Outlining your terms of service with an engagement letter is the key to starting a smooth, transparent relationship with your clients. This won’t just set clear expectations from the outset; it can also save you time and money.

If you’re a bookkeeper looking to improve your client experience, this guide covers everything you need to know about creating a professional engagement letter.

You’ll also find a free bookkeeping engagement letter template below that you can download and use right away to initiate best practices.

What is a bookkeeping engagement letter?

A bookkeeping engagement letter is a formal written agreement that defines the terms and conditions between a bookkeeper and a client. Engagement letters are legally binding and typically shorter and less formal than traditional contracts.

In general, bookkeeping engagement letters can include the terms and conditions for:

- The scope of bookkeeping services to be provided

- The duration of the engagement

- Client responsibilities

- Ownership of records

- Payment and late fees

- Resolution in the event of a dispute

- Termination of the engagement

- Confidentiality

- Liabilities

- Compliance with laws and regulations

To ensure clarity at the time of signing and throughout the professional relationship, a bookkeeping engagement letter should be thorough, detailed and clear. This guarantees both a mutual legal understanding and agreement of the listed terms and conditions.

Key components of an effective engagement letter

The purpose of a bookkeeping engagement letter is to outline the terms and conditions of the professional relationship — so there are several key components it must include. We’ve listed these below with a description of each component.

- Scope of services: the full list of bookkeeping services that you will provide for the client

- Duration of engagement: the duration or frequency of the bookkeeping services you will provide, which may be monthly, quarterly, etc.

- Client responsibilities: the responsibilities you expect from the client, such as providing documentation and information in a transparent and timely manner

- Ownership of records: a clarification of who retains ownership of all financial records (typically the client)

- Payment terms and fees: the price of your bookkeeping services, how they will be calculated and when they must be paid, along with any fees for late payments

- Dispute resolution: the terms and process for resolving a dispute

- Termination: the terms and conditions for both parties in the event the engagement will be terminated

- Confidentiality: the terms and conditions for both parties to protect and safeguard private or sensitive information

- Compliance: a statement to ensure both parties agree to comply with pertinent bookkeeping laws and regulations

- Liability: a section defining the terms for compensation in the event of errors or disputes

- Signatures: a final section for the signatures of both parties, with a short statement explaining that signing the document confirms the agreement of all terms and conditions

Including these key components in your bookkeeping engagement letter will reduce the risk of misunderstandings between you and your client. It will promote a smooth professional relationship, with clear terms and conditions to guide both parties.

Why engagement letters are crucial

Having a client sign your engagement letter is a crucial step before providing your services. Not only will an engagement letter ensure a mutual legal understanding of the relationship but also improve the first impression you offer your clients.

An engagement letter establishes clear expectations for your client, including the services you will provide and how you will provide them. It also sets the terms for payment and other legalities, such as client confidentiality, dispute resolution and compliance.

Ultimately, an engagement letter minimizes risk and protects both parties. It will lay the groundwork for a successful relationship while ensuring that you and your clients remain accountable for the agreed terms.

Free bookkeeping engagement letter template

Download this free bookkeeping engagement letter template — created to include all the key components listed above.

This professional template offers an organized layout and a list of industry-standard terms and conditions. It also allows you to enter custom information, such as your firm’s details, the client’s details, your bookkeeping services, payment terms and more.

To use the template, follow the link and download the document as a Microsoft Word file. You can then edit the template as needed before sending it to your clients as a PDF document.

