Key takeaways:

- Practice management software is an essential piece of an accounting tech stack, providing the tools firms need to manage their clients, staff, and workflows on one centralized platform.

- The best accounting practice management software enables you to improve efficiency, collaboration, and accuracy while delivering an exceptional client experience.

- No two practice management platforms are the same. While they may share similar capabilities, each system has its own unique feature set, pricing, pros, and cons.

- TaxDome stands out as a comprehensive practice management platform, while Karbon, Canopy, Jetpack Workflow, and Financial Cents are all solid contenders.

- QuickBooks Online Accountants and Xero Practice Manager offer useful integration options but lack key functionality, while CountingWorks Pro is an interesting choice for accounting practices focusing on content marketing and lead generation.

Modern accounting firms rely on practice management software to streamline accounting processes, automate workflows, reduce paperwork, and offer a superior client experience. But with an ever-increasing number of options to choose from, how do you know which platform is the right one for your firm?

Don’t worry, we’re here to help. In this detailed guide, you’ll find a profile of 12 popular accounting practice management platforms, including key features, pricing options, and client satisfaction ratings.

So, let’s dive in!

What is accounting practice management software?

Accounting practice management software provides all the tools accounting firms need to efficiently manage their daily operations. This spans client communication, document management, task automation, team collaboration, time and billing, and more.

To learn more about practice management software and watch a video explainer, check out this article: Accounting practice management software in action.

What are the benefits of using practice management software for your accounting firm?

Increased efficiency. By automating repetitive and time-consuming tasks, such as data entry, report generation, and invoicing, accounting firms can focus on more important tasks.

Simple and effective communication. Accounting practice management software provides a secure platform for communicating with clients and team members, reducing the need for back-and-forth emails and phone calls.

Increased accuracy. Automated workflows can help you reduce errors, ensuring accurate financial reporting and compliance with all relevant regulations.

Happy clients who keep coming back. Practice management software provides a secure way to collaborate with your clients and share information, making it a smooth experience for your clients.

Key features of accounting practice management software

Not all accounting software is created equal — some are better for certain tasks than others. But how can you find the best solution for your needs? Here are some key features of practice management software to look out for.

Project and task management

Look at how well the software helps you organize your work. Here are some important questions to ask:

- How can you assign tasks to your team members?

- Is it easy to search for tasks? Are there filters or tags that simplify searching?

- Can you see the overall progress of your team’s work?

Team management

Does the software provide tools for collaborating with your team, onboarding new or seasonal employees, assigning tasks, and tracking progress? During the busy season, you may need more assistance with tax-related tasks, so the software should enable you to add new team members and assign different access rights.

Workflow automation

Workflow automation is a key feature of accounting practice management software. When selecting a platform, consider whether it allows you to create dependencies that automate tasks, send automatic reminders to clients, and perform other actions that can streamline your workload.

Document management

To reduce paperwork and streamline your document workflows, ensure that the software enables you to:

- Securely store and manage documents

- Request legally binding e-signatures

- Share documents with both clients and team members

- Manage access rights

Client management

A client portal is another vital feature, providing a secure online space for clients to upload, view, and e-sign documents, communicate with their accountant, and pay bills.

Time tracking and invoicing

Practice management software should allow you to track the time spent on each project, record any expenses incurred, and auto-generate accurate invoices based on this data.

Reporting

This feature can help you make sense of all the client and team data at your disposal, allowing you to make smarter decisions across your firm. Here are some factors to consider:

- Does the practice management software offer report templates?

- What types of reports can you generate?

- Does it allow you to create custom reports?

Pricing

Practice management software can have varying pricing options and features, so be sure to consider what you need and what you are willing to pay for. Additionally, think about whether you prefer to pay monthly or annually. Opting for the latter can potentially lead to significant cost savings.

Onboarding and support

We recommend looking into the support options available. It’s also worth checking what the onboarding process looks like, and if you’ll receive dedicated advice and support on how to implement accounting practice management software.

Integration with other software

If you are planning to switch from your current accounting management software to a new one, ensure that seamless data transfer is feasible. Additionally, we recommend looking into the software’s integration options, such as schedulers, email apps, and other related tools.

To explore essential practice management features in more detail, check out this detailed guide: Key features of practice management software for accountants.

Best accounting practice management software in 2025

Choosing practice management software can be a tricky process. There are so many platforms to consider, each with its own feature set, benefits, and pricing to weigh up. But as leading New York-based CPA Kelly Rohrs points out, implementing the right software can transform your accounting practice:

I fully understand how overwhelming accounting practice management software can seem at first, especially with so many choices available. Decision fatigue is real, but the key is to find a system that checks the most critical boxes for your firm’s needs and commit to it. Once implemented, it can streamline workflows, improve client communication, and eliminate manual tracking, ultimately transforming your practice. The long-term benefits far outweigh the initial setup challenges, making it a game-changer for efficiency and growth.

To help you choose the right practice management software for your needs, we’ve narrowed down the field to 12 of the best. Read on to explore their key features, pros and cons, and what users have to say.

- TaxDome

- Karbon

- Jetpack Workflow

- Financial Cents

- QuickBooks Online Accountant

- Canopy

- Xero Practice Manager

- CountingWorks Pro

- Keeper

- Onvio Firm Management

- Aero Workflow

- OfficeTools

1. TaxDome

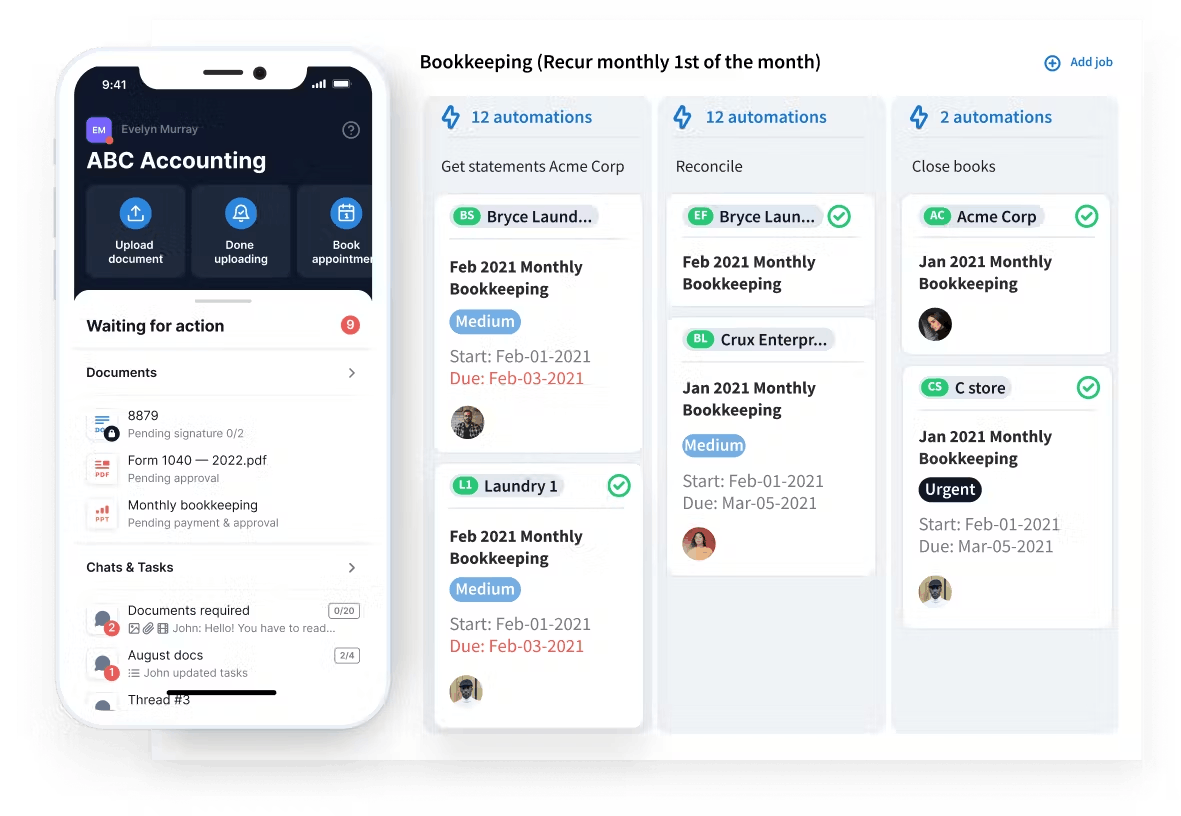

TaxDome is an all-in-one cloud-based platform that helps tax, bookkeeping, and accounting firms of all sizes manage their practices. It’s easy to use and has many useful features to simplify your processes and make your work more efficient.

