In the ultra-competitive world of accounting, it has never been more important to make the right technology choices. A firm can have the most talented and experienced accountants, but if they don’t have the right tools at their disposal, they’ll struggle to meet the growing demands of their clients.

In this guide, we’ll cover everything you need to know about choosing and implementing the right software, allowing you to streamline processes, enhance the client experience and ultimately boost your bottom line.

Factors to consider when choosing new technology

The technology you choose impacts virtually every aspect of your firm, from client satisfaction to process efficiency. In other words, it could be the difference between success and failure.

To help you make informed choices, let’s look at some key factors to consider when building a winning tech stack.

1. Alignment with business goals

Before diving into technology options, it’s important to take a step back and assess your firm’s goals. Are you looking to streamline your internal processes, improve client communication or enhance data security? Clearly defining your objectives will help you filter out solutions that don’t align with your strategic vision.

2. Cost and ROI

Good technology comes at a cost, but it’s important to look beyond the price tag and consider the potential return on investment (ROI). If a more expensive solution delivers greater efficiency and value in the long run, it’s likely the better financial decision.

3. Integration

The best tech stacks combine tools that work effortlessly together, allowing seamless data transfer and streamlined workflows. Before you add a new tool to your stack, consider how it will integrate with your existing software.

Look for software with ready-made integrations and APIs, or consider comprehensive practice management platforms that bring together multiple tools and processes in one place — like TaxDome.

4. Customization

Your accounting firm has its own unique needs and challenges, and the technology you choose should reflect that. Look for software that allows customization, allowing you to adapt it to your specific workflows and client requirements. A one-size-fits-all approach often misses the mark.

5. Data security and compliance

Given the sensitive financial information you deal with on a daily basis, data security should be a top priority. Ensure that any technology you consider meets industry-standard security protocols and compliance requirements. Look for features like data encryption, access controls and audit trails to protect client data.

6. Scalability

As your firm grows, your tech stack should be able to grow with it. Choose solutions that can scale up to accommodate an expanding client base and increasing data volumes. Avoid being locked into solutions that can’t adapt to your changing needs.

7. User-friendliness

The best software balances powerful features with an intuitive and simple user experience. Complex and hard-to-use software can lead to resistance from your team and reduce the overall effectiveness of your tech stack. Consider solutions that are simple to set up, easy to use and offer comprehensive help and training materials.

8. Support and maintenance

Even the best technology can encounter issues. Look for solutions that offer hands-on assistance during implementation, reliable customer support and regular product updates.

9. User feedback and reviews

Before making a final decision, do your due diligence. There’s a wealth of user feedback and reviews out there, and these are often the most reliable way to gauge how effective and reliable a software solution is.

Essential tech solutions for accounting firms

To thrive in a competitive landscape, you need a tech stack that not only streamlines your operations but also enhances the client experience, improves accuracy and allows you to build processes that can scale seamlessly.

Let’s explore the essential solutions that can make a difference:

1. Accounting software

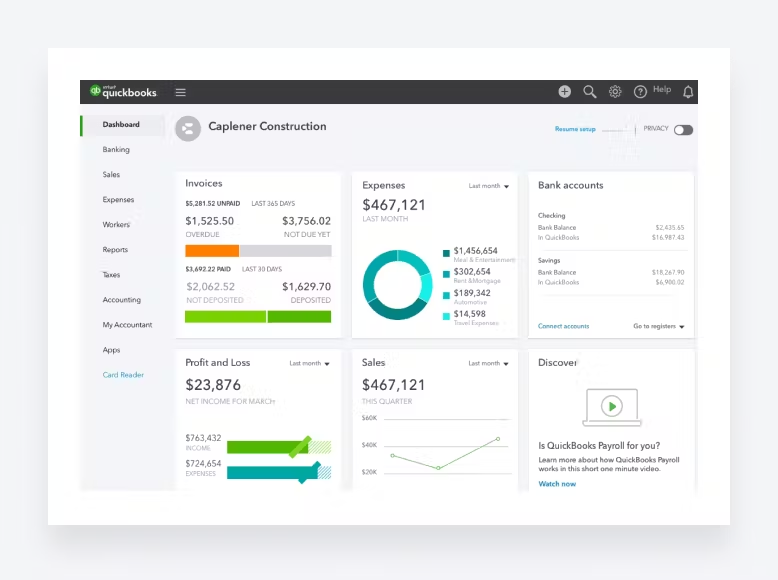

QuickBooks Online, a market leader in the small-business-accounting market.

