Key takeaways:

- CPAs are highly qualified accountants who work on more complex, high-value tasks than regular accountants. As such, they often charge considerably more for their services.

- CPAs typically charge anywhere from $200 to $500 per hour depending on factors such as service type, complexity of work, and geographic location. Some CPAs may charge up to $800 for highly specialized services.

- In addition to hourly rates, CPAs may charge flat fees, value-based fees, or monthly or yearly retainers.

- Different industries have their own unique accounting challenges. You can expect to pay more for a CPA with extensive experience in niche sectors.

- There are several ways you can reduce the overall cost of working with a CPA, including negotiating fees, purchasing bundled services, and taking advantage of early-bird or loyalty discounts.

Most day-to-day accounting tasks can be handled by regular accountants. If you have complex tax or accounting needs, however, you may need to work with a certified public accountant (CPA). CPAs are highly qualified accounting professionals who have met rigorous standards set by professional accounting bodies. As such, they cost significantly more than a regular accountant.

In this article, we’ll explore the services CPAs offer, how much they tend to charge, and the factors that influence costs. We’ll also provide some handy tips for saving money and finding affordable CPA services.

What services do CPAs offer?

With their extensive expertise, CPAs offer a broader range of services than regular accountants. In addition to day-to-day accounting tasks, they can handle more complex and specialized work. In this section, we’ll highlight some areas where CPAs tend to focus.

Tax preparation and planning

While any tax accountant can help clients prepare income tax returns, CPAs are often needed for clients with more complex tax issues. In addition to tax preparation, CPAs often provide tax planning services to businesses and high-net-worth individuals. This helps clients minimize future tax liabilities while remaining compliant with the latest tax regulations.

Representing clients in front of the IRS

In the event of an audit by the Internal Revenue Service (IRS), taxpayers will often turn to a CPA or an enrolled agent. Like enrolled agents, CPAs are qualified to represent taxpayers in front of the IRS for audits, appeals, or disputes. Seeking representation from a CPA can make all the difference in complex tax matters relating to the IRS.

Financial accounting and reporting

CPAs help businesses prepare accurate financial statements. These include balance sheets, income statements, and cash flow reports. These reports are essential for assessing the financial health of a business, ensuring compliance with accounting standards, and providing transparency to investors, lenders, and regulatory agencies.

Conducting audits

CPAs regularly conduct rigorous audits. This involves assessing the accuracy of financial statements. It also ensures that businesses are compliant with accounting standards and regulations and have strong internal controls. In addition, audits provide assurance for external stakeholders, such as investors and regulatory bodies.

Business consulting

CPAs are qualified to provide strategic advice to businesses. This could relate to growth strategies, cost management, or major corporate transactions such as mergers and acquisitions. CPAs may help business leaders by providing insights into financial forecasting, business structuring, and optimizing operations for profitability.

Forensic accounting

Some CPAs specialize in forensic accounting. This involves investigating businesses and individuals for financial discrepancies that may indicate accounting fraud, embezzlement, or other financial crimes. Forensic accountants often work with large accounting firms, government agencies, and law enforcement.

Risk management

CPAs are often heavily involved in financial risk management. They may develop risk management frameworks, conduct risk assessments for new business ventures and investments, and provide guidance on best practices for avoiding financial risk.

Budgeting and forecasting

CPAs help businesses plan for the future through accurate budgeting and forecasting. This helps businesses set realistic short and long-term goals while maintaining a healthy financial position and mitigating financial risks.