Key features

Workflow automation: you can use customizable templates to automate entire accounting workflows from start to finish, including all client communication, data collection, document management, invoicing, and more.

Task and team management: gain complete visibility into who’s working on what, auto-assign work, and set access rights on an individual or team level.

Document management: TaxDome provides a secure environment for uploading, storing, managing, and sharing client documents. And with a document scanner built into the mobile app and legally binding e-signatures (including KBA, AdES, and QES), you can manage your entire document workflow on the go.

CRM: TaxDome’s built-in CRM allows you to manage all your client data, documents, and communications in one place, allowing you to build long-lasting client relationships.

Time and billing: you can track billable hours, automate invoicing, and set up one-time or recurring payments. TaxDome also integrates with payment providers Stripe and CPACharge.

Proposals and engagement letters: this handy feature enables you to engage clients, present your services and prices, and secure payment in one simple workflow.

AI-powered reporting: unlock the power of your data in TaxDome to deliver real-time insights into team performance and profitability. And with our AI-powered search, you can type in queries and get relevant data insights in response.

Client communication: TaxDome offers a complete communication ecosystem comprising secure chats, synced email, and SMS communication, allowing you to choose the perfect communication channel for different situations.

Client portal and mobile app: TaxDome takes your client experience to the next level with a secure, custom-branded portal where clients can upload, view, and e-sign documents, complete tasks, pay bills, and communicate with your team. All this is available on desktop or via our award-winning client mobile app.

What kind of practices use TaxDome?

TaxDome is well suited to accounting, tax, and bookkeeping businesses of all sizes — from solo practices to large firms. With its comprehensive feature set that’s available to all users, simple pricing, and zero restrictions on usage, TaxDome is able to scale as businesses grow.

Pricing

TaxDome has designed three plans tailored to meet your specific needs and goals:

- TaxDome Solo: The all-in-one platform to run your entire firm with ease.

- TaxDome Pro: Empower your team and streamline operations with advanced tools for collaboration, visibility, and efficiency.

- TaxDome Business: Deliver premium client experiences and enhance internal efficiency with the most advanced tools in the market.

Current Pricing:

TaxDome Solo

- 3-year subscription: $700/year

- 2-year subscription: $750/year

- 1-year subscription: $800/year

TaxDome Pro

- 3-year subscription: $900/year

- 2-year subscription: $950/year

- 1-year subscription: $1,000/year

TaxDome Business

- 3-year subscription: $1,100/year

- 2-year subscription: $1,150/year

- 1-year subscription: $1,200/year

Free trial?

Yes, TaxDome offers a free 14-day trial where you can access all of its features (apart from Zapier integrations).

Pros and cons

| 👍 Pros | 👎 Cons |

| Replace multiple apps with a single unified platform | Because the feature set is so comprehensive, using the platform to its full potential involves a learning curve |

| Implement best practices faster with a library of templates for workflows, tasks, emails, and other components | |

| Built-in CRM with unlimited contacts | |

| Client mobile app and user-friendly client portal | |

| Simple and transparent pricing plan | |

| Integrations with QuickBooks, Zapier, Calendly, MailChimp, Office 365, CPACharge, Stripe, and more | |

| Personalized support and onboarding sessions |

Ratings and reviews

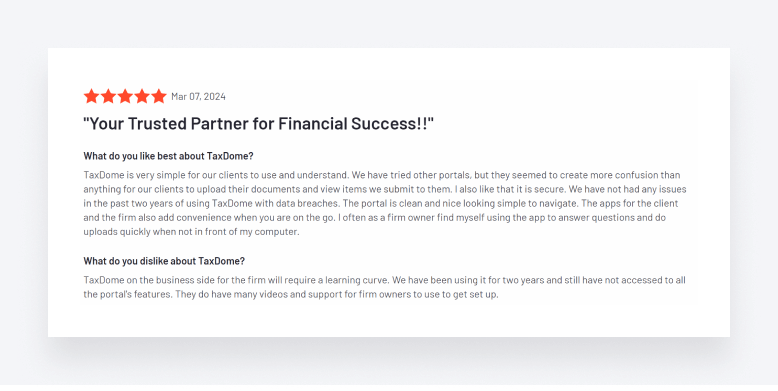

G2 rating: 4.7 from 550 reviews

Capterra rating: 4.8 from 3000+ reviews

TaxDome has plenty of glowing reviews, with users enjoying the platform’s user-friendly interface, security, and ability to enhance the client experience. The firm and client mobile apps are also a big hit, allowing users to manage tasks and keep in touch on the go.

Because TaxDome’s capabilities are so broad, some reviewers mention that it can take time to learn how to use it to its full potential. But thankfully, TaxDome’s Help videos and other educational materials provide everything you need to get up and running.

See how TaxDome is helping accounting firms across the world drive efficiency, productivity, and growth:

- Polaris Tax & Accounting scaled its customer base from 50 to 1,500+

- BHR Finans & Regnskap AS grew by 9% in 12 months

- Athene Group replaced multiple apps and slashed onboarding times to a couple of minutes

2. Karbon

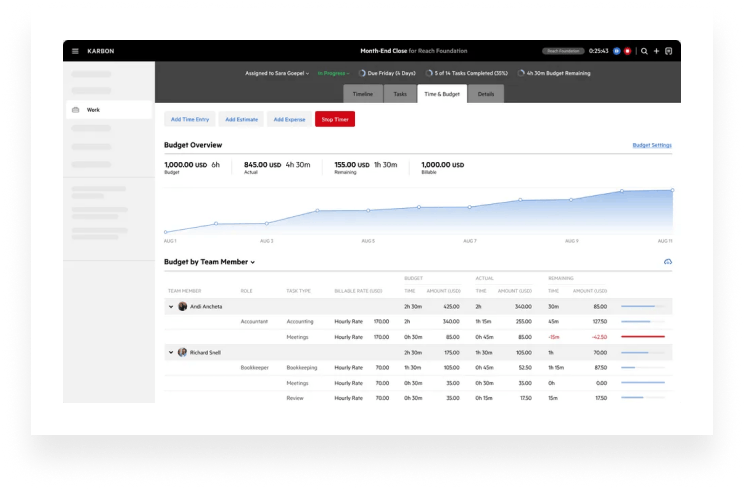

Karbon is a cloud-based practice management platform that helps accounting, bookkeeping, and CPA firms manage their day-to-day processes.

Key features

Karbon allows you to automate repetitive tasks, such as client data collection, file storage, or billing. You can also set auto-reminders at times of your choosing. There’s also a handy AI assistant that integrates with ChatGPT, enabling you to automatically summarize emails and compose client communications.

For team collaboration, you have internal and external messaging, collaborative task lists, kanban boards, and timelines to help you manage work more effectively as a team. On the client side, Karbon offers a secure client portal — available on desktop only — where you can assign tasks to clients and keep them in the loop.

Karbon also offers practice intelligence, allowing you to access real-time data insights about your firm’s performance.

What kind of practices use Karbon?

