In an industry where AI and automation are transforming how accountants operate, spreadsheets may seem like a relic from the past. Excel celebrated its thirty-seventh birthday this year, after all! Yet despite advances in technology, many accountants still rely on spreadsheets to manage core processes.

So why are spreadsheets still so popular? The answer is simple: accountants need a reliable, easy-to-use way to manage financial data and standardize processes.

In this article, we’ll look at five accounting spreadsheet templates that you can use to simplify routine tasks, enhance accuracy, and improve efficiency. We’ll also provide links, so you can download and implement these handy tools in your firm today. Read on to explore:

- Month-end close template

- Accounts receivable template

- Accounts payable template

- Bookkeeping pricing template

- Balance sheet template

While spreadsheet templates have stood the test of time, legacy tools can only take you so far. To take your accounting practice to the next level, you need to combine spreadsheet templates with accounting practice management software — like TaxDome.

TaxDome provides all the tools you need to automate workflows, boost efficiency, and improve collaboration. Firms that use TaxDome save up to 40 hours and more than $18,000 per employee per month, all while delivering an incredible client experience.

Why use accounting spreadsheet templates?

Accounting spreadsheets are simple yet effective tools for improving productivity and accuracy. Here are some key reasons why you should use them in your practice.

Save time and effort

Spreadsheet templates are essentially productivity tools. Once they’re set up, your team can use them again and again without building new spreadsheets from scratch. With the structure, formatting, and functions already in place, all you have to do is enter the necessary data.

Using spreadsheet templates, you can save hours during routine accounting tasks such as tracking expenses, preparing financial statements, and managing cash flow.

Consistent data entry

Templates help standardize the way data is entered and recorded. You can set templates up to automatically format data in specific ways, such as using currencies, percentages, or decimal points. This ensures uniformity across all records while reducing the likelihood of errors caused by inconsistent data formatting or missing fields.

Excel templates also enable you to set up powerful functions that automatically calculate values or present data based on preset rules. This saves you tons of time while ensuring more accurate and reliable data entry.

Further reading: for a look at some of the best Excel functions, check out our article: Top 15 Excel functions for accountants.

Spreadsheets have been around for decades, so virtually all accountants are familiar with them. Once a template is set up, there’s very little learning curve involved. Spreadsheet templates are also flexible — your staff can adapt them to meet specific needs and accounting scenarios.

Finally, spreadsheet templates are easily shareable. You can also grant access rights with just a few clicks. This makes them solid collaboration tools that help your team stay on the same page.

Key accounting tasks you can simplify with templates

So how exactly can you use accounting spreadsheet templates in your practice? In this section, we’ll highlight some key tasks and processes that you can simplify and enhance using templates.

Closing books

Month-end closes can be stressful. There are numerous individual tasks to tick off, and tight deadlines to meet. With a spreadsheet template, you can systematize the process. This ensures that all financial transactions are accounted for, all account reconciliations are completed, and all financial reports are prepared.

This way, spreadsheet templates can double as collaborative task management tools. You can create dynamic to-do lists, assign colleagues, set due dates, and record the time spent on each task in the closing process.

Managing receivables and payables

Templates can help you record and track accounts receivable and payable. In turn, this can help you monitor and understand cash flow and ensure that payments are processed and received on time. The more organized you are, the less the risk of missed payments or late invoices.

Setting pricing and budgeting

You can set up spreadsheet templates to record pricing and set budgets. This helps you forecast financial performance and ensure that pricing models align with projected costs and revenue targets. With all the information in one easy-to-access place, your team can compare historical data and adjust strategies accordingly.

Maintaining financial statements

Templates can make financial reporting more streamlined and accurate. By using spreadsheet templates for income statements, balance sheets, and cash flow statements, you can ensure the consistency and completeness of your financial data. Ultimately, this makes it easier to analyze the financial health of a business and report key insights to stakeholders.

Tracking expenses

Taking a systematic approach to tracking expenses is crucial for any business. Using an expense tracking template, you can record and categorize expenses and monitor spending patterns across your business. This makes it easier to manage budgets and generate reports for tax or financial reporting purposes.

