When it comes to running a successful business, keeping accurate financial records is non-negotiable. But despite its importance, not all businesses have the time or resources to handle bookkeeping in-house.

Sixty percent of small business owners admit that they aren’t confident when it comes to finance and accounting. And when you consider that small businesses account for 99.9% of all businesses in the US, you can see the huge demand for professional bookkeeping services.

No wonder there are now well over 300k bookkeeping and payroll businesses in the US, representing a 1.5% increase since last year.

There are tons of great reasons to start a bookkeeping business beyond just the thriving demand. Running a bookkeeping business is a highly flexible and autonomous career, and the barrier to entry is relatively low compared to other business ventures — but more on that later.

In this article, we’ll explain everything you need to know about starting a bookkeeping business, covering:

- The key advantages

- The essential traits of a successful bookkeeper

- A step-by-step guide to getting started

Ready? Let’s dive in.

What is a bookkeeping business?

At the heart of every successful company’s financial operations is a diligent bookkeeper, there to manage the business accounts, track transactions and ensure that everything’s in order.

Some businesses handle bookkeeping and accounting in-house, but this requires a level of bookkeeping expertise and experience, not to mention the costs associated with bookkeeping software. Handling bookkeeping in-house without the right level of expertise and experience can lead to expensive mistakes.

With this in mind, many other organizations choose to outsource this function to a bookkeeping business. For a monthly fee, they can then hand over all bookkeeping-related processes to a professional. Not only does this result in fewer mistakes, but it also tends to be cheaper.

What are the benefits of starting a bookkeeping business?

Thinking of venturing into the bookkeeping world? Well, there are plenty of good reasons to. Whether you’re a seasoned accountant or a relative newcomer, starting a bookkeeping business can be a game-changer for your career and lifestyle.

Here are some of the key benefits of starting a bookkeeping business:

1. Flexibility

Tired of the nine-to-five grind? Owning a bookkeeping business means you can dictate your work hours. You can choose to work during your most productive hours, making work more enjoyable and fulfilling.

2. Financial rewards

Bookkeeping isn’t just a vitally important service. It can also be a financially rewarding one. Businesses depend on accurate financial records, making skilled bookkeepers highly sought after. At the same time, the ability to set your pricing and take on as much work as you want gives you control over your income.

3. Autonomy

Starting a bookkeeping business means you’re the captain of your own ship. You decide the direction you want your business to take. You can choose whether you want to work with specific industries, offer specialized services, or even expand into related areas like financial consulting.

4. Minimal start-up costs

Compared to many other business ventures, the cost of starting a bookkeeping business is relatively low. All you really need to get started is a computer, some accounting software and a marketing plan. This makes it one of the easiest businesses to start.

5. Professional growth

Running a bookkeeping business is a continuous learning journey. To stay ahead of the curve, you’ll need to refine your financial expertise, stay updated on industry trends and enhance your business management skills. This growth not only benefits your business but also enriches your professional profile.

What essential traits do you need to be a successful bookkeeper?

Being a successful bookkeeper requires a unique blend of qualities, of which number-crunching is just one. In this section, we’ll run through some of the key skills you need to be a successful bookkeeper.

1. Meticulous attention to detail

When it comes to bookkeeping, the devil really is in the details. The smallest mistakes can be hugely costly. That’s why successful bookkeepers leave no stone unturned when tracking financial transactions.

2. Unwavering reliability

Reliability is the cornerstone of client trust. In bookkeeping, that means meeting deadlines, communicating clearly and delivering accurate reports on time. If your clients trust you with their financial data, they’ll stick around for the long term.

3. Tech-savviness

The days of manually crunching numbers are long gone. Modern bookkeepers now rely on advanced software and digital tools to streamline and automate bookkeeping processes. The ability to master new tech and adapt to the fast rate of change is key for a successful bookkeeper.

4. Ethics and integrity

Bookkeeping involves handling sensitive financial information, so ethics and integrity are of paramount importance. To be a successful bookkeeper, you need to prioritize honesty and transparency. This is how you build a solid reputation and client base.

5. Problem-solving skills

Challenges are inevitable in the bookkeeping world. Successful bookkeepers are able to solve problems with a cool head. Whether it’s reconciling discrepancies or optimizing a budget, great problem-solving skills will set you apart.

6. Effective communication skills

The financial world is full of arcane language. Your job as a bookkeeper is to break through that jargon and communicate clearly with your clients. This involves explaining complex concepts in a simple manner.

7. A customer-centric approach

It goes without saying, but putting clients first is a golden rule in bookkeeping. Successful bookkeepers actively listen to their clients’ needs, tailor their services accordingly and maintain open lines of communication.

A step-by-step guide: how to start a bookkeeping business

So now we know the advantages of running a bookkeeping business and the skills it takes to succeed. But how do you actually go about starting a bookkeeping business? In this section, we’ll run through the key steps to follow.