Gone are the days of manually crunching numbers and working in spreadsheets. Today, accounting software helps firms manage their financial transactions, generate financial statements, streamline financial record-keeping, run payroll and simplify the tax preparation process. The benefits include:

- Increased efficiency: automating repetitive manual tasks saves you countless hours

- Improved accuracy: accounting software reduces the risk of human error that comes with manual data entry

- Powerful insights: with real-time reports and analytics, you can make smarter financial decisions

Software to consider

There are plenty of options to choose from, but among the most popular are QuickBooks Online, Xero, Zoho and FreshBooks. You can also get dedicated tax preparation software, such as Intuit ProConnect, which streamlines the tax filing process.

2. CRM

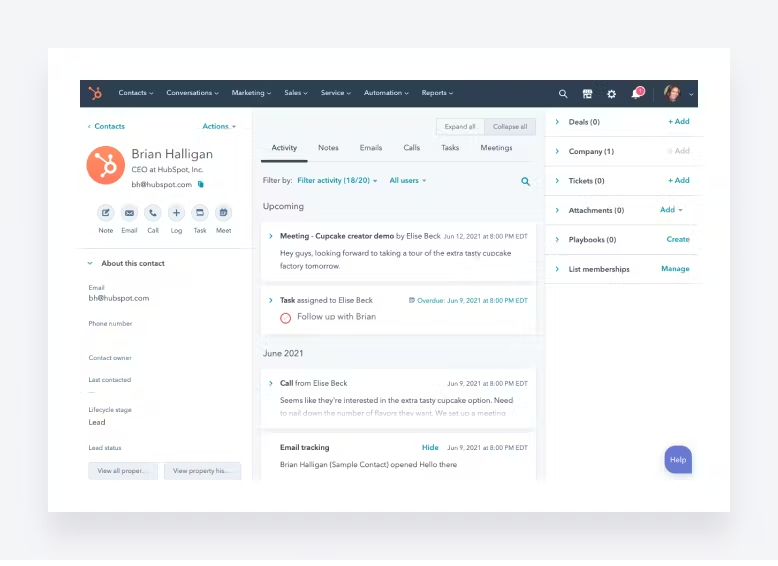

HubSpot’s free CRM platform.

A CRM (customer relationship management) tool helps your firm manage and nurture its relationships with clients and leads. It provides a centralized hub for all client information, interactions and records, resulting in:

- Improved client engagement: a CRM helps you understand your clients’ needs and preferences, providing you with the tools you need to build lasting relationships

- Streamlined communication: you can easily track client interactions, emails and appointments

- Data-driven decision-making: by utilizing client data, you can offer more personalized services and marketing strategies

Software to consider

There are plenty of CRM tools out there, with popular options including HubSpot, Pipedrive and Insightly. These tools aren’t focused on any one industry or niche, however, so you’ll find they come with a lot of sales-related features that might not be relevant to your average accounting firm.

Then there are CRMs designed specifically for accountants, bookkeepers and tax professionals, like TaxDome. Instead of focusing on pushing leads through the sales funnel, TaxDome provides you with all the tools you need to manage client data, organize client accounts and provide effective and timely communications.

3. Project management software

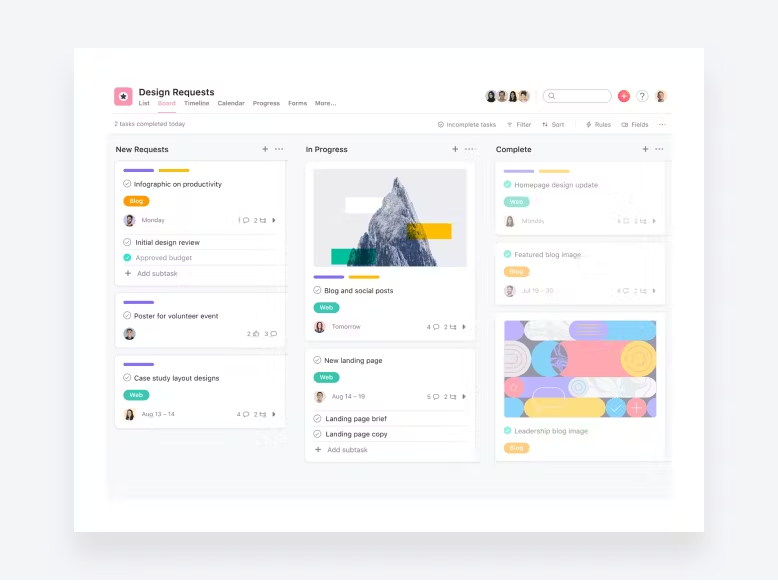

Asana’s Kanban view for project management.