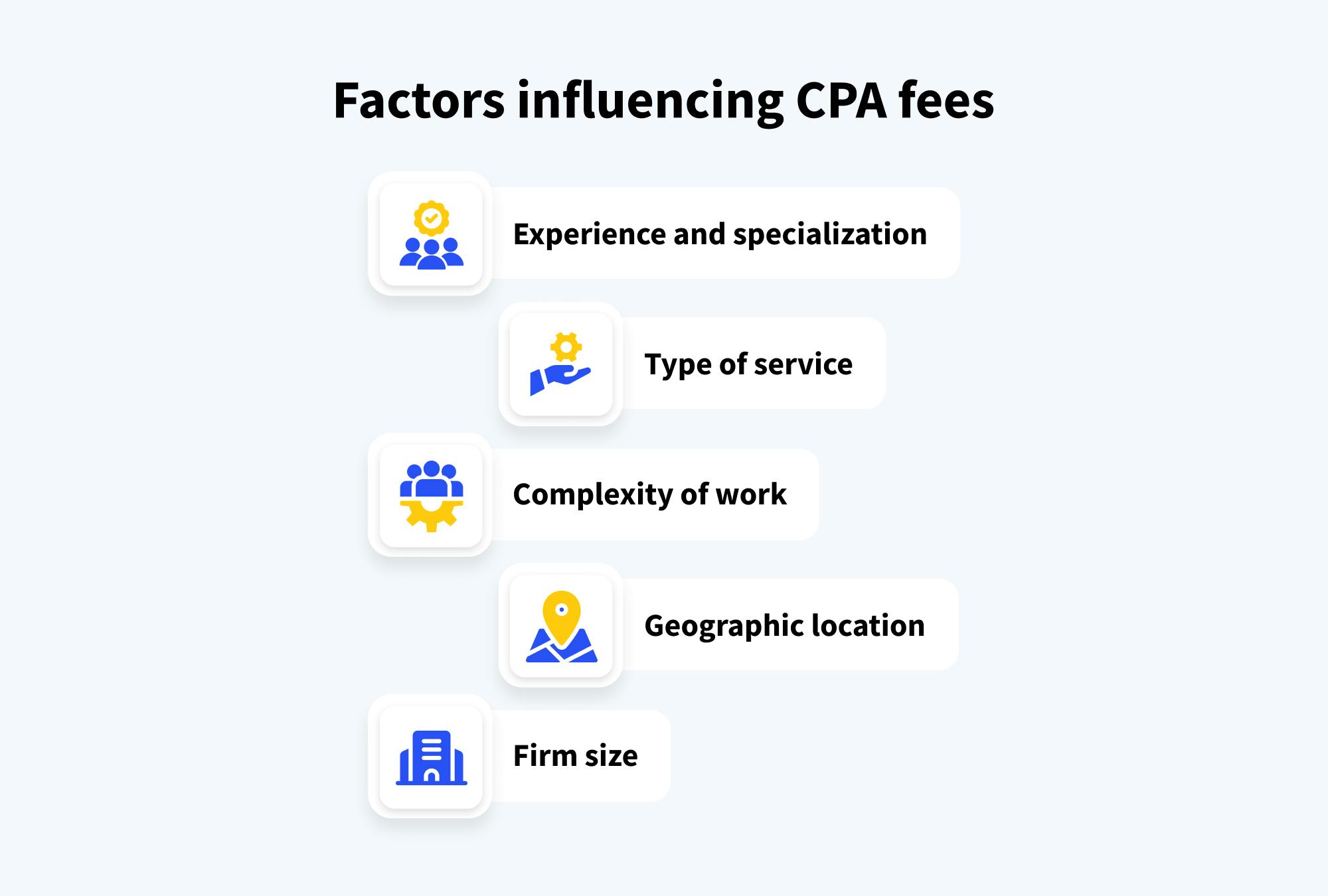

Factors influencing CPA fees

The amount a CPA will charge for their services may vary greatly depending on different factors. In this section, we’ll look at the key variables that impact CPA fees.

Experience and specialization

To maintain their designation, all CPAs must have the required experience, expertise, and commitment to professional development and ethics. That said, not all CPAs are the same. Some are newly qualified and still building a reputation. Others have decades of experience and a strong personal brand and reputation. Generally speaking, the more experienced a CPA is, the more they’ll charge.

Likewise, some CPAs provide a broad range of accounting services while others focus on highly specialized areas of accounting. Specialized accountants tend to charge more because they are experts in a particular niche.

Type of service

The type of service you require will have a big impact on your overall costs. The more complex and time-consuming a task is, the more the CPA will charge. A relatively simple tax return, for example, might take just an hour to prepare and file. An extensive audit of a business could take several weeks or even months to complete.

Complexity of work

The complexity of your situation will greatly affect the price a CPA will charge. Using the example of a tax return again, a CPA will charge more if your case involves different employment types, tax deductions, and income streams compared to a straightforward tax return.

Geographic location

Where your CPA is based will also impact how much they charge. CPAs who operate in affluent areas and cities with high costs of living will charge considerably more than those in less expensive or rural areas.

Firm size

The size and reputation of a CPA firm can also impact pricing. If you choose to work with a large, well-established firm with a national or international reach, they’ll likely be very expensive. On the other hand, if you choose to work with a sole practitioner with a small local business, you’ll likely pay less.