1. Choose your market and niche

Before you get started, it’s worth thinking about the type of clients you’d like to serve. Some bookkeeping businesses serve a wide variety of clients, while others focus on specific industries or niches.

The benefit of specializing in a particular sector is that you can differentiate yourself from others through specific expertise. In other words, you can corner a market.

Some examples of markets you can target include:

- Startups and small businesses

- E-commerce and online businesses

- Healthcare

- Construction and building

- Freelancers and creative professionals

- Traditional bricks-and-mortar retail

- Restaurants and hospitality

2. Craft a solid business plan

Next, it’s time to create your business plan, which will serve as a roadmap for the success and growth of your bookkeeping business. In practice, this involves outlining your:

- Services

- Target market

- Pricing strategy

- Marketing plan

You’ll also need to think about your business name, as well as any certification options that will help boost your expertise and brand. Becoming a Certified QuickBooks ProAdvisor, for example, will help you stand out from the crowd.

3. Officially register your business

Beyond business plans, you’ll need to navigate the various legal formalities associated with starting a new business: These include:

- Officially registering your business with the relevant authorities

- Choosing a legal structure (LLC, sole proprietorship, etc.) for your business

- Securing an employer identification number (EIN)

- Obtaining liability insurance

While it’s possible to handle this stuff yourself, there are tons of legal firms that will happily guide you through the process if you can afford it.

4. Select the right bookkeeping software

Bookkeeping is a tech-driven industry, and the tools you choose will dictate how effectively you work. Take the time to evaluate different software options, with a focus on cloud-based solutions for accessibility and efficiency.

There are tons of options out there, but popular small-business bookkeeping software solutions include QuickBooks Online, Xero, Wave and FreshBooks.

5. Set up your business infrastructure

To present your business and brand to the world, you’ll need a professional online presence. And that means a well-designed website.

You’ll also need to look at your broader tech stack. Beyond traditional bookkeeping software, you’ll want to look at tools that can enhance and automate key processes such as:

- Customer relationship management

- Marketing

- Task management

- Document management and e-signatures

- Invoicing

The more tools you use, the more complex your tech stack will be. That’s why it pays to look at practice management platforms like TaxDome, which allow you to manage most of these processes from a central hub.

Further reading: Every bookkeeping business needs an effective customer relationship management (CRM) system. In this article, we highlight some of the best: 8 Best CRMs for Accountants, Bookkeepers, and Tax Professionals.

6. Determine your pricing strategy

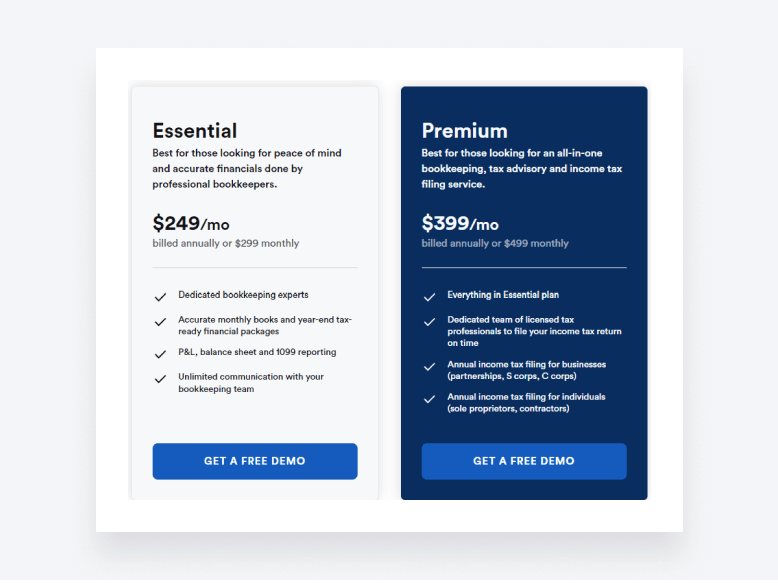

Now it’s time to determine what you’ll charge your clients. It’s worth doing some market research here to see what your competitors charge. You’ll also want to factor in your experience, specialization and niche when settling on numbers.

Most bookkeeping businesses charge a monthly fee, with different packages or pricing tiers designed to meet the needs of different clients.

6. Find clients through effective marketing

This step is all about finding effective ways to reach and engage potential clients. There are several ways you can do this, each requiring different skills and resources. Here are some examples:

- Content marketing and SEO

- Social media marketing

- Direct marketing (email, cold calling)

- Asking for referrals and reviews from existing clients

- Client success stories

- Networking at community or industry events

Further reading: for a deep dive into the ins and outs of marketing your bookkeeping business, take a look at this article: 11 best ways to market your bookkeeping business.

7. Understand funding options

Finally, you’ll need to explore funding options for your initial setup. As we’ve already discussed, starting a bookkeeping business has relatively low upfront costs, but you’ll still need to ensure that you have enough money to set solid foundations.