Running an accounting firm involves a lot of moving parts. At any one time, you need to know who’s working on what, and when that work will be finished. This is where project management software comes in. With the right platform, you can:

- Improve team collaboration and project transparency

- Ensure that everyone’s on the same page by making assignments and deadlines visible to everyone

- Keep projects on schedule and within budget with real-time updates

Software to consider

There are tons of project management tools on the market, each with its own unique benefits. Asana, for example, offers simple and intuitive project management. Jira is excellent for issue tracking but offers limited collaboration features, while AirTable takes a spreadsheet approach to project management.

You’ll also find project and task management capabilities in practice management software. With TaxDome, for example, you can assign tasks and access rights, manage workflows, and view all your projects and deadlines via Kanban and list views.

4. Document management software

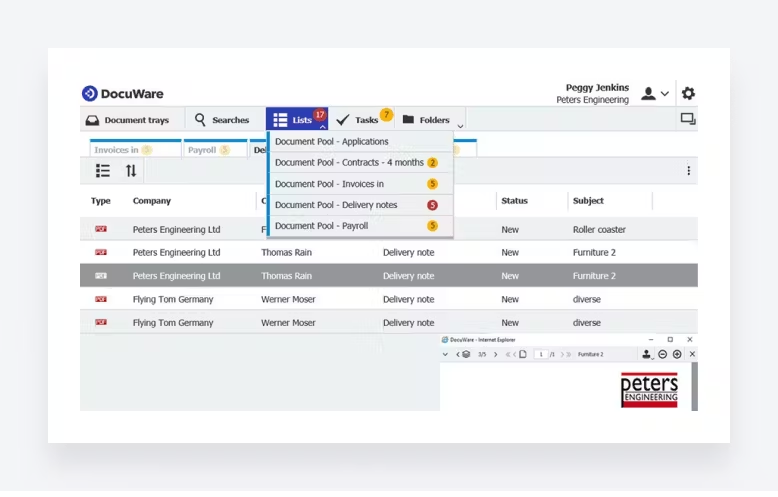

Document lists in DocuWare.

Accounting firms handle a lot of documents, so it’s critical to have the right software to help you organize, store and manage them securely and efficiently. With the right document management software, you can:

- Easily store, retrieve and share important financial documents and records

- Track changes, ensure data accuracy and maintain a complete audit trail

- Enable secure document sharing and collaboration with clients and team members

- Streamline and automate document workflows

Software to consider

Again, it depends on your needs. Tools like DocuWare offer digital document management and automated workflows. File storage platforms like Google Drive allow you to store files in the cloud. Then there’s dedicated e-signature software like DocuSign.

If you want to go for a more unified tech stack, TaxDome offers robust document management capabilities alongside everything else you need to run a forward-thinking accounting firm. You get unlimited cloud storage, centralized file management, a built-in PDF editor and an e-signature tool all in one place.

5. Proposal software

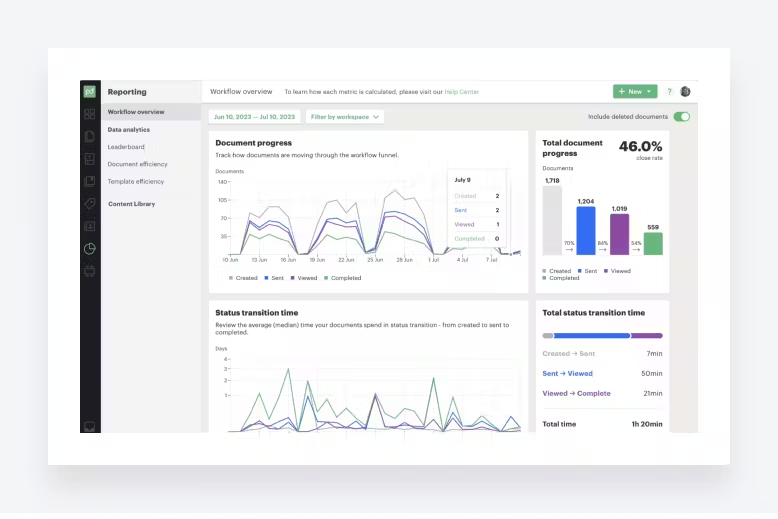

Reporting and analytics in PandaDoc.