5 must-have Excel accounting spreadsheet templates

To save you the time and hassle of creating your own accounting spreadsheets, here are five essential templates that will help boost efficiency and accuracy across your firm

1. Month-end close template

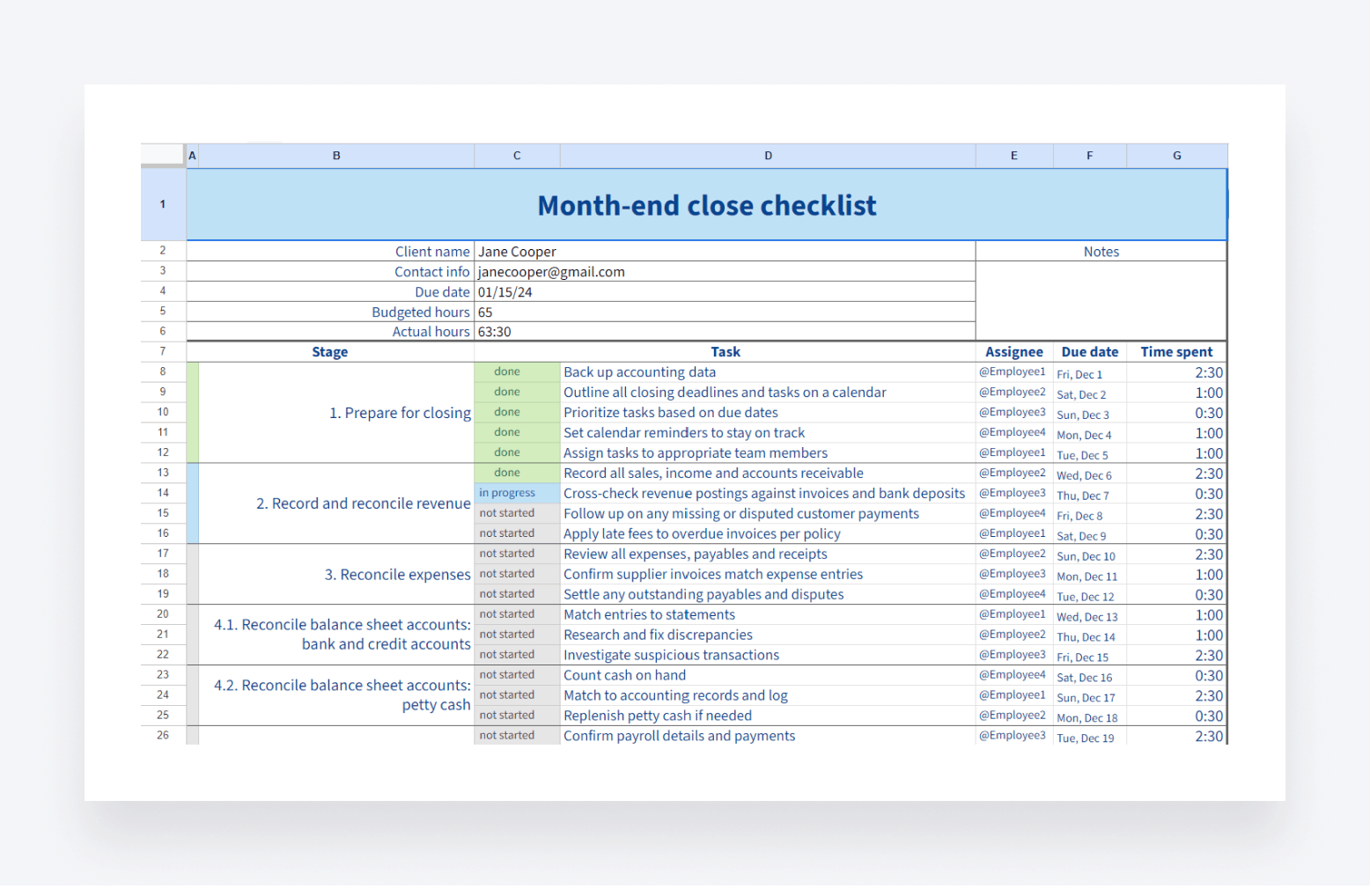

The month-end close comprises a series of steps that need to be taken to effectively close the books for that accounting period. Our month-end close checklist template breaks this crucial process down into stages and tasks, enabling you to track your progress from start to finish.