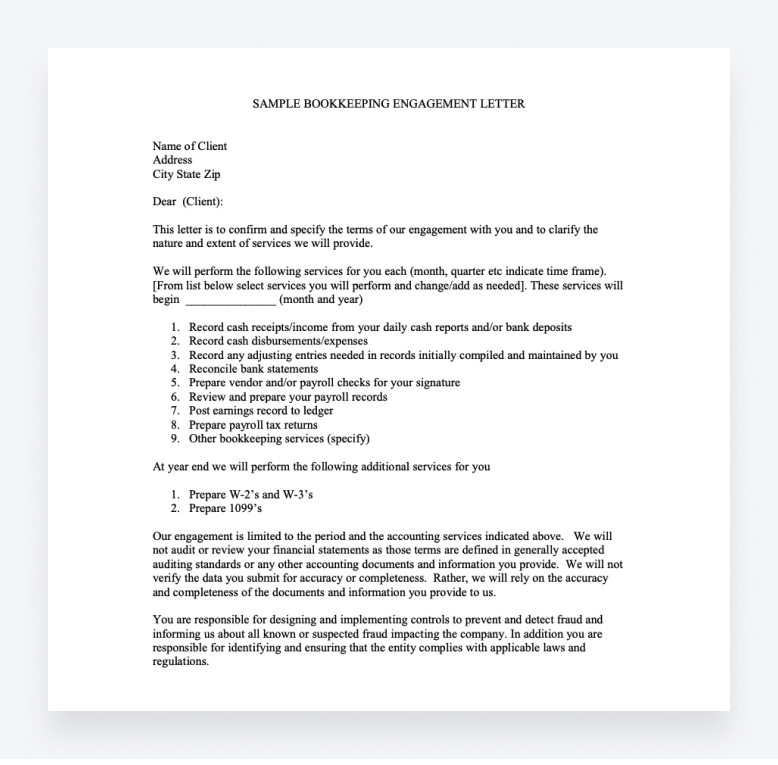

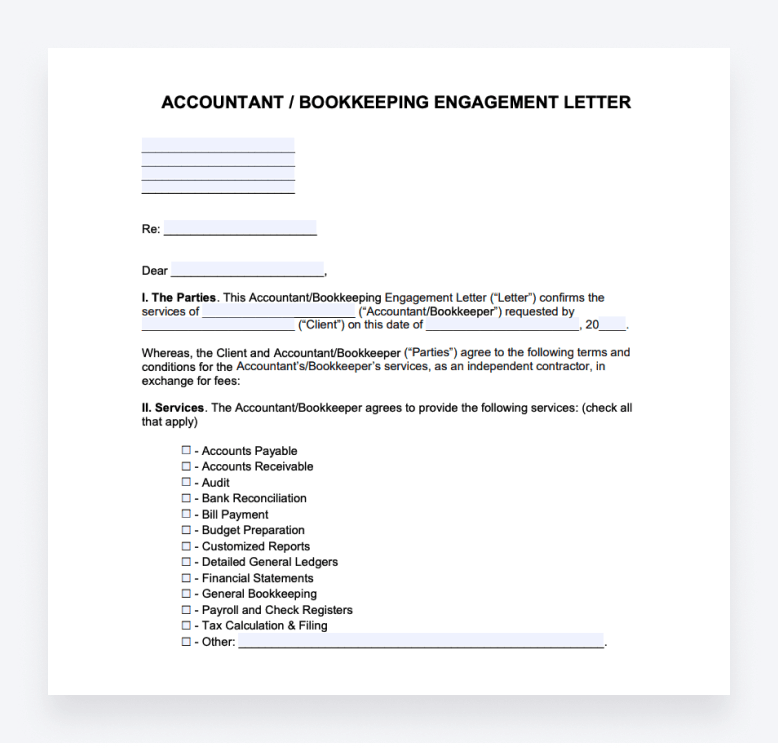

Bookkeeping engagement letter samples

For more insights on how to format a bookkeeping engagement letter, here are two samples worth looking at.

Sample Bookkeeping Engagement Letter: an example of a comprehensive bookkeeping engagement letter, which provides blank fields for entering custom information.

Accountant/Bookkeeping Engagement Letter: an example of a full-service accounting engagement letter that includes bookkeeping, ideal if you are an accountant offering bookkeeping as part of your overall service.

Best practices for bookkeeping engagement letters

In addition to using a ready-made engagement letter template, you can maintain best practices by carrying out the following:

Include your engagement letter as part of an onboarding process

Including your engagement letter as part of a client onboarding process won’t just improve the client experience you offer; it can also help increase efficiency and productivity.

For example, practice management software, such as TaxDome, can automate client onboarding. This improves and simplifies the onboarding process, from lead capture and document collection to e-signing and e-filing.

Update your engagement letter annually

It’s good practice to update your bookkeeping engagement letter every year, as there are bound to be changes, whether that’s to the services you offer, rates or liability terms.

If you no longer offer a specific service, for example, it’s worth updating your engagement letter to reflect that and improve the overall clarity of the work you’re providing.

Offer clients the ability to e-sign your engagement letter

Wet signatures are time-consuming and make it difficult for your clients to sign your engagement letter, as it typically gives them no choice but to print, sign and scan the document.

A solution to this is providing your clients with the option to e-sign your engagement letter. E-signatures

are legally binding and offer a faster, safer way to sign important documents.

Final thoughts

Engagement letters set clear expectations, minimize risk and ensure both parties remain accountable. Having an engagement letter that’s clear and comprehensive is therefore essential before providing your services — and this is where templates come in handy.

Despite that, modifying and sending an engagement letter template on a client-by-client basis can become difficult to manage as your business expands. This makes practice management software an alternative worth considering.

With TaxDome, you can choose from a broad range of templates created for bookkeeping, tax preparation and more. TaxDome also offers time-saving features — such as autofill via shortcodes, automated document sending and e-signature requests — streamlining the entire process from start to finish.

Thank you! The eBook has been sent to your email. Enjoy your copy.

There was an error processing your request. Please try again later.

What makes the best accounting firms thrive while others struggle to keep up? We analyzed our top 20 TaxDome firms, representing over $100M in combined revenue, to uncover the strategies driving their success.