Proposal software helps you streamline and automate the creation and management of proposals, engagement letters and other legal documents. Essentially, it helps your firm pitch its services and stand out in what is a highly competitive market.

Here are just some of the things you can do with proposal software:

- Quickly generate customized and polished proposals

- Ensure consistent branding across all proposals

- Streamline the lead conversion process – from first contact to e-signatures

- Gain insights into engagement levels, helping you understand what works and what doesn’t

Software to consider

PandaDoc helps businesses streamline their document workflows, allowing them to quickly generate, manage, share and e-sign proposals and engagement letters.

Ignition is another popular option and includes client billing and payments alongside proposals. And because it’s designed specifically for accountants, there are ready-made integrations with QuickBooks Online and Xero.

6. Workflow management software

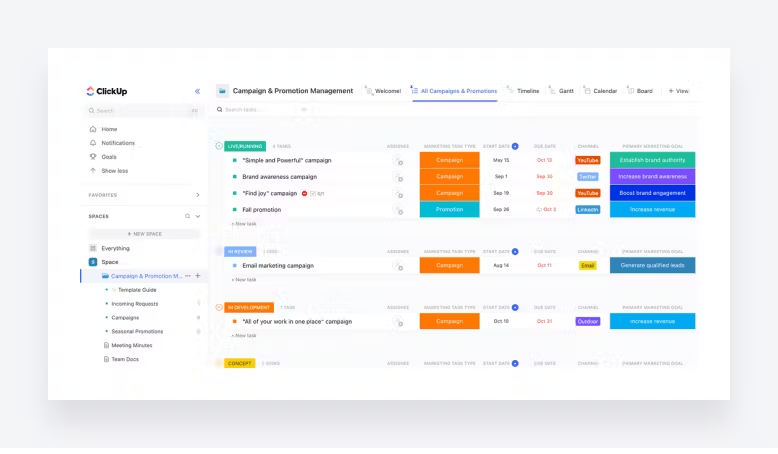

Workflow management in ClickUp.

Workflow management software automates, streamlines and tracks the different tasks involved in a process, or workflow. This is a game-changer for accounting firms, enabling them to:

- Build custom workflows, assign tasks and set deadlines

- Improve efficiency and reduce manual work

- Gain a top-down view of processes and track progress towards completion

- Build processes that scale seamlessly as demand increases

Software to consider

Tools like ClickUp, Monday.com and Asana all help teams organize and streamline their workflows. Then there are process automation tools like Zapier and Make (formerly Integromat), which allow you to build custom workflows by connecting tools and apps via integrations.

Alternatively, you can keep everything in one place and choose a practice management platform that offers workflow management and automation. With TaxDome, you can automate entire workflows from start to finish, including client communications, document sharing, task management and invoicing — and schedule jobs to trigger automatically at times of your choosing.

7. Time and billing software

Clockify’s dashboard.

Every firm wants to get paid accurately and on time. This is where time and billing software comes in. It allows you to track the time spent on client projects, generate invoices and manage financial transactions. The best time and billing software allows you to:

- Automate the process of generating and sending invoices

- Reduce manual data entry and minimize invoicing errors

- Access real-time financial insights and reports

Software to consider

There are plenty of standalone time and billing tools available, with popular options including Clockify, TimeCamp and Harvest.

Accounting software such as QuickBooks Online and Xero has time-tracking and invoicing functionality built-in, as do practice management platforms like TaxDome. The benefit of this is that all your data relating to your clients, staff, jobs and costs are together in one place.