Why you should use it

Our free template enables you to take a methodical approach to the month-end close. With a global view of tasks that need completing for each stage of the process, you can work through the procedure systematically, ensuring that nothing slips through the cracks. The result is:

- A more thorough and standardized month-end process

- Greater accountability for each individual task

- More accurate data for financial reporting

How to use it effectively

You can download the free template here. Once in the document, click “File” in the top-left corner. You can then select either “Make a copy” or “Download” to use the spreadsheet. Once that’s done, you can follow these steps to set it up for your firm:

- Fill in the client or business details at the top of the spreadsheet

- Add or remove rows/tasks in the spreadsheet so that it aligns with your month-end process

- Assign individual tasks to team members and add due dates

- Share with your relevant team members

- Update task statuses in real time and record time spent

2. Accounts receivable template

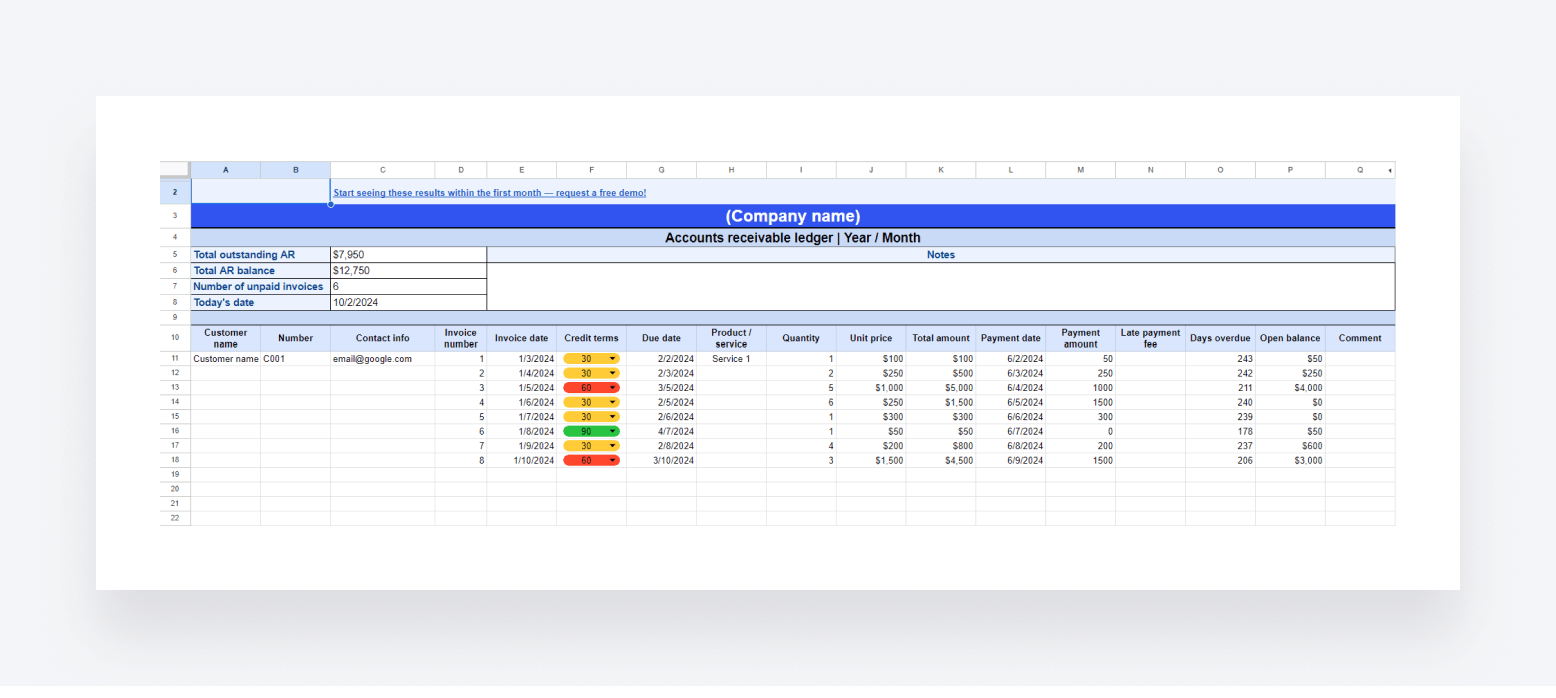

Effective management of accounts receivable (AR) is critical for a business to maintain a healthy cash flow. With this accounts receivable template, you can gain complete visibility into the money your business is owed.

Why you should use it

This template provides a simple way to track which customers or clients owe you money, how much they owe you, and when payment is due. It also goes into detail about credit terms and service types. With fields for entering product or service quantities and amounts, the template automatically calculates your AR balance and total outstanding AR.

By recording your accounts receivable entries in this template, you can understand cash flow and manage your business’s finances more effectively.