Karbon is designed for accounting firms with 5+ team members. Because of the pricing structure, smaller firms that are growing fast will have to upgrade to more expensive plans to unlock higher usage limits.

Pricing

Karbon offers three price plans:

- Team at $59 per user per month

- Business at $89 per user per month

- Enterprise, with a custom price for teams of 50+

Free trial?

Yes, Karbon offers a free trial with access to all features.

Pros and cons

| 👍 Pros | 👎 Cons |

| User-friendly interface | Limited number of e-signatures |

| Secure client portal | You can’t send emails in bulk |

| Customer support available | You can’t custom-brand your website or choose a URL |

| Easy task management process | Paid setup and training only |

| Integrated AI and ChatGPT | No client mobile app |

Ratings and reviews

G2 rating: 4.8 from 500+ reviews

Capterra rating: 4.7 from 168 reviews

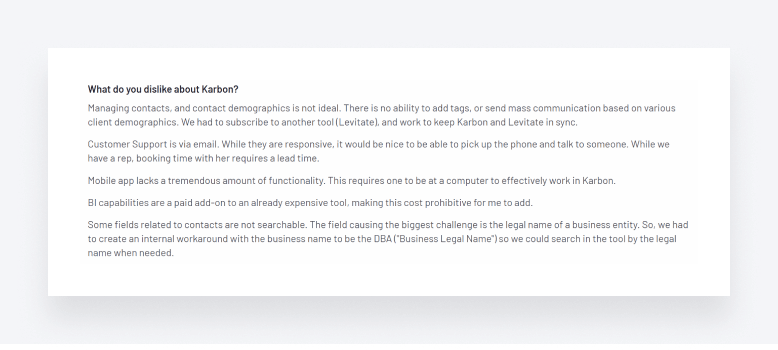

Most reviewers are happy with Karbon’s product offering, with several users singling out the platform’s email capabilities and task management for praise.

We also saw some major concerns that users have with certain features, however, including contact management, customer support, and the mobile app:

You can explore how Karbon compares with TaxDome in this detailed article: TaxDome vs Karbon.

3. Jetpack Workflow

Founded in 2014, Jetpack Workflow is a practice management software for accounting and bookkeeping firms.

Key features

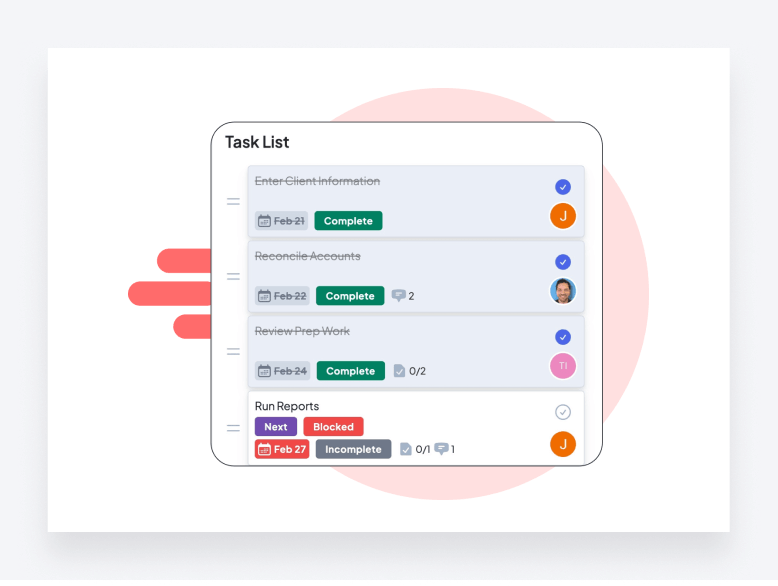

Jetpack Workflow offers basic task automation and allows you to set automations to repeat at custom intervals. There’s also a template library to help you standardize documents, processes, and checklists with ease.

In terms of team collaboration and task management, the platform allows you to view all client work at a glance — and filter and search for more detail. You also get internal communication and alerts.

What kind of practices use Jetpack Workflow?

Jetpack Workflow’s somewhat limited functionality make it well suited to smaller firms that don’t expect to scale significantly in the foreseeable future.

Pricing

Jetpack Workflow has one package with two different billing options:

- Starter Yearly: $30 per user per month, billed yearly

- Starter Monthly: $45 per user per month, billed monthly

Free trial?

Yes, Jetpack Workflow offers a free 14-day trial.

Pros and cons

| 👍 Pros | 👎 Cons |

| Workflow library | Outdated interface |

| Rapid job creation process | Limited functionality |

| Unlimited clients and contacts | No client portal, only a Clients section within the platform |

| Integration with QuickBooks | Minimal email and document management tools |

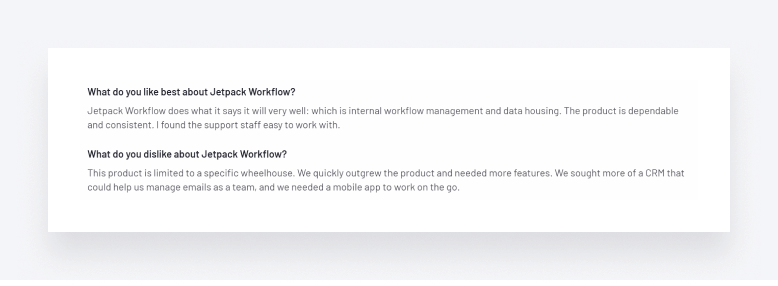

Ratings and reviews

G2 rating: 4.1 from 11 reviews

Capterra rating: 4.8 from 50+ reviews

Reviewers are generally happy with Jetpack Workflow, but it’s clear that it’s not the most comprehensive platform, with minimal email and document management tools, and no client portal or mobile app:

Want to see a direct comparison between Jetpack Workflow and TaxDome? Then check out this article: TaxDome vs Jetpack Workflow.

4. Financial Cents

Financial Cents is another cloud-based practice management software that helps small and medium-sized accounting and bookkeeping companies handle daily tasks.

Key features

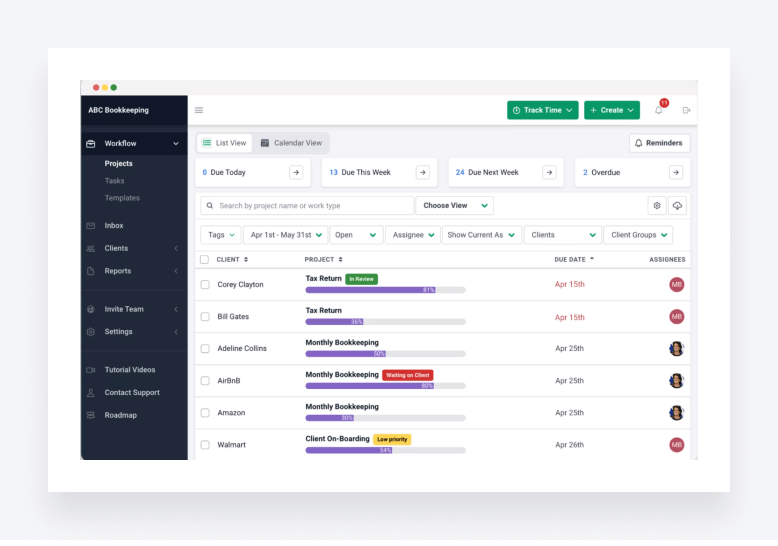

Financial Cents offers a range of workflow management tools, allowing you to understand staff capacity, assign work, and keep up to date on progress. You also get a simple task dashboard with dynamic progress bars.

In terms of automation, Financial Cents offers automated document requests and reminders. Then there’s a built-in CRM for all your client data, time tracking and billing, and a branded client portal.

What kind of practices use Financial Cents?

Financial Cents is designed for small and medium-sized accounting practices that are happy with a more basic, user-friendly platform.

Pricing

Financial Cents has two pricing plans: Team at $39 per user per month and Scale at $59 per user per month.

