The month-end close remains one of the most vital recurring duties of any accounting department. To balance thoroughness with speed during these condensed monthly reporting windows, it’s essential to have a streamlined checklist with all the steps.

In this article, we’ll break down the entire month-end closing process and provide a customizable checklist template, so you can approach it systematically.

Understanding the month-end close process

The month-end close process is a pivotal accounting procedure for every business, regardless of size or structure. Essentially, it refers to steps and procedures carried out by a company’s finance team to prepare and finalize the company’s financial statements and books for the just-completed month. This vital accounting process involves:

- Carefully closing out revenue and expense accounts

- Reconciling data across systems

- Recording adjustments

- Verifying the accuracy of financial data

The ultimate goals of the closing process are to generate updated and accurate financial reports that reflect the past month’s business operations and provide insights to guide future strategies.

Why is a month-end close checklist important?

Closing out the financial books is a critical monthly task for any finance team. However, various discrepancies, including misclassified expenses, unresolved payroll issues or unapplied customer credits, can undermine the accuracy of the numbers if processes are inconsistent.

This is why a standardized checklist is invaluable for efficient month-end closes, as it:

- Outlines the required tasks to verify completeness across all accounts and entries

- Safeguards accuracy by mandating thorough account reconciliation procedures

- Creates detailed documentation trails, aids regulatory compliance and provides clear auditability

- Aligns recorded transactions with actual business operations and enables reliable inputs to drive quality financial outputs

In summary, a month-end close checklist fosters standardized workflows for precision, governance and insightful data to guide strategic decisions.

Creating a month-end close checklist: step-by-step

1. Prepare for closing

Proper preparation is key for an efficient closing process. Initial steps focus on setting the groundwork:

- Back up accounting data to safeguard the business

- Outline all closing tasks on a calendar with deadlines

- Prioritize activities based on due dates to streamline work

- Set calendar reminders to help the team stay on track

- Assign closing procedure tasks to team members by areas of expertise

With responsibilities defined and sequenced, teams can progress effectively through the month-end workloads.

2. Record and reconcile revenue

Carefully validating and recording all revenue underpins accurate financial reporting. This critical step focuses on:

- Recording all sales, income and accounts receivable entries to pull preliminary revenue totals

- Cross-checking revenue postings against invoices and bank deposits to verify agreement

- Following up on discrepancies, such as missing customer payments, to reflect true cashflow

- Applying late fees to overdue invoices per company policy

By thoroughly examining revenue from all streams, teams can catch errors early and ensure recognition policies adhere to accounting standards.

3. Reconcile expenses

Similar meticulous validation on the expense side is key for precise financials. This step involves:

- Reviewing all expenses, accounts payable and receipts to understand total outflows

- Confirming individual supplier invoices match entries prior to payment

- Setting up any outstanding payables disputes and processing write-offs

Auditing every expense transaction verifies details while uncovering potential duplicate postings or inaccuracies for correction ahead of reporting.

4. Reconcile balance sheet accounts

With income and expenses validated, accountants verify balance sheet continuity across all asset, liability and equity accounts. Verifying balance sheet account details is crucial across six areas:

- Bank and credit accounts: compare ledger postings to statement activity in order to research and resolve discrepancies or suspicious transactions

- Petty cash: count physical cash on hand and replenish if needed to match accounting system records

- Payroll accounts: verify employee payment details, including taxes, deductions and reimbursements, while ensuring accurate underlying payroll expense recording

- Loans: focus on matching liability account balances to lender statements, including up-to-date interest calculations and principal repayments

- Accounts payable: review aging reports to pinpoint unpaid supplier invoices or unrecorded liabilities for correction so payables align with the general ledger

- Accounts receivable: investigate variances, unapplied customer credits and other invoice issues to state receivables accurately

Careful verification across balance sheet accounts ensures credible financial position insights to guide decisions.

5. Complete inventory count

For product resellers, inventory constitutes a major asset requiring careful tracking:

- Perform full physical inventory checks, counting all stock items

- Compare counts to accounting records and update any variances found

- Analyze data for fast/slow-moving items near expiration dates

Accurate inventory assessment informs key decisions on purchasing, logistics and sales.

6. Review profit and loss statement

With underlying transactions validated, accountants can review profit and loss statements for reasonableness:

- Scan that revenues and expenses align to the chart of accounts

- Investigate significant variances against budgets and prior periods

- Make any required adjusting entries for accuracy

Verifying profit and loss integrity helps safeguard margin analysis and operating decisions.