How to use it effectively

- Download the template

- Go to “File” and click “Make a copy” or “Download” to get your own copy

- Share with relevant team members

- Enter the company name at the top of the spreadsheet

- Enter all relevant information for each AR entry

3. Accounts payable template

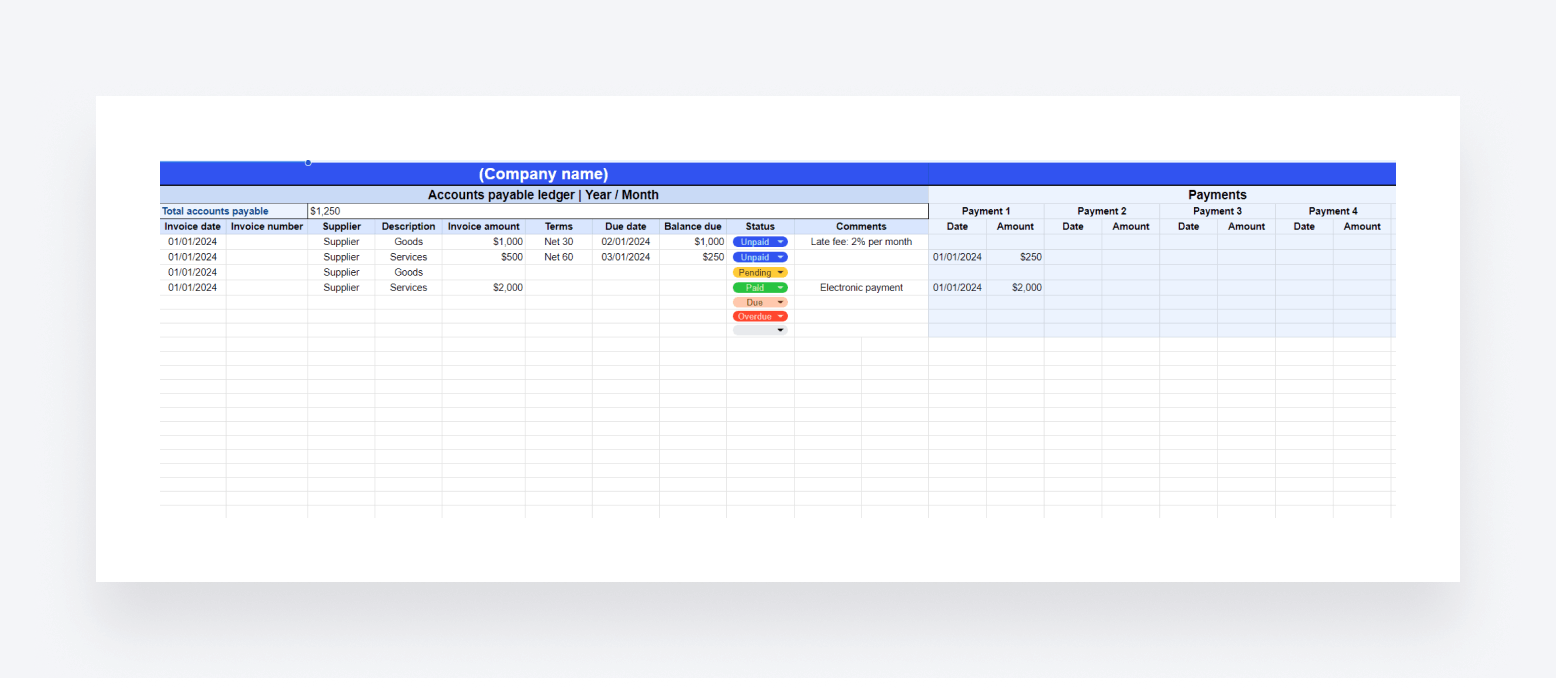

The opposite of accounts receivable, accounts payable refers to the money your business owes to suppliers, vendors, or contractors. With our free accounts payable template, you can track the money you owe for goods and services in one simple and easy-to-use spreadsheet.

Why you should use it

Our accounts payable template lets you record all accounts payable items in one place. You can easily log invoice dates, supplier numbers, due dates, amounts, and more. The template also automatically calculates your total accounts payable.

By using this template, you can:

- Avoid missing payment dates

- Maintain good relationships with suppliers and vendors

- Manage your cash flow and budget

How to use it effectively

- Download the template

- Go to “File” and click “Make a copy” or “Download” to get your own copy

- Share with relevant team members

- Enter the company name at the top of the spreadsheet

- Enter all relevant information for each AR entry

- Update the status column in real time

4. Bookkeeping pricing template

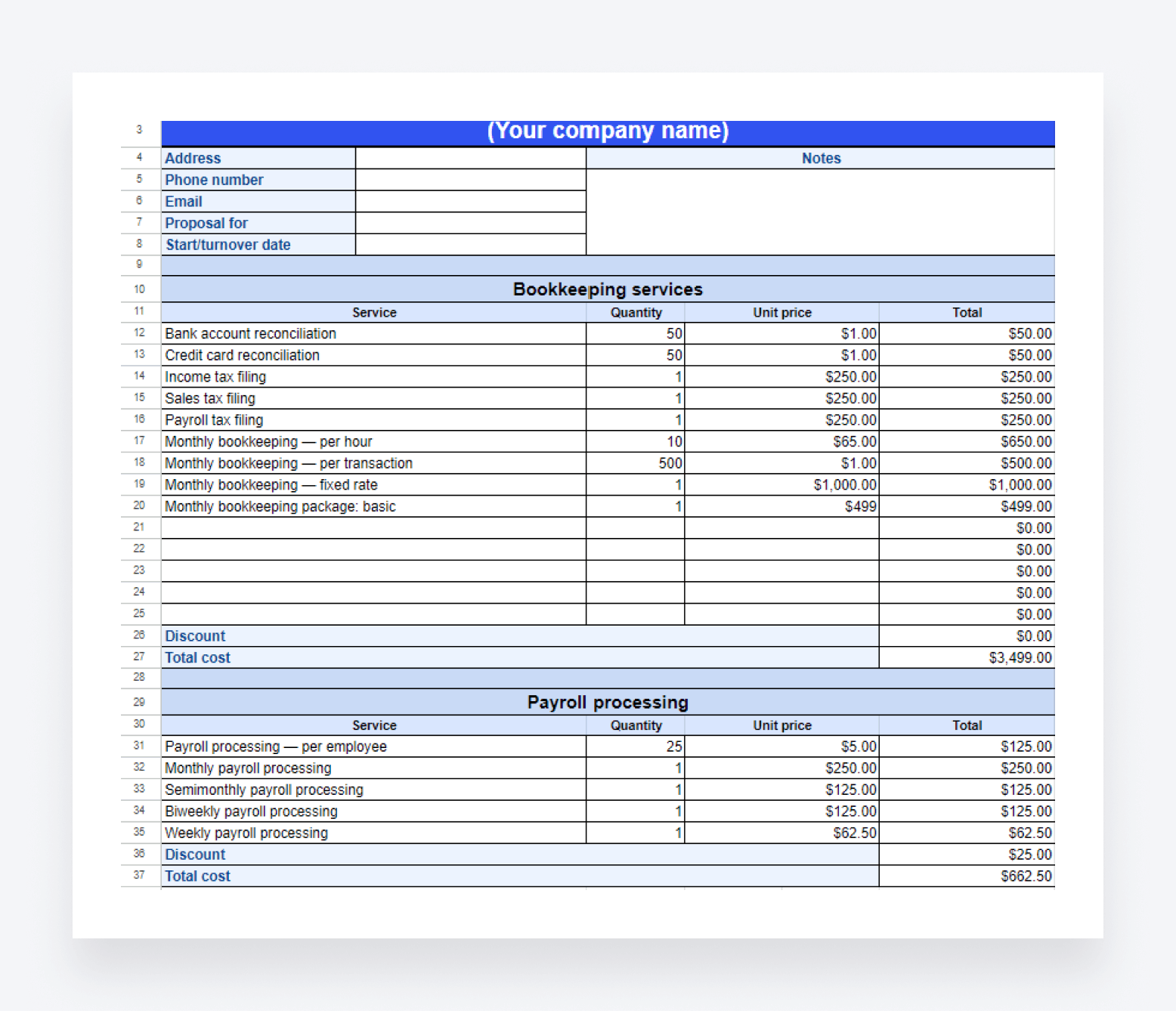

One of the most important questions potential new bookkeeping clients will have is how much do you charge? Given that every client has their own unique service requirements, pricing can vary. With our free bookkeeping pricing template, you can quickly calculate service fees.

Why you should use it

This template enables you to list your services and costs in one spreadsheet. You can enter quantities, and the template will automatically calculate service totals. You can even share it with your clients to improve transparency around pricing.

Using this template, you can:

- Standardize your bookkeeping pricing

- Quickly calculate total service costs

- Improve client engagement

- Save time on manual calculations

- Easily review and update your pricing

How to use it effectively

- Download the template

- Go to “File” and click “Make a copy” or “Download” to get your own copy

- Share with relevant team members

- Enter the company name at the top of the spreadsheet

- Add, remove, or edit any of the service types

- Enter the unit price for each service

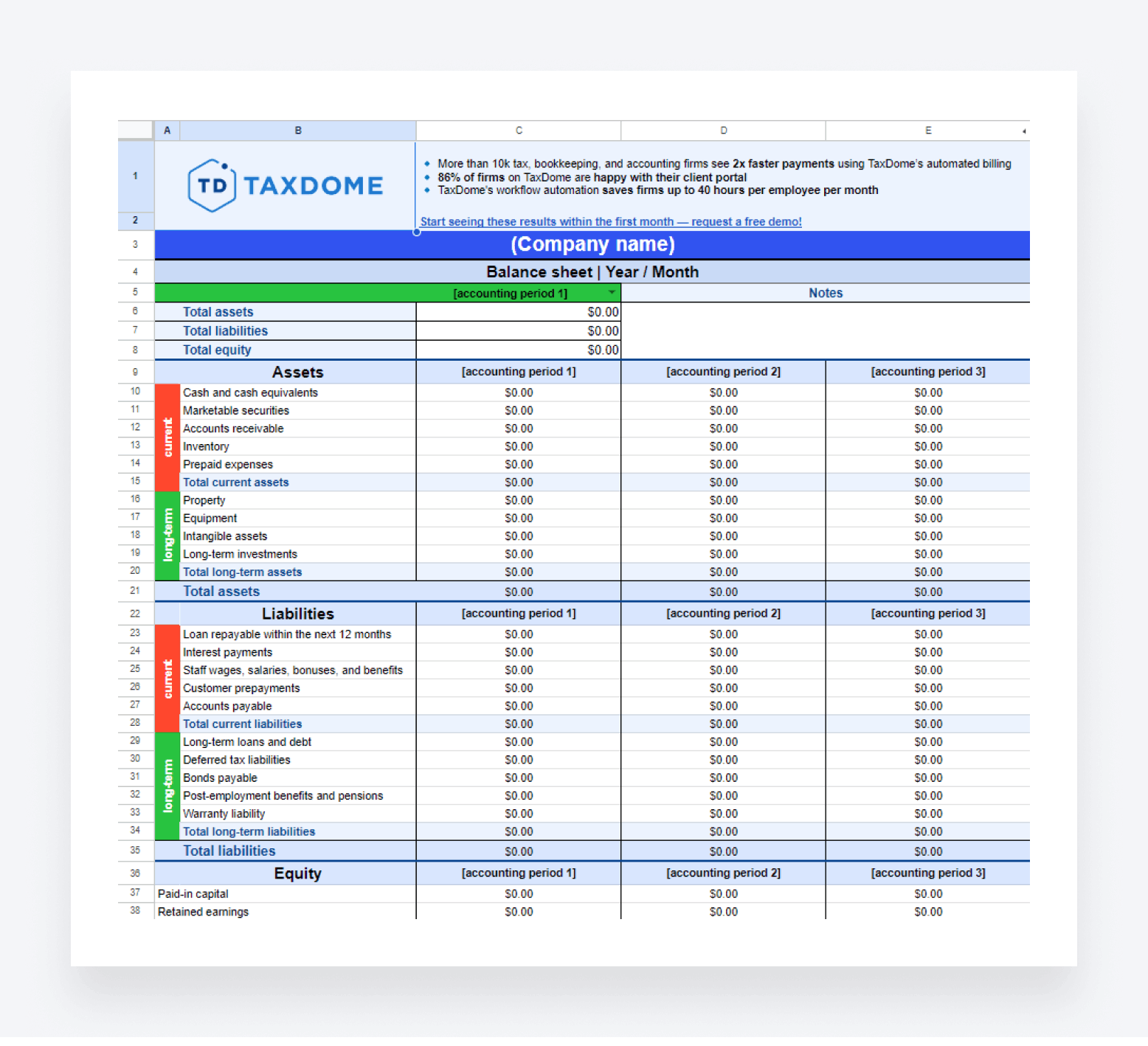

5. Balance sheet template

Alongside the income statement and cash flow statement, the balance sheet is one of the core financial statements. It provides a snapshot of a business’s financial position during any given accounting period. Our free balance sheet template provides the fields and functions you need to accurately record assets, liabilities, and equity.

Why you should use it

Maintaining accurate financial statements is essential to understand and report a business’s financial health. With this template, you can systematize your financial reporting. The template is clear, easy to use, and includes all the functions you need to automatically calculate total assets, liabilities, and equity.

With this template, you can:

- Improve consistency across your financial reporting

- Accurately compare financial performance over time

- Save time creating a balance sheet from scratch each month or quarter

- Improve accuracy through predefined fields and formulas

How to use it effectively

- Download the template

- Go to “File” and click “Make a copy” or “Download” to get your own copy

- Share with relevant team members

- Enter the company name and reporting period at the top of the spreadsheet

- Enter all relevant financial data into the spreadsheet

How to use these templates effectively

Here are some tips to help you get the most out of our free accounting spreadsheet templates.

Customize to suit your needs

Spreadsheet templates are flexible tools. While the templates we’ve listed above can all be used “out of the box”, the first step is to look closely through the data fields and check them against your own processes or requirements.

You can add or delete rows or columns as you see fit. For example, your month-end close process might include extra steps, or you may want to reorder the steps to better reflect your internal workflows. You may also want to add custom service categories to the bookkeeping pricing template.

Boost collaboration with cloud-based tools

The templates in this list are all in Google Sheets, a cloud-based spreadsheet system. The benefit of cloud-based tools is they enable easy access from any device, without needing to rely on local storage.

Not only does this reduce the risk of lost files, but it also improves collaboration. Your team can access templates from anywhere and at any time — and multiple team members can work on the same document simultaneously. Google Sheets also allows you to leave comments and tag staff in relevant data fields.