Free trial?

Yes, you can try Financial Cents for free during a 14-day trial.

Pros and cons

Let’s take a look at some of the best features and drawbacks of Financial Cents.

| 👍 Pros | 👎 Cons |

| Various tools for workflow automation | Some users have reported complexity when integrating with Xero and QuickBooks Online |

| Build-in client portal | Issues with triggering events |

| User-friendly platform | No firm or client mobile app |

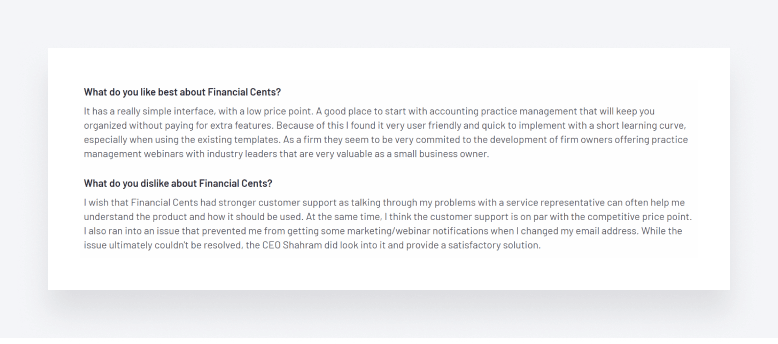

Ratings and reviews

G2 rating: 4.8 from 80+ reviews

Capterra rating: 4.8 from 120+ reviews

Based on user reviews, it’s clear that Financial Cents is relatively easy to use and cost-effective. At the same time, however, customer support can be lacking at times:

Explore how Financial Cents compares with TaxDome in this detailed guide: TaxDome vs Financial Cents.

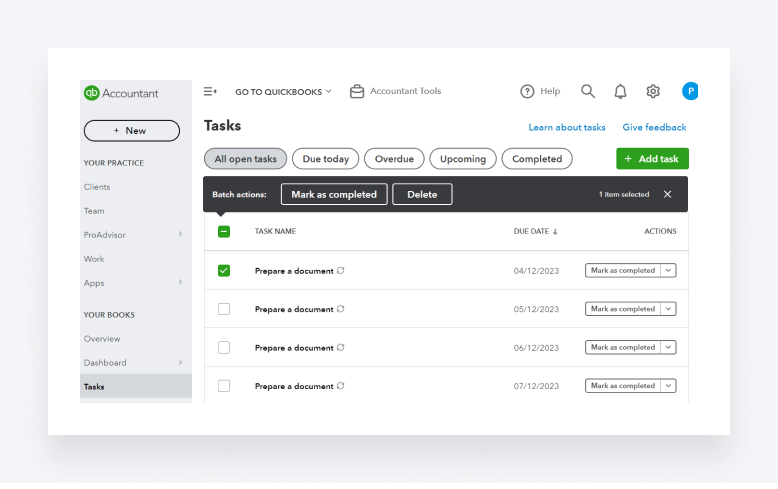

5. QuickBooks Online Accountant

QuickBooks Online Accountant is a cloud-based accounting software with various smart tools for organizing your tasks and team management.

Key features

QuickBooks Online Accountants offers secure communication and document sharing. And with seamless integration with QuickBooks Online, you can also access your clients’ books for joined-up accounting workflows. You can also automate routine accounting tasks and sync with banks.

Like most other accounting software, this platform provides a range of task management tools, and you can easily track project expenses, income, time, and labor. You get some pretty standard reporting and analysis tools too, as well as time and billing capabilities.

What kind of practices use QuickBooks Online Accountant?

Like other QuickBooks products, QuickBooks Online Accountant is geared towards small and medium-sized accounting businesses.

Pricing

QuickBooks Online Accountant is available for free. You only pay for clients you add, depending on whether you offer the software through direct billing or wholesale.

If you choose direct billing, your clients will need to purchase their own QuickBooks Online subscription. Alternatively, with the wholesale option, your firm can purchase Quickbooks subscriptions for your clients, and save up to 50% on the cost of each subscription.

Free trial?

Yes, you can take QuickBooks Online Accountant for a spin with a 30-day free trial.

Pros and cons

| 👍 Pros | 👎 Cons |

| User-friendly and intuitive workflow | Has a different platform for time tracking |

| A vast library of workflow templates | There’s no “undo” button |

| Free access to the QuickBooks Online ProAdvisor program | Lacks payroll features |

| Seamless integration with QuickBooks Online | Not ideal if your clients don’t use QuickBooks Online |

Ratings and reviews

G2 rating: 4.4 from 80 reviews

Capterra rating: 4.6 from 30+ reviews

Reviewers frequently praise QuickBooks Online Accountant’s usability and simplicity:

But there are a few minor gripes here and there, such as the inability to connect to certain banks:

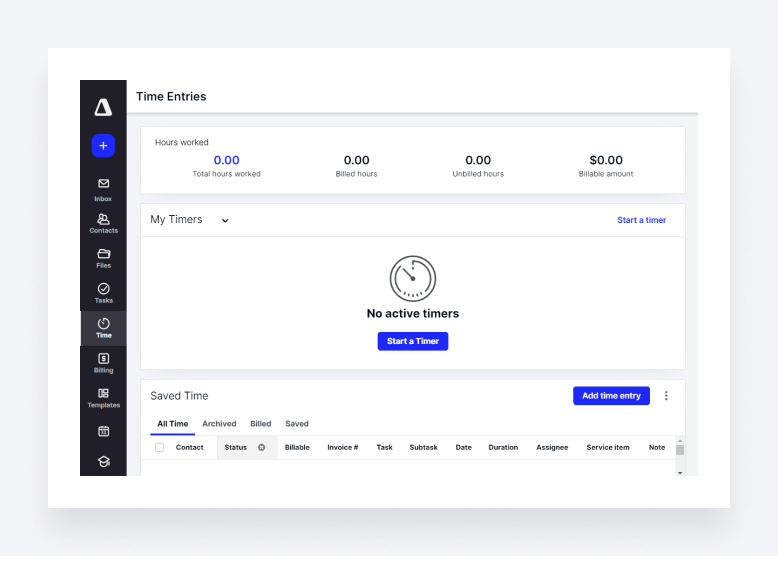

6. Canopy

Canopy is a cloud-based practice management software designed to meet all your practice management needs.

Key features

Canopy has a pretty comprehensive set of features. As you’d expect from a practice management platform, you get standard stuff like document management, e-signatures, workflow automation, and task management.

On top of that, you get some interesting capabilities such as an AI assistant that drafts emails and answers queries with data insights, custom-branded client engagement letters, and a client portal mobile app.

What kind of practices use Canopy?

Canopy’s pricing specifies a minimum of five users, so small and solo practices will want to look elsewhere. Given Canopy’s complex, modular pricing, however, it may put off larger or fast-growing firms that want a complete feature set.

Pricing

Canopy offers a modular pricing model, where you pay extra for additional functionality. The most basic plan comes with client engagement and is free for up to 250 clients. The more clients you have over the 250-client threshold, the more you pay.

Likewise, by adding additional modules — such as document management, workflow, or time and billing — you pay more. There are add-ons for tax resolution, transcripts and notices, KBA e-signatures, and more — plus an implementation fee for getting up and running.

Free trial?

Yes, Canopy offers a free 15-day trial.

Pros and cons

| 👍 Pros | 👎 Cons |

| User-friendly interface | No website builder |

| Comprehensive feature set | You can’t set up your domain name |

| Client portal mobile app | Lack of document storage |

| Several reporting options | Limitations on the number of clients |

| Confusing pricing, with lots of add-ons and extra costs |

Ratings and reviews

G2 rating: 4.6 from 300+ reviews

Capterra rating: 4.5 from 220+ reviews

Reviewers love Canopy’s comprehensive feature set that allows them to replace multiple apps with a single platform.