Average CPA costs for different services

So, what exactly can you expect to pay when engaging a CPA? In this section, we’ll provide an overview of average fees for different types of accounting services in the US. It’s worth noting that the prices we’ve mentioned below are best estimates. In reality, prices can vary greatly depending on the factors we’ve outlined above.

Tax preparation

In a recent survey by the National Society of Accountants, the average hourly CPA rate for federal and state tax returns was $180. Given that the report was conducted a couple of years ago, it’s safe to assume that this amount has gone up to at least $200 per hour.

That said, many accountants charge a flat fee for relatively simple tax returns — although flat fees are often calculated by multiplying hourly rates by the average time it takes to complete a job.

With that in mind, you can expect to pay:

- Around $250 for a simple individual tax return with non-itemized deductions

- Up to $1000 for more complex individual tax returns — for example, those with self-employment income, itemized deductions, capital gains, and passive income

For corporate tax returns, the average costs are much higher, starting at around $500 for simple returns and reaching several thousands of dollars for more complex ones.

IRS representation

CPAs typically charge per hour for IRS representation. This involves representing you, the taxpayer, in front of the IRS in the event of an audit, appeal, or tax dispute. Hourly rates can range from $200 to $500. How many hours they will take depends on the nature of your case.

Audit services

Audits can be very complex and time-intensive to complete. At the same time, no two audits are the same. Each business has its own unique issues, needs, and goals. The average CPA rate for audit services is anywhere between $200 and $400 per hour, but some larger CPA firms may charge as much as $800 per hour.

The average cost of an audit in the US is now more than $2.2 million, but fees will vary wildly depending on the size of your business and its revenue. With that in mind, here are some rough estimates for a complete audit of different types of businesses:

- Small and medium-sized businesses (SMEs) can expect to pay anywhere from $10,000 to more than $100,000

- Large enterprises can expect to pay millions of dollars, with an average audit cost for S&P 500 companies now more than $13 million

Consultation and advisory services

For consultation and advisory services, CPAs tend to charge an hourly rate or on a per-project basis, depending on the nature of the work.

Some consultations may be one-off sessions that last a couple of hours. In this case, based on an example hourly rate of $500 per hour, you’d pay $1000. Other times, CPAs may be required to provide advisory services for a longer-term project, for example providing advice during a corporate restructuring or major acquisition. In this case, the CPA may charge a flat fee of $10,000, calculated using their hourly rate and a rough estimate of the time the project will take.

Payroll management

The cost of payroll management depends on the size of your business. The more employees you have, the more you can expect to pay. Below are some estimated costs for outsourcing your payroll to a CPA based on a standard per-employee rate. Fees may be different for CPAs who charge per hour, however.

- Small businesses with fewer than 10 employees — $100 to $250 per month

- Medium-sized businesses with up to 100 employees — $500 to $1000 per month

- Large businesses with hundreds of employees — $1000 to $2500 per month

- Enterprises with thousands of employees — $2500 to more than $10,000 per month

Bookkeeping

For bookkeeping, the cost of services often depends on the number of transactions and the complexity of your business. For this reason, it’s very difficult to provide an average cost.

With CPAs charging a relatively high hourly rate of between $200 and $400, however, in most cases it will be more cost-effective to engage a regular bookkeeper.

Forensic accounting

As a highly specialized and niche area of accounting, CPAs may charge a higher hourly rate for forensic accounting than they would for, say, tax preparation. You can expect to pay in the region of $300 to $500 per hour — or even more in certain cities and areas with a high cost of living. For specific projects such as a divorce, fees can reach more than $3,000.

| Service type | Average cost | Depending on … |

| Personal tax preparation | $250 to $1,000 | The complexity of the return |

| Business tax preparation | $500 to $2,000 | The complexity of the return and type of business |

| IRS representation | $200 to $500 per hour | |

| Audit services | SMEs: $10,00 to $100,000 Enterprises: $1 million to $15 million+ |

Business size and complexity, revenue amount |

| Consultation and advisory | $250 to $500 per hour | |

| Payroll management | SMEs: $100 to $1000 per month Large businesses: $1,000 to $2,500 per month Enterprises: $2,500 to $10,000+ per month |

Number of employees |

| Bookkeeping | $200 to $400 per hour | Volume and complexity of transactions |

| Forensic accounting | $300 to $500 per hour |

Further reading: for a deep dive into the average cost of other accounting services, take a look at these articles:

- The average cost of payroll services in 2024: a comprehensive guide

- How much does a bookkeeper cost in 2024: an ultimate guide

What types of CPA fee structures exist?