7. Generate financial statements

The outputs of all closing activities are fully updated financial statements reflecting the latest business transactions:

- Prepare accurate balance sheet based on reconciled account balances

- Finalize month-end profit and loss statement after validation and adjustments

- Compile the full set of required financial reports for publication

These state the financial position and performance of the company for managerial strategy and external reporting.

8. Close accounting period

Finally, the finance team reviews deliverables, approves final adjusting journal entries and closes the period on the accounting system. Completed checklists, manager approvals and archived files provide the audit trail for regulators. With the books fully reconciled and closed, leadership can rely on these buttoned-up financials to guide operations and growth strategies.

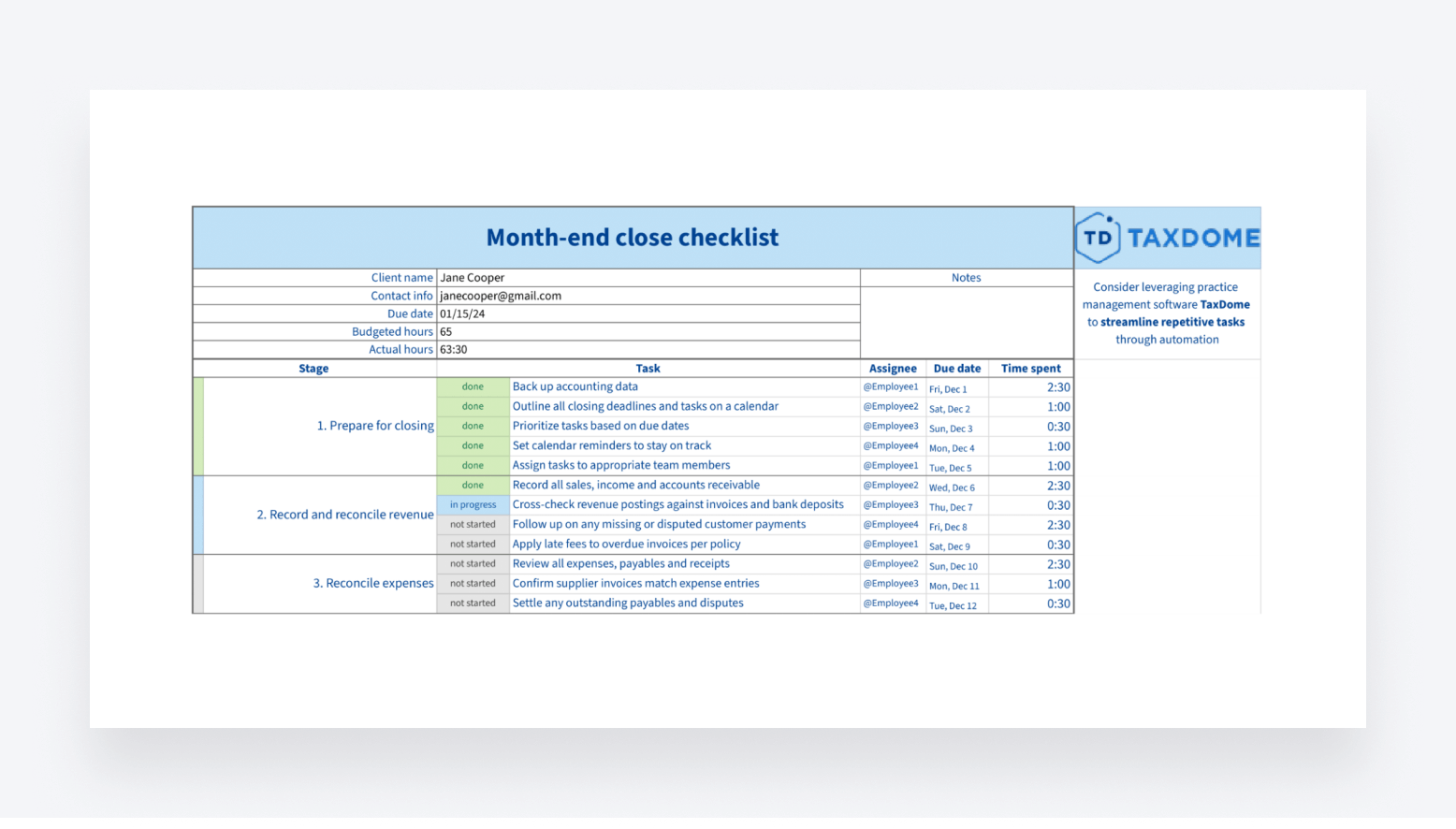

Month-end close checklist template

To get your own copy to edit, once you are in the document, please click “File” in the top left corner and look for the “Make a copy” or “Download” option right there.