There are, however, some concerns over certain areas of the platform, such as Canopy’s time and billing functionality. For a detailed look at how Canopy stacks up against TaxDome, take a look at this article: TaxDome vs Canopy.

For a detailed look at how Canopy stacks up against TaxDome, take a look at this article: TaxDome vs Canopy.

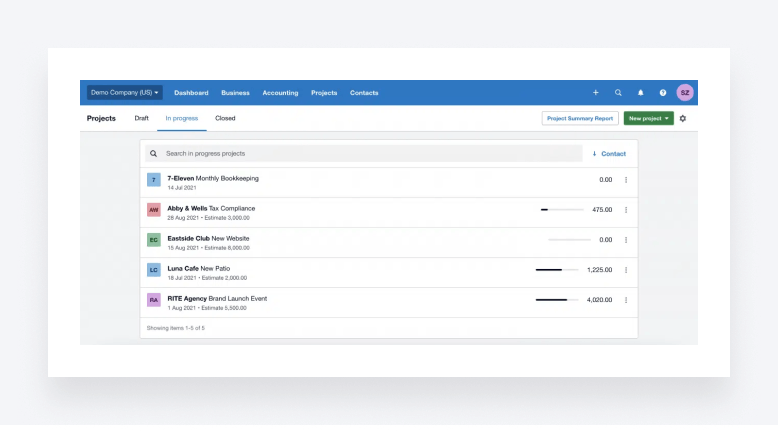

7. Xero Practice Manager

Xero Practice Manager is a practice management software for small accounting firms and solopreneurs.

Key features

As you’d expect, Xero Practice Manager offers seamless integration with Xero accounting software, providing a complete ecosystem for managing your clients’ books and your firm’s processes.

There are basic task management features, allowing you to assign work to team members, set deadlines, and monitor progress towards completion via a workflow dashboard. You can also track time and generate accurate invoices. On the data side, Xero Practice Manager offers customized reports and data visualizations.

What kind of practices use Xero Practice Manager?

Like Xero accounting software, Xero Practice Manager targets the small-business accounting market. It’s also a popular choice with users of other Xero products thanks to its seamless integration.

Pricing

We found it difficult to find clear information about the pricing of Xero Practice Management. The Xero website has a general pricing page, but the pricing options seem to be for Xero’s accounting software, not its practice management software.

Free trial?

Yes, Xero Practice Manager offers a free 30-day trial.

Pros and cons

| 👍 Pros | 👎 Cons |

| Useful billing module | Not ideal if you don’t already use Xero |

| Good practice management features for solopreneurs | Xero is unable to connect with several banks |

| Seamless integration with Xero accounting software | Can be buggy at times |

| Not suitable for team management |

Ratings and reviews

G2 rating: 4.4 from 35 reviews

Clients love its simple user interface and ability to integrate with Xero accounting software:

At the same time, some users state that the system can be a bit buggy at times, which can be complicated and time-consuming to fix.

8. CountingWorks PRO

CountingWorks PRO is an all-in-one marketing and practice management software developed for small accounting firms and tax professionals.

Key features

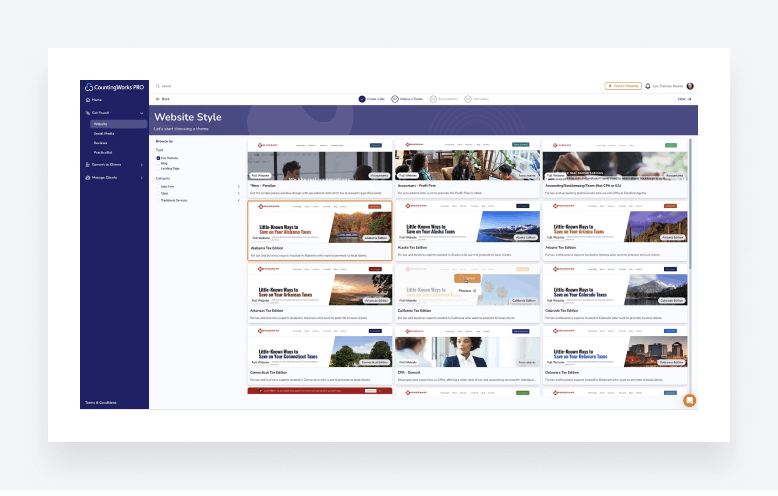

As a slightly unconventional platform that leans more towards content marketing and lead generation than traditional practice management, you get some interesting and unique features on CountingWorks PRO.

For example, you can make use of the custom website and landing page builder to capture more clients. Then there are automated content, social media, and email marketing capabilities, as well as AI and templates for drafting content, communications, and documents faster.

On the more traditional side, you get a CRM for sharing documents and scheduling appointments, as well as secure chats and video conferencing.

What kind of practices use CountingWorks Pro?

CountingWorks Pro is aimed at a specific niche — accounting businesses looking for a platform that focuses primarily on content marketing and lead generation.

Pricing

CountingWorks PRO provides multiple pricing options for its services:

- Web Presence, at $125 per month

- Grow, at 200 per month

- Premier, at 300 per month

- Premier+, at 500 per month

There’s also an a la carte option, where you can pick and choose the packages you want.

Free trial?

Yes, CountingWorks PRO offers a free 14-day trial.

Pros and cons

| 👍 Pros | 👎 Cons |

| Client hub and client portal | Limited workflow automation: no dependencies and recurring jobs |

| Interesting features for marketing your firm | Document upload times may be long |

| Modern and user-friendly interface | Marketing-first approach might not suit all firms |

Reviews and ratings

Capterra rating: 4.0 from 11 reviews.

Users rate the platform’s web builder as well as its marketing and e-commerce capabilities:

But there are also major concerns about its ability to streamline day-to-day accounting workflows:

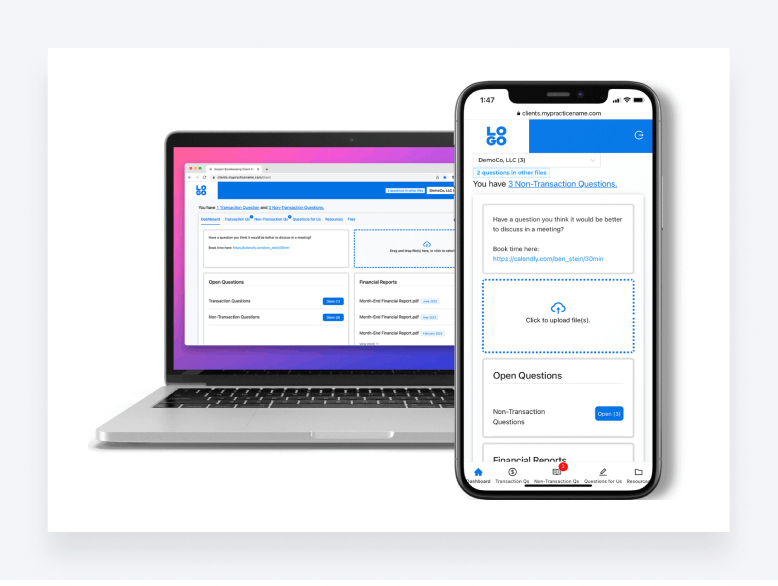

9. Keeper

Keeper is a practice management app designed to make it easier than ever to run a bookkeeping business.

Key features

So what does Keeper offer? First up, you get a host of features you’d expect from a well-rounded practice management platform, including document management, team collaboration, task management, a built-in CRM, and a custom-branded client portal.

On top of this, Keeper offers some interesting features such as a file review tool that automatically sports errors in client files.

What kind of practices use Keeper?

Keeper has pricing plans for businesses of all sizes, but it focuses more on the bookkeeping side of things than tax and accounting.

Pricing

Keeper offers three pricing options: Standard at $8 per client per month, Premium at $10 per client per month, and Enterprise, for which you’ll need to contact their sales team directly to receive a quote.