Take steps to secure your financial data

Accounting spreadsheet templates are used for recording highly sensitive financial data. With this in mind, you should take any necessary steps to secure that data. In Google Sheets, for example, you can set access rights. You can share it with individual people only, or set it to be available to anyone with the link. You can also set whether those with access can edit, view, or comment on the document.

Using Microsoft Excel, you can take data security a step further by password-protecting your templates. This way, only those with authorized access can view the data stored in your spreadsheets. You can convert a Google Sheet to an Excel document by following these steps:

- Click “File” in the top-left corner

- Hover over “Download” and select “Microsoft Excel (.xlsx)” from the dropdown menu

To password-protect your new Excel file, follow these steps:

- Click “File”

- Select “Info”

- Click “Protect Workbook” and select “Encrypt with Password”

- Enter a password and select “OK”

- Reenter the password to confirm and select “OK”

Integrate spreadsheets into your accounting workflows

To ensure smooth and joined-up processes, make sure your accounting spreadsheets are embedded into your accounting workflows. There are several ways you can do this:

- Ensure that the right people have access to your spreadsheet templates

- Clearly outline when templates should be used and how

- Attach spreadsheets to relevant tasks and projects for easy access

- Leverage integrations between your accounting software and Excel or Google Sheets

Know when to upgrade to practice management software

While spreadsheet templates are highly effective accounting tools, it’s important to understand their limitations — and when a more comprehensive system is required.

As your firm grows, you may find that managing and updating spreadsheets becomes increasingly cumbersome and error-prone. Here are some telltale signs your firm is ready to upgrade to practice management software:

- Wasting time on manual data entry. Spreadsheet templates require some degree of manual data entry, making them time-consuming and prone to errors. The more data you have to add, the more time you spend — and the greater the risk of error.

- Overly complex workflows. Spreadsheets sit outside your core accounting software systems, meaning you have to jump between systems to get stuff done. This can make your workflows unnecessarily complex.

- Need for automation. Besides functions that automatically calculate values, spreadsheets cannot automate core accounting functions. If you’re ready to embrace automation, you need modern software, not legacy tools.

- Collaboration issues. The bigger your team gets, the harder it is to collaborate via spreadsheets — especially if you are using them as a task management tool. It’s not easy to gain a top-down understanding of task progress across multiple team members from a single document.

To manage your clients, tasks, and teams more effectively, you should consider upgrading to practice management software such as TaxDome. As an award-winning practice management platform, TaxDome provides a central hub for all your accounting workflows.

You can manage client relationships and data in a powerful CRM. You can gain complete visibility into tasks and projects, delegate work, and track deadlines. You can set up automated pipelines that run entire accounting workflows on autopilot, saving you time and hassle.

Upgrading a system like TaxDome doesn’t have to mean saying goodbye to spreadsheets altogether. In some cases, the two tools can work together in harmony. You can attach relevant spreadsheets to tasks and workflows in TaxDome, for example. So when a team member is assigned a task, all the relevant documents and instructions are right there in one place.

To sum up

In a world defined by technological change, it might come as a surprise that spreadsheets are still so popular with accountants. Despite the advent of workflow automation and AI, Excel is still the number-one tool for managing workflows in small accounting practices, thanks to its familiarity, simplicity, and ease of use.

Yet relying too heavily on spreadsheets can be counterproductive. Spreadsheets are great for recording and storing data, but they don’t offer sophisticated features for collaboration, automation, and reporting. When it comes to task and team management, there are far better tools available.

To ensure you stay ahead of the curve, we recommend upgrading to practice management software. With TaxDome, you get a suite of tools designed to streamline and automate your accounting workflows — and a central repository for all your client data, tasks, documents, and more. You can still use spreadsheets to track financial data, but you’ll be able to incorporate them into seamless workflows on one easy-to-use platform.

To see why TaxDome is rated 4.7 out of 5 from over 3,500 reviews on G2 and Capterra, request a demo today!

Thank you! The eBook has been sent to your email. Enjoy your copy.

There was an error processing your request. Please try again later.

What makes the best accounting firms thrive while others struggle to keep up? We analyzed our top 20 TaxDome firms, representing over $100M in combined revenue, to uncover the strategies driving their success.