Depending on the type of service you require, CPAs may use different fee structures when calculating how much the service will cost. Understanding how different fee structures work can help you make wiser decisions when choosing a CPA. In this section, we’ll explore the most common structures in detail.

Hourly rates

CPAs often charge hourly rates for temporary or short-term jobs, such as consulting and advisory services. As we’ve already discussed, CPAs can charge anywhere from $200 to $800 per hour, depending on factors such as:

- Geographic location: CPA rates tend to reflect the cost of living in the region they operate in. A CPA based in Manhattan, New York, is almost certain to charge more than a CPA in rural Kansas, for example.

- Experience and firm size: experienced CPAs command higher fees, as do larger CPA firms with a well-established brand and reputation.

- Type of service: more complex or specialized services will cost more per hour than regular accounting services. You’ll pay more per hour for forensic accounting services than tax preparation, for example.

With hourly rates, you’re essentially paying for the CPA’s time. This works for certain service types, but for ongoing projects with an undefined scope, it can mean soaring costs and anxiety about budgeting.

Fixed or project-based fees

CPAs often charge flat fees for specific, one-time tasks, such as tax preparation and filing. These tasks tend to be fairly predictable when it comes to resources and complexity. As a result, accountants can provide the cost upfront.

The benefit from the client side is that you know what you’ll pay. This makes it easier to budget for CPA services and eliminates unpleasant surprises when the bill arrives. That said, you should always make sure the CPA is transparent about what the fee includes to make sure there aren’t any hidden costs down the line.

Monthly and yearly retainers

CPAs often charge retainer fees for ongoing accounting services. Examples include payroll management, bookkeeping, and financial reporting. This is essentially a down payment to secure the CPA’s services for future work — a bit like a subscription, but for professional services.

Monthly retainers can range from hundreds of dollars to tens of thousands of dollars depending on the services required. Alternatively, CPAs might charge yearly. The benefit of this structure is that you ensure smooth, year-round operations and consistent professional support.

Value-based pricing

This is a unique pricing structure compared to the others on this list. Instead of charging based on time spent or work completed, CPAs may charge based on the value they bring to your firm. This structure only works for services where the return on investment (ROI) of using a CPA is tangible and measurable. For example, taking a percentage of the money saved through tax planning.

Value-based pricing often represents good value for both parties — if the CPA does a great job, both the client and the accountant benefit. That said, depending on the type of service and the percentage charged, you may end up paying significantly more in some cases.

A side-by-side comparison of different pricing structures

In the table below, you can see a direct comparison of the pros and cons of different pricing structures. The ideal fee structure for you will depend on the service type, your budgeting requirements, and your overall preference.

| Fee structure | Pros | Cons | Ideal for |

| Hourly rates | You pay only for time spent, flexibility for short-term needs | Fees can creep up, issues around trust and efficiency | Occasional consultations or time-limited services |

| Fixed/project-based | Upfront costs, easier budgeting, fewer issues around trust or efficiency | Risk of overpayment if the project is simpler than anticipated | One-time projects with a clearly defined scope |

| Retainers | Secure reliable CPA services for longer periods | Monthly costs can add up, doesn’t make sense for one-off tasks | Ongoing services where you need reliable and consistent support |

| Value-based | Fees reflect the value provided — you pay nothing if the work isn’t successful | Fees can be higher than traditional pricing models in some cases | High-impact projects where ROI can be easily measured |

CPA costs by business size and industry

CPA costs can also vary depending on the industry you operate in or the size of your business. Different industries have unique financial needs and challenges, which can influence how much you’ll pay for accounting services. In this section, we’ll break down how CPA fees vary for different sectors.

Freelancers and solopreneurs

Freelancers generally have simple financial requirements compared to businesses, usually spanning yearly income tax preparation and minimal bookkeeping services.

In most cases, freelancers will be able to handle tax preparation and bookkeeping themselves using software. If they do need professional support, it will likely be more cost-effective to engage a regular tax accountant or bookkeeper — unless they have unusually complex issues to resolve.