Free trial?

Yes, Keeper offers a free 14-day trial.

Pros and cons

| 👍 Pros | 👎 Cons |

| The ability to automatically spot errors in client files | You have to pay more for key features |

| Client portal for an enhanced client experience | File organization can be a bit clunky |

| Everything you need to streamline your monthly close | Focused more on bookkeeping than accounting and tax |

| Limited client management tools |

Ratings and reviews

G2 rating: 5.0 from 48 reviews

A lot of the positive reviews focus on Keeper’s ability to streamline the month-end close.

Some reviews claim that the platform’s file management system could be improved, however.

10. Onvio Firm Management

Part of the Thomas Reuters software ecosystem, Onvio Firm Management is a cloud-native solution that helps accountants and tax professionals run their firms.

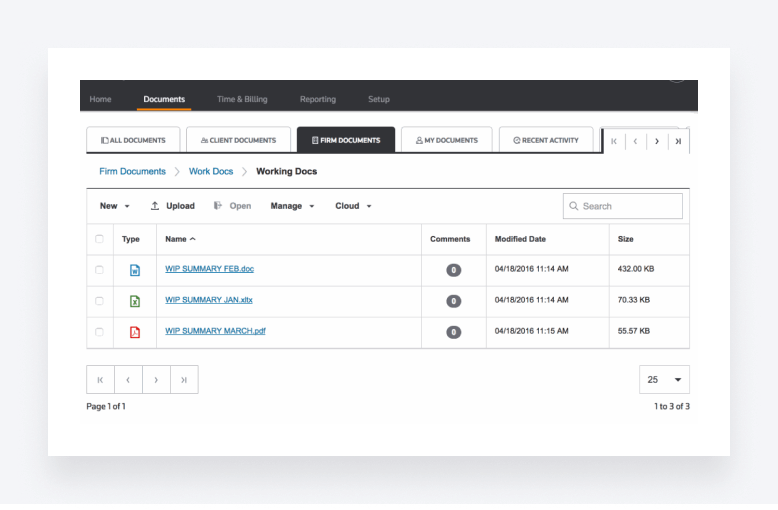

Key features

Onvio Firm Management offers document management, with e-signatures and a mobile app where clients scan and upload documents. You also get a range of project management features, including task tracking and budgeting tools.

Onvio also offers time and expense tracking, billing, and the ability to communicate with clients on any device.

What kind of practices use Onvio Firm Management?

As a Thomas Reuters product, Onvio Firm Management is likely to be more popular with firms that use other Thomas Reuters software, such as UltraTax CS.

Pricing

We couldn’t find any information about pricing on the Thomas Reuters website.

Free trial?

There’s an option for a free demo, but we couldn’t see any information about a free trial on the website.

Pros and cons

| 👍 Pros | 👎 Cons |

| Seamless integration with other Thomas Reuters software, including UltraTax CS | Unclear pricing |

| Mobile app with a document scanner | Server errors can lead to downtime |

| Limited integrations with third-party apps | |

| Not the most user-friendly |

Reviews and ratings

G2 rating: 3.5 from 12 reviews

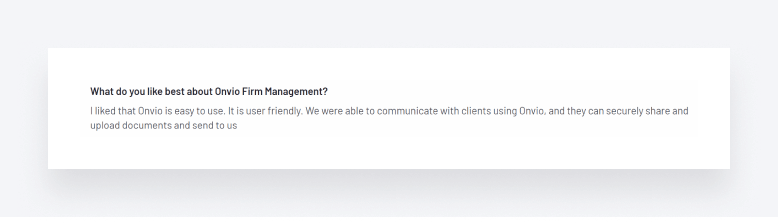

Based on user reviews, it’s clear that Onvio gets some of the basics of practice management right.

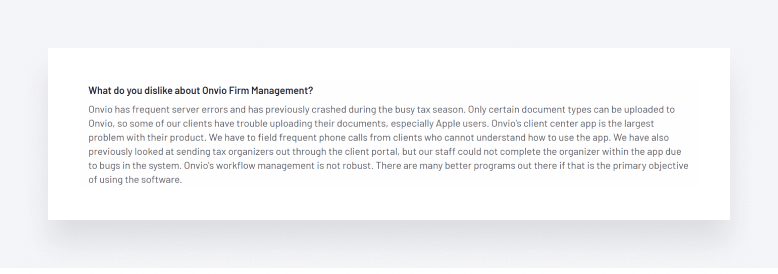

That said, there are some serious concerns about some of the technical issues and bugs that users are experiencing.

11. Aero Workflow

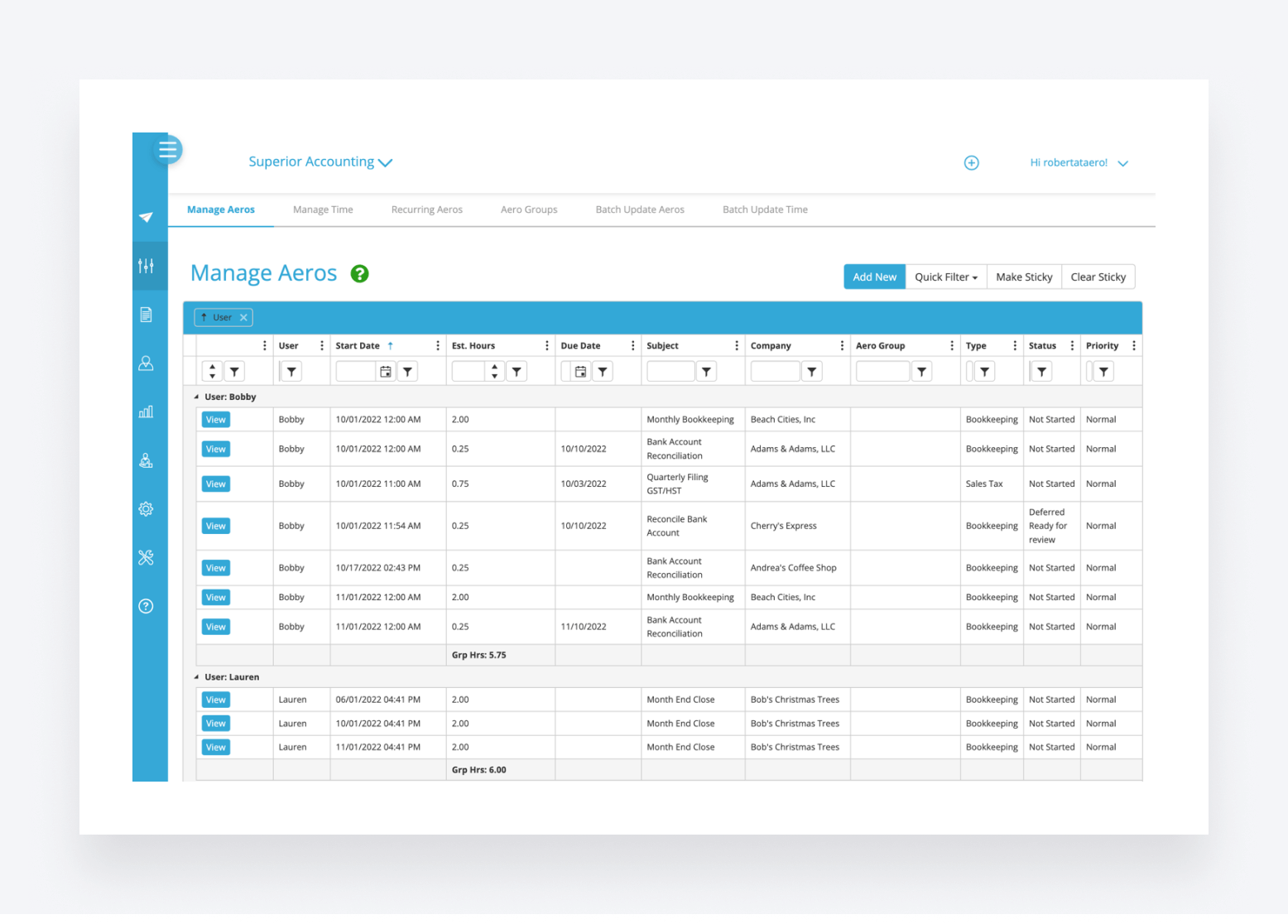

Aero Workflow is a practice management platform designed for accountants, by accountants. It offers a range of features designed to help you define, organize, and track your accounting workflows.

