As a small business owner, you have to wear multiple hats. Sometimes you’re the CEO, other times solving customer issues or devising marketing strategies.

Amid all the chaos, it’s easy to overlook one key role: bookkeeper.

Bookkeeping might not sound as exciting or urgent as other business processes, but its importance can’t be overstated. Effective bookkeeping forms the bedrock of good financial management, which is essential for your business’s growth.

In this article, we’ll explain everything you need to know about hiring the right bookkeeper, covering:

- How it could benefit your business

- How to approach the hiring process

- Some of the key skills, traits and certifications to look out for

Let’s dive in.

Understanding the role of bookkeepers

Bookkeepers play a key role in your financial ecosystem, but their role is often misunderstood. Here are six areas that bookkeepers typically cover:

1. Maintaining financial records

Think of your bookkeeper as the custodian of your financial history. They record every financial transaction, from sales and expenses to payroll and tax payments.

Maintaining accurate records not only provides you with a clear picture of your business’s financial health but also helps you make more informed decisions.

2. Bank reconciliations

Bookkeepers reconcile bank statements with financial records. This process helps identify errors or discrepancies that may have occurred during the recording of transactions.

3. Compliance management

By maintaining accurate records and preparing the necessary tax documents, bookkeepers play a key role in ensuring that your business adheres to the latest tax and accounting laws.

4. Financial reporting

Bookkeepers are responsible for generating financial reports, including income statements, balance sheets and cash flow statements. These reports offer insights into your business’s financial performance, aiding strategic planning and decision-making.

5. Payroll processing

If your business has employees, bookkeepers can handle your payroll processing. This includes calculating wages, deducting taxes, administering benefits and ensuring that employees are paid accurately and on time.

6. Expense Management

Bookkeepers track and manage expenses. By identifying areas of overspending or inefficiency, they can also suggest cost-saving measures.

When should you hire a bookkeeper?

As a small-business owner, you need to decide which processes you can handle yourself, and which you need to delegate to an expert.

Some entrepreneurs attempt to handle bookkeeping themselves in the early stages, but as business picks up, there often comes a point when it’s necessary to look for professional bookkeeping help.

Hiring a bookkeeper isn’t just about relieving the burden of financial tasks. It’s a strategic move that helps ensure the financial health of your business.

Let’s look at some scenarios where hiring a bookkeeper becomes essential:

Overwhelming complexity

As your business grows, so does the complexity of your financial transactions. Before you know it, you’ve got multiple income streams, various expenses and intricate financial processes to deal with. Without the right expertise, this can soon become overwhelming.

A professional bookkeeper will help keep your financial records accurate and organized regardless of increased complexity.

Lack of financial expertise

Many small-business owners have zero or limited experience in finance or accounting. Trying to manage finances without the necessary expertise can lead to costly errors, missed deductions and compliance issues. At the same time, acquiring bookkeeping skills can be costly and time-consuming.

Hiring a bookkeeper instantly fills a critical skills gap in your business, all but eliminating the risk of costly errors.

Time constraints

Small-business owners are often stretched thin as they juggle numerous responsibilities. Given the risks involved in poor financial record-keeping, bookkeeping isn’t something you can afford to cut corners on.

If you find your time is limited, delegating bookkeeping tasks to a professional makes a lot of sense. You’ll be able to reclaim valuable time that can be invested in strategic decision-making and business development.

Tax season stress

Tax preparation can be a tricky process for the uninitiated. There are strict deadlines too, which can make tax season a stressful time for small-business owners.

A bookkeeper can streamline this process, ensuring that your business meets its tax obligations, takes advantage of available deductions and avoids penalties associated with late filing.

Continued growth

If your business is growing fast, it’s a strong signal that you need a bookkeeper. Growing pains often come with increased financial transactions, payroll complexities and the need for financial forecasting — all areas where a bookkeeper’s expertise is invaluable.

Financial planning

As your business grows, financial planning becomes essential. A bookkeeper can provide insights into cash flow management, budgeting and financial forecasting, giving you the information you need to make smarter plans.

Audit preparation

In the event of an audit, having well-maintained financial records is essential. A bookkeeper ensures that your records are in order, making the audit process smoother and less stressful.