If you can’t (or don’t want to) fund the costs through personal savings, you can look at small business loans or even grants. Whatever you choose, remember that responsible financial management paves the way for future success.

Frequently asked questions

There’s a lot to consider when starting a bookkeeping business. While we’ve already covered a lot so far, we’ll answer any additional questions you might have in this section.

Do I need a certification to start a bookkeeping business?

While certification isn’t mandatory from a legal perspective, it certainly enhances your credibility while providing you with the knowledge you need to succeed.

Consider becoming a Certified Public Bookkeeper (CPB) through the National Association of Certified Public Bookkeepers (NACPB) or a Certified Bookkeeper (CB) through the American Institute of Professional Bookkeepers (AIPB). These certifications validate your skills and will help attract clients seeking qualified professionals.

Additionally, you can gain software-specific certifications. If you primarily use QuickBooks, for example, you might want to become a QuickBooks Certified ProAdvisor. Likewise, if you use Xero, you could become a Xero Certified Advisor.

What industries can I specialize in as a bookkeeper?

The possibilities are diverse – you can target pretty much any industry, from healthcare and e-commerce to real estate and more. Pick a niche that aligns with your interests and expertise. Specializing can set you apart and attract clients with specific needs.

Can I start a bookkeeping business part-time?

Yes, starting part-time is a viable option. Many entrepreneurs begin by offering their services after their regular work hours and gradually transition to full-time as their client base grows. The beauty of starting a bookkeeping business is that you can put in as much (or little) time as you want.

Do I need a business license to operate a bookkeeping business?

Yes, obtaining a business license is usually required. The exact requirements vary by location, so check with your local government or small business administration for the specifics in your area.

How much should I charge for bookkeeping services?

Your pricing should reflect factors like your experience, specialization and local market conditions. Research industry rates to set competitive prices that reflect the value you provide.

What software should I use for bookkeeping?

There are tons of options to choose from, and the perfect solution will depend on your specific needs. That said, popular options for small-business bookkeepers include QuickBooks Online, Xero and Wave.

How can I market my bookkeeping business?

Develop a strong online presence through a professional website and social media platforms. Leverage networking events, referrals and industry-specific forums to spread the word. Share high-value content such as informative videos, blog posts and client stories.

Can I start a bookkeeping business from home?

Absolutely. Many bookkeepers run successful businesses from their homes, utilizing technology to connect with clients and manage their work effectively. Not only is running a fully remote business more convenient and cost-effective, but it also enables you to serve a broader client base.

Is bookkeeping a lucrative business venture?

Yes, bookkeeping can be lucrative, especially with the growing demand for accurate financial management. Your earning potential will increase as you gain experience and expand your client base.

How can I balance managing clients and their finances?

The key is effective time management and clear communication — and leveraging the right tools can help you deliver this. At the same time, setting expectations and maintaining organized workflows will help you provide a high-quality service to all your clients.

Do I need to be tech-savvy to run a bookkeeping business?

While being tech-savvy is certainly beneficial, it’s not a prerequisite. If you have the willingness to learn, you can quickly become proficient using bookkeeping software and keep up with the latest technological trends.

Can I offer additional services besides bookkeeping?

Yes, you can expand your offerings to include related services like financial consulting, tax preparation, or payroll management to meet your clients’ unique needs.

What steps should I take to become a certified bookkeeper?

Research and choose a reputable certification program, complete the required coursework and pass the certification exam. As discussed earlier, it’s worth considering becoming a Certified Public Bookkeeper (CPB) or Certified Bookkeeper (CP).

Further reading: Interested in gaining bookkeeping certification? This article will give you the lowdown on some of the best free courses available: Top 9 free online bookkeeping courses with certificates in 2024.

How can I manage tax season as a bookkeeper?

The key is to prepare well in advance, communicate deadlines clearly to clients and leverage your organization skills. You’ll also need to stay updated on tax regulations. And perhaps most importantly, you’ll need to leverage the power of good technology to streamline, enhance and automate your bookkeeping processes.

What are some key challenges in the bookkeeping business?

Common challenges include staying updated with ever-changing tax laws, managing client expectations and handling periods of high demand, such as tax season.

Conclusion

Starting a bookkeeping business offers a wealth of opportunities, from flexible work schedules and professional freedom to the ability to shape your career and business.

By specializing in specific industries, honing essential qualities and mastering bookkeeping technology, you’ll be well positioned to launch a bookkeeping business that not only meets the needs of various clients but also thrives in a competitive market.

If you’ve decided to go for it, now is the time to take action. Follow the steps outlined in this guide, tap into the resources provided and embrace the journey ahead.

Here’s to a prosperous and fulfilling career in the world of bookkeeping!

Thank you! The eBook has been sent to your email. Enjoy your copy.

There was an error processing your request. Please try again later.

Looking to boost your firm's profitability and efficiency?

Download our eBook to get the answers