Key features

One of Aero’s strongest points is its ability to help you organize and define your firm’s processes. You can create accounting procedures and checklist templates, and then store them all in one centralized library for easy access.

On the work management front, you can easily schedule one-time or recurring tasks. There are tools for tracking work and time, with access to 20 customizable reports that provide real-time insights into your firm’s performance.

What kind of practices use Aero Workflow?

Aero Workflow is designed for accounting practices looking for a simple platform to help them standardize their accounting processes and procedures. Its lack of functionality will put firms with broader needs off, however.

Pricing

Aero’s pricing is based on the number of users and is broken down into three tiers:

- Startup (1-5 users) at $135 per month

- Growth (6-25 users) at $250 per month

- Scaling (26-50 users) at $365 per month

There are also cheaper rates when paid yearly.

Free trial?

Yes, Aero offers a 30-day free trial.

Pros and cons

| 👍 Pros | 👎 Cons |

| Plenty of templates and checklists | Workflow automation is very basic |

| Customizable reports for tracking performance | No mobile apps |

| Suffers from system lags | |

| Not a complete practice management solution |

Reviews and ratings

G2 rating: 4.7 from just three reviews.

Aero doesn’t have enough user reviews to form a well-rounded view of its effectiveness, but the positive comments focus on the platform’s task management and time-tracking features.

On the other hand, several users mention that the system is often slow and that reports are fiddly to use.

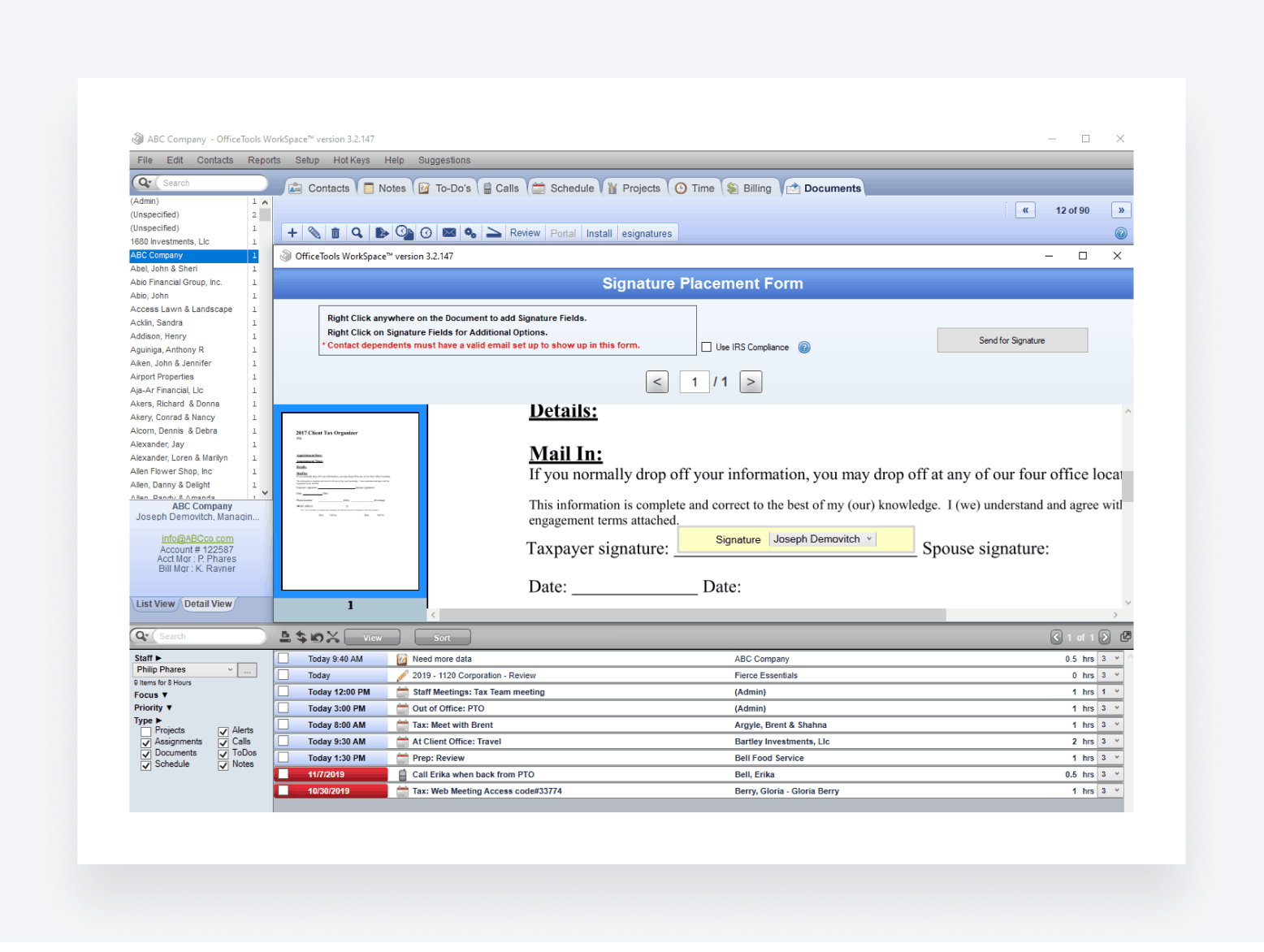

12. OfficeTools WorkSpace

OfficeTools WorkSpace is an accounting practice management system developed by software company Caret, which also makes solutions for legal firms.

Key features

OfficeTools WorkSpace offers a range of features that help you organize client data, track due dates, and automate the billing process.

You get a customizable client portal, where clients can view, upload, and e-sign documents. There’s also a firm mobile app for running your practice on the go.

What kind of practices use OfficeTools Workspace?

With its outdated user interface and limited feature set, OfficeTools Pro is more likely to appeal to older, slower-moving accounting firms.

Pricing

There are no details about pricing on the OfficeTools website. You have to call for more information.

Free trial?

OfficeTools offers a free demo, but not a free trial.

Pros and cons

| 👍 Pros | 👎 Cons |

| Decent time and billing features | Outdated user interface |

| Firm mobile app | Slow and buggy |

| Custom-branded client portal | Limited automation features |

| No client mobile app | |

| Support can be slow to respond |

Reviews and ratings

G2 rating: OfficeTools has a rather disappointing average rating of 3.6.

Based on user reviews, OfficeTools’ strongest suit seems to be its time and billing capabilities.

There are plenty of negative reviews, however, with users focusing on how buggy, slow, and outdated the system is. Customer support also seems to be an issue.