Small and medium-sized businesses

SMEs tend to need a mix of general accounting services. These are often ongoing services such as payroll management, bookkeeping, and tax preparation. Their needs are naturally more complex and broader in scope than those of freelancers, and in many cases, they won’t have the resources for an in-house accounting team.

SMEs can expect to pay less than larger businesses for services such as payroll, bookkeeping, and audit. This is because they have fewer employees, a lower volume of transactions, and less revenue.

Startups and tech firms

Startups and tech firms tend to have quite specific accounting needs. In addition to regular support around payroll, bookkeeping, and tax compliance, they may need additional services to help them navigate periods of rapid expansion and uncertainty. These may include:

- Budgeting, financial forecasting, and cash flow analysis

- Advice on business restructuring and the financial impact of growth strategies

- Advice on seeking external capital investment and loans

- Accounting for equity-based compensation

These services are considered more high-value and specialized than day-to-day accounting services. As such, CPAs will likely charge a higher hourly rate than they would for something like bookkeeping.

Large businesses and enterprises

Generally speaking, the larger the business, the broader and more complex its accounting needs. Large businesses and enterprises often require comprehensive accounting services such as:

- Detailed financial audits

- Compliance management

- Financial strategy consulting

- Tax planning across multiple jurisdictions

- Advice on major corporate transactions such as mergers and acquisitions

These are all highly complex services, and CPAs will charge higher hourly rates and one-off fees accordingly. At the same time, large businesses will pay significantly more for regular accounting services such as bookkeeping and payroll due to having higher volumes of transactions and a large number of employees.

What sectors require specialized CPA services?

In addition to the above, certain sectors have specific accounting needs. As such, they can expect to pay a higher hourly rate for specialized services from a CPA with proven experience in that particular industry. Here are just a few examples:

- Healthcare providers require CPAs to handle complex transactions involving insurance companies, patients, and government programs such as Medicare. Healthcare providers must also stay compliant with industry-specific regulations such as the Health Insurance Portability and Accountability Act (HIPAA).

- Nonprofits need to track restricted and unrestricted funds separately. They must also comply with IRS regulations for tax-exempt organizations, and provide transparency to donors and grant providers.

- Real estate businesses may need CPAS to manage rental income, property sales, and complex tax rules related to depreciation and capital gains.

- Manufacturing businesses may need a CPA to help with inventory management, cost accounting, production cost variance analysis, and supply chain accounting.

- Retail businesses handle high transaction volumes, inventory management, and multi-state sales tax reporting, all of which require precise accounting systems and niche expertise.

These are just some examples. Virtually all industries have unique accounting challenges that require CPAs with relevant experience. The key takeaway is this: if you need a CPA to help with complex, sector-specific accounting services, you can expect to pay a higher hourly rate than for standard accounting services.

How to save on CPA costs

Engaging a CPA can get expensive. Thankfully, there are several strategies you can use to reduce the overall cost of CPA services without compromising on quality. Here are some simple ways you can save on CPA costs.

Bundled services

Some CPA firms offer discounts for bundled services. These are essentially service packages, combining multiple standalone services as part of one deal. For example, you might get a tax bundle, comprising tax preparation and filing, tax planning, and tax compliance services — all for one price. Bundled services tend to be cheaper than buying all of the included services individually.

Early-filing discounts

CPA firms may offer seasonal discounts for clients who file their tax returns early. Early filing gives CPAs more flexibility as they’re typically less busy at the start of tax season than at the end. You may be able to cut 10% off your yearly tax return fees this way.

Loyalty discounts

Some CPAs may reward returning clients with a small discount of up to 10%. This is common for seasonal work such as tax preparation and filing. Client retention is a huge driver of revenue for CPAs, so they may be keen to incentivize you to stick around. Some CPAs might even offer discounts on future services if you write them a positive online review or refer a friend.

Negotiating fees

Some CPAs may be open to negotiating fees — especially if you are a long-term client or require multiple services. In some cases, you might be able to get reduced fees by committing to longer-term contracts for ongoing services such as payroll management or bookkeeping.

Tips for finding affordable CPA services

Finding the right CPA isn’t always easy. You need to balance factors such as relevant experience and positive reviews with affordability. In this section, we’ll provide you with some tips for finding the perfect CPA for your needs and budget.