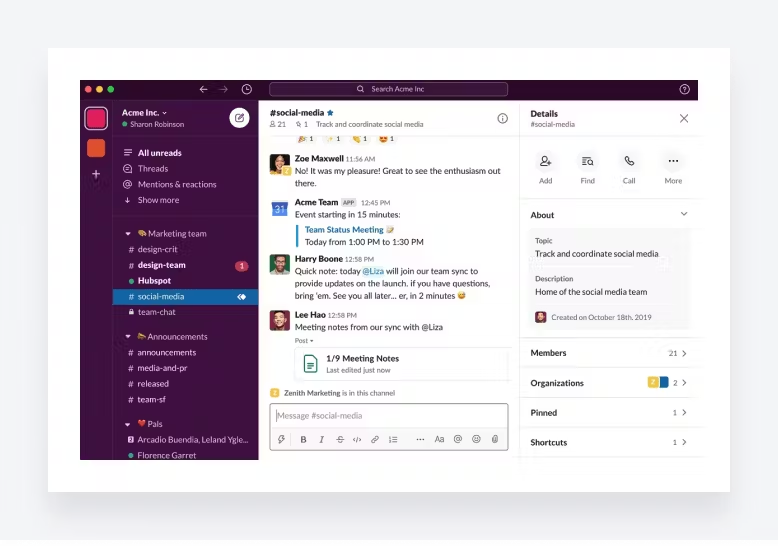

8. Communication software

Slack, one of the most popular instant-messaging platforms.

When it comes to running a successful firm, communication is key — both internally and with clients. To communicate effectively, however, you need more than traditional tools like email and phone calls. Modern communications tools allow you to:

- Keep clients in the loop and communicate in a way that’s familiar to them

- Promote real-time collaboration across remote teams

- Keep conversations organized with dedicated channels and threaded conversations

- Share files easily

- Seamlessly integrate with other tools

Software to consider

Both Slack and Teams are popular collaboration tools, offering instant messaging, video calls and file sharing. Then there are dedicated video conferencing tools like Zoom and Google Meet.

It’s also worth looking at screen-recording tools like Loom, which can be an effective way to share detailed instructions and welcome videos with clients.

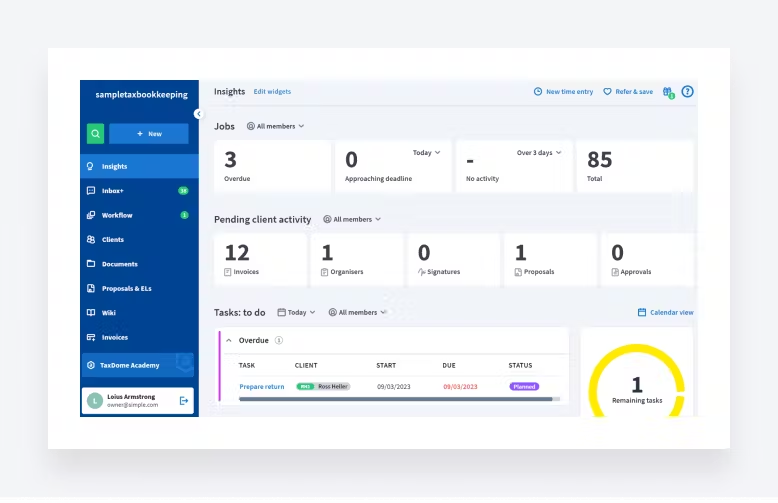

9. Practice management software

TaxDome’s dashboard, showing an overview of jobs, tasks and client activity.

Practice management software helps you manage the day-to-day running of your firm, covering task management, document management, client communications, workflow management, time and billing — pretty much everything apart from the actual accounting.

In other words, practice management tools allow you to replace most of the software we’ve outlined in this list with a single platform, bringing the following benefits:

- A unified tech stack: instead of jumping between multiple different tools, each with its own look and feel, you can manage different processes in one place

- Cost-savings: having a single software license instead of multiple is a more cost-effective approach to building a tech stack

- A single source of truth: all your data relating to clients, workflows, staff and billing is in one place

Software to consider

With an average G2 rating of 4.7, TaxDome brings together all the tools and processes you need to run your firm efficiently, from team collaboration and client communication to getting paid.

TaxDome allows you to replace almost all of the apps on this list by bringing the following tools and features together in one easy-to-use platform:

- CRM for tax professionals

- Accounting workflow automation

- Document management, including e-signatures and a PDF editor

- Invoices and payments

- Secure client messages

- Team collaboration, task management and time tracking

- Ready-made integrations with the most popular accounting, tax and payment software

From the client’s side, our secure client portal and brand-new client mobile app ensure that they can interact with your firm, complete key tasks and stay updated easily.

