting

An accounting CRM is a treasure trove of valuable data — from client activity to team productivity. But to harness the true power of this information, you need robust reporting capabilities.

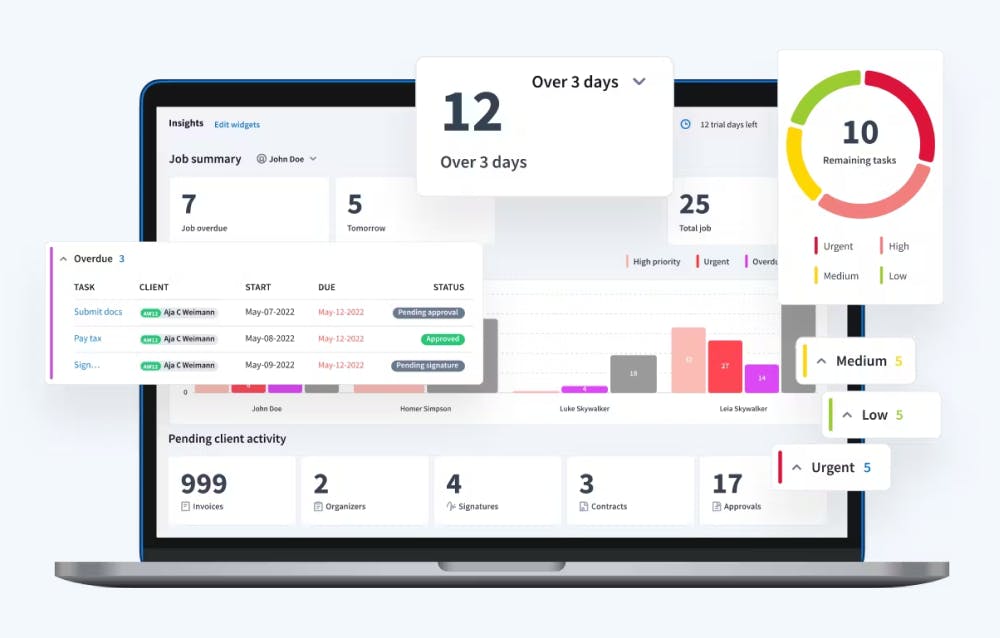

In the long run, this will allow your firm to optimize sales and marketing efforts, improve customer lifecycle management, and increase revenue. With TaxDome, you can view all your firm’s key insights on a highly customizable dashboard, adding and deleting widgets to surface the most important metrics.

Key takeaways

A good accounting CRM acts as a hub for all the information, emails, and tasks related to managing clients. Among the most important features are:

- Integrations with tax software, billing systems, and other core accounting tools

- Comprehensive client and account management capabilities

- Workflow automation for streamlining routine tasks

- Collaboration tools for seamless teamwork

- Client self-service portals

- Robust security and compliance measures

- Brand customization options

- Insightful reporting and analytics

When evaluating CRM options, be sure to find a solution that strikes the right balance between robust features and affordability for your firm’s needs. Don’t simply go for the cheapest or most expensive option — prioritize long-term value and scalability.

Take the time to thoroughly assess your requirements, research leading CRM providers, and test out different platforms. With the right accounting CRM as the backbone of your tech stack, you’ll be well-equipped to thrive in an increasingly digital-first world.

Thank you! The eBook has been sent to your email. Enjoy your copy.

There was an error processing your request. Please try again later.

What makes the best accounting firms thrive while others struggle to keep up? We analyzed our top 20 TaxDome firms, representing over $100M in combined revenue, to uncover the strategies driving their success.