Define your needs

Before approaching a CPA, it’s important to clearly define the scope of your needs. If you’re an individual taxpayer with a relatively simple tax return to prepare, this will be easy. If you’re a business with complex financial, tax, and compliance needs, it may take more time. Defining your needs at this early stage will help you avoid overpaying for services you don’t need.

Questions to ask a CPA

Before committing to work with a CPA, make sure you have all the information you need about their experience, pricing, and processes. Here are some questions to ask them to help fill in the blanks.

- What is your experience in my industry? Depending on your needs, you might want a CPA with verifiable experience in your specific niche or sector.

- How do you charge for services? Understanding whether the CPA uses an hourly rate, retainer, or flat-fee structure can make all the difference in your choice.

- Can you provide client references or case studies? Social proof is a powerful way to understand the impact the CPA has had on other similar clients.

- What technology do you use for managing finances and clients? Ask whether they use cloud-based platforms such as TaxDome, which can streamline collaboration and document sharing. The software a CPA uses will have a direct impact on the client experience.

Look for certifications and specialization

It’s worth verifying that the accountant holds a CPA license. In addition to the CPA designation, check what additional qualifications, experience, or specializations they have. If you’re looking for a forensic accountant, for example, simply being a CPA might not be enough — you need someone with provable experience in that niche.

Use specialized directories such as TaxDome Advisors

Looking for the right CPA can be a time-consuming process. You can simplify and streamline your search by using industry-specific directories, such as TaxDome Advisors. All of the accountants, tax professionals, and bookkeepers listed on Advisors are top-rated experts with industry expertise. They are also committed to delivering an outstanding client experience using the very best technology.

FAQs

1. How much does a CPA charge per hour?

The hourly rate for a CPA typically ranges from $200 to $500, depending on their experience, location, and the complexity of the services. Rates can reach as high as $800 per hour for CPAs from large firms that engage in highly specialized work.

2. What’s the average cost for tax preparation by a CPA?

The average cost for individual tax preparation starts at about $250 for a simple tax return. For more complex returns featuring multiple income sources, capital gains, and itemized deductions, you might pay as much as $1,000. The cost of corporate tax returns tends to be higher, typically ranging from $500 to $2,000 or more, depending on the complexity of the return and the type of business.

3. Do CPAs charge more for complex business services?

Yes, CPAs generally charge a higher hourly rate for complex business services like financial audits, strategic consulting, and tax planning. These services require more expertise and experience to deliver.

4. Can I negotiate CPA fees?

In some cases, CPAs may be open to negotiating their fees, especially if you are a long-term or returning client and require multiple services. For more straightforward services such as tax preparation, however, CPAs are less likely to negotiate fees.

5. What’s the difference between a CPA and an accountant in terms of fees?

CPAs tend to charge higher fees than general accountants due to their additional certification, expertise, and ability to offer specialized services such as financial audits and IRS representation. If you have simple tax preparation or bookkeeping needs, for example, it might be more cost-effective to work with a regular accountant.

6. Is it cheaper to hire a CPA during tax season or off-season?

It’s typically more expensive to hire a CPA during tax season (January to April) due to higher demand. If you require a CPA for something non-tax-related, it makes sense to engage them during the off-season when they’ll have more capacity.

7. What factors should I consider when hiring a CPA?

There are several key factors to consider when hiring a CPA, including:

- Their experience and industry specialization

- Fee structures (hourly, fixed, or retainer)

- Certifications and credentials

- The technology they use for managing finances

- Client reviews or testimonials

To sum up

For complex or specialized accounting matters, it’s often essential to engage a CPA. Unlike regular accountants, CPAs are held to rigorous standards by professional accounting bodies. This ensures that they have the skills, experience, and commitment to professional ethics required to handle highly complex and high-impact accounting services.

Before you agree to work with a CPA, however, it’s crucial to understand the costs involved. Gaining a clear picture of the factors that impact fees, different fee structures, and strategies for reducing costs can help you maximize value for money.

Finding a CPA that aligns with your service requirements and budget can be tricky. With TaxDome Advisors, it’s simple. As an industry-specific directory, you can connect with the very best accountants, tax professionals, and bookkeepers from across the world. Speed up your CPA search today with TaxDome Advisors.

Thank you! The eBook has been sent to your email. Enjoy your copy.

There was an error processing your request. Please try again later.

What makes the best accounting firms thrive while others struggle to keep up? We analyzed our top 20 TaxDome firms, representing over $100M in combined revenue, to uncover the strategies driving their success.