Tips for an efficient month-end close

1. Keep data organized

- Maintain organized files, folders and naming conventions for all documentation

- Digitize and electronically store documents to eliminate paper chase

- Establish a centralized file management system with access controls

- Standardize bookkeeping practices across departments

- Keep an updated record of all account information

2. Automate recurring tasks

- Use practice management software to automate workflows

- Set up recurring bulk reconciliations where possible

- Develop templates for recurring journal entries

- Schedule time weekly for data organization and filing

- Automate data collection and transfers between systems

3. Enhance team skills

- Cross-train employees on different closing tasks to cover absences

- Train staff on new software features to maximize efficiency

- Schedule refresher training on reconciliation processes and accounting standards

4. Communicate expectations

- Review responsibilities and timelines with team members

- Give ample notice of vacation schedules to plan coverage

- Provide status updates on closing progress to management

Frequently asked questions

- What is the timeline for a month-end close?

While timelines vary, the best practice is to complete the closing process within 10-15 business days after month-end. Larger enterprises may take up to 30 days due to complexity. The exact timeline depends on a company’s size and the complexity of its operations.

- Who is responsible for the month-end close?

The core accounting team owns month-end close responsibilities, including the corporate controller, assistant controllers, financial reporting manager, accounting managers, senior accountants and staff accountants. The CFO and controller maintain executive oversight to ensure procedures adhere to internal controls and financial reporting standards.

- How can technology streamline the month-end close process?

Accounting software can be configured to automatically reconcile transactions, send reminder notifications, and establish approval workflows. Dashboards give leadership real-time visibility into the percentage of tasks fully completed. Using macros and templates within systems expedites journal entries. Shared drives facilitate financial statement collaboration across closing owners. For more in-depth information on how to automate your accounting processes, check out our blog.

- What activities can be transitioned to the new month?

Timely month-end closing relies on prioritizing daily tasks on the critical path while allowing flexibility for less time-sensitive procedures. Therefore, teams should focus first on completing activities that directly drive the ability to close the books. Meanwhile, non-critical reconciliations, inventory counts, accrual estimates and audit tests may shift to the first week of the new month without unreasonable workloads.

- What are the risks of a delayed or inaccurate close?

A delayed close shrinks the window leadership has to analyze results and make data-driven decisions for the current period. Information relevance declines sharply after 30 days. Common impacts include improper revenue recognition, undetected fraud, unreliable metrics for investors and regulatory non-compliance. Rating agencies may downgrade companies demonstrating close inconsistencies or weaknesses over time.

- How can I improve my efficiency during the month-end close?

Download our closing checklist and follow it step-by-step to improve efficiency. This prescribed checklist covers all necessary reconciliations and approval steps to ensure nothing gets missed.

Wrapping up

With everything we’ve explored in this article, your team is equipped to approach monthly closings systematically. To recap the vital points:

- Standardized checklists outline all closing tasks, enforce reconciliation procedures, ensure compliance and align transactions with actual business operations.

- Major steps include preparing for closing, recording and reconciling revenue and expenses, verifying balance sheet accounts, counting inventory, reviewing P&L statements, generating reports and closing the accounting period

- Tips to improve close efficiency include organizing data, automating tasks, enhancing team skills and clearly communicating expectations

- Common risks of delayed or inaccurate closes include improper revenue recognition, undetected fraud, unreliable metrics and regulatory non-compliance

Consider leveraging the checklist template as a framework along with software tools such as TaxDome. This can help streamline repetitive tasks through automation, allowing you to focus your efforts on high-value areas instead.

Consistent, durable processes yield the insights that steer companies to prosperity. It’s time to transform monthly closings into a core competency that sets you up for success.

Thank you! The eBook has been sent to your email. Enjoy your copy.

There was an error processing your request. Please try again later.

Looking to boost your firm's profitability and efficiency?

Download our eBook to get the answers