Case study: how Athene Group implemented a unified tech stack

Athene Group is an accounting firm headquartered in Oslo, Norway, but with offices across Scandinavia and Europe. Here, we’ll look at how they implemented a streamlined accounting tech stack — and the benefits they enjoyed as a result.

Challenge

With more than 100 staff spread across 10 offices in three countries, Athene Group needed the right technology to ensure clear communication with its 1,700 clients, as well as effective collaboration among team members.

Solution

After testing over 1,000 software systems, they settled on TaxDome. This allowed Athene Group to implement a unified tech stack, replacing multiple separate tools for task management, client communication and document management.

Results

Athene Group now has a single platform for all client communications, document management and project management. This has allowed the team to streamline its workflows, improve efficiency and enhance the client experience.

Before TaxDome we used one system for handling sensitive documents (GDPR), one system for sharing documents, one system for task management, one system for time-tracking… Packing that into a single system instead of 10 different ones is great.

Watch this video to see how TaxDome is helping Athene Group provide seamless team collaboration across its remote team and enable faster client onboarding:

Implementing an accounting tech stack: a step-by-step approach

Implementing a new accounting tech stack can be a transformative process, but it’s also fraught with potential challenges. By following the steps below, you’ll be able to manage the transition to a new tech stack smoothly.

1. Identify your needs and goals

Start by conducting a comprehensive assessment of your firm’s needs. Engage with key stakeholders to understand what you hope to achieve with your tech stack. This may involve improving efficiency, enhancing the client experience or ensuring compliance with ever-changing regulations.

2. Choose the right technology

Research and evaluate potential technology providers and solutions. Consider factors like cost, features, integration capabilities and scalability, as well as user reviews. Look for software that aligns with your firm’s specific requirements.

3. Create a tech stack blueprint

Develop a detailed plan outlining which software and tools will be part of your tech stack. Ensure that they complement each other and fulfill your firm’s identified needs and goals. This blueprint will serve as a roadmap for your implementation.

4. Data migration and integration

Before you start using the new software, you’ll need to migrate your existing data. Work closely with your chosen software provider(s) to ensure a seamless transition. Ensure that the selected solutions can integrate with one another and with your legacy systems.

5. Implementation

This stage involves setting up and configuring the selected software according to your firm’s requirements. You’ll need to customize the software to suit your specific workflows and processes, and assign roles and responsibilities within your team.

6. Training and onboarding

Invest time in training your team to ensure that they know how to maximize the value of your new tech stack. Some software providers offer training resources and hands-on support, while others go for a self-service approach, so be sure to choose one that suits your needs.

7. Testing

Before fully deploying your new tech stack, conduct thorough testing to identify and resolve any issues. This helps ensure that the system is working as planned and meets your expectations.

8. Rollout

Now it’s time to start using your new tech stack. You might want to start with a smaller group of users at first and then roll it out to your entire team. This will help you monitor its performance, gather feedback and make any necessary adjustments based on initial user experiences.

9. Ongoing feedback and evaluation

Once you are up and running, regularly collect feedback from your team members and clients to identify areas for improvement. Continuously evaluate the performance of your tech stack against your initial goals and make adjustments as necessary.

10. Maintenance and updates

Regularly maintain and update your tech stack to stay current with software upgrades and security patches. This will help ensure optimal performance and data security.

11. Ongoing optimization

Continuously seek opportunities to optimize your tech stack. By staying informed about emerging technologies and industry trends, you’ll ensure that your firm remains ahead of the curve.

Conclusion

In today’s digital world, the technology you choose is a defining factor in the success of your firm. With the right accounting tech stack, you’ll be able to streamline your operations, enhance the client experience, and ensure timely and accurate financial management.

Choosing the right technology takes careful consideration and planning. We hope this guide has given you the information you need to approach those big decisions with confidence.

Thanks for reading, and all the best on your technological journey!

Thank you! The eBook has been sent to your email. Enjoy your copy.

There was an error processing your request. Please try again later.

Looking to boost your firm's profitability and efficiency?

Download our eBook to get the answers