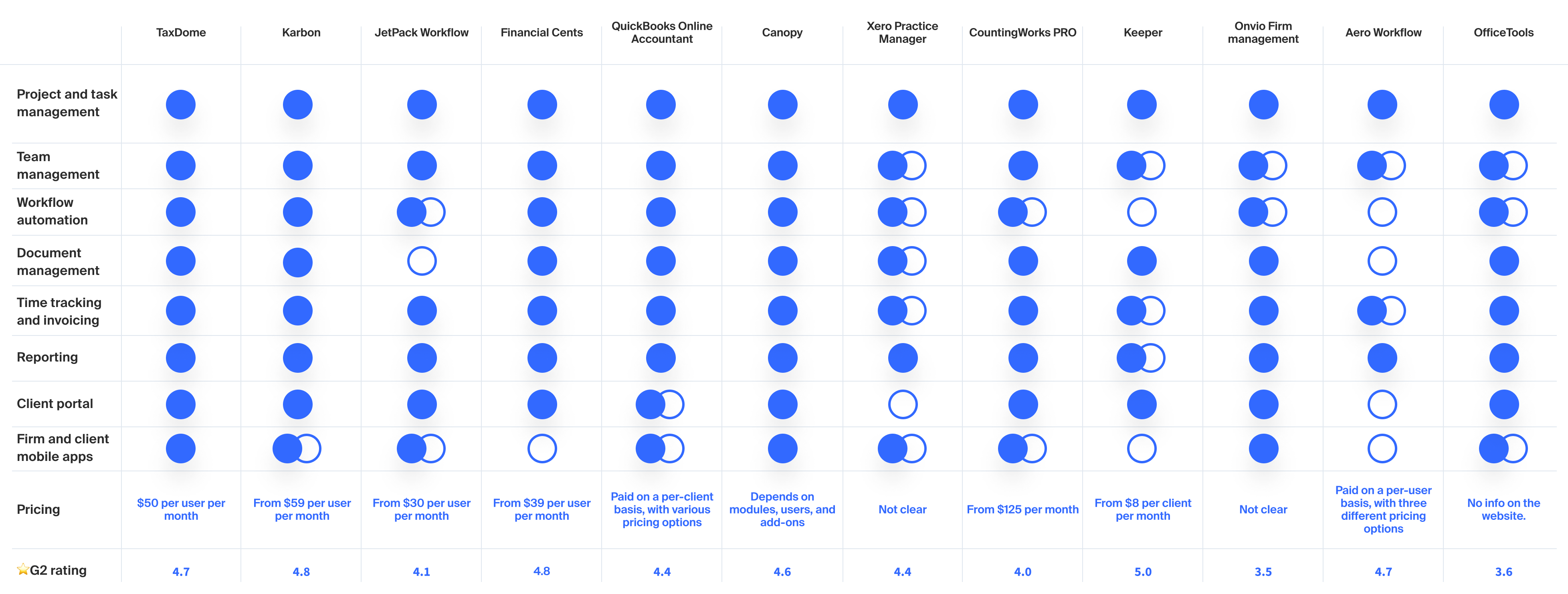

A comparison of the best accounting practice management software

We covered a lot of information in this guide so far. So, to help you understand how these different platforms stack up at a glance, here’s a handy comparison table.

As we can see from this comparison, no two practice management solutions are the same. The ideal choice for you will depend on your firm’s needs.

For accountants, bookkeepers, and tax pros looking for a complete practice management platform, TaxDome is a standout choice that offers a full spectrum of features. Karbon, Jetpack Workflow, and Financial Cents are all solid contenders, but they lack some core functionality, while Canopy is let down by complex pricing. Aero Workflow has too many key features missing, and OfficeTools has clear issues with performance.

If you already use QuickBooks Online or Xero accounting software, then QuickBooks Online Accountant and Xero Practice Manager may seem like sensible choices. Unfortunately, however, both offer limited capabilities in key areas, such as workflow automation or mobile apps.

For firms wanting to prioritize marketing and lead generation, CountingWorks PRO is the standout platform. But if your focus is on running all aspects of your firm more efficiently, there are better options.

Case study: a real-life example of accounting practice management software in action

In this section, we’ll explore how Evolution Accounting & Consulting, LLC used TaxDome to streamline their accounting workflows and drive efficiency.

About the company

Evolution Accounting & Consulting grew rapidly by acquiring paper-oriented firms and transforming them into remote ones. They needed the right technology to keep up with this rapid growth and deliver top-notch customer service. TaxDome was just the solution they needed.

Implementation

The company implemented TaxDome's automation tools to automate their client communication. They incorporated customized email templates and included helpful shortcodes that replace specific information like the recipient’s name, address, or account name, allowing them to send highly personalized emails automatically.

The company also utilized TaxDome’s project management tools to enhance its workflow and identified tags, pipelines, and task automation as the top three features in TaxDome.

Results

TaxDome assisted Evolution Accounting & Consulting in expanding their business across the country, allowing them to serve up to 1,000 clients.

By using TaxDome’s automation capabilities, the Evolution team was able to say goodbye to repetitive manual tasks and focus on more important work. This increased efficiency, enabling the company to scale its operations and serve a larger clientele.

Eric Gray, CEO of Evolution Accounting & Consulting, shares his experience of working with TaxDome:

Concluding our review of the top accounting management software

Every accounting practice management platform has its own unique set of features tailored to specific goals. The perfect software for you will depend on your firm’s requirements, aims, budget, and even size.

We hope this guide has helped you understand more about the different practice management software out there. If you’d like to learn more about TaxDome, you can join us for a free demo to discuss your requirements.

Thank you! The eBook has been sent to your email. Enjoy your copy.

There was an error processing your request. Please try again later.

What makes the best accounting firms thrive while others struggle to keep up? We analyzed our top 20 TaxDome firms, representing over $100M in combined revenue, to uncover the strategies driving their success.

I just wanted to say thank you for this detailed article. It helps to have the break downs of all the options in one place.

Thank you, Sarah! We’re so glad to hear that the article was helpful for you. Choosing the right accounting practice management software can indeed be challenging, but we’re here to make that process easier. Check out our blog if you’re looking for more insights.

When it comes to mobile apps how does TaxDome’s stack up against the others? Do clients like it?

Hi David! TaxDome’s mobile app is a leading contender in this area. Clients can use the app to share and sign documents, make payments, and communicate securely with their accountants. We’re also very popular with clients – top-100 rated in the Finance section of the iOS store and rated 4.9/5 with 6k+ reviews!

I’ve been using Xero but its kinda limited in terms of automation. Anyone like the automation features on any of these platforms?

Yeah, the automation could be better at Xero. But if you’re super integrated into the Xero ecosystem, you might miss some of the connections if you switch. If you want the best automation features, I’d look closer at TaxDome or Karbon.

Hi Karen, I understand your concerns about automation. TaxDome might be just what you’re looking for. With our platform, you can set up processes that automatically handle repetitive tasks, such as sending reminders for documents, following up on client requests, or getting invoices paid. This means less manual work for you and more consistency in how tasks are handled across your practice. Plus, with our customizable templates, you can tailor the automation to fit your specific needs. If you have any questions or want to see these features in action, feel free to reach out!

Thanks for putting this together—it’s really helpful!

We appreciate your kind words, Lisa! Glad to hear you found the article helpful. If you have any other questions or need more info, don’t hesitate to reach out!

I’m curious, how does document management in TaxDome compare with Xero Practice Manager? Is there a big difference?

Hi Emily! The document management in TaxDome is more comprehensive compared to Xero Practice Manager. With TaxDome, you get secure document storage, e-signatures, and a mobile app with a document scanner, which makes it easier to manage documents on the go. Xero Practice Manager does integrate well with Xero accounting software, but it may not have the same depth in document management that you need.

Been using both TaxDome and Quickbooks online accountant. Taxdome’s automation and client portal are great, but still need QuickBooks for accounting. If only TaxDome could handle the accounting work too 😉

Thanks for sharing your experience, Alex! I’m glad you’re finding value in both platforms. TaxDome integrates with QuickBooks Online to create a more seamless exchange between the two and offer an elevated accounting practice management experience. Check out this video we posted on syncing QuickBooks Online and TaxDome.

https://vimeo.com/555747740

If you have any questions, feel free to reach out!

Thanks for the article! These accounting management practices tips will be helpful for my own small business accounting UK.

Thanks for letting us know, David! We’re glad you found this article useful. We believe that choosing the right practice management platform is one of the biggest decisions an accounting business can make, so we hope this has helped shine a light on some of the best options available.