Every accounting practice manages sensitive financial data on a daily basis. At TaxDome, we want you to be able to handle this responsibility with ease. For this reason, we’re happy to announce that TaxDome has attained SOC 2 certification: a testament to our commitment to providing you and your clients with multi-layered, industry-leading security and privacy.

What is the SOC 2 report?

The SOC 2 (System and Organization Control) report is an independent, third-party evaluation of a service provider’s adherence to critical trust service criteria established by the American Institute of Certified Public Accountants (AICPA). This rigorous audit examines an organization’s systems and controls related to security, availability, processing integrity, confidentiality, and privacy.

SOC 2 certification is particularly relevant for technology and cloud-based companies such as TaxDome, as it assesses the effectiveness of our security measures.

The power of SOC 2 certification

For accounting firms, top-level data security, continuous access to critical information, and maximum processing integrity are non-negotiables. SOC 2 certification confirms that TaxDome’s protocols are compliant across five key areas:

- Security: safeguarding client financial data and records from breaches and unauthorized access

- Availability: ensuring uninterrupted access to client data and systems for timely service delivery

- Processing integrity: preventing errors in financial calculations, tax filings, and bookkeeping

- Confidentiality: maintaining strict confidentiality of sensitive client information and records

- Privacy: complying with data privacy laws and regulations for personal and financial data

Benefits for your firm

By partnering with TaxDome and leveraging our SOC 2 compliant system, you unlock a host of advantages for your firm and clients:

- Fortified data security: minimize breach risks and unauthorized access with our rigorous safeguards

- Seamless operations: ensure timely service delivery through our reliable system

- Superior client experience: provide customer service that includes industry-leading security measures

- Regulatory compliance: uphold robust privacy practices to earn client confidence

- Trusted partnership: stand out as a reliable partner in information protection

- Effortless scaling: our SOC 2-compliant infrastructure means you never have to compromise security, privacy, or service in order to grow

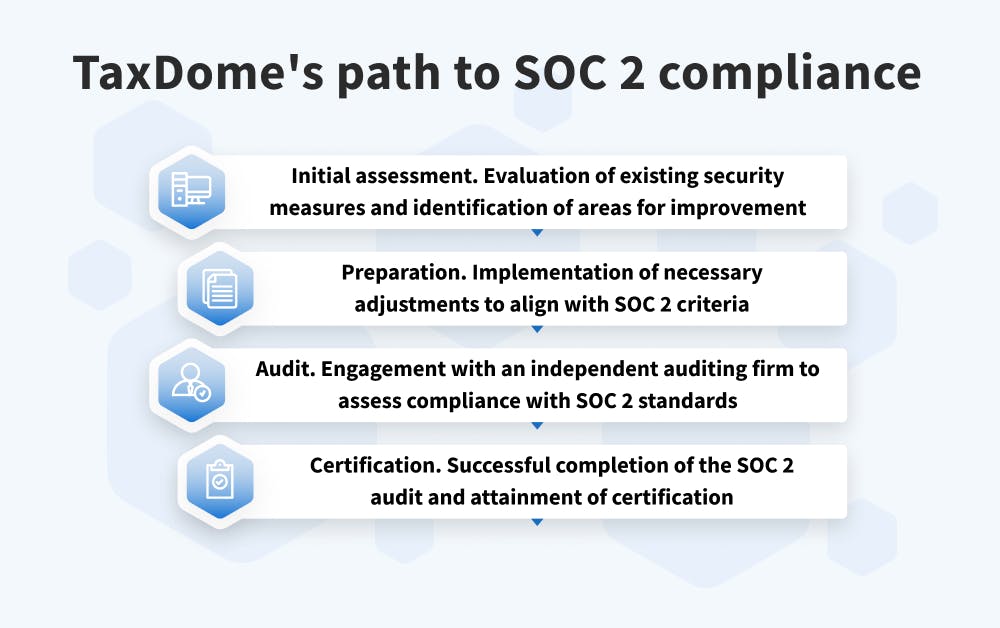

TaxDome’s SOC 2 journey

SOC 2 certification involves a thorough evaluation of systems, data practices, and security controls. An independent auditing firm scrutinized TaxDome’s operations to ensure alignment with SOC 2’ criteria.

Should you have any questions or wish to request our SOC 2 report, please contact help@taxdome.com.

Continuous improvement

At TaxDome, we don’t just meet standards; we surpass them. Our dedication to continuous improvement sets us apart from other platforms. By undergoing regular third-party audits and assessments, we proactively strengthen our defenses against evolving cyber threats so that you and your clients can rest easy knowing you’re safe.

Experience the future of secure, client-centric accounting services with TaxDome. Book a personalized demo now and witness how you can set the stage for growth and elevate your firm’s client experience to new heights.

Thank you! The eBook has been sent to your email. Enjoy your copy.

There was an error processing your request. Please try again later.

What makes the best accounting firms thrive while others struggle to keep up? We analyzed our top 20 TaxDome firms, representing over $100M in combined revenue, to uncover the strategies driving their success.