The benefits of hiring a bookkeeper

Although hiring a bookkeeper represents an additional cost to your business, the benefits tend to outweigh the financial burden. Here are just some of the ways working with a professional bookkeeper could help improve your business:

- Accurate financial records

- Reduced risk of errors, discrepancies and fines

- Legal compliance

- Reliable payroll

- Valuable financial insights

Beyond these “hard” benefits that have a tangible impact on your business, hiring a bookkeeper also offers plenty of “soft” benefits. It’s hard to put a price on peace of mind, for example, while the time you’ll save will allow you to spend more time working on growing your business.

What are the different types of bookkeepers?

If you’ve decided that hiring a bookkeeper is the best way forward, you’ll probably be left with an important question: what type of bookkeeper, and why?

Bookkeepers can be grouped according to their levels of expertise and experience. The more experienced a bookkeeper, the more they’ll be able to offer your business — and the more they’re likely to cost.

Understanding the following ranks will help you make the right decision when it comes to choosing a bookkeeper.

Entry-level bookkeeper

Entry-level bookkeepers are typically new to the profession, having recently trained or retrained to become a bookkeeper. They have the basic expertise needed to handle fundamental bookkeeping tasks, such as:

- Accurately recording financial transactions

- Organizing receipts

- Reconciling accounts

An entry-level bookkeeper won’t have advanced financial expertise or years of experience, but their skills should be sufficient to cover most of your bookkeeping needs as a small business.

Junior bookkeeper

Junior bookkeepers typically have some experience and may be pursuing accounting or finance degrees or certifications. They’ll likely be able to take on a broader scope of responsibilities than entry-level bookkeepers, including:

- Payroll processing

- Preparing financial reports

- Bank and credit card reconciliations

Senior bookkeeper

Senior bookkeepers have gained substantial experience and expertise in bookkeeping and financial management. They can handle complex financial tasks, including:

- Creating detailed financial statements

- Managing accounts payable and accounts receivable

- Providing insights into cost reduction and financial efficiency

You’re in safe hands with a senior bookkeeper, but whether that level of expertise — and the cost that comes with it — is necessary for your business is a different matter.

Certified public bookkeeper (CPB)

A CPB is a bookkeeper who has obtained a professional certification, demonstrating a high level of competence and commitment to ethical practices. They possess a deep understanding of accounting principles and tax laws, enabling them to:

- Handle advanced financial tasks

- Provide strategic financial advice

- Ensure compliance with tax regulations

Typically, this level of expertise is something larger businesses and enterprises would look for, rather than small businesses.

How bookkeepers can collaborate with accountants

While bookkeepers and accountants both play vital roles in managing a company’s financial affairs, they have distinct responsibilities that complement each other.

Understanding the synergy between these roles is essential for optimizing your business’s financial management. Let’s take a closer look at each role — and how they can work together effectively.

Bookkeepers

Bookkeepers are generally responsible for day-to-day financial record-keeping, bank reconciliations and financial reporting. They often cover payroll as well, although in some businesses, this can fall under other departments such as HR.

Accountants

An accountant’s responsibilities are broader, spanning financial analysis, tax preparation, tax planning, audit and strategic financial planning. Because of the complexity of these tasks, there is a strong need for regulatory compliance.

How bookkeepers and accountants can work together

If you run a very small business, you might find that a bookkeeper covers all your financial needs. But as you grow, the complexities of business and the need to plan for your financial future may mean an accountant is also necessary.

There are many ways that bookkeepers and accountants can work together harmoniously. Let’s explore some key examples:

- Data transfer: bookkeepers maintain clean and organized financial records, which are essential for accountants to perform their analysis and audits effectively

- Collaboration: bookkeepers and accountants often work together to resolve discrepancies, reconcile accounts and ensure financial accuracy

- Efficiency: by delegating day-to-day tasks to bookkeepers, accountants can focus on higher-level financial analysis and strategy

- Tax preparation: bookkeepers can provide accountants with well-organized financial data during tax season, streamlining the tax preparation process

In essence, bookkeepers and accountants can form a collaborative partnership that leverages each other’s strengths to ensure your company’s finances are run effectively.

What is the cost of hiring a bookkeeper?

There’s no simple answer to this question because the cost of hiring a bookkeeper depends on several factors, including the:

- Bookkeeper’s level of expertise, experience or certification

- Scope and complexity of your bookkeeping needs

- Frequency of services (e.g. weekly, monthly, quarterly, full-time)

- Bookkeeper’s preferred pricing model (e.g. hourly rate, monthly fixed fee)

But to give you a rough idea, a freelance bookkeeper can cost anywhere between $11 and $25 per hour, while a full-time bookkeeper could expect a salary between $35k and $50k per year, depending on experience.

To find the perfect bookkeeper, you’ll need to consider your current and future needs as well as your budget. This will help you narrow down the field and find a bookkeeper that’s both qualified and affordable.

Finally, when considering the costs, it’s important to focus on the long-term value a bookkeeper can bring to your business. They can help you avoid costly financial mistakes, optimize your financial processes and provide insights that contribute to your business’s growth.

Deciding between full-time and freelance bookkeepers

If you decide to hire a bookkeeper, one of the key decisions you’ll have to make is whether to go with a full-time employee or a freelancer.

Each option has its advantages and disadvantages, which you should weigh up based on your needs and circumstances. Let’s compare the pros and cons of both options:

| Full-time bookkeeper | Freelance bookkeeper | |

| Cost |

|

|

| Commitment | Fully committed to your business. Poor hiring decisions can be difficult to fix, however. | Less committed — you can hire a freelancer for one-off projects or on a longer contract. Relatively easy to replace if needed. |

| Knowledge | Will develop a deep understanding of your business’s financial intricacies over time. | Works with multiple clients so will have a more surface-level understanding of your business. |

| Flexibility | Limited flexibility in terms of work hours and scope of tasks. | More flexibility in terms of when and how tasks are completed. |

| Management | Requires direct management and supervision, including training and performance reviews. | Requires less hands-on management. Happy to work independently. No expectations around training or professional development. |

| Scalability | Not easily scalable. Suitable for businesses with consistent and substantial bookkeeping needs. | Ideal for businesses with fluctuating or unpredictable bookkeeping needs. Easy to scale up or down as needed. |

Whether a full-time or freelance bookkeeper is best for you ultimately depends on the size of your business, your financial requirements and your long-term goals.

As businesses grow, some find success in combining both options, utilizing a full-time bookkeeper for core tasks and freelancers for specialized projects or at peak times. This hybrid approach offers flexibility while ensuring your financial needs are always met.

Essential skills and attributes to look for

When searching for the ideal bookkeeper, there are certain core skills and attributes to look out for.

It’s worth noting, however, that some skills aren’t easily verifiable. You can’t tell from a CV if a bookkeeper prioritizes an ethical approach to work, for example.

With this in mind, it makes sense to look for bookkeepers who have great references, client reviews or referrals from businesses you trust. This is especially true if you are going for a freelancer, because you won’t be able to monitor and supervise their work like you would with an internal employee.

Here are ten essential skills and attributes of a great bookkeeper:

1. Industry experience

Depending on your business type or industry, it can be beneficial to hire a bookkeeper with experience in your specific field. They may bring insights and knowledge that are particularly relevant to your business.

2. Attention to detail

The role of a bookkeeper demands precision and accuracy. They should have unwavering attention to detail, enabling them to avoid costly errors in financial records.

3. Software proficiency

Software plays a central role in modern bookkeeping, so look for someone proficient in accounting software such as QuickBooks, Xero or other industry-standard platforms. You could even look for bookkeepers that have software-specific certification (more on this later).

4. Organizational skills

Keeping on top of financial records, receipts and invoices requires exceptional organizational skills. Your bookkeeper should keep all financial documents in order and readily accessible for reference.

5. Time management

Bookkeepers often juggle multiple tasks and deadlines, making effective time management crucial. This is especially true during peak times such as tax season, when there are hard deadlines to meet.

6. Communication skills

Clear and transparent communication is vital, especially when discussing financial matters. A good bookkeeper should be able to explain financial concepts to non-experts and collaborate with you and your team effectively

7. Analytical skills

Beyond record-keeping, bookkeepers should possess analytical skills to interpret financial data and provide insights into your business’s financial health. They should help identify trends, potential cost savings and areas for improvement.

8. Integrity and ethics

Trust is paramount when dealing with finances. A bookkeeper should uphold the highest ethical standards and maintain the confidentiality of your financial information at all times.

9. Adaptability

The financial landscape is continually evolving. Make sure you choose a bookkeeper who is adaptable and willing to stay updated on changes in tax laws, accounting regulations and industry best practices.

10. Financial reporting

They should also have the ability to create and interpret financial reports, such as income statements, balance sheets and cash flow statements, providing you with a clear picture of your business’s financial performance.

Where to find bookkeepers

Searching for the right bookkeeper can be a daunting task. With the advent of remote work and cloud-based software, your future bookkeeper could be based pretty much anywhere. So how do you know where to start?

Let’s highlight some of the places you can find professional bookkeepers.

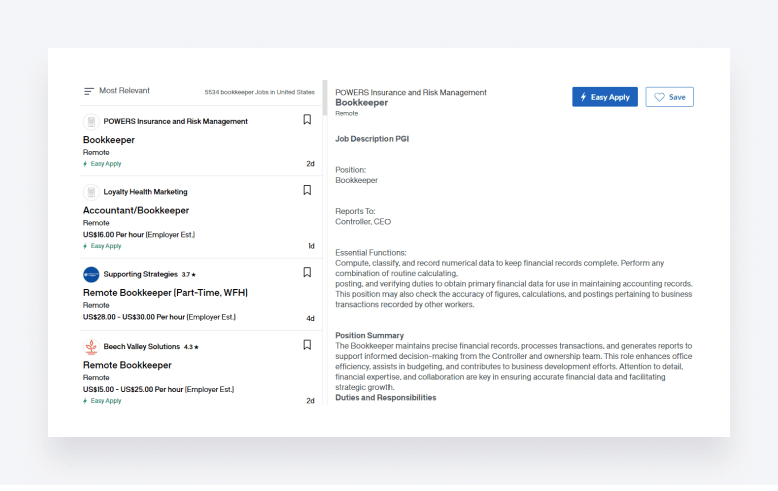

Online job platforms

If you’re looking for a full-time bookkeeper, one of the easiest ways to start is by posting a listing on an online job platform such as:

- Glassdoor

- Indeed

In addition to posting listings, these platforms allow you to review resumes, conduct interviews and verify qualifications.

Professional organizations

Industry-specific organizations such as the American Institute of Professional Bookkeepers (AIPB) or the Association of Chartered Certified Accountants (ACCA) often have job boards or directories where you can post listings and find certified bookkeepers.

Freelance platforms

If you‘re after a freelance bookkeeper, there are plenty of online platforms where you can find professionals willing to take on ad hoc bookkeeping tasks or longer-term contracts. Check out platforms like:

- Upwork

- Freelancer

- Fiverr

These platforms allow you to post job details, review profiles, communicate with candidates and hire people in one place. You also get access to a global audience of freelancers, which can help you find more cost-effective options.

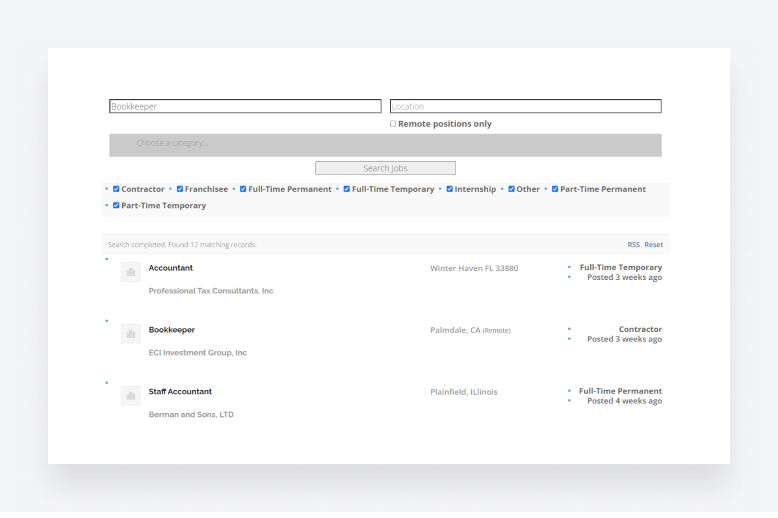

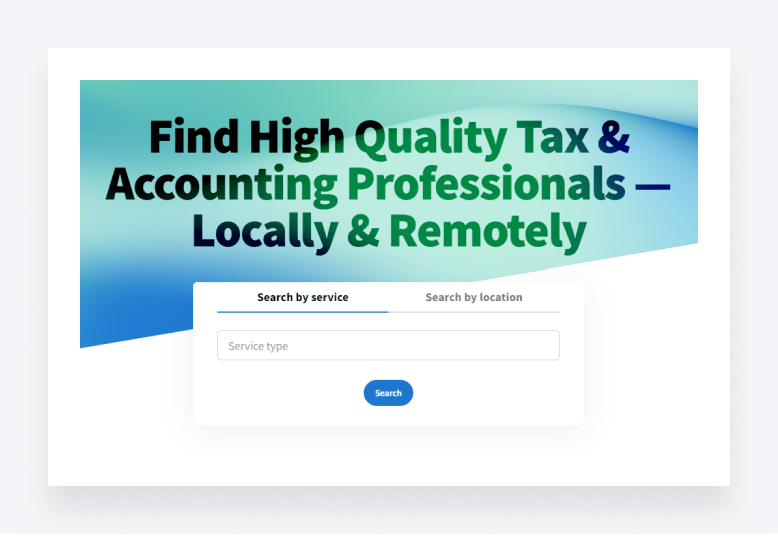

Bookkeeping business directories

Industry-specific directories can help you connect with professionals fast. TaxDome Advisor, for example, allows you to search a database of highly rated accountants, bookkeepers and tax professionals. You can view profiles, read reviews and send messages all in one place.

Local accounting firms

If you want to hire a bookkeeper that you can meet face-to-face, you’ll need to look up local accounting firms in your area. They may have experienced bookkeepers who are available for part-time or freelance work. If not, they may be able to provide referrals or recommendations.

Personal and professional networks

Tap into your personal and professional networks to seek recommendations. Ask fellow business owners, former colleagues or industry contacts if they have worked with or know of reliable bookkeepers.

Local universities and colleges

Consider reaching out to local universities or colleges that offer accounting or finance programs. Many students are eager to gain practical experience and may be willing to work as interns or part-time bookkeepers. This can be a cost-effective way to access emerging talent.

Online business communities

Join online forums, social media groups or business communities related to your industry. These platforms can be excellent places to seek referrals and advice from other entrepreneurs who have hired bookkeepers.

Certification organizations

Check with certification organizations like AIPB for their directory of certified bookkeepers. These individuals have demonstrated their expertise through rigorous exams and may be a good fit for your needs.

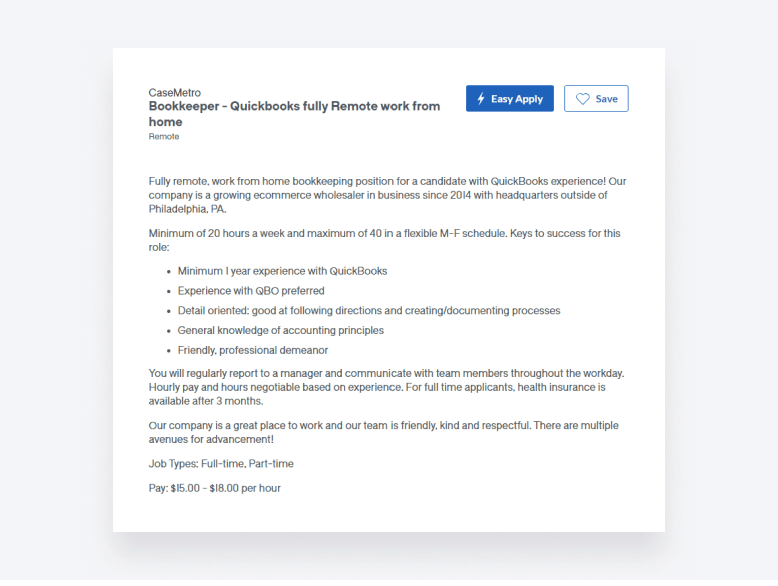

Crafting an effective bookkeeper job description

Creating a well-structured job description is a crucial step in attracting the right bookkeeper.

The key here is to provide all the information the candidate needs to understand whether this opportunity suits their needs and skills, but not so much information that you overwhelm them.

We recommend including the following information in your job description:

- A clear title, e.g. “Bookkeeper” or “Senior Bookkeeper”

- An overview of your company and its values

- Key responsibilities

- The necessary experience or qualifications you require

- The soft skills you are looking for

- Information about specific software proficiency

- Reporting structure

- Working hours and flexibility

- Company culture

- Compensation and benefits

- Information on the hiring process

When it comes to the actual writing process, be sure that you use language that is both inclusive and representative of your business and brand. It’s also a good idea to get some feedback on the description before posting.

Here’s an example of a job description from Glassdoor.

Interviewing bookkeeper candidates

When it comes to the interview, you’ll want to ask questions that help you assess the bookkeeper’s technical skills, experience and cultural fit.

Here are some interview questions to consider:

Technical skills and experience

- Can you describe your experience with accounting software such as QuickBooks or Xero?

- Can you provide an example of a complex financial problem you’ve encountered and how you resolved it?

- How do you stay updated on changes in tax laws and accounting regulations that may impact our business?

- What types of financial reports have you prepared in previous roles?

- How do you ensure the accuracy of financial records and prevent errors in your work?

- How do you handle high-pressure situations or tight deadlines?

Cultural fit

- What type of work environment brings out the best in you?

- Give an example of a time when you had to collaborate with other team members or departments to achieve a common goal

- What motivates you in your work?

- Why do you want to work for our company specifically?

Remember to ask follow-up questions to gain a deeper understanding of the candidate’s qualifications and fit for your organization. Additionally, conducting skills tests or asking candidates to provide examples of their work can provide valuable insights into their abilities.

Do certifications matter?

Unlike some professions, it’s possible to get into bookkeeping without any formal certification. That said, certification can be a valuable indicator of a candidate’s expertise and commitment to the profession.

Let’s look at some of the most commonly recognized bookkeeping certifications and the benefits they bring:

Certified Public Bookkeeper (CPB)

The CPB designation is awarded by the National Association of Certified Public Bookkeepers (NACPB). It is a prestigious certification that signifies a high level of expertise and professionalism in bookkeeping.

Relevance

To get this qualification, a CPB must have demonstrated proficiency in essential bookkeeping skills, including accounting principles, payroll, taxation and financial reporting. This qualification is pretty much a seal of approval when it comes to bookkeeping proficiency.

Benefits:

- Expertise: CPBs are well-versed in accounting software, tax codes and financial regulations

- Trustworthiness: clients and employers often trust CPBs due to their rigorous training and adherence to a strict code of ethics

- Credibility: the CPB designation is highly credible, which can be reassuring for clients and employers

Certified Bookkeeper (CB)

The Certified Bookkeeper designation is awarded by the American Institute of Professional Bookkeepers (AIPB). Like CPB, it is a respected designation that signifies a high level of competence in bookkeeping.

Relevance

CBs have demonstrated their ability to perform bookkeeping tasks accurately and efficiently, including double-entry bookkeeping, adjusting entries and financial statement preparation.

Benefits:

- Accuracy: CBs are known for their precision and ability to maintain accurate financial records

- Compliance: they are well-versed in financial regulations and can help businesses stay compliant with tax laws

- Recognition: the CB designation is recognized across the industry, increasing the bookkeeper’s trustworthiness and reliability

Software-specific certification

Besides qualifications awarded by official bookkeeping bodies, it’s also possible to gain certification from software providers. For example, bookkeepers can take the QuickBooks ProAdvisor program or become a Xero certified advisor.

Relevance

These qualifications are technology-focussed and tend to cover both accounting and bookkeeping processes.

Benefits:

- Niche expertise: if your company already uses QuickBooks or Xero, finding a bookkeeper with the relevant certifications makes a lot of sense

- Easy to find: once certified, accountants and bookkeepers can be found via official directories

- Tech-savvy: gaining one of these qualifications shows a commitment to self-improvement and an understanding of the tech-driven nature of modern bookkeeping

Conclusion

Accurate financial management is essential for the success of any small business. As your business grows, handing over this responsibility to a bookkeeper will allow you to navigate the complexities of financial record-keeping with ease.

While hiring a bookkeeper may seem like a financial burden, it’s important to see the benefits that it will bring to your business. Not only can you rest assured that your books are in safe hands, but you’ll also save countless hours while avoiding costly mistakes.

Seen this way, hiring a bookkeeper is more of an investment in your business’s future success.

So, happy hiring!

Thank you! The eBook has been sent to your email. Enjoy your copy.

There was an error processing your request. Please try again later.

What makes the best accounting firms thrive while others struggle to keep up? We analyzed our top 20 TaxDome firms, representing over $100M in combined revenue, to uncover the